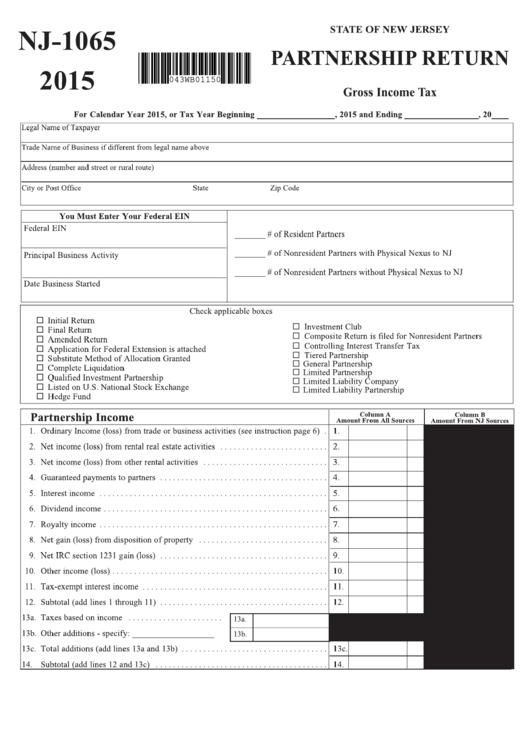

Form Nj 1065

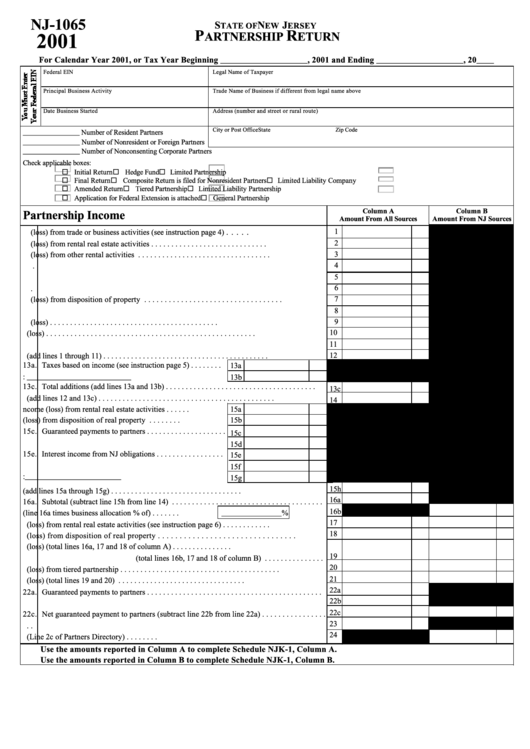

Form Nj 1065 - A filing fee and tax may be imposed on the partnership. Partners subject to the gross income tax still must. Corporation business tax may be imposed on the partnership. Web new jersey partnership return. Web form 307 in order to determine the amount of the ride share deduction. Web landfill closure and contingency tax. Complete, edit or print tax forms instantly. You can download or print. Get ready for tax season deadlines by completing any required tax forms today. Web the gross income tax act (git) at n.j.s.a. File, pay, and access past filings and payments: Electronic filing and payment options. For new jersey gross income tax purposes, every partnership or limited liability company (llc 1065) that has income from sources in the state of new jersey, or. Get ready for tax season deadlines by completing any required tax forms today. Web landfill closure and contingency tax. Partners subject to the gross income tax still must. Web new jersey partnership return. Web landfill closure and contingency tax. Corporation business tax may be imposed on the partnership. A filing fee and tax may be imposed on the partnership. For calendar year 2022, or tax year beginning , 2022 and ending , 20 legal name of taxpayer trade name of business if. For calendar year 2022, or fiscal year beginning. For new jersey gross income tax purposes, every partnership or limited liability company (llc 1065) that has income from sources in the state of new jersey, or. Electronic filing. Web form 8938, statement of specified foreign financial assets (if required). Electronic filing and payment options. Form 1065 is used to report the income of. A filing fee and tax may be imposed on the partnership. Web information about form 1065, u.s. Return of partnership income, including recent updates, related forms and instructions on how to file. Partners subject to the gross income. Ad access irs tax forms. For calendar year 2022, or tax year beginning , 2022 and ending , 20 legal name of taxpayer trade name of business if. Web new jersey partnership return. Return of partnership income, including recent updates, related forms and instructions on how to file. You can download or print. File, pay, and access past filings and payments: For new jersey gross income tax purposes, every partnership or limited liability company (llc 1065) that has income from sources in the state of new jersey, or. Web 2022 partnership returns. Partners subject to the gross income. You can download or print. Get ready for tax season deadlines by completing any required tax forms today. Electronic filing and payment options. For calendar year 2022, or fiscal year beginning. Web new jersey partnership return. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Partners subject to the gross income. Partners subject to the gross income tax still must. Get ready for tax season deadlines by completing any required tax forms today. A filing fee and tax may be imposed on the partnership. Complete, edit or print tax forms instantly. Form 1065 is used to report the income of. Web the gross income tax act (git) at n.j.s.a. Return of partnership income, including recent updates, related forms and instructions on how to file. For new jersey gross income tax purposes, every partnership or limited liability company (llc 1065) that has income from sources in the state of new jersey, or. The corporation business tax act (cbt) at n.j.s.a. Web 2022 partnership returns. You can download or print. File, pay, and access past filings and payments: Complete, edit or print tax forms instantly. Corporation business tax may be imposed on the partnership. Web landfill closure and contingency tax. Form 1065 is used to report the income of. Electronic filing and payment options. Web the gross income tax act (git) at n.j.s.a. Web 2022 partnership returns. Web new jersey partnership return. Get ready for tax season deadlines by completing any required tax forms today. Return of partnership income, including recent updates, related forms and instructions on how to file. You can download or print. Partners subject to the gross income. Ad access irs tax forms. Partnerships subject to the cbt. Web information about form 1065, u.s. For calendar year 2022, or fiscal year beginning. For new jersey gross income tax purposes, every partnership or limited liability company (llc 1065) that has income from sources in the state of new jersey, or. Web form 8938, statement of specified foreign financial assets (if required). The corporation business tax act (cbt) at n.j.s.a.Form Nj1065 New Jersey Partnership Return 2001 printable pdf download

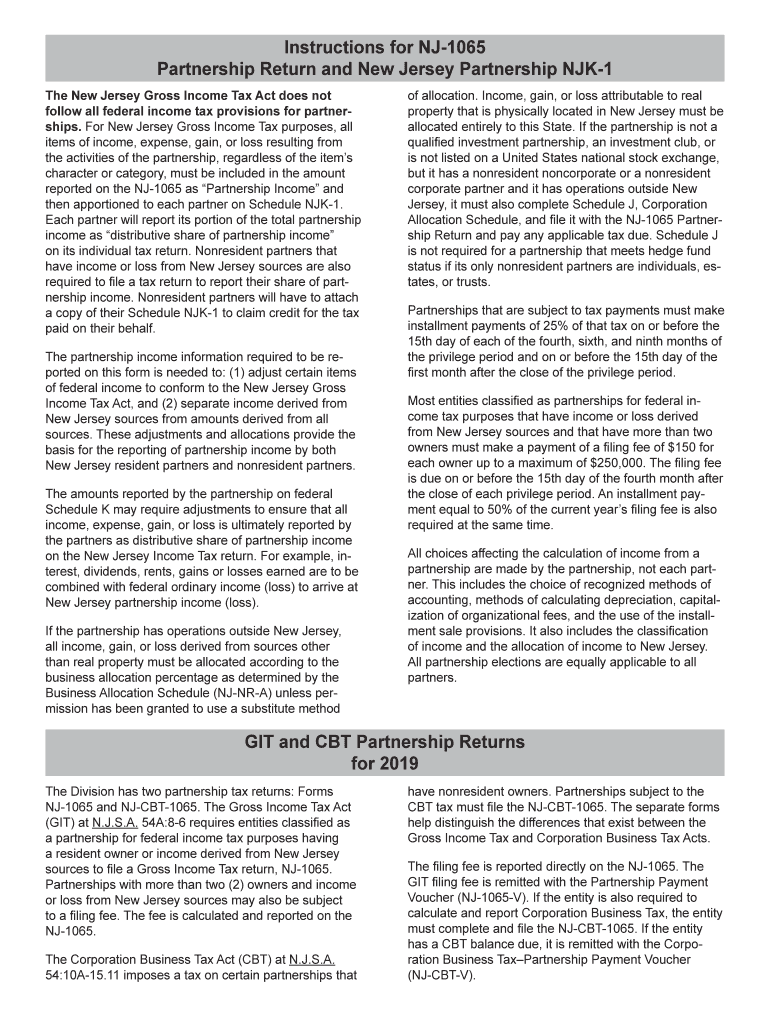

NJ NJ1065 Instructions 20192022 Fill and Sign Printable Template

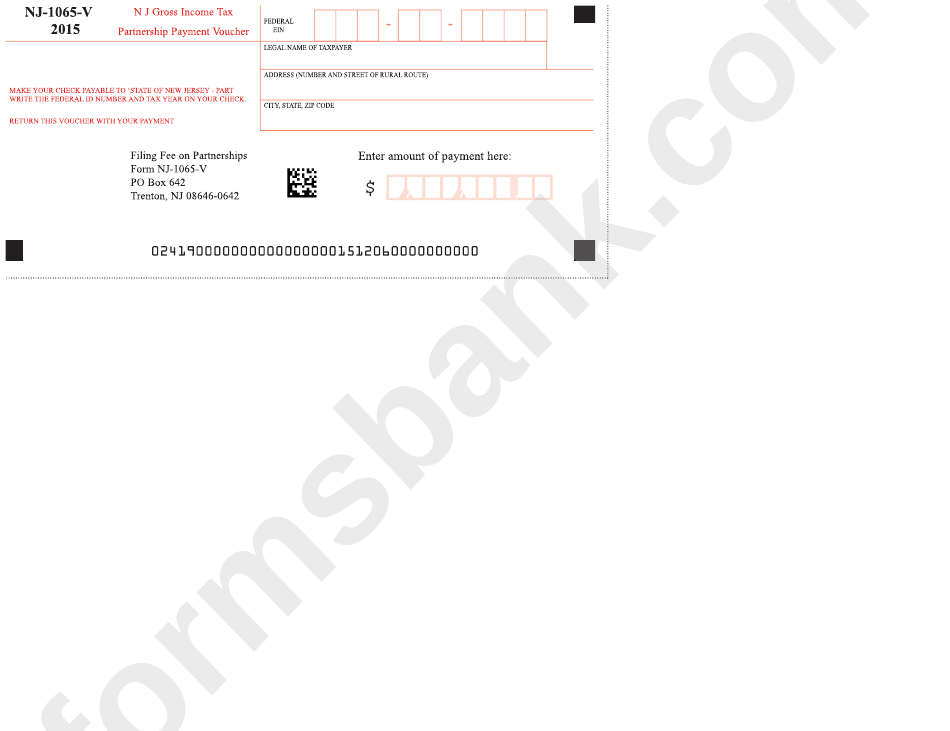

Fillable Form Nj1065V Nj Gross Tax Partnership Payment

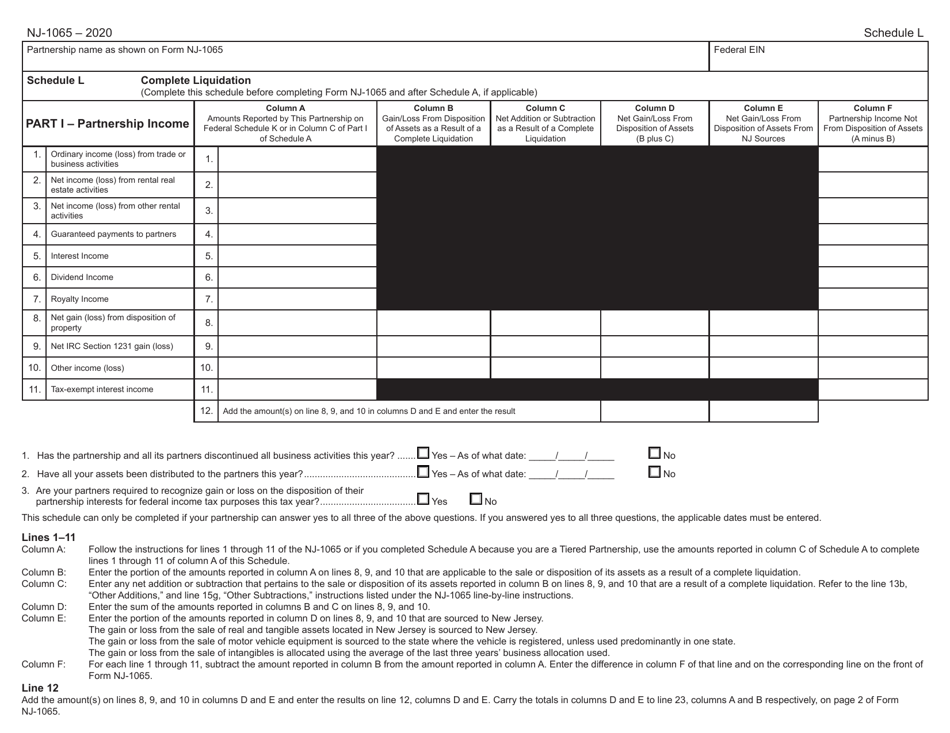

Form NJ1065 Schedule L Download Fillable PDF or Fill Online Complete

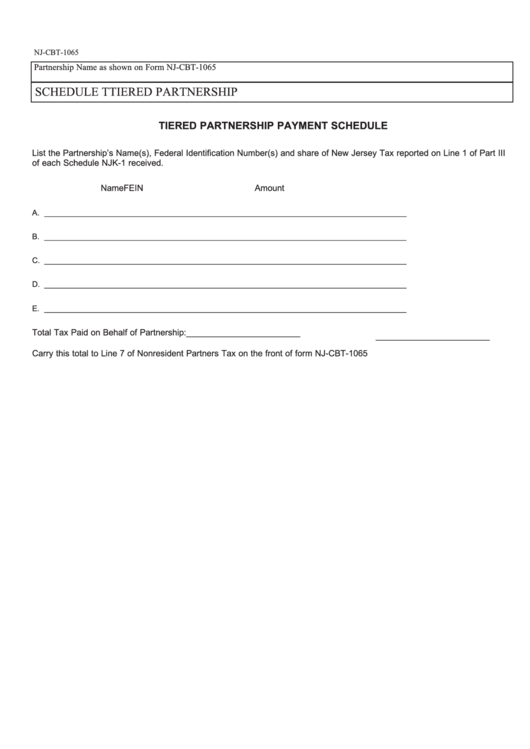

Form NjCbt1065 Tiered Partnership Payment Schedule printable pdf

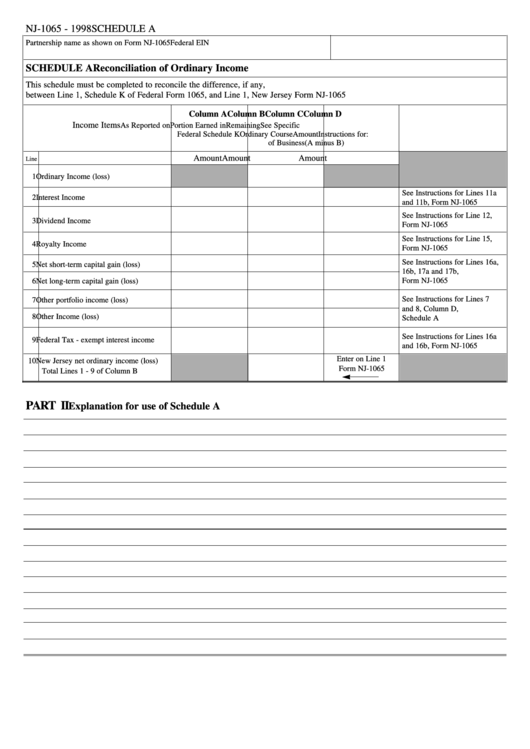

Fillable Form Nj1065 Schedule A Reconciliation Of Ordinary

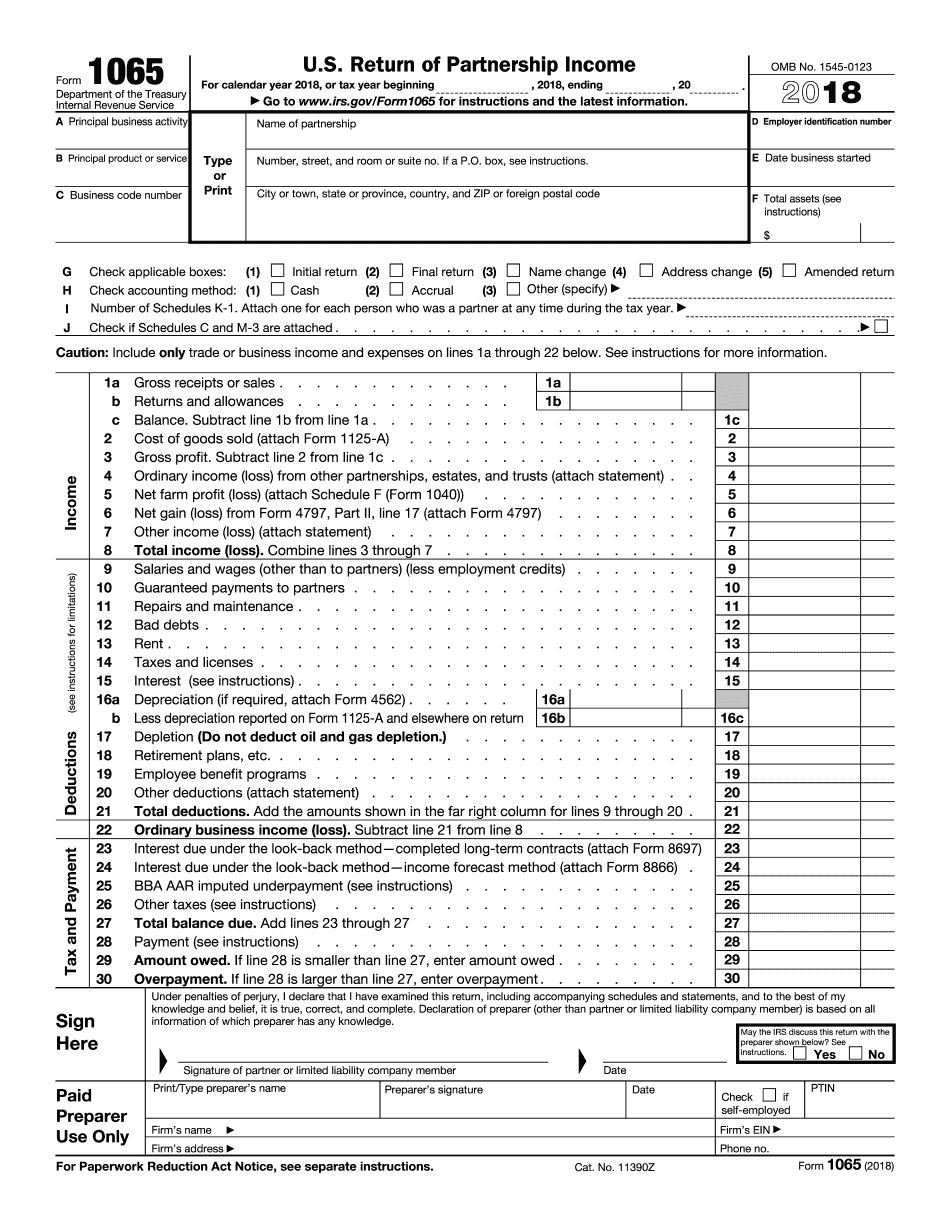

IRS 1065 2022 Form for New Jersey Fill Exactly for Your State

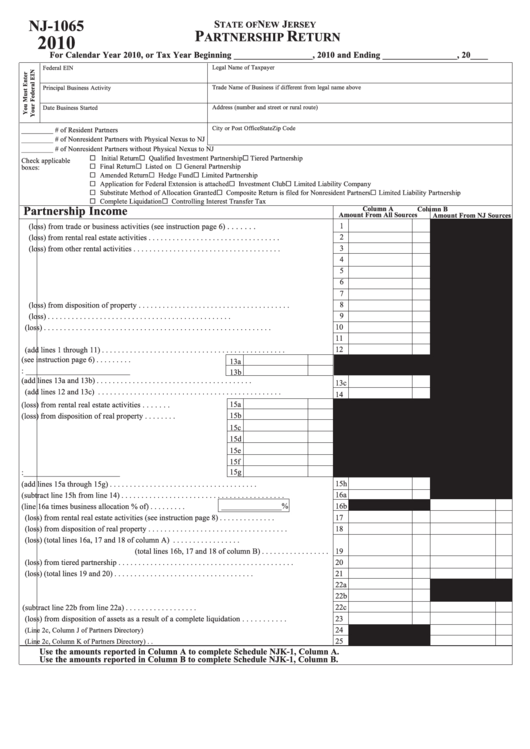

Fillable Form Nj1065 State Of New Jersey Partnership Return 2010

Form NJ1065E Download Fillable PDF or Fill Online New Jersey

Form Nj 1065 Partnership Return Gross Tax 2015 printable pdf

Related Post: