Irs Form 4972 Instructions

Irs Form 4972 Instructions - Web forms and instructions. C if you choose not to use any part of form 4972, report the. Severance pay, retirement benefits and special payroll instructions all uses the lump sum tax method to calculate. Web use screen 1099r in the income folder to complete form 4972. Web form 4972 and its instructions, such as legislation enacted after they were published, go to. Easily sign the form with your finger. Web regulatory and legislative. Web what is irs form 4972 used for? Upload, modify or create forms. ★ ★ ★ ★ ★. Web open form follow the instructions. ★ ★ ★ ★ ★. Send filled & signed form or. Use this form to figure the amount of investment interest expense you can. Web treat this amount as a capital gain on form 4972 (not on schedule d (form 1040)). Web technique for the calculation of lump sum tax. Send filled & signed form or save. Send filled & signed form or. Easily sign the form with your finger. Web use screen 1099r in the income folder to complete form 4972. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. ★ ★ ★ ★ ★. The following choices are available. C if you choose not to use any part of form 4972, report the. Web treat this amount as a capital gain on form 4972 (not on schedule d. Web instructions for form 4972. Web open form follow the instructions. Web treat this amount as a capital gain on form 4972 (not on schedule d (form 1040)). Web use screen 1099r in the income folder to complete form 4972. Easily sign the form with your finger. Free downloads of customizable forms. Web forms and instructions. Web what is irs form 4972 used for? See the form 4972 instructions. About form 4952, investment interest expense deduction. Ad outgrow.us has been visited by 10k+ users in the past month Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Web what is irs form 4972 used for? Web instructions for form 4972. Section references are to the internal revenue code. Web form 4972 and its instructions, such as legislation enacted after they were published, go to. Use this form to figure the amount of investment interest expense you can. Web technique for the calculation of lump sum tax. Easily sign the form with your finger. Web forms and instructions. Section references are to the internal revenue code. Web to fill out irs form 4972, you need to gather all necessary information, fill out your identifying information, calculate the tax, complete the schedule for additional taxes if. Easily sign the form with your finger. We ask for the information on. Web instructions for form 4972. Try it for free now! Severance pay, retirement benefits and special payroll instructions all uses the lump sum tax method to calculate. Free downloads of customizable forms. General instructions purpose of form. Open form follow the instructions. Send filled & signed form or. Web forms and instructions. Web regulatory and legislative. About form 4952, investment interest expense deduction. Web instructions for form 4972. Easily sign the form with your finger. Ad outgrow.us has been visited by 10k+ users in the past month Web treat this amount as a capital gain on form 4972 (not on schedule d (form 1040)). Web instructions for form 4972. Web technique for the calculation of lump sum tax. Use this form to figure the amount of investment interest expense you can. Open form follow the instructions. Free downloads of customizable forms. Easily sign the form with your finger. Web form 4972 and its instructions, such as legislation enacted after they were published, go to. The following choices are available. Web what is irs form 4972 used for? Web regulatory and legislative. Web use screen 1099r in the income folder to complete form 4972. Severance pay, retirement benefits and special payroll instructions all uses the lump sum tax method to calculate. Web to fill out irs form 4972, you need to gather all necessary information, fill out your identifying information, calculate the tax, complete the schedule for additional taxes if. Try it for free now! Upload, modify or create forms. About form 4952, investment interest expense deduction. Section references are to the internal revenue code.IRS Form 712 Instructions

IRS Form 4972 Instructions Lump Sum Distributions

Form 4972 Tax on LumpSum Distributions (2015) Free Download

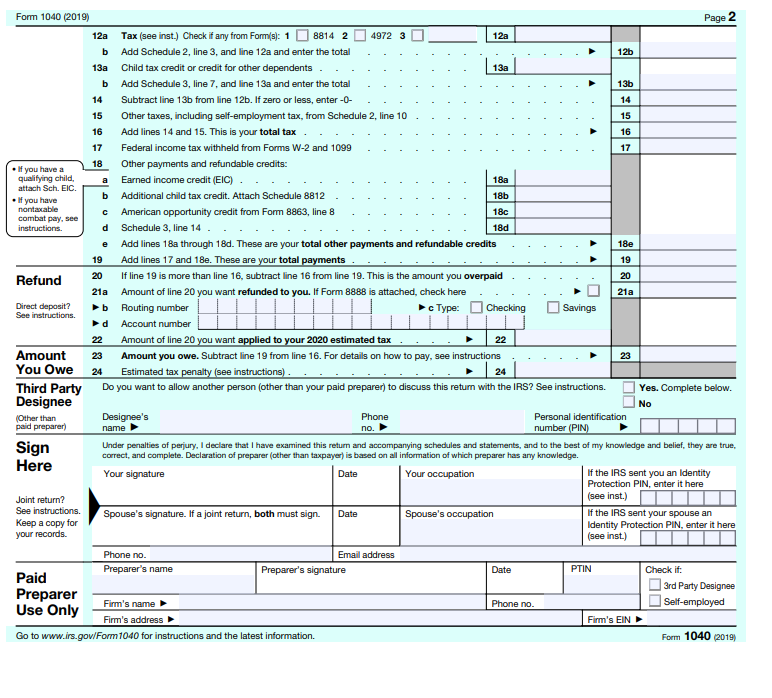

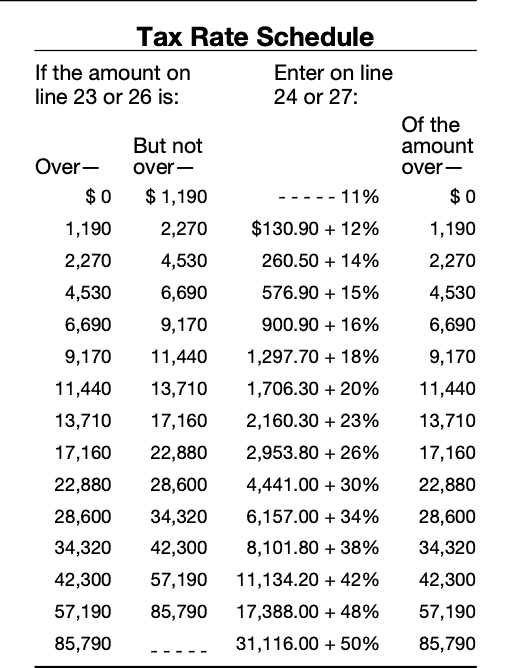

Solved USE 2020 TAX SCHEDULE, FILL OUT SPACES THAT APPLY ON

2019 IRS Form 4972 Fill Out Digital PDF Sample

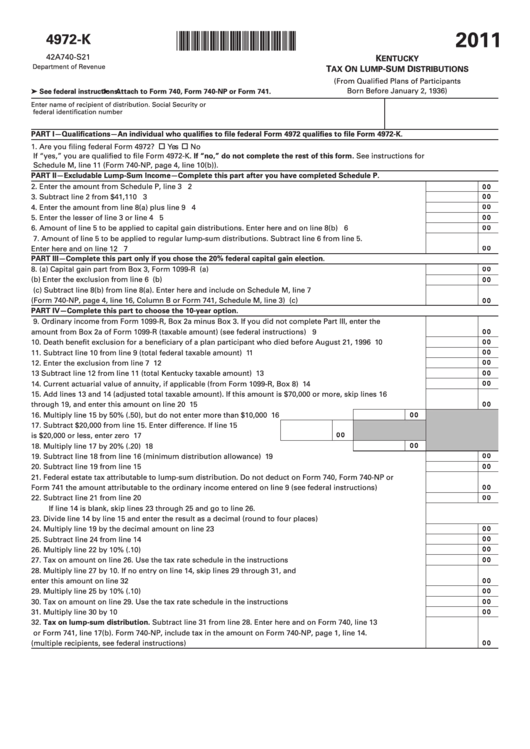

Fillable Form 4972K 2011 Kentucky Tax On LumpSum Distributions

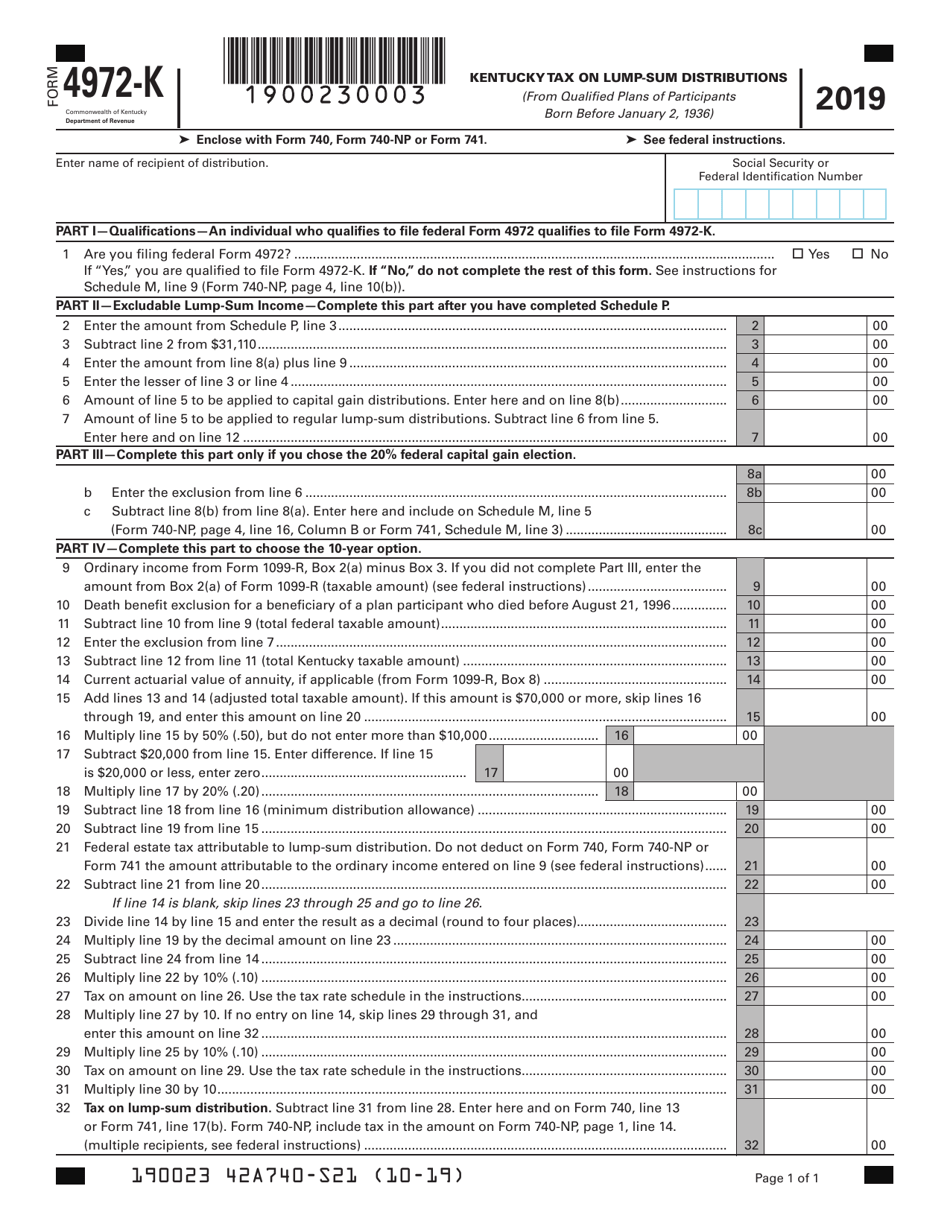

Form 4972K Download Fillable PDF or Fill Online Kentucky Tax on Lump

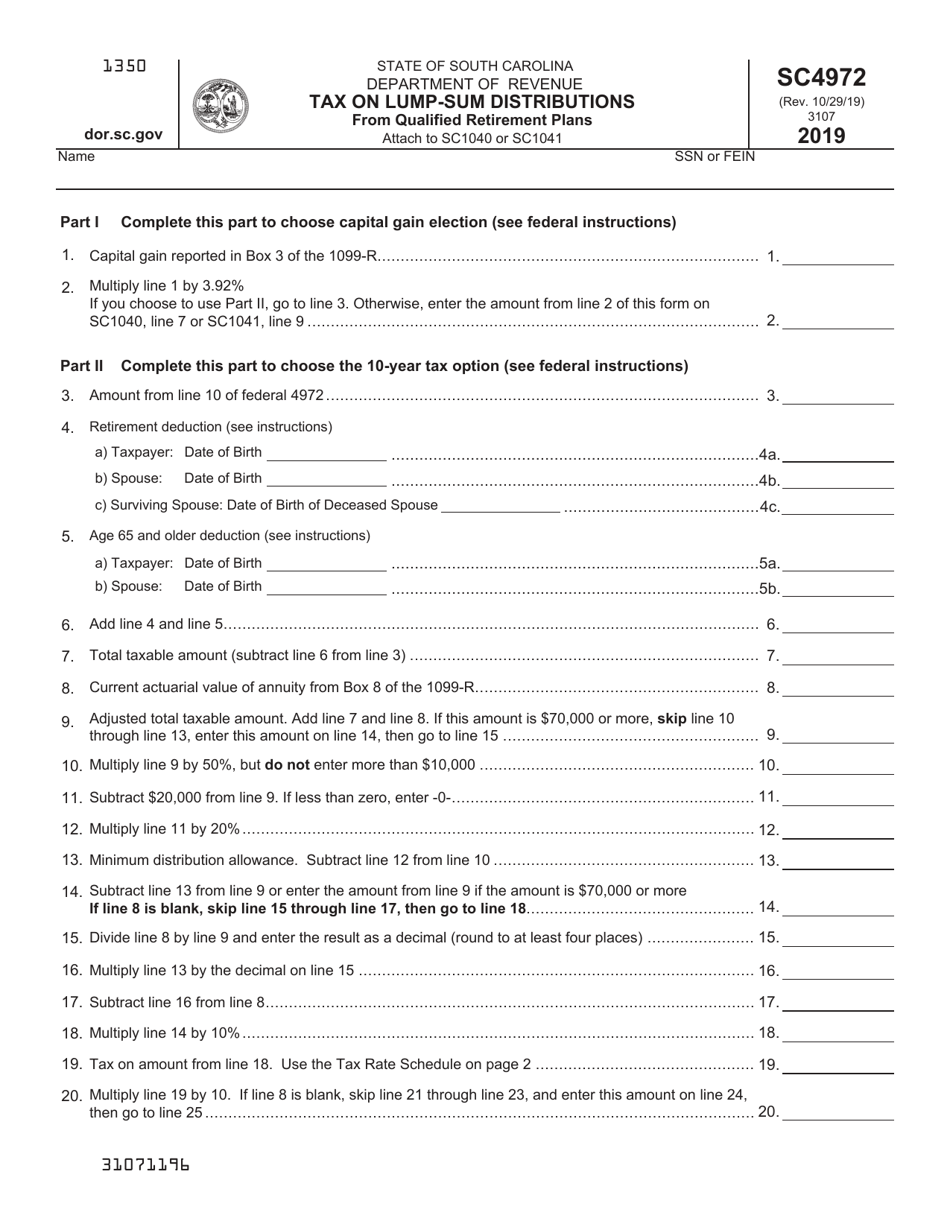

Form SC4972 Download Printable PDF or Fill Online Tax on LumpSum

IRS Form 4972A Guide to Tax on LumpSum Distributions

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Related Post: