Form 5471 Schedule P Instructions

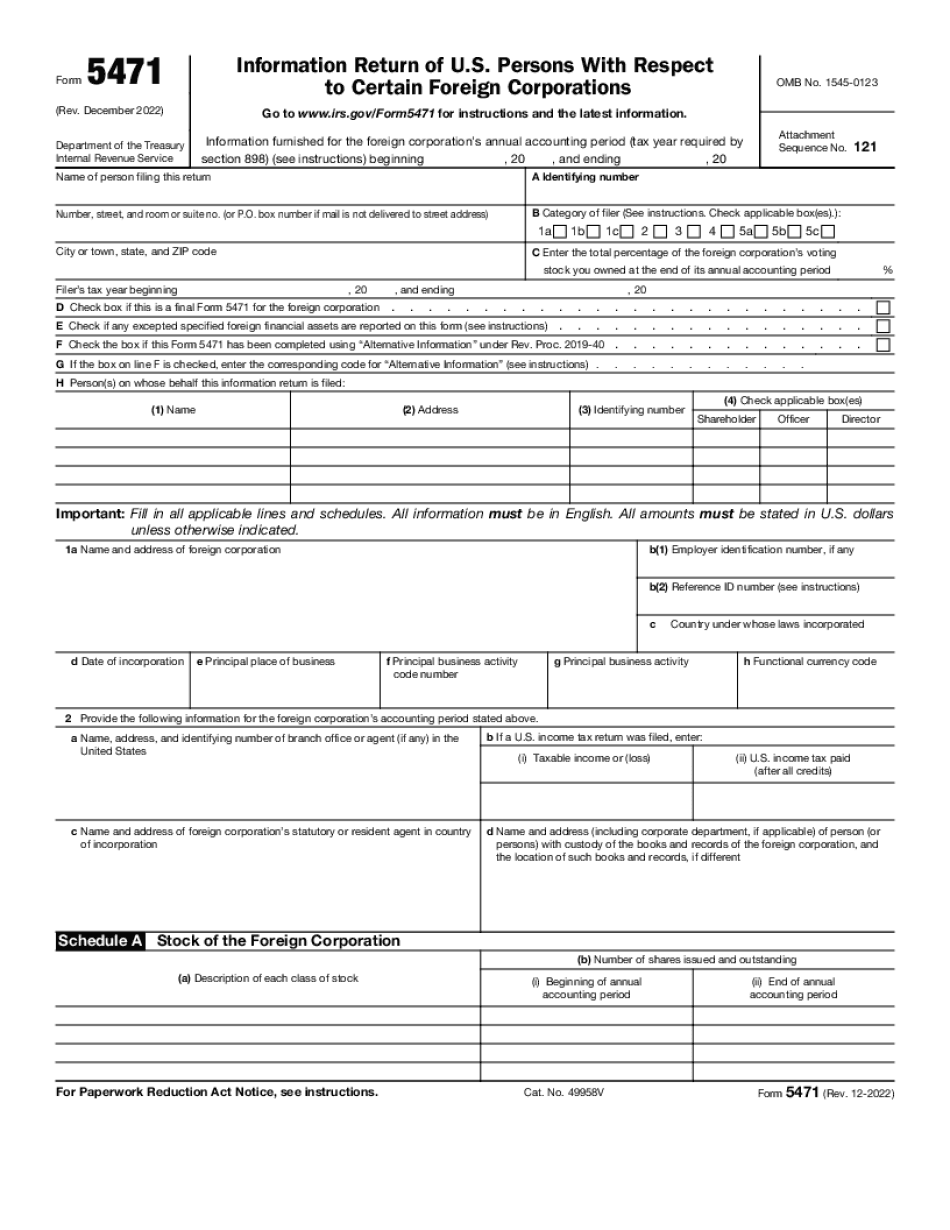

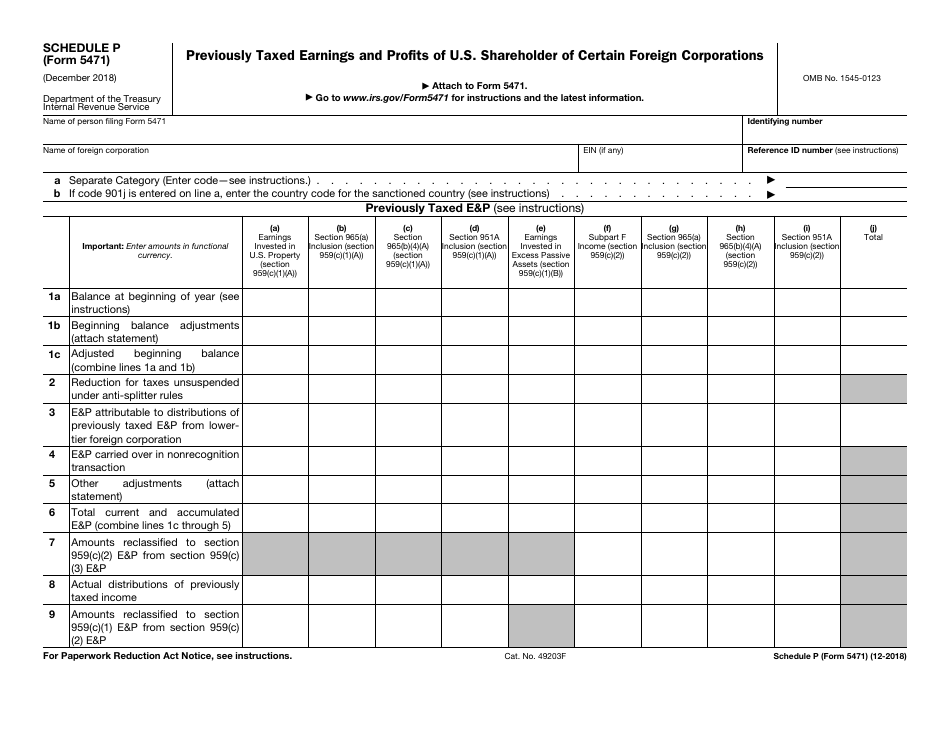

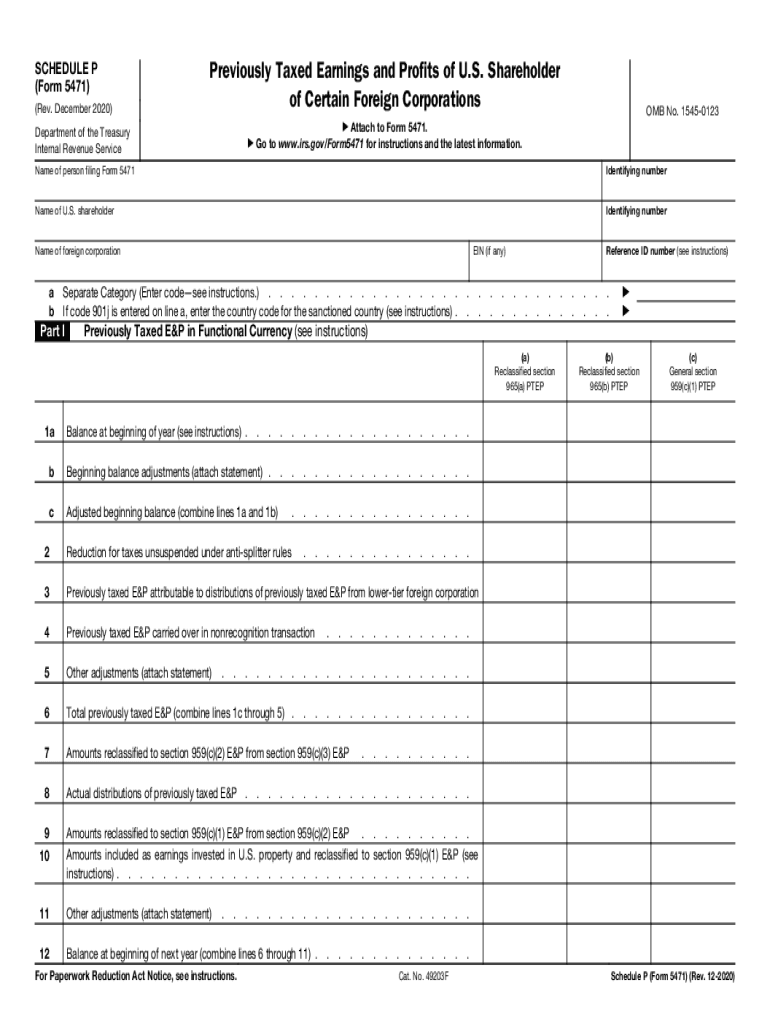

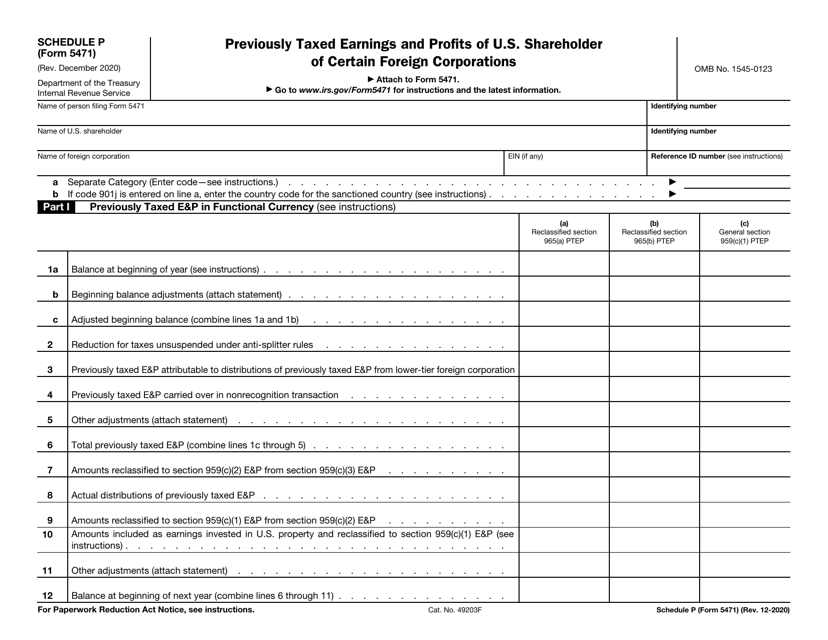

Form 5471 Schedule P Instructions - Web instructions for form 5471(rev. The term ptep refers to. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; When and where to file. To be completed by u.s. Web schedule p of form 5471 is used to report ptep of the u.s. Shareholder of a controlled foreign currency (“cfc”) in the cfc’s functional currency. Changes to instructions for form 5471 and separate schedules. December 2020) department of the treasury internal revenue service. Income, war profits, and excess profits taxes paid or accrued. Web schedule p of form 5471 is used to report ptep of the u.s. December 2020) department of the treasury internal revenue service. There have been revisions to the form in both 2017 and. Previously taxed earnings and profits of u.s. Persons with respect to certain foreign corporations. Ad access irs tax forms. December 2020) department of the treasury internal revenue service. To be completed by u.s. In such a case, the schedule p must be attached to the statement described above. December 2020) department of the treasury internal revenue service. Shareholder of certain foreign corporations 1220 12/04/2020 form 5471 (schedule o) organization. However, category 1 and 5 filers who are related constructive u.s. Web instructions for form 5471(rev. Web schedule p of form 5471 is used to report ptep of the u.s. There have been revisions to the form in both 2017 and. Web the irs form instructions say that there need to be additional schedule p for each shareholder being filed with the 5471 on their behalf. We also have attached rev. Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously taxed earnings and profits of u.s. Web schedule p (form. Web all persons identified in item h must complete a separate schedule p (form 5471) if the person is a u.s. Persons with respect to certain foreign corporations. For paperwork reduction act notice, see instructions. December 2020) department of the treasury internal revenue service. December 2019) department of the treasury internal revenue service. We also have attached rev. Need to produce two or. Web schedule p (form 5471) (rev. December 2019) department of the treasury internal revenue service. Persons with respect to certain foreign corporations. The instructions have been updated for each of the aforementioned. Web instructions for form 5471(rev. There have been revisions to the form in both 2017 and. Changes to instructions for form 5471 and separate schedules. And as julie mentioned, there is. Previously taxed earnings and profits of u.s. Shareholder described in category 1a, 1b, 4, 5a, or 5b. The december 2019 revision of. December 2019) department of the treasury internal revenue service. Ad access irs tax forms. Web schedule p (form 5471) (rev. The instructions have been updated for each of the aforementioned. December 2020) department of the treasury internal revenue service. And as julie mentioned, there is. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web column of the schedule p. Web form 5471 (schedule p) previously taxed earnings and profits of u.s. Web instructions for form 5471(rev. Complete, edit or print tax forms instantly. December 2019) department of the treasury internal revenue service. December 2020) department of the treasury internal revenue service. We also have attached rev. Web column of the schedule p. Previously taxed earnings and profits of u.s. The december 2021 revision of separate. Previously taxed earnings and profits of u.s. Shareholder of certain foreign corporations 1220 12/04/2020 form 5471 (schedule r) distributions. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; December 2019) department of the treasury internal revenue service. Web form 5471 (schedule p) previously taxed earnings and profits of u.s. However, category 1 and 5 filers who are related constructive u.s. Persons with respect to certain foreign corporations. To be completed by u.s. The term ptep refers to. Ad access irs tax forms. Income, war profits, and excess profits taxes paid or accrued. Changes to instructions for form 5471 and separate schedules. Web schedule p must be completed by category 1, category 4 and category 5 filers of the form 5471. Previously taxed earnings and profits of u.s. December 2020) department of the treasury internal revenue service.Form 5471 Filing Requirements with Your Expat Taxes

Schedule P Previously Taxed E&P of US Shareholder IRS Form 5471

Form 5471 Instructions 20222023 Fill online, Printable, Fillable Blank

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

2012 form 5471 instructions Fill out & sign online DocHub

IRS Form 5471 Schedule P Fill Out, Sign Online and Download Fillable

5471 Worksheet A

5471 Schedule P Form Fill Out and Sign Printable PDF Template signNow

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

5471 Worksheet A

Related Post: