Form 990 Schedule J Instructions

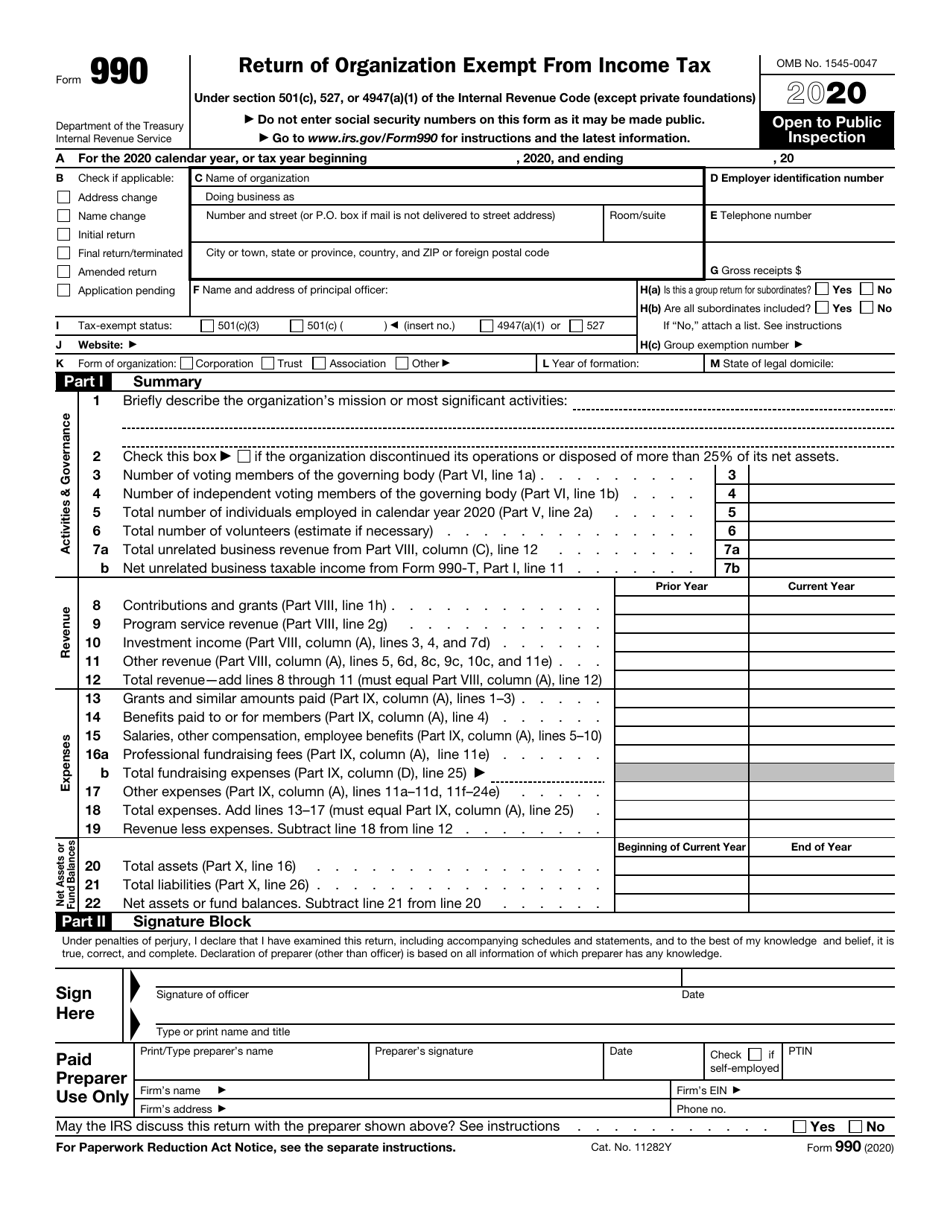

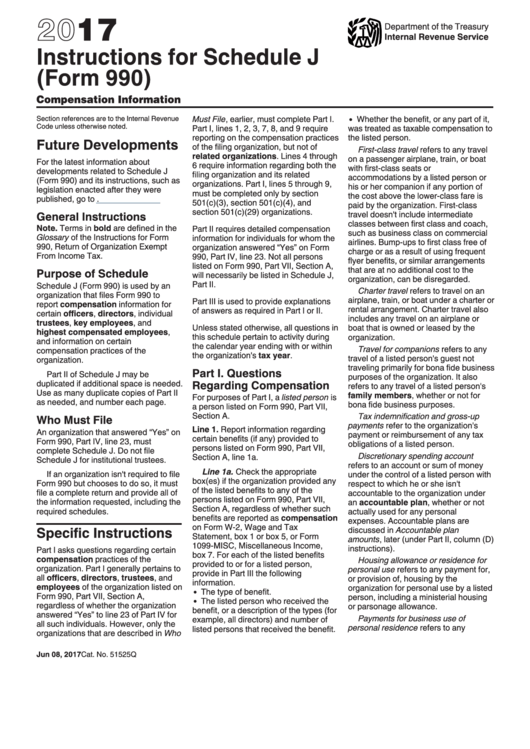

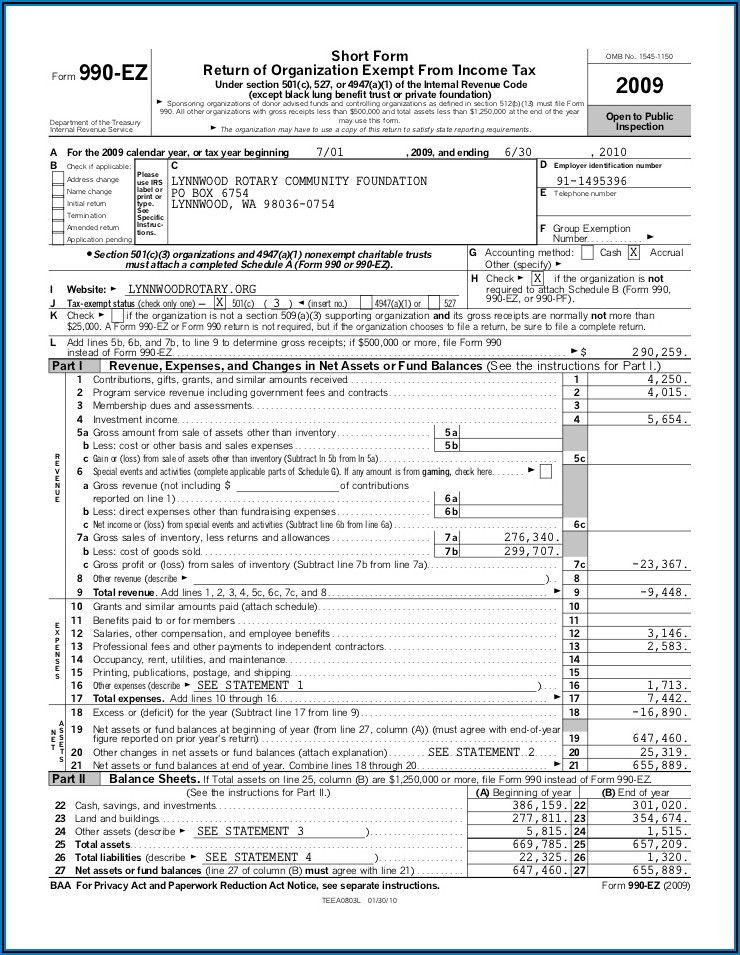

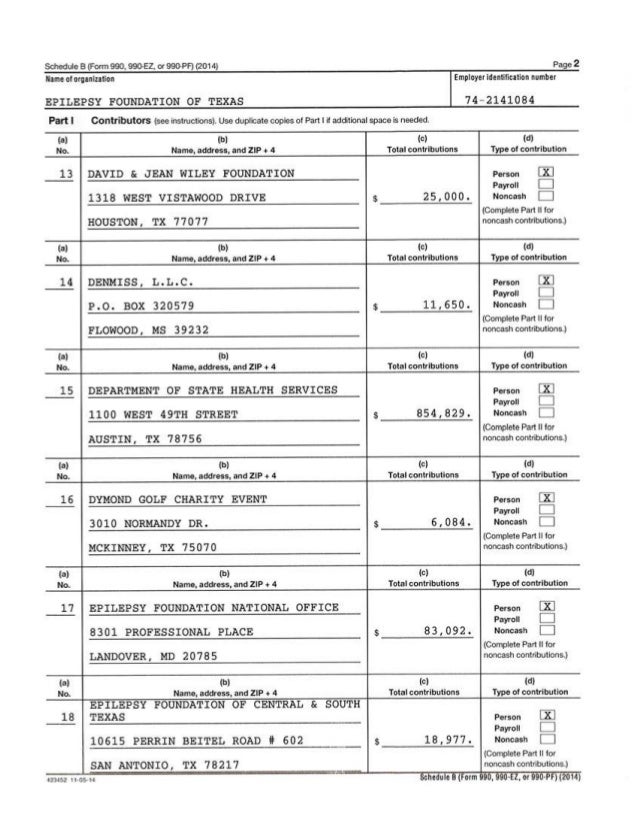

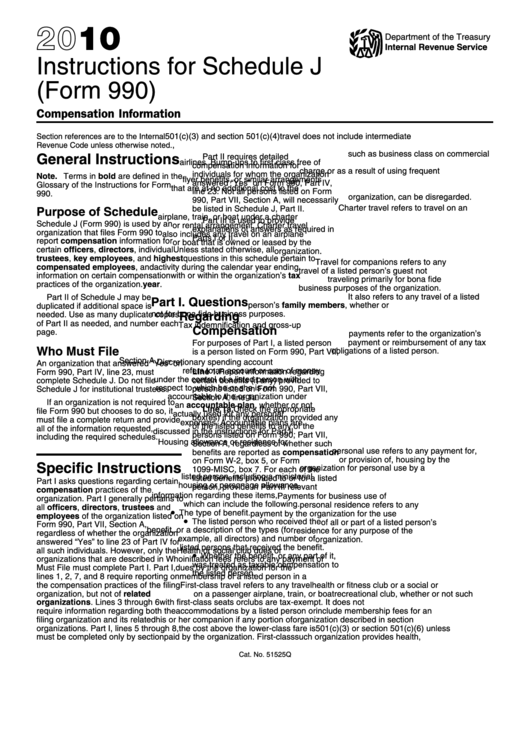

Form 990 Schedule J Instructions - Web schedule d of the form 990 was modified to conform to asc 958. Web attach to form 990. Web instructions for form 990. Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990. Web there are five sections of primary interest on schedule j, part ii, labeled as column b (i) through column b (iii), column c, and column d. Ad get ready for tax season deadlines by completing any required tax forms today. Web organizations that file form 990 use this schedule to report: Get ready for tax season deadlines by completing any required tax forms today. Instructions for these schedules are. The deadline to file the 990 series forms is. Web there are five sections of primary interest on schedule j, part ii, labeled as column b (i) through column b (iii), column c, and column d. Web for instructions and the latest information. Web instructions for form 990. Ad get ready for tax season deadlines by completing any required tax forms today. Web we last updated the compensation information. The deadline to file the 990 series forms is. Complete, edit or print tax forms instantly. Web schedule d of the form 990 was modified to conform to asc 958. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Purpose of schedule schedule j (form 990) is used by an. Web video instructions and help with filling out and completing 2018 990 schedule j form. Web see the instructions for schedule l (form 990), transactions with interested persons, and complete schedule l (form 990) (if required). Complete, edit or print tax forms instantly. Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules. Web instructions for form 990, return of organization exempt from income tax. Web schedule d of the form 990 was modified to conform to asc 958. Instructions for these schedules are. Web beginning of current year paid preparer use only under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) | do not enter social security.. Go to www.irs.gov/form990 for instructions and the latest information. Nonprofit organizations that file form 990 may also be required to include. The 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Get ready for tax season deadlines by completing any required tax forms today. Nonprofit explorer has irs digitized. Web see the instructions for schedule l (form 990), transactions with interested persons, and complete schedule l (form 990) (if required). Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web beginning of current year paid preparer use only under section 501(c), 527, or 4947(a)(1) of the internal revenue code. Web schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers, directors, individual trustees, key. Web organizations that file form 990 use this schedule to report: Complete, edit or print tax forms instantly. The 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable. Web like current compensation payable to such employees, deferred compensation must be reported annually on form 990, schedule j. Web we last updated the compensation information in december 2022, so this is the latest version of 990 (schedule j), fully updated for tax year 2022. The deadline to file the 990 series forms is. Web organizations that file form 990. Web for instructions and the latest information. You can download or print. Instructions for these schedules are. Web instructions for form 990, return of organization exempt from income tax. Reduce document preparation complexity by getting the most out of this helpful video. Instructions for these schedules are. Web for instructions and the latest information. Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990. Web schedule d of the form 990 was modified to conform to asc 958. Web beginning of current year paid preparer use only under section. Web for instructions and the latest information. Web beginning of current year paid preparer use only under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) | do not enter social security. Web purpose of schedule. Web see the instructions for schedule l (form 990), transactions with interested persons, and complete schedule l (form 990) (if required). Go to www.irs.gov/form990 for instructions and the latest information. Web organizations that file form 990 use this schedule to report: Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. Web there are five sections of primary interest on schedule j, part ii, labeled as column b (i) through column b (iii), column c, and column d. Web instructions for form 990. Web instructions for form 990, return of organization exempt from income tax. Web like current compensation payable to such employees, deferred compensation must be reported annually on form 990, schedule j. Web we last updated the compensation information in december 2022, so this is the latest version of 990 (schedule j), fully updated for tax year 2022. Web video instructions and help with filling out and completing 2018 990 schedule j form. Get ready for tax season deadlines by completing any required tax forms today. Reduce document preparation complexity by getting the most out of this helpful video. Purpose of schedule schedule j (form 990) is used by an organization that files form 990 to. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Compensation information for certain officers, directors, individual trustees, key employees, and highest. Nonprofit organizations that file form 990 may also be required to include.Fillable Online 2020 Instructions for Schedule J (Form 990) IRS tax

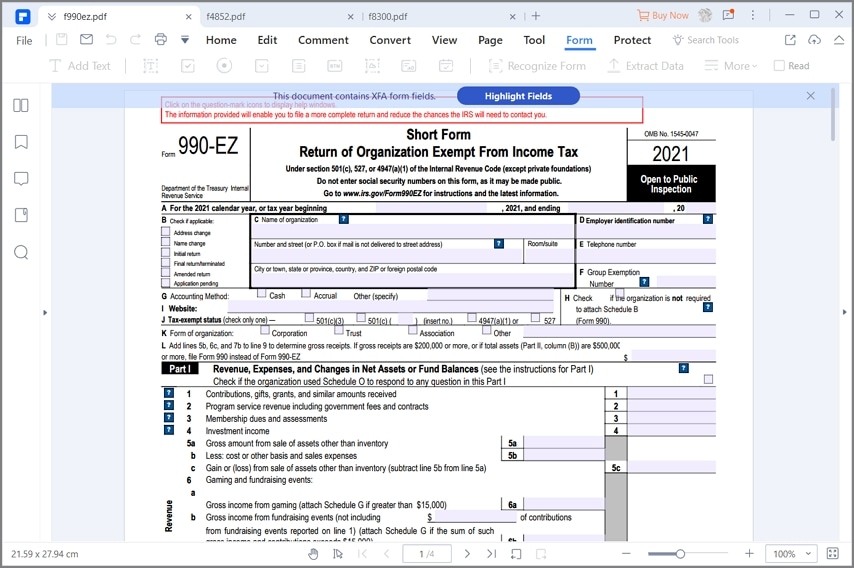

IRS Form 990 Download Fillable PDF or Fill Online Return of

Instructions For Schedule J (Form 990) printable pdf download

Form 990 (Schedule J1) Continuation Sheet for Schedule J (2009) Free

Federal Tax Form 990 Ez Instructions Form Resume Examples 0g27lBAx9P

Form 990 Schedule J Instructions

990 instructions 2023 Fill online, Printable, Fillable Blank

IRS Form 990EZ Filling Instructions before Working on it

Form 990 Instructions For Schedule J printable pdf download

Form 990 (Schedule J) Compensation Information Form (2015) Free Download

Related Post: