1099 Form Onlyfans

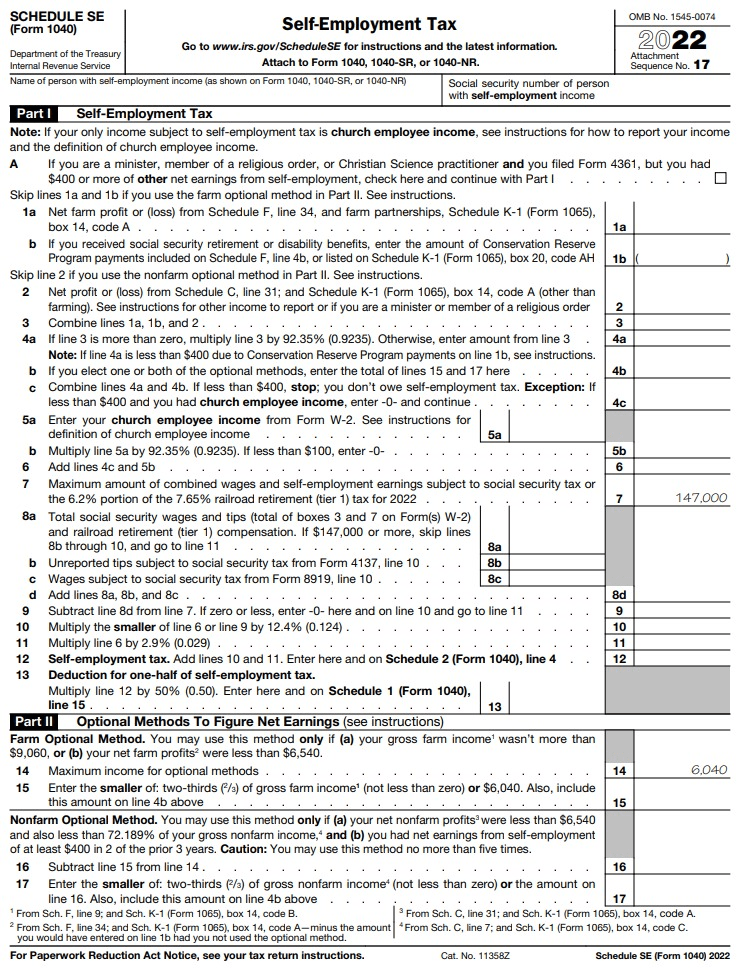

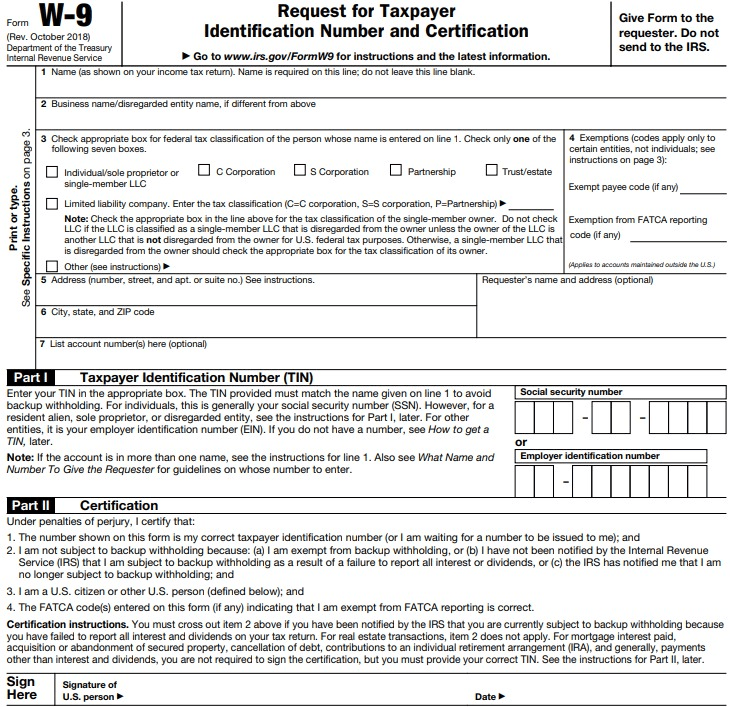

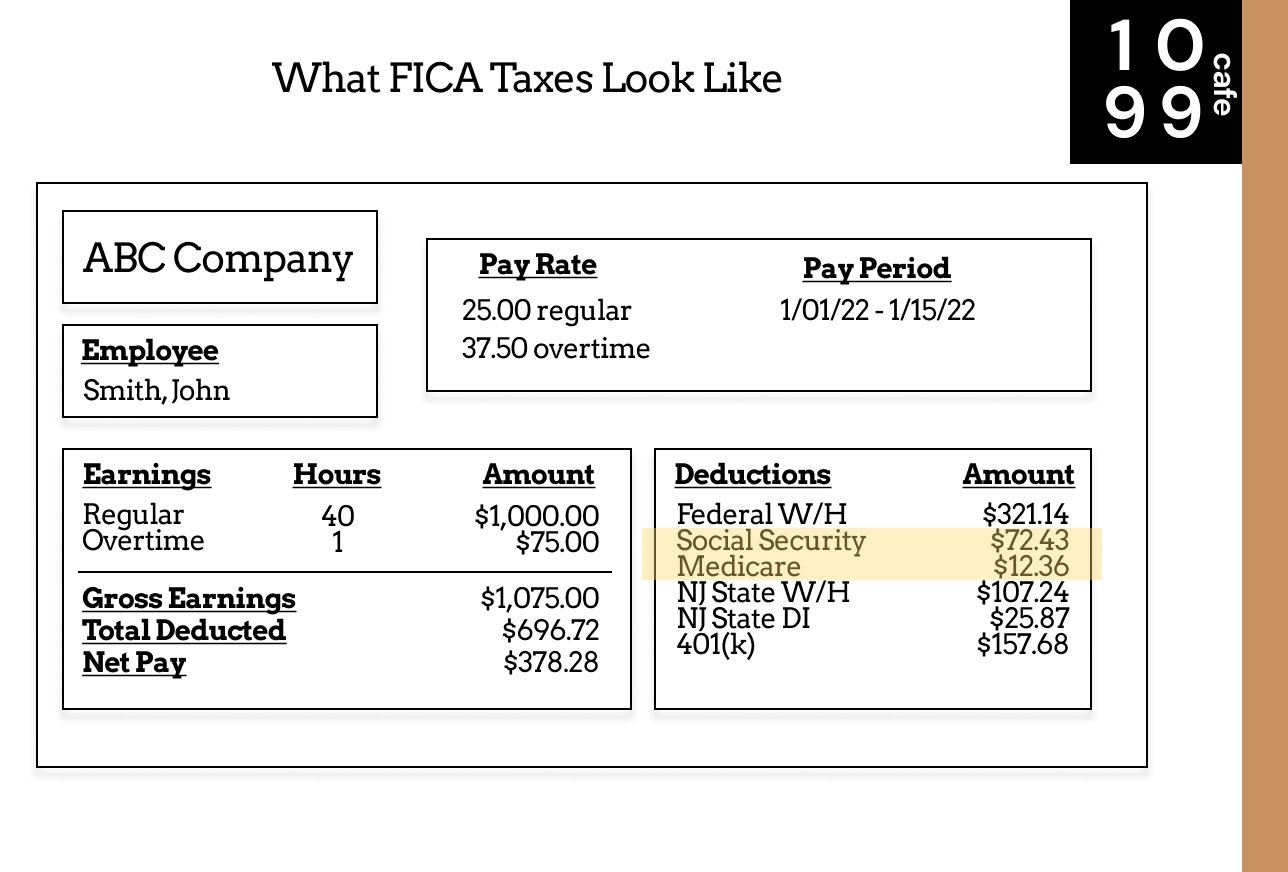

1099 Form Onlyfans - Web this makes your tax life very simple; Web wondering if you're going to receive a 1099 form in the mail from onlyfans? It is important to keep receipts for. The most common form creators will receive if they earn more. Web if you are resident in the united states and earn more than $600 from onlyfans, you should receive a 1099 form from the different brands you receive. Web onlyfans content creators can expect to receive one or more 1099 forms at the end of a tax year. This form is used to report. Web you may get a 1099 in the mail, and it looks like they will come from a company called fenix international ltd (i can update this when someone confirms). Prepare for irs filing deadlines. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. As an onlyfans creator, you’re considered. Web you may get a 1099 in the mail, and it looks like they will come from a company called fenix international ltd (i can update this when someone confirms). Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Prepare for irs filing deadlines. You will file. Web 1099 forms & schedules. In the united states, anyone who makes a yearly income of $600 is subject to paying taxes by filing a 1099 form. Web onlyfans tax forms onlyfans content creators can expect to receive one or more 1099 forms at the end of a tax year. This form is used to report. As an onlyfans creator,. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Everything you need to know. Web as an onlyfans content creator, you will likely receive a 1099 form from the platform if you have earned over $600 in a calendar year. Onlyfans income, including tips, is subject to taxes like any other job. To. Order 1099 forms, envelopes, and software today. The most common form creators will receive if they earn more. Onlyfans income, including tips, is subject to taxes like any other job. If you made less than $600,. To file your 1099 with the irs, you must file 4 schedules and forms schedule c, form 8829, form 4562, and schedule se. Web wondering if you're going to receive a 1099 form in the mail from onlyfans? You can simply download your 1099 form by following this simple. Onlyfans income, including tips, is subject to taxes like any other job. This form is used to report. The most common form creators will receive if they earn. Web wondering if you're going to receive a 1099 form in the mail from onlyfans? Prepare for irs filing deadlines. Web onlyfans is the social platform revolutionizing creator and fan connections. Onlyfans will issue you these around tax time. As an onlyfans creator, you’re considered. Web onlyfans is the social platform revolutionizing creator and fan connections. Web if you are resident in the united states and earn more than $600 from onlyfans, you should receive a 1099 form from the different brands you receive. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Onlyfans income, including tips, is. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. It is important to keep receipts for. This form will report your. When does onlyfans send 1099? You will file a schedule c and a schedule se with your 1040. It is important to keep receipts for. Web this makes your tax life very simple; The most common form creators will receive if they earn. Web onlyfans tax forms onlyfans content creators can expect to receive one or more 1099 forms at the end of a tax year. You can simply download your 1099 form by following this simple. Onlyfans income, including tips, is subject to taxes like any other job. The site is inclusive of artists and content creators from all genres and allows them to monetize their. Understanding onlyfans income tax and how it works. In the united states, anyone who makes a yearly income of $600 is subject to paying taxes by filing a 1099 form.. You can simply download your 1099 form by following this simple. Understanding onlyfans income tax and how it works. Prepare for irs filing deadlines. Web if you are resident in the united states and earn more than $600 from onlyfans, you should receive a 1099 form from the different brands you receive. Web you may get a 1099 in the mail, and it looks like they will come from a company called fenix international ltd (i can update this when someone confirms). Order 1099 forms, envelopes, and software today. As an onlyfans creator, you’re considered. In the united states, anyone who makes a yearly income of $600 is subject to paying taxes by filing a 1099 form. Web 1099 forms & schedules. It is important to keep receipts for. Web wondering if you're going to receive a 1099 form in the mail from onlyfans? This form is used to report. This form will report your. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. The most common form creators will receive if they earn. Well the answer is no. You will file a schedule c and a schedule se with your 1040. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web onlyfans content creators can expect to receive one or more 1099 forms at the end of a tax year. Web does onlyfans send you a 1099?How to file OnlyFans taxes (W9 and 1099 forms explained)

Why hasn’t the 1099 form popped up for me on onlyfans yet? I’ve made

How to file OnlyFans taxes (W9 and 1099 forms explained)

Onlyfans downloading your 1099 form for taxes. YouTube

Onlyfans release forms 🍓I have the OnlyFans Model Release Form in the

How to file OnlyFans taxes (W9 and 1099 forms explained)

OnlyFans Taxes in 2022 A Comprehensive Guide — 1099 Cafe

OnlyFans Taxes in 2022 A Comprehensive Guide — 1099 Cafe

Onlyfans downloading your 1099 form for taxes. YouTube

Memo OnlyFans & Myystar Creators Business Set Up and Tax Filing Tips

Related Post: