Irs Form 8009-A

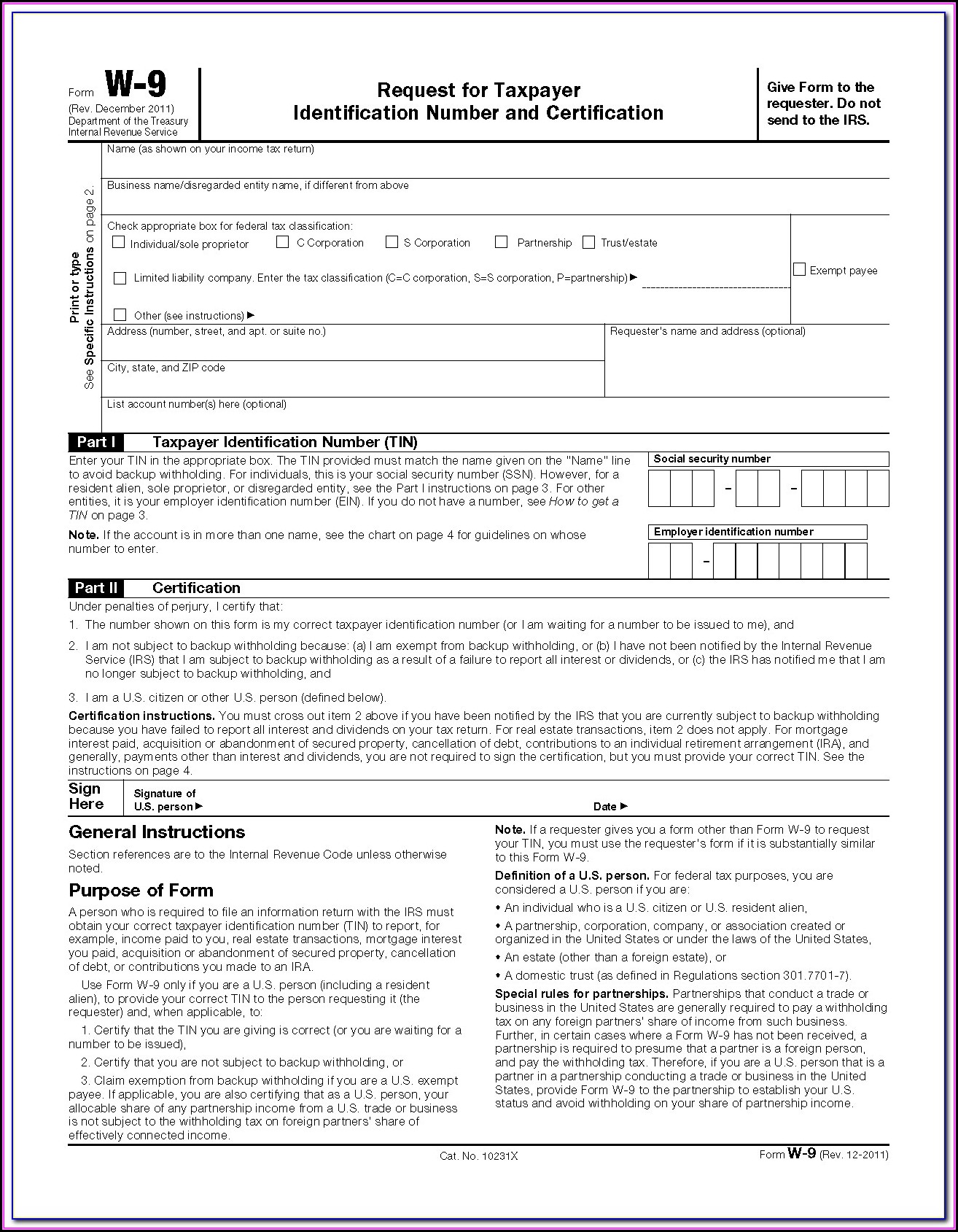

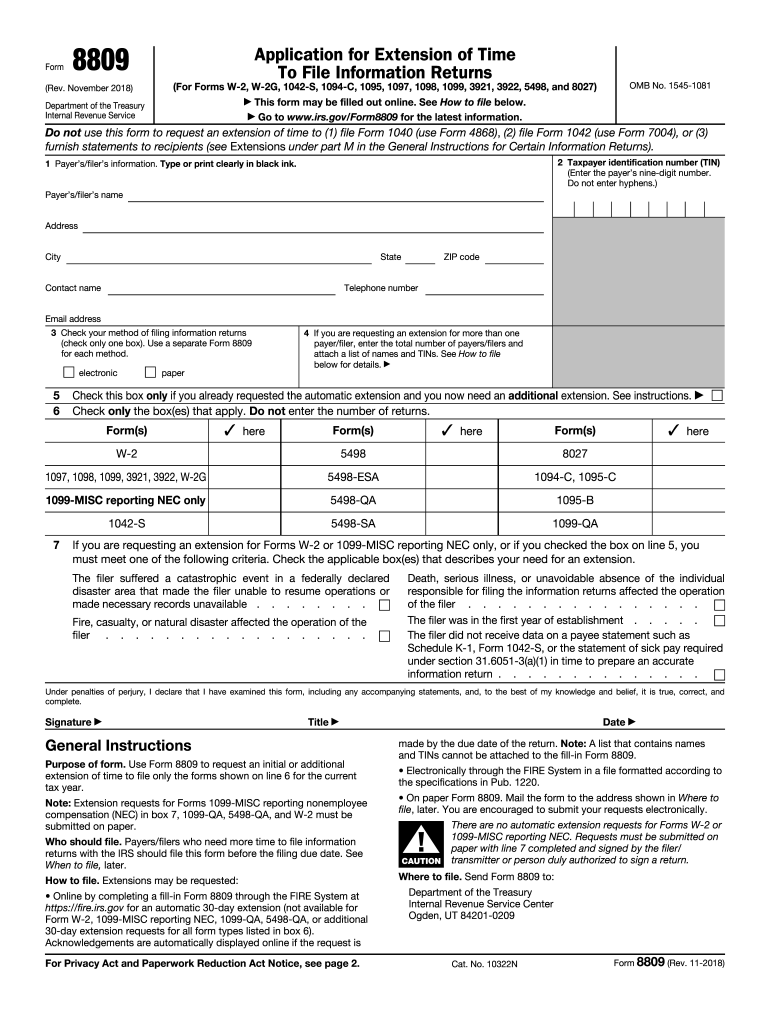

Irs Form 8009-A - Person (including a resident alien) and to request certain certifications and claims for. Browse for the irs form 8009 a. Send out signed form 8009 a irs or print it. I don't know what it means or how to fix my return. Irs form 8809 can be extremely helpful for. Ad we help get taxpayers relief from owed irs back taxes. Box 7 states that i need to submit a. Enter the entity's name as shown on the entity's tax return on line 1 and any business, trade,. Ad find essential office supplies for meticulous recordkeeping at amazon. Start by gathering all the necessary information and documents required for filling out the form. Start by gathering all the necessary information and documents required for filling out the form. Web information about form 8809, application for extension of time to file information returns, including recent updates, related forms and instructions on how to. The irs sent me the form 15111 because we might be eligible for the earned income tax credit. Web up to. Ad we help get taxpayers relief from owed irs back taxes. Use form 8809 to request an initial or additional extension of time to file only the forms shown on line 6 for the current tax year. Ad find essential office supplies for meticulous recordkeeping at amazon. The irs sent me the form 15111 because we might be eligible for. The irs sent me the form 15111 because we might be eligible for the earned income tax credit. Start by gathering all the necessary information and documents required for filling out the form. I accidentally filed single even though i. Web up to $40 cash back to fill out form 8009 a, follow these steps: Web employer's quarterly federal tax. Send out signed form 8009 a irs or print it. Web employer's quarterly federal tax return. Box 7 states that i need to submit a. So we sent in form 15111. Person (including a resident alien) and to request certain certifications and claims for. Get deals and low prices on irs form 1099 nec at amazon I accidentally filed single even though i. I had to send in a third 1040x amended. Use form 8809 to request an initial or additional extension of time to file only the forms shown on line 6 for the current tax year. Start by gathering all the necessary. Ad find essential office supplies for meticulous recordkeeping at amazon. Enter the entity's name as shown on the entity's tax return on line 1 and any business, trade,. Web i filled out the form 15112 earned income credit worksheet and sent march 23rd, 2022, and they received it on march 25th, 2022. Start by gathering all the necessary information and. Customize and esign 8009 a form. I don't know what it means or how to fix my return. So we sent in form 15111. Send out signed form 8009 a irs or print it. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Use form 8809 to request an initial or additional extension of time to file only the forms shown on line 6 for the current tax year. Send out signed form 8009 a irs or print it. Customize and esign 8009 a form. I had to send in a third 1040x amended. The irs sent me the form 15111 because we. Use form 8809 to request an initial or additional extension of time to file only the forms shown on line 6 for the current tax year. Send out signed form 8009 a irs or print it. I had to send in a third 1040x amended. So we sent in form 15111. I accidentally filed single even though i. The irs sent me the form 15111 because we might be eligible for the earned income tax credit. Estimate how much you could potentially save in just a matter of minutes. Send out signed form 8009 a irs or print it. Irs form 8809 can be extremely helpful for. Use form 8809 to request an initial or additional extension of. I had to send in a third 1040x amended. Customize and esign 8009 a form. Web information about form 8809, application for extension of time to file information returns, including recent updates, related forms and instructions on how to. The irs sent me the form 15111 because we might be eligible for the earned income tax credit. Get deals and low prices on irs form 1099 nec at amazon Web employer's quarterly federal tax return. So we sent in form 15111. Enter the entity's name as shown on the entity's tax return on line 1 and any business, trade,. Send out signed form 8009 a irs or print it. Irs form 8809 can be extremely helpful for. Person (including a resident alien) and to request certain certifications and claims for. As everyone gets started on 2019 taxes i'm still dealing with a mistake on my 2017 taxes. However, today (10/07/22), i received form. Web i filled out the form 15112 earned income credit worksheet and sent march 23rd, 2022, and they received it on march 25th, 2022. They have checked box 9. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Use form 8809 to request an initial or additional extension of time to file only the forms shown on line 6 for the current tax year. Box 7 states that i need to submit a. I don't know what it means or how to fix my return. Web one form that many small business owners don’t know about, and therefore can’t take advantage of, is irs form 8809.Fill Free fillable IRS PDF forms

Osha Fillable Forms Form Resume Examples 7NYAW712pv

Form 2220 Underpayment of Estimated Tax by Corporations (2014) Free

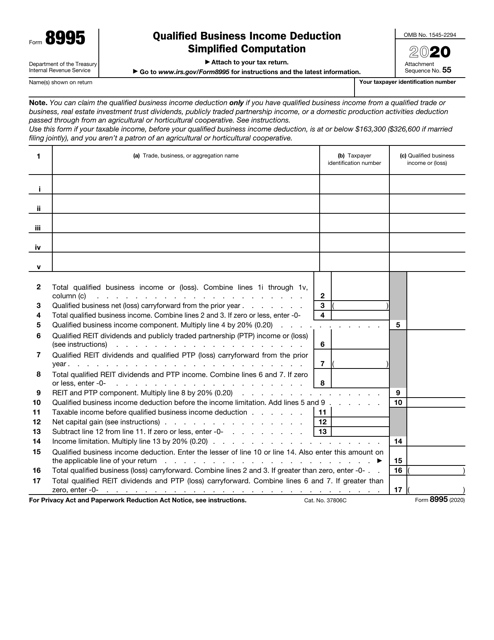

Qualified Business Deduction Simplified Worksheet Instructions

2020 8804 Fill out & sign online DocHub

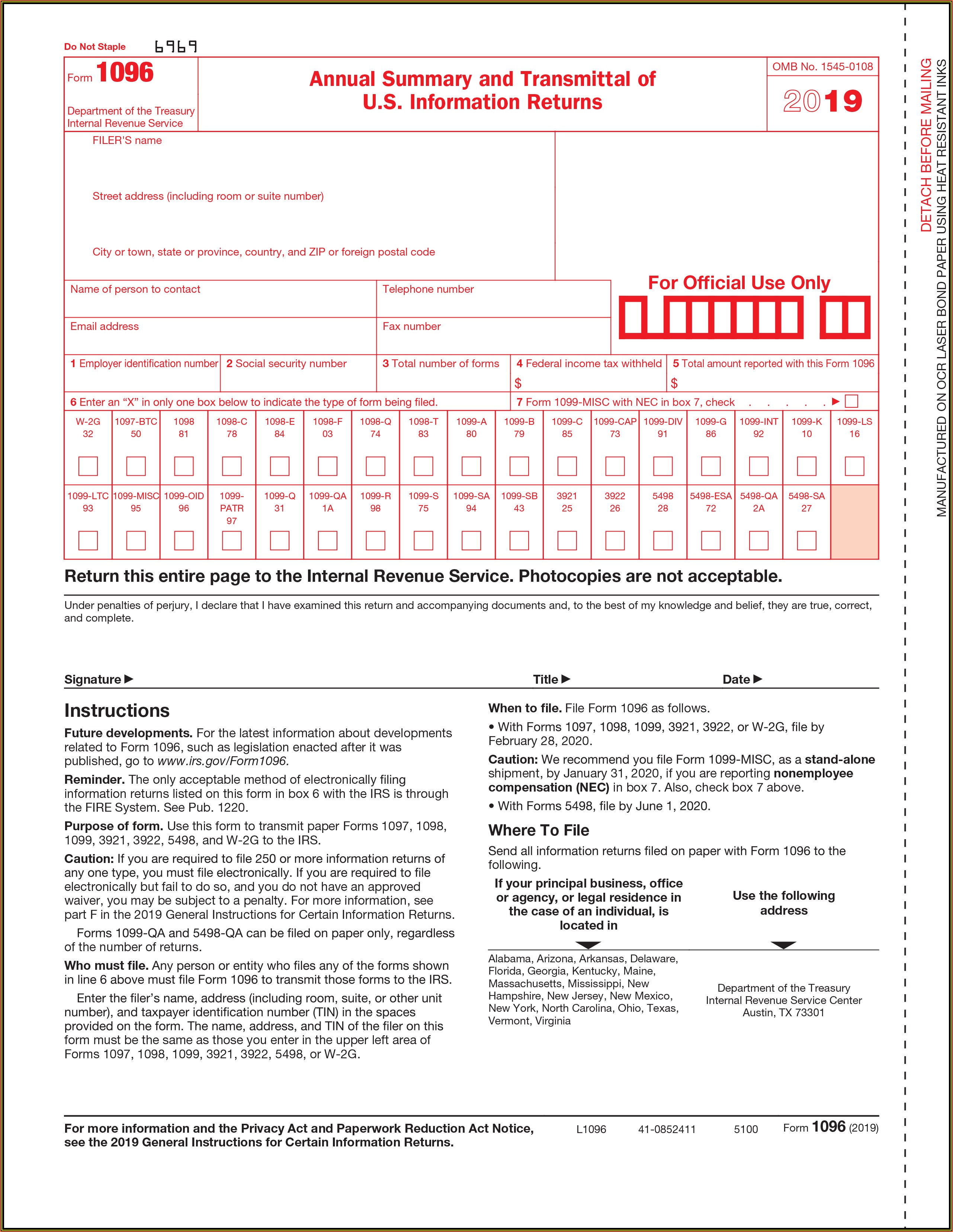

Irs Forms 1096 Order Form Resume Examples ojYqPro9zl

Ith Bolt Tensioning Chart Fill Online, Printable, Fillable,

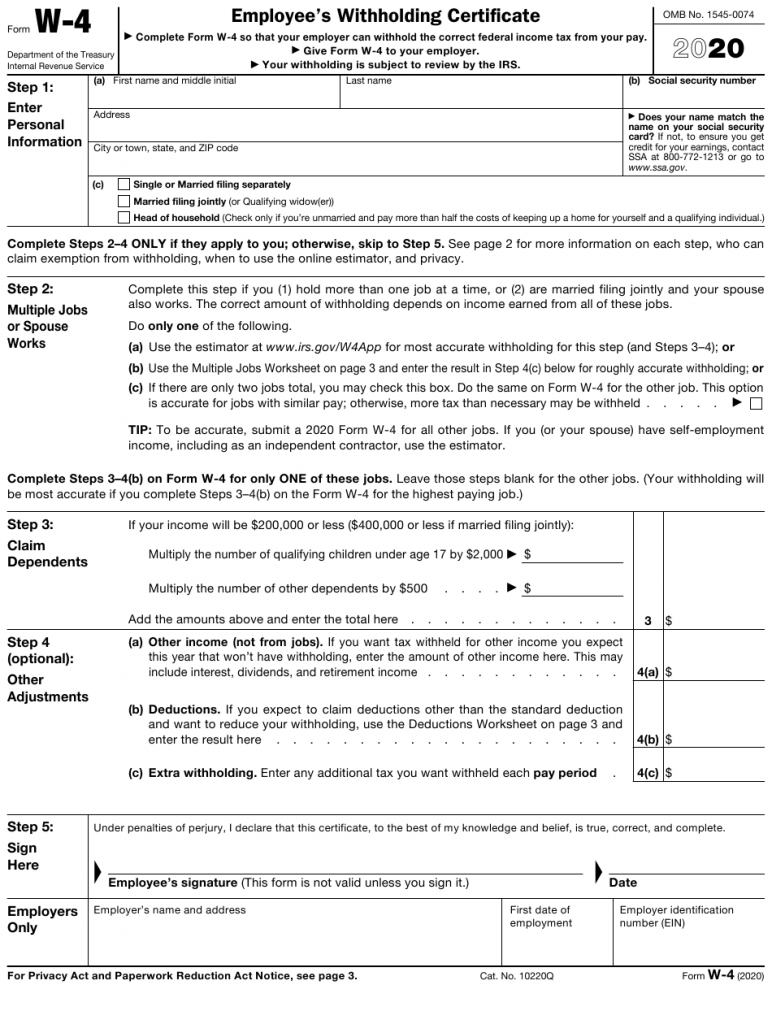

Irs W 4 Form Printable Printable Form 2021

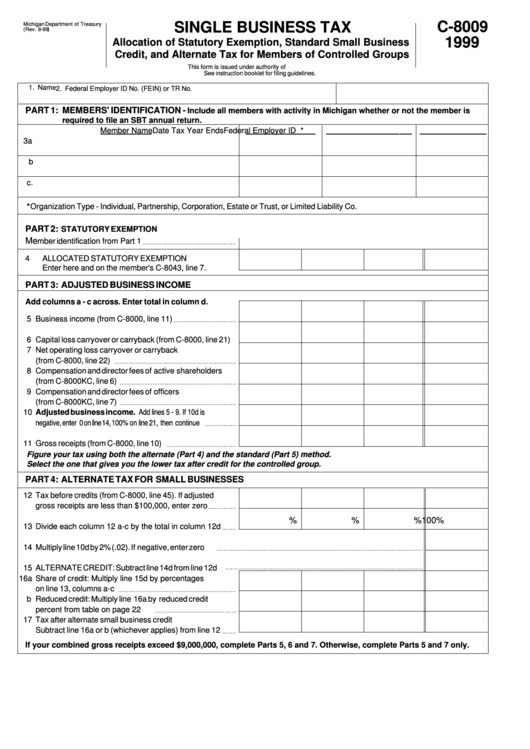

Form C8009 Single Business Tax Allocation Of Statutory Exemption

Irs Form W4V Printable where do i mail my w 4v form for social

Related Post: