What Is The Difference Between Form 1040 And 1040-Sr

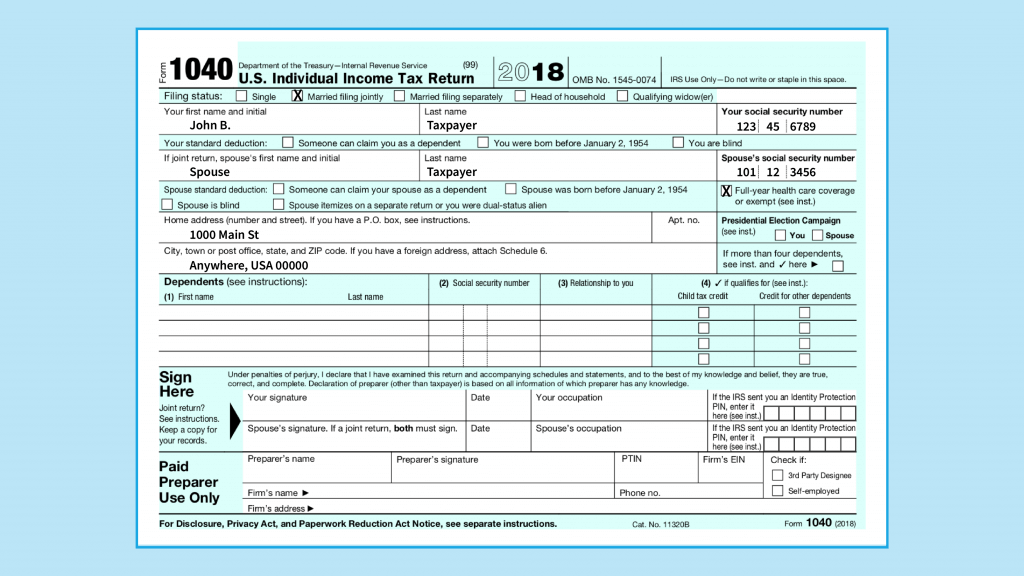

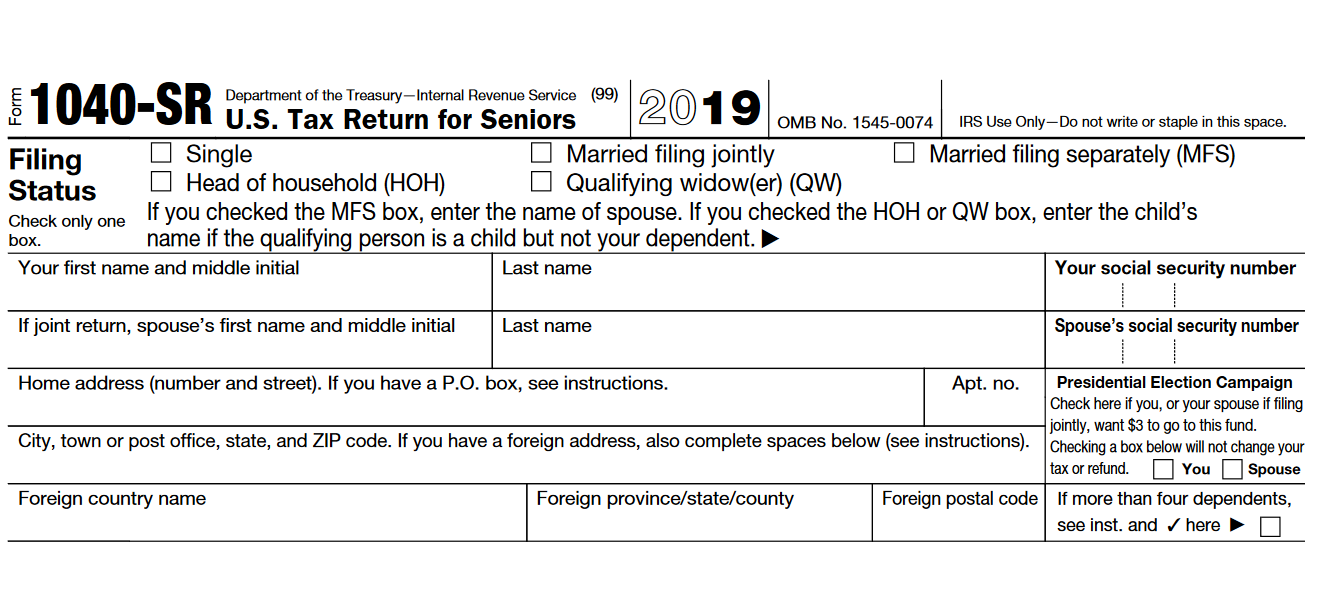

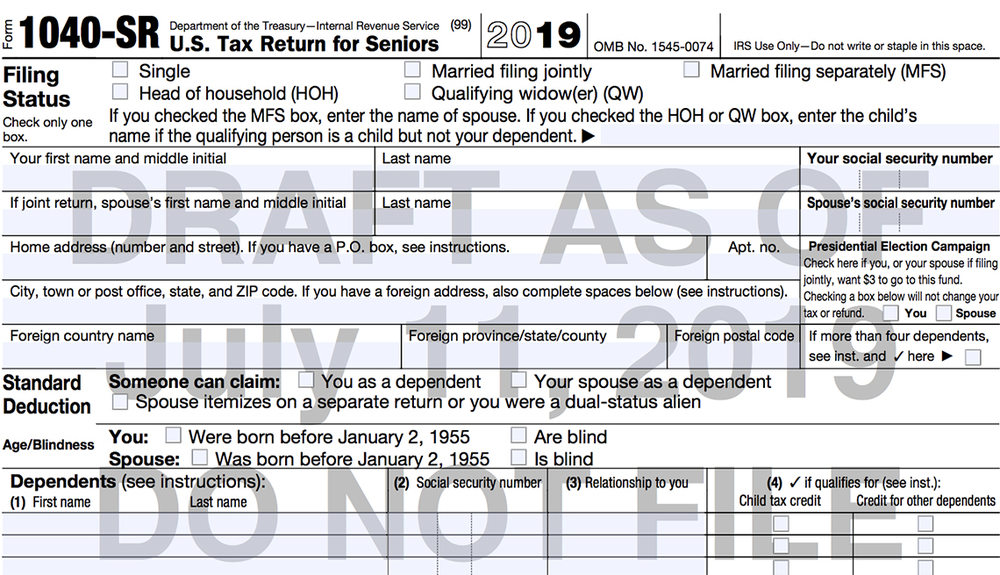

What Is The Difference Between Form 1040 And 1040-Sr - Web the 1040sr just has larger print for seniors to make it easier to read. It’s almost exactly the same as the standard 1040 form, but it’s printed in a larger font for. Upload, modify or create forms. Web fees varies by filing option show pros, cons, and more what is form 1040? Web does it really matter? Your tax calculations will be the same and you can itemize whether you use form 1040 or 1040sr. You must be 65 or older. Try it for free now! Form 1040 is the irs form that us taxpayers use to file their annual income tax returns. Taxpayers 65 and older can use this form. Web the 1040sr just has larger print for seniors to make it easier to read. Web fees varies by filing option show pros, cons, and more what is form 1040? The 1040 form changes by tax year. Enter your status, income, deductions and credits and estimate your total taxes. You must be 65 or older. Upload, modify or create forms. Web taxpayers 65 or over are entitled to an additional $1,300 standard deduction. Web • box 6, add $5,000 to the taxable disability income of the spouse who was under age 65. Income tax return for single and. But one aspect of the change that hasn't gotten a. Enter your status, income, deductions and credits and estimate your total taxes. Web published january 21, 2020. Try it for free now! Web fees varies by filing option show pros, cons, and more what is form 1040? Your tax calculations will be the same and you can itemize whether you use form 1040 or 1040sr. The 1040 form changes by tax year. But one aspect of the change that hasn't gotten a. Web • box 6, add $5,000 to the taxable disability income of the spouse who was under age 65. Web does it really matter? It’s almost exactly the same as the standard 1040 form, but it’s printed in a larger font for. Web but there were alternative forms that were used depending on the circumstances of individual taxpayers: Your tax calculations will be the same and you can itemize whether you use form 1040 or 1040sr. Web if any of your social security or equivalent railroad retirement benefits are taxable, the amount to enter on this line is generally the difference between. Web published january 21, 2020. Tax return for seniors, including recent updates, related forms and instructions on how to file. Web if any of your social security or equivalent railroad retirement benefits are taxable, the amount to enter on this line is generally the difference between the amounts entered on. • box 2, 4, or 9, enter your taxable disability. Web but there were alternative forms that were used depending on the circumstances of individual taxpayers: Web taxpayers 65 or over are entitled to an additional $1,300 standard deduction. Form 1040 is the irs form that us taxpayers use to file their annual income tax returns. Your tax calculations will be the same and you can itemize whether you use. Web but there were alternative forms that were used depending on the circumstances of individual taxpayers: It's optional but has larger print and a chart designed to help taxpayers calculate their standard deductions. Web does it really matter? It’s almost exactly the same as the standard 1040 form, but it’s printed in a larger font for. Tax return for seniors,. • box 2, 4, or 9, enter your taxable disability income. Web does it really matter? But one aspect of the change that hasn't gotten a. You must be 65 or older. Upload, modify or create forms. Ad discover helpful information and resources on taxes from aarp. Upload, modify or create forms. Web does it really matter? You must be 65 or older. • box 2, 4, or 9, enter your taxable disability income. Web does it really matter? Web taxpayers 65 or over are entitled to an additional $1,300 standard deduction. But one aspect of the change that hasn't gotten a. Web the 1040sr just has larger print for seniors to make it easier to read. The internal revenue service's new “u.s. Web fees varies by filing option show pros, cons, and more what is form 1040? You must be 65 or older. Your tax calculations will be the same and you can itemize whether you use form 1040 or 1040sr. Taxpayers 65 and older can use this form. Tax return for seniors” could make filing season a bit less taxing for some older taxpayers — provided. Upload, modify or create forms. • box 2, 4, or 9, enter your taxable disability income. Web • box 6, add $5,000 to the taxable disability income of the spouse who was under age 65. It’s almost exactly the same as the standard 1040 form, but it’s printed in a larger font for. Try it for free now! Web published january 21, 2020. The 1040 form changes by tax year. Enter your status, income, deductions and credits and estimate your total taxes. Income tax return for single and. Ad discover helpful information and resources on taxes from aarp.1040SR What you need to know about the new tax form for seniors

What Is The 1040 And What S The Difference Between The 1040 Form

Form 1040 U.S. Individual Tax Return Definition

“1040SR The New Tax Return Form for Seniors” The Balance Berks

Form 1040 SR Should You Use It For Your 2019 Tax Return 1040 Form

IRS Creates New 1040SR Tax Return for Seniors The Good Life

What Is the Difference Between Form 1040 and 1040SR?

1040SR What you need to know about the new tax form for seniors

Form 1040SR Seniors Get a New Simplified Tax Form

Us Tax Forms 1040 And New 1040 Sr For 2019 Stock Photo

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png)