Form 4797 Vs Schedule D

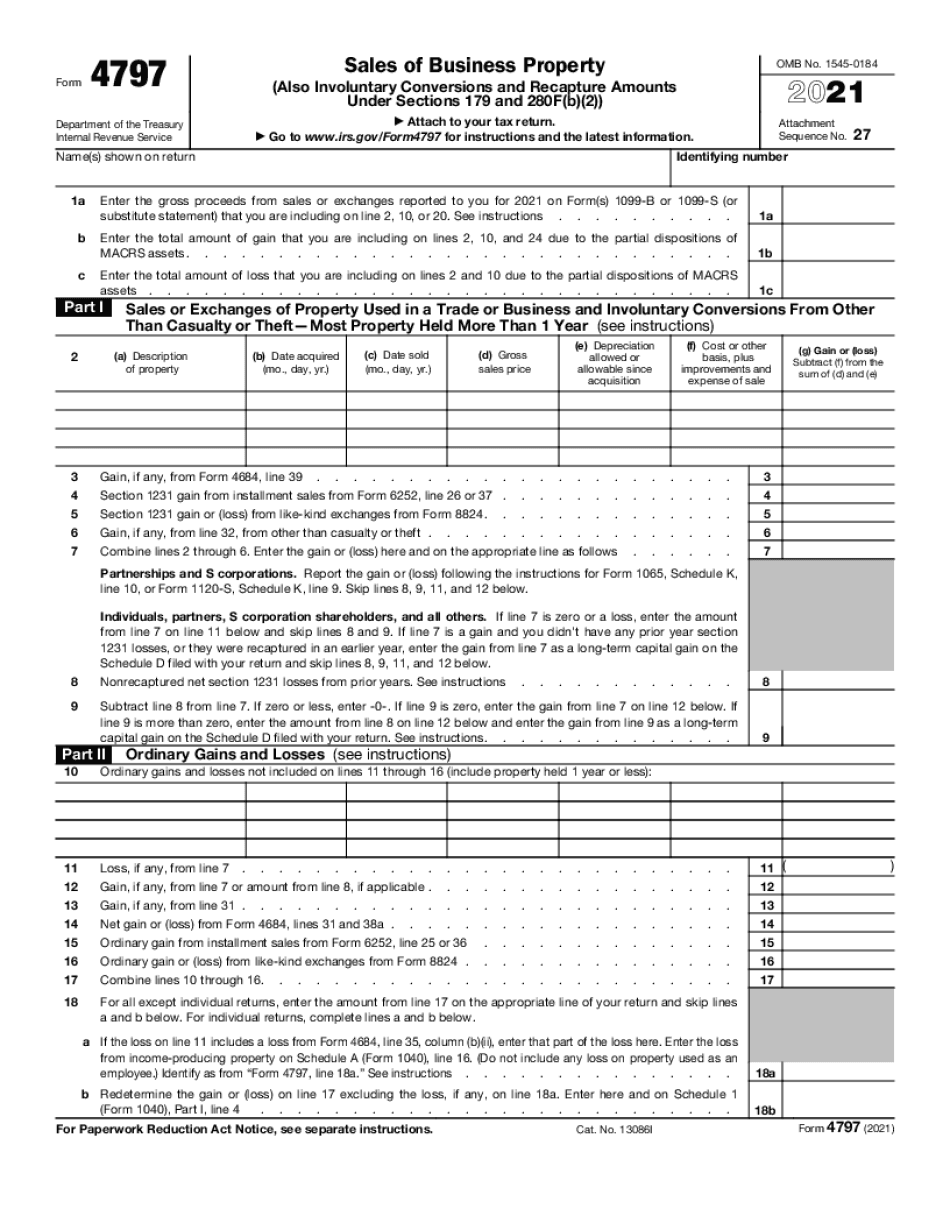

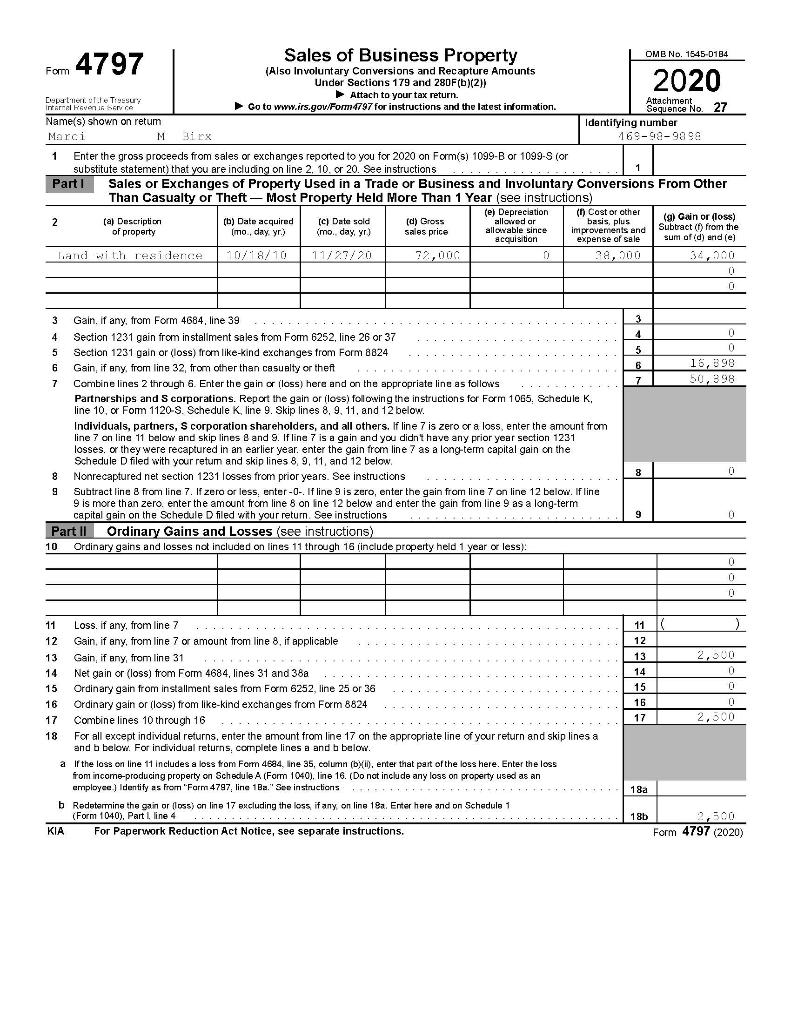

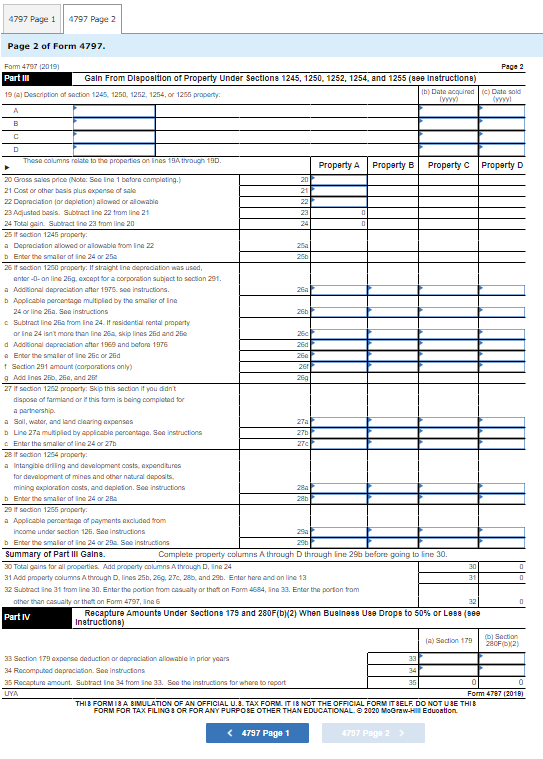

Form 4797 Vs Schedule D - Web should i use form 4797 or schedule d for the sale of residential rental property that i sold at a loss? Web part i of form 4797 can be used to record section 1231 transactions that are not mandated to be recorded in part iii. Capital gains and losses from other sources are reported using. The irs includes the following. Ordinary and capital gains tax. Not inventory or other property held for sale to customers. Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of. However, a very distinct difference is that schedule d is for gains/losses on personal property, while form 4797 is for property used for. Most common code sections used on 4797. Web individuals typically use schedule d (form 1040), capital gains and losses together with form 4797 or form 8949. To view form 4797, go to forms mode by selecting the form icon on the. If a transaction can't be. The irs includes the following. Get ready for tax season deadlines by completing any required tax forms today. Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the. Web to view your schedule d go to forms mode by selecting the form icon on the toolbar; The sale or exchange of property. From the above two sections, it may seem as though these forms are reporting the same thing. Any time you sell depreciable property, form 4797. Web individuals typically use schedule d (form 1040), capital gains and. Part 3, box 2 (net rental real estate income): Most common code sections used on 4797. Offset ordinary and capital losses. Not inventory or other property held for sale to customers. Web business owners and operators must file schedule d to report mergers or acquisitions. I received a 'final k1' with following details: Web what is form 4797? The irs includes the following. Both are reporting gains or losses on the sale of property. Part 3, box 2 (net rental real estate income): Part 3, box 2 (net rental real estate income): The involuntary conversion of property and capital assets. Web business owners and operators must file schedule d to report mergers or acquisitions. Web capital gains and losses are generally calculated as the difference between what you bought the asset for (the irs calls this the “ tax basis ”) and what. For further information, refer to: Web part i of form 4797 can be used to record section 1231 transactions that are not mandated to be recorded in part iii. From the above two sections, it may seem as though these forms are reporting the same thing. And enter description of property, date acquired, date sold, and any other applicable information.. Web what is form 4797? Most common code sections used on 4797. Capital gains and losses from other sources are reported using. Any time you sell depreciable property, form 4797. The irs includes the following. Web in the case of taxpayers other than corporations, you can also deduct the lower of $3,000 ($1,500 if you are a married individual filing a separate return), or the excess of such. Most common code sections used on 4797. If a transaction can't be. Both are reporting gains or losses on the sale of property. Web about form 4797,. Web updated on february 23, 2022. The involuntary conversion of property and capital assets. However, part of the gain on the sale or exchange of the depreciable property may have to be recaptured as ordinary income on. The irs includes the following. Web what is the difference between schedule d and form 4797? Both are reporting gains or losses on the sale of property. To view form 4797, go to forms mode by selecting the form icon on the. Web capital gains and losses are generally calculated as the difference between what you bought the asset for (the irs calls this the “ tax basis ”) and what you sold. Part 3, box. Web business owners and operators must file schedule d to report mergers or acquisitions. The involuntary conversion of property and capital assets. Get ready for tax season deadlines by completing any required tax forms today. Ad download or email irs 4797 & more fillable forms, register and subscribe now! Web what is the difference between schedule d and form 4797? Web do not report on form 4797. The irs includes the following. If a transaction can't be. Not all mergers or acquisitions require the completion of this form. Web to view your schedule d go to forms mode by selecting the form icon on the toolbar; Web part i of form 4797 can be used to record section 1231 transactions that are not mandated to be recorded in part iii. Not inventory or other property held for sale to customers. I received a 'final k1' with following details: Web capital gains and losses are generally calculated as the difference between what you bought the asset for (the irs calls this the “ tax basis ”) and what you sold. Web final k1 tax computation schedule d vs 4797. And enter description of property, date acquired, date sold, and any other applicable information. Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of. Web what is form 4797? However, a very distinct difference is that schedule d is for gains/losses on personal property, while form 4797 is for property used for. Most common code sections used on 4797.3. Complete Moab Inc.'s Form 4797 for the year.

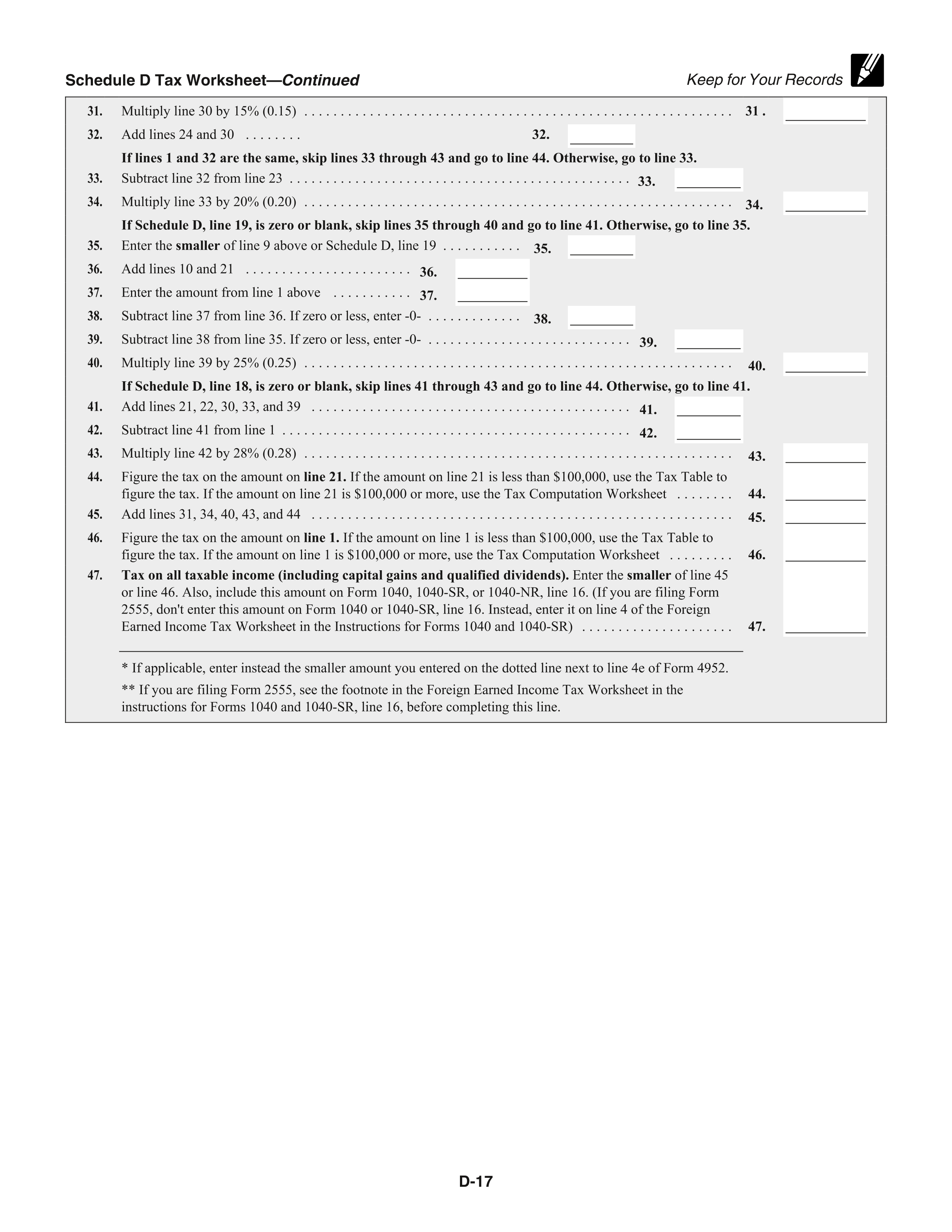

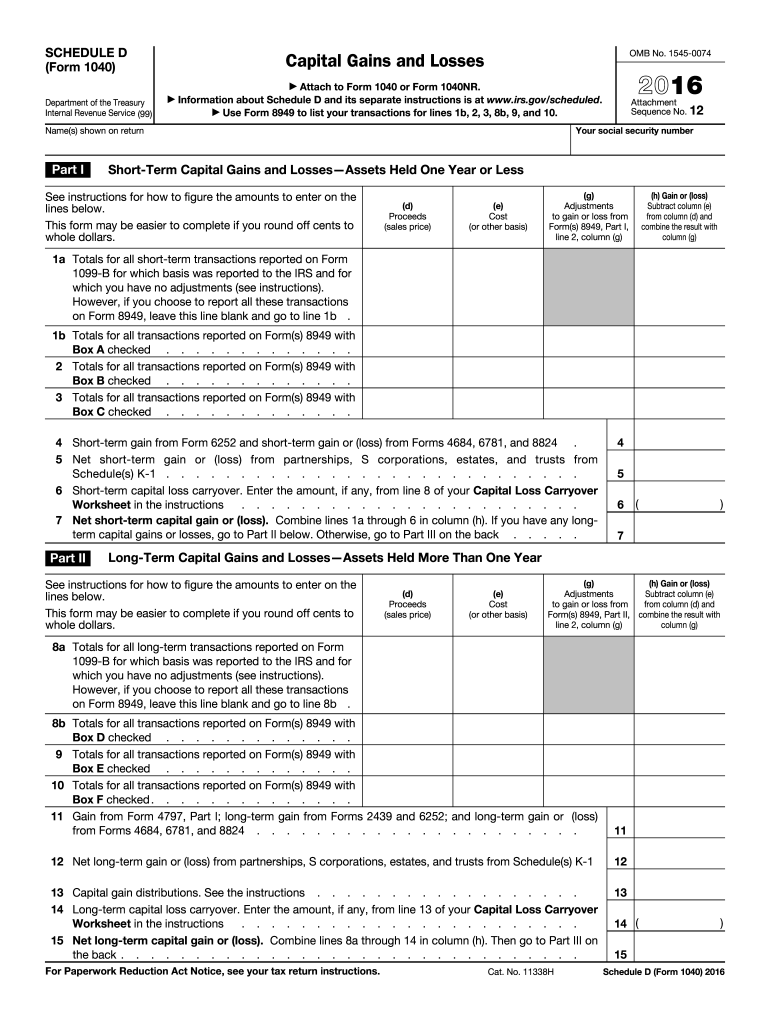

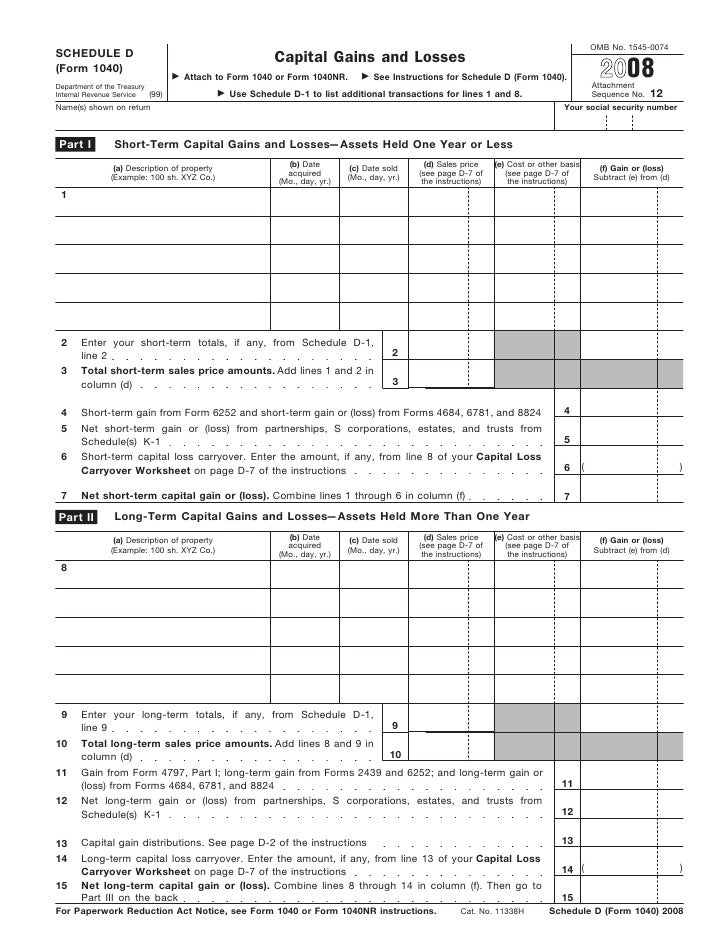

Form 1040, Schedule DCapital Gains and Losses

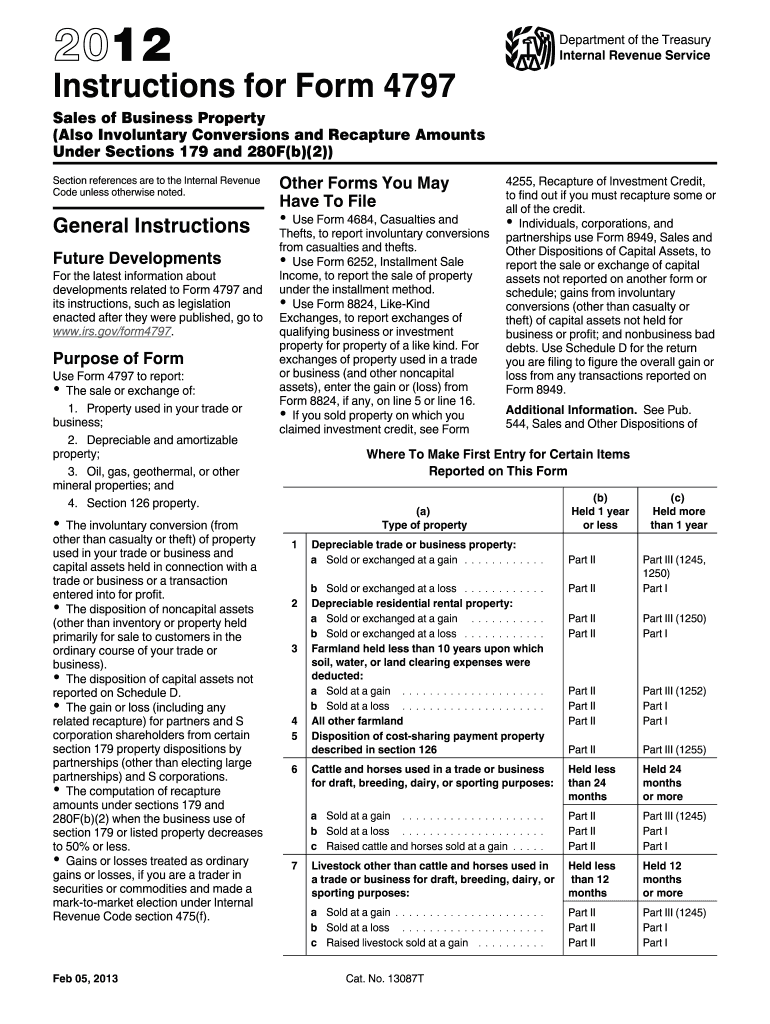

Form 4797 Instructions Fill out and Edit Online PDF Template

Schedule D

Form 4797 Fill Out and Sign Printable PDF Template signNow

Form 4797 The Basics

Line 7 of Form 4797 is 50,898At what rate(s) is

IRS Schedule D Instructions

IRS 1040 Schedule D 2016 Fill out Tax Template Online US Legal Forms

Form 4797 Fill Out and Sign Printable PDF Template signNow

Related Post:

:max_bytes(150000):strip_icc()/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)