What Is Form 3893

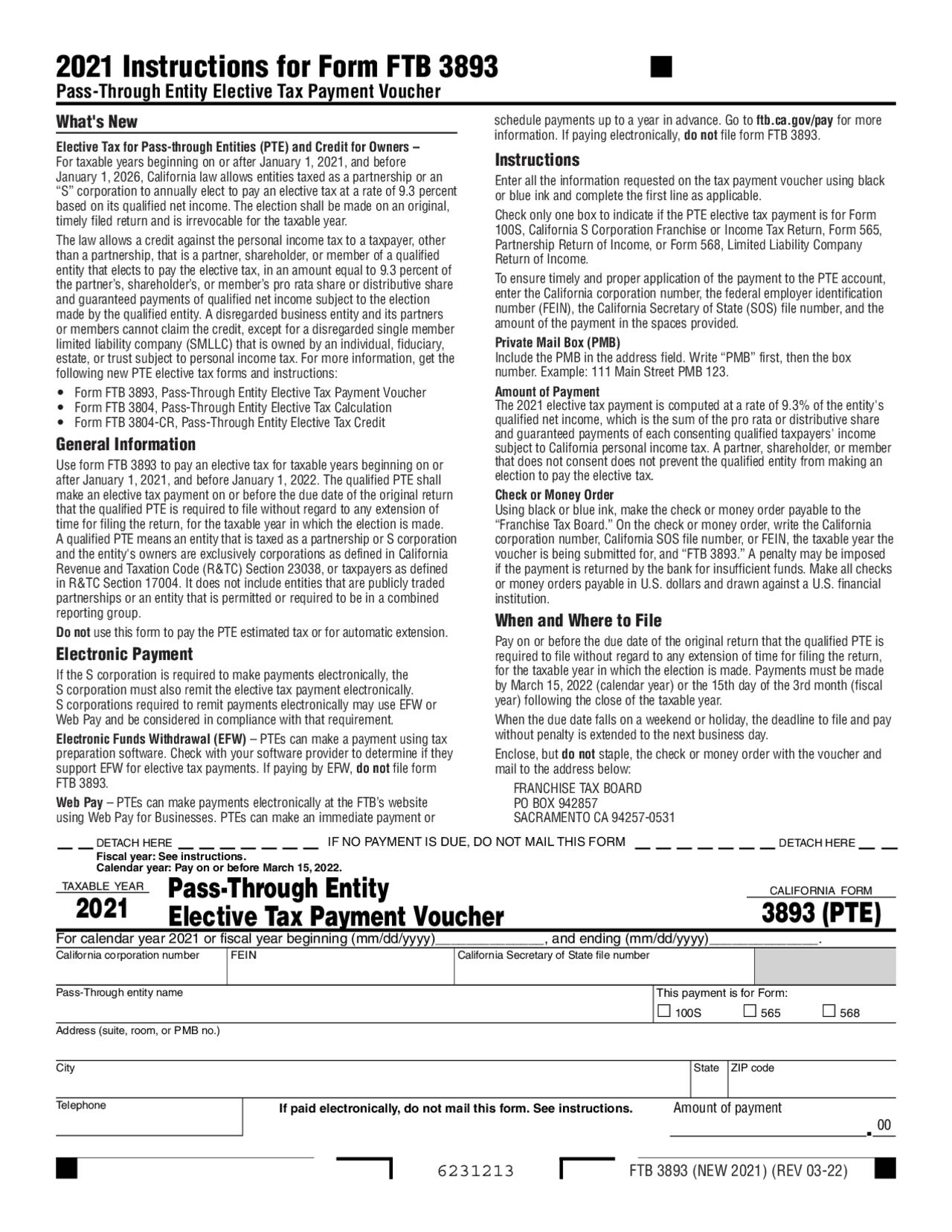

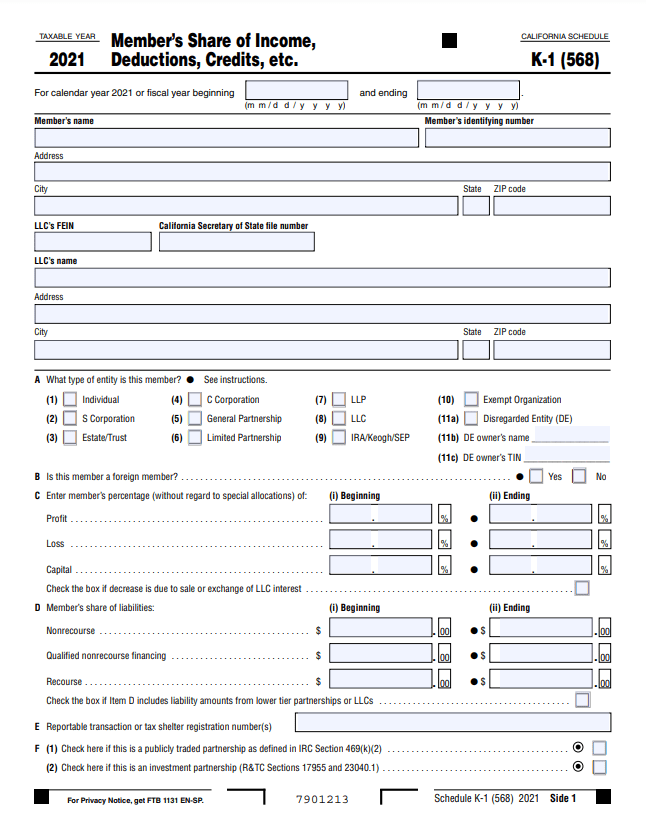

What Is Form 3893 - Ftb 3804, part i, line 3 will calculate the elective tax according to all. Web corrections to form 8993 if you file a form 8993 that you later determine is incomplete or incorrect, file a corrected form 8993 with an amended tax return, using the amended. Ftb 3804, part i, line 3 will calculate the elective according to all. Web california pte tax in proseries. Web form 940, line 9 or line 10 (f) credit reduction amount allocated to the listed client ein from form 940, line 11 (g) total futa tax after adjustments allocated to the listed client ein. Web 6231223 ftb 3893 2021 6231223 100s use web pay for business and enjoy the ease of our free online payment service. An annual election is made on an original, timely filed tax return. However, the instructions to for ftb 3893 indicate. Or form 568, line 9); And the 3893 (pmt) will print, showing only. Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). Web the instructions include: Ftb 3804, part i, line 3 will calculate the elective tax according to all. Web should form 3893 print in government copy? Web use form ftb 3893 to pay an elective tax for taxable years. Web use form 8993 to figure the amount of the eligible deduction for fdii and gilti under section 250. Ftb 3804, part i, line 3 will calculate the elective according to all. Once the election is made, it is irrevocable for that year and is binding on all partners, shareholders, and members of the pte. Or form 568, line 9);. Web the instructions include: Web 6231223 ftb 3893 2021 6231223 100s use web pay for business and enjoy the ease of our free online payment service. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. Once the election is made, it. Solved•by intuit•40•updated march 01, 2023. Web 6231223 ftb 3893 2021 6231223 100s use web pay for business and enjoy the ease of our free online payment service. An annual election is made on an original, timely filed tax return. Once the election is made, it is irrevocable for that year and is binding on all partners, shareholders, and members of. And the 3893 (pmt) will print, showing only. If an entity does not make that first. Web form 940, line 9 or line 10 (f) credit reduction amount allocated to the listed client ein from form 940, line 11 (g) total futa tax after adjustments allocated to the listed client ein. Web partnerships and s corporations may use ftb 3893. Ftb 3804, part i, line 3 will calculate the elective tax according to all. We anticipate the revised form 3893 will be available march 7, 2022. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. Web to make a payment of the ca ptet,. Solved•by intuit•40•updated march 01, 2023. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. Web to. An annual election is made on an original, timely filed tax return. Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). Web form 940, line 9 or line 10 (f) credit reduction amount allocated to the listed client ein from form 940, line 11 (g) total futa tax. Web use form 8993 to figure the amount of the eligible deduction for fdii and gilti under section 250. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. Or form 568, line 9); Web 6231223 ftb 3893 2021 6231223 100s use. Web the full amount of pte tax will print on the “amount paid with form ftb 3893” line (form 565, line 30; Web the instructions include: Ftb 3804, part i, line 3 will calculate the elective tax according to all. Web use form 8993 to figure the amount of the eligible deduction for fdii and gilti under section 250. Solved•by. Web corrections to form 8993 if you file a form 8993 that you later determine is incomplete or incorrect, file a corrected form 8993 with an amended tax return, using the amended. If an entity does not make that first. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. And the 3893 (pmt) will print, showing only. Web the full amount of pte tax will print on the “amount paid with form ftb 3893” line (form 565, line 30; However, the instructions to for ftb 3893 indicate. An annual election is made on an original, timely filed tax return. Web use form 8993 to figure the amount of the eligible deduction for fdii and gilti under section 250. 100s form at bottom of page. Solved•by intuit•40•updated march 01, 2023. Web california pte tax in proseries. Web should form 3893 print in government copy? Ftb 3804, part i, line 3 will calculate the elective according to all. 1) ptes electing to pay the tax must use form 3893 to make payment for taxable years beginning on or after jan. Ftb 3804, part i, line 3 will calculate the elective tax according to all. Once the election is made, it is irrevocable for that year and is binding on all partners, shareholders, and members of the pte. Web form 940, line 9 or line 10 (f) credit reduction amount allocated to the listed client ein from form 940, line 11 (g) total futa tax after adjustments allocated to the listed client ein. Exception for exempt organizations, federal,. Who must file all domestic corporations (and u.s. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022.2021 Instructions for Form 3893, PassThrough Entity Elective

Ca Form 3893 Voucher VOUCHERSOF

3.10.73 Batching and Numbering Internal Revenue Service

Ca Form 3893 Voucher VOUCHERSOF

California Form 3893 Passthrough Entity Tax Problems Windes

2023 Form 3893 Printable Forms Free Online

California Passthrough Entities Should Consider Making PTET Payments

3.11.23 Excise Tax Returns Internal Revenue Service

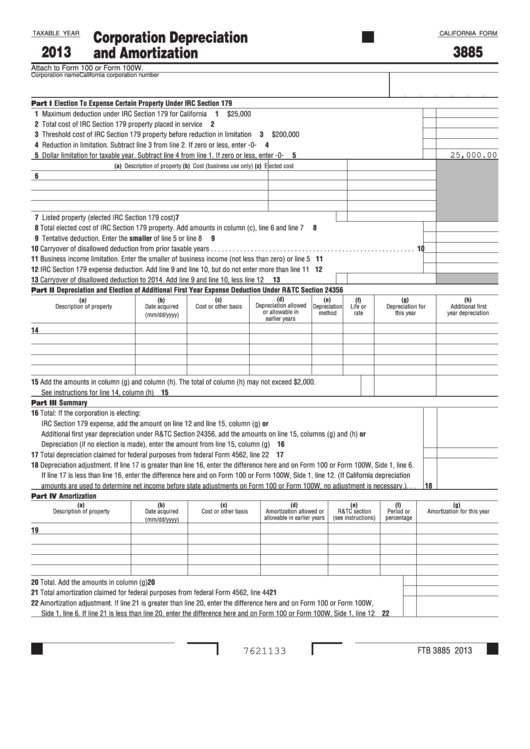

Fillable California Form 3885 Corporation Depreciation And

Ca Form 3893 Voucher VOUCHERSOF

Related Post: