What Is Form 2210 Line 4

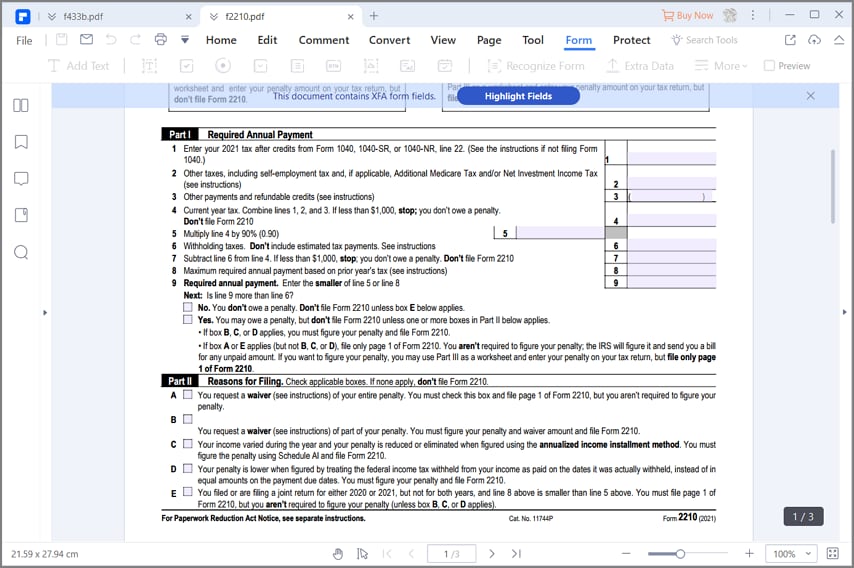

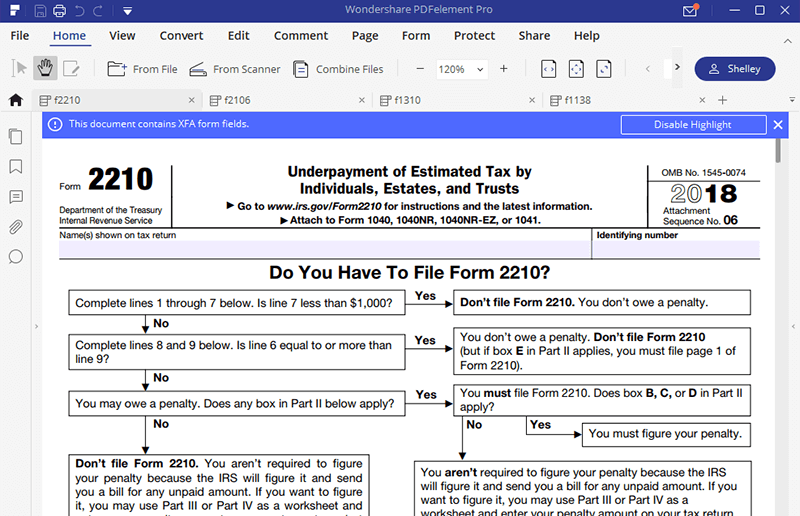

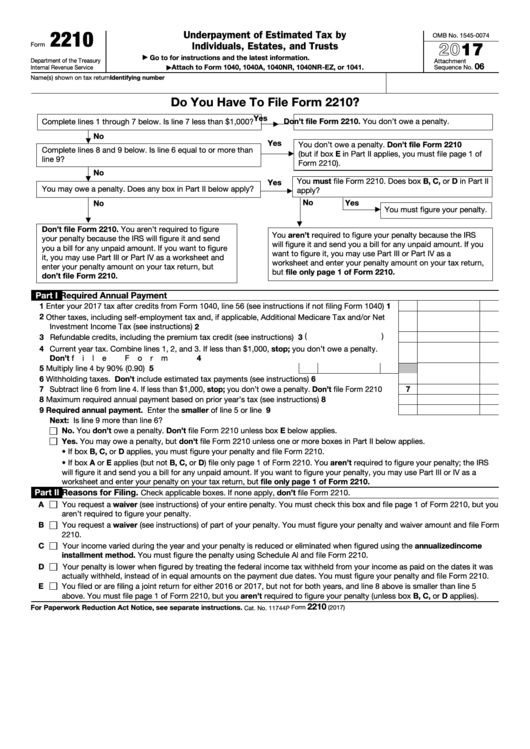

What Is Form 2210 Line 4 - Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Solved•by turbotax•2479•updated january 13, 2023. Web the house has been without a speaker for nearly two weeks, paralyzing the chamber. Generally, if a due date for performing any act for tax purposes falls on a. Web form 2210 is used to calculate a penalty when the taxpayer has underpaid on their estimated taxes (quarterly es vouchers). Web complete lines 1 through 7 below. Web there is a convenient flow chart on page one of irs form 2210 that allows taxpayers to determine whether they are required to file irs form 2210. No complete lines 8 and 9 below. Web go to www.irs.gov/form2210f for instructions and the latest information omb no. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. No complete lines 8 and 9 below. 06a name(s) shown on tax return identifying. Yes don’t file form 2210. Web there is a convenient flow chart on page one. This penalty is different from the penalty for. If you want to figure it, you may use part iii or part iv as a. Web 2 best answer julies expert alumni you may not have had to file form 2210 last year. Web generally, use form 2210 to see if you owe a penalty for underpaying your estimated tax and,. No complete lines 8 and 9 below. Web you are not required to figure your penalty because the irs will figure it and send you a bill for any unpaid amount. Web complete lines 1 through 7 below. Web go to www.irs.gov/form2210f for instructions and the latest information omb no. This form calculates any penalty due based. If you want to figure it, you may use part iii or part iv as a. Web form 2210 is a tax form that you use to see if you owe a penalty for underpaying your estimated tax and to figure out the amount of the penalty if you do owe. You don’t owe a penalty. Even if you are. Web go to www.irs.gov/form2210f for instructions and the latest information omb no. Is line 4 or line 7 less than $1,000? Web form 2210 underpayment of estimated tax, is used to calculate any penalties incurred due to underpayment of taxes over the course of the year. Generally, if a due date for performing any act for tax purposes falls on. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Web form 2210 is a document used by individuals to determine if they owe a penalty for underpaying their estimated tax. Web generally, use form 2210 to see if you owe a penalty. Solved•by turbotax•2479•updated january 13, 2023. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the. This penalty is different from the penalty for. 17, 2023 — as part of larger transformation efforts underway, the internal revenue service announced today key details about the direct file pilot for. Web form 2210 is used to calculate a penalty when the taxpayer has underpaid on their estimated taxes (quarterly es vouchers). Kenny holston/the new york times. Web there is a convenient flow chart on page one of irs form 2210 that allows taxpayers to determine whether they are required to file irs form 2210. Web the house has been without. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web enter the total penalty from line 14 of the worksheet for form 2210, part iv, section b—figure the penalty. Enter the total penalty from line 14 of the worksheet for form 2210, part iii, section b—figure penalty. Is line 6. Web is line 4 or line 7 less than $1,000? The amount on line 4 of your 2210 form last year would be the same as the. Web you are not required to figure your penalty because the irs will figure it and send you a bill for any unpaid amount. Web form 2210 underpayment of estimated tax, is used. Solved•by turbotax•2479•updated january 13, 2023. Even if you are not required to file. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. No complete lines 8 and 9 below. The irs will generally figure your penalty for you and you should not file. Web the house has been without a speaker for nearly two weeks, paralyzing the chamber. Future developments for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Form 2210 is typically used by. Web form 2210 is a tax form that you use to see if you owe a penalty for underpaying your estimated tax and to figure out the amount of the penalty if you do owe. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Is line 4 or line 7 less than $1,000? You don’t owe a penalty. Web through q2 2023, the state, territorial, and tribal recipients of haf have expended over $5.5 billion to assist homeowners, a 32% increase from q1 2023. The form doesn't always have to be. Web there is a convenient flow chart on page one of irs form 2210 that allows taxpayers to determine whether they are required to file irs form 2210. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the. Web form 2210 is used to calculate a penalty when the taxpayer has underpaid on their estimated taxes (quarterly es vouchers). Kenny holston/the new york times. Web enter the total penalty from line 14 of the worksheet for form 2210, part iv, section b—figure the penalty. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due.IRS Form 2210Fill it with the Best Form Filler

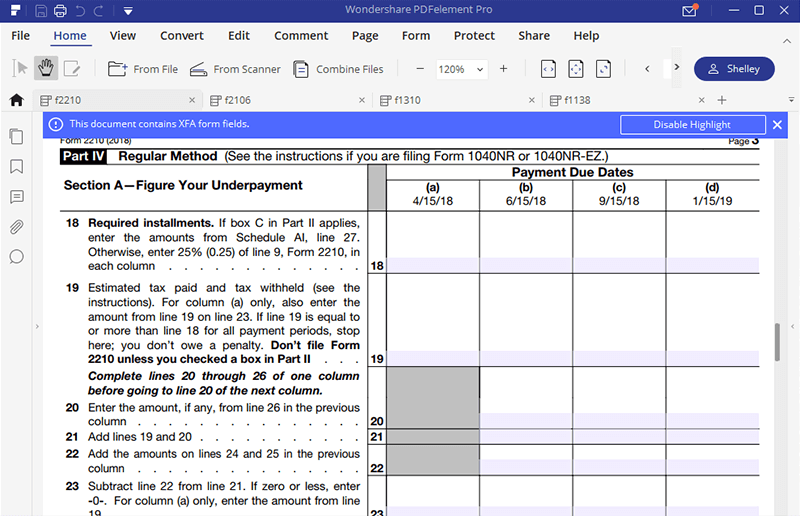

IRS Form 2210Fill it with the Best Form Filler

Form 2210Underpayment of Estimated Tax

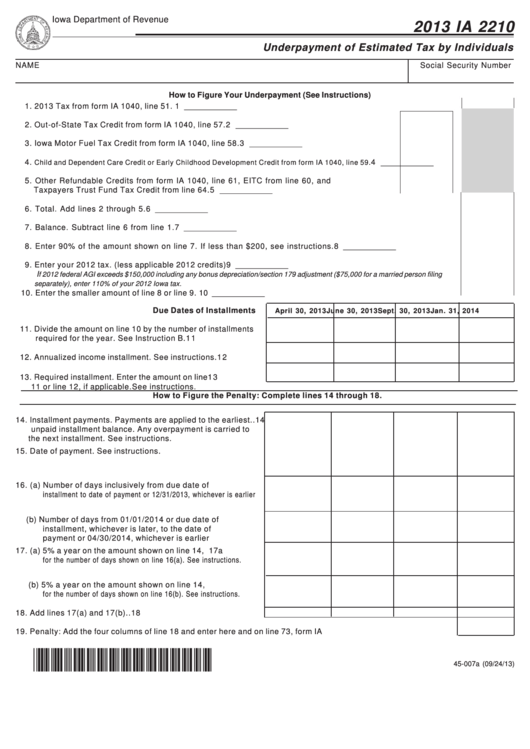

Fillable Form Ia 2210 Underpayment Of Estimated Tax By Individuals

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals

IRS Form 2210 walkthrough (Underpayment of Estimated Tax by Individuals

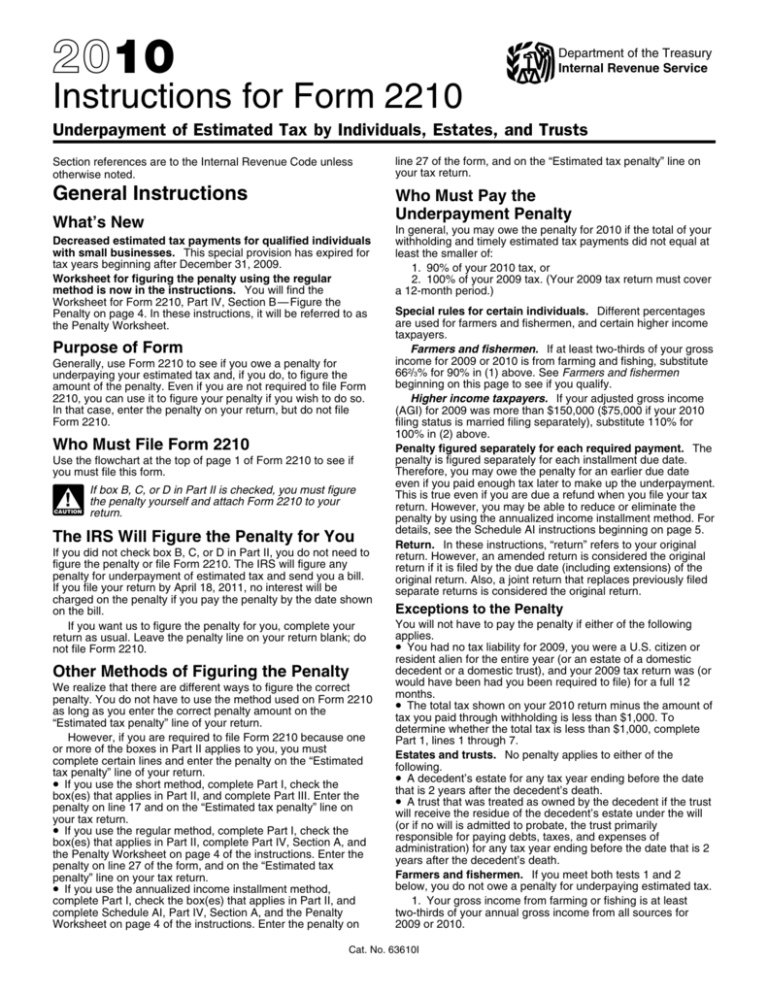

Instructions for Form 2210

Cómo completar el formulario 2210 del IRS

MI2210_260848_7 michigan.gov documents taxes

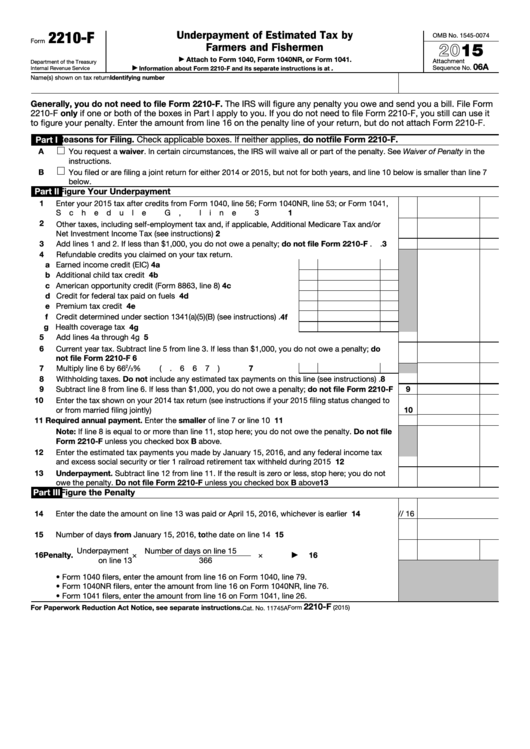

Fillable Form 2210F Underpayment Of Estimated Tax By Farmers And

Related Post: