What Is An Ero On Tax Form

What Is An Ero On Tax Form - Web an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. Web the electronic return originator, ero, is a person or business that originates federal income tax returns electronically for the internal revenue service, irs. Web about the ero pinan electronic return originator (ero) pin is a numeric representation of the preparer's signature used on form 8879. Web the ero is the electronic return originator. If they filed adjusted returns for more than one tax period, they must follow the. In this article, we’ll take a closer look at irs form 9325 so you can better understand what to look for when your accountant electronically files your. How do you get ero?. Web an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. The ero is usually the first point of ask for most payer filing a return. Officially, the ero is the person who's name appears on form 8633 as a. The ero is usually the first point of contact for most. Officially, the ero is the person who's name appears on form 8633 as a person authorized to sign for your firm. In many cases, the ero also prepares returns. Officially, the ero is the person who's name appears on form 8633 as a. Web the ero is the electronic. Web the ero is the electronic return originator. It's not assigned by any t you need to enable javascript to run this app. Web an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. Ero stands for electronic return originator. Web what is ero and why is it important in. Go to www.irs.gov/form8879 for the latest information. The ero is usually the first point by contact for most taxpayers filing a. Web irs form 9325 is the official form that the irs uses to inform taxpayers that their federal return was accepted. In this article, we’ll take a closer look at irs form 9325 so you can better understand what. Go to www.irs.gov/form8879 for the latest information. In this article, we’ll take a closer look at irs form 9325 so you can better understand what to look for when your accountant electronically files your. This is the person or firm who signs the actual return and agrees to electronically file the return with the irs. In many cases, the ero. It's not assigned by any t you need to enable javascript to run this app. This is to help prevent fraud and interception and ensure the accuracy of the forms. Web the ero is the electronic return originator. Alliantgroup has done a significant number of erc claims and it is. The ero is usually the first point by contact for. Officially, the ero is the person who's name appears on form 8633 as a person authorized to sign for your firm. Web as stated above, an ero is a company that files electronic tax returns and usually helps prepare them. Web an ero on a tax form is a document that certifies the accuracy, authenticity, and validity of an electronically. Web what does ero mean on tax form? Web as stated above, an ero is a company that files electronic tax returns and usually helps prepare them. In many cases, the ero also prepares returns. This includes companies such as turbotax or h&r block. Web an electronic return originator (ero) is a business which is authorized to electronically submit a. How do you get ero?. Web as stated above, an ero is a company that files electronic tax returns and usually helps prepare them. Web the electronic return originator, ero, is a person or business that originates federal income tax returns electronically for the internal revenue service, irs. The ero is the person or firm who collects the actual return. Ero stands for electronic return originator, an individual or business authorized by the irs to electronically file tax returns. This is the person or firm who signs the actual return and agrees to electronically file the return with the irs. This process allows for faster processing and. It's not assigned by any t you need to enable javascript to run. Web an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. How do you get ero?. Web irs form 9325 is the official form that the irs uses to inform taxpayers that their federal return was accepted. In many cases, the ero also prepares returns. Web the ero is the. Ero stands for electronic return originator, an individual or business authorized by the irs to electronically file tax returns. This is to help prevent fraud and interception and ensure the accuracy of the forms. This process allows for faster processing and. The ero is usually the first point by contact for most taxpayers filing a. Sign in products lacerte proconnect. Web what does ero mean on tax form? The irs requires application and approval to be an ero. This includes companies such as turbotax or h&r block. In this article, we’ll take a closer look at irs form 9325 so you can better understand what to look for when your accountant electronically files your. Ero stands for electronic return originator. Web an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. In many cases, the ero also prepares returns. Web who is the electronic return originator (ero)? Web the electronic return originator, ero, is a person or business that originates federal income tax returns electronically for the internal revenue service, irs. Web one quick indication that you may have gone down a bad path is if your business / tax exempt claimed 6 or 7 quarters for the erc. If they filed adjusted returns for more than one tax period, they must follow the. Web an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. Officially, the ero is the person who's name appears on form 8633 as a. The ero is usually the first point of ask for most payer filing a return. Web irs form 9325 is the official form that the irs uses to inform taxpayers that their federal return was accepted.ERO eFiling 94x Completing Form 8879EMP (DAS)

PA8879C 2015 PA EFile Signature Authorization for Corporate Tax

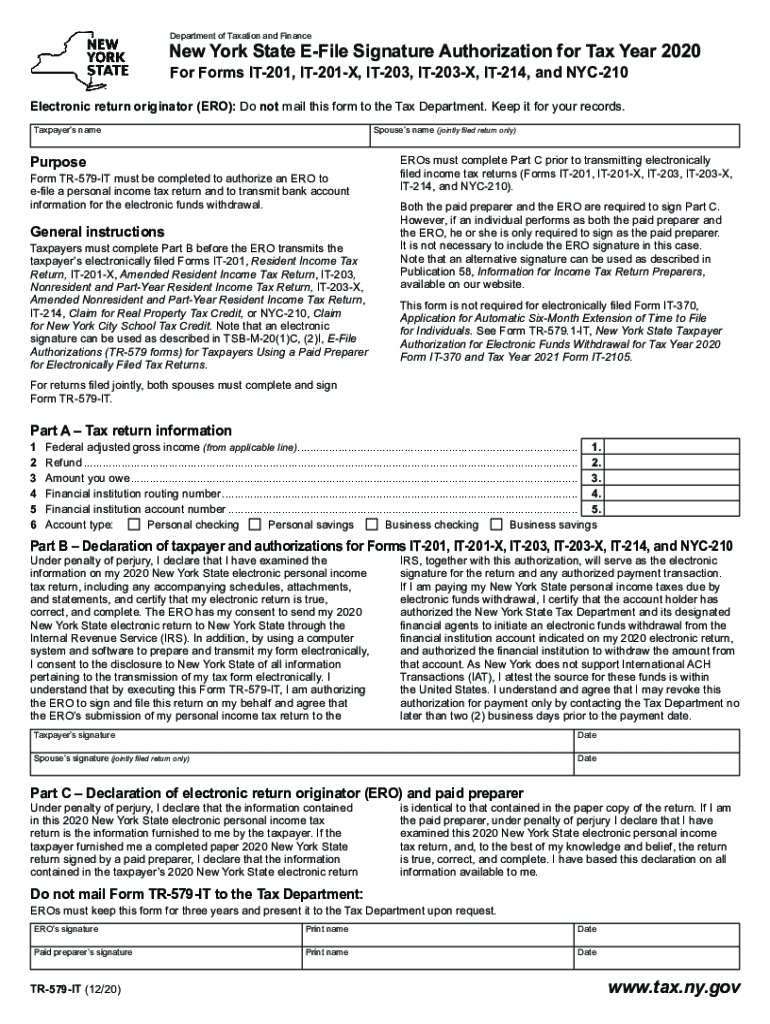

NY DTF TR579IT 20202022 Fill out Tax Template Online US Legal Forms

ERO eFiling 94X Completing Form 8879EMP (CWU)

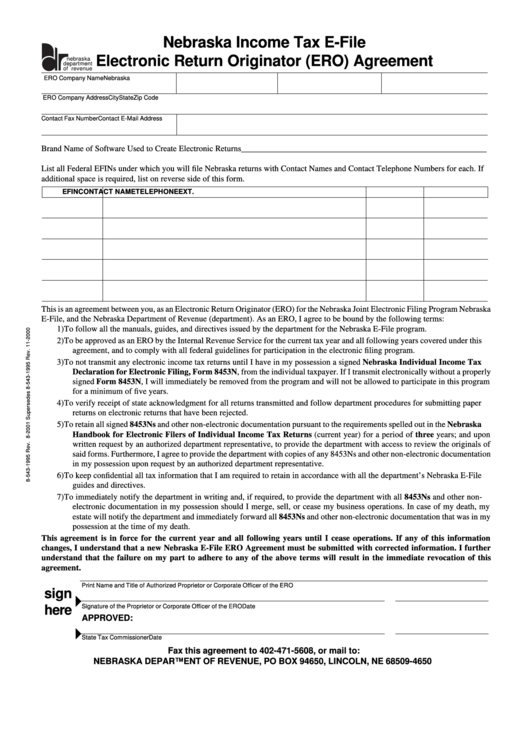

Form 85431999 Nebraska Tax EFile Electronic Return

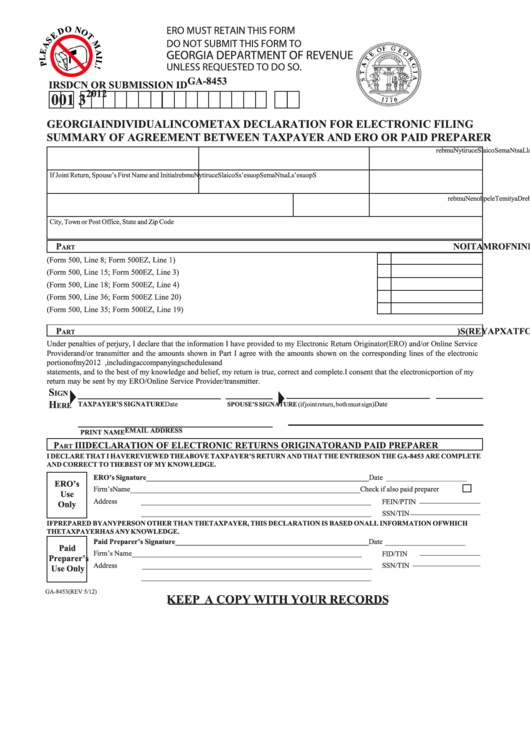

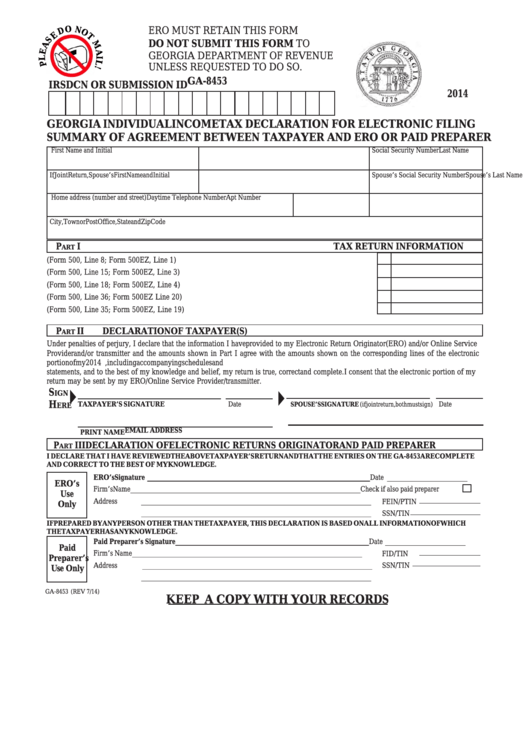

Fillable Form Ga8453 Individual Tax Declaration For

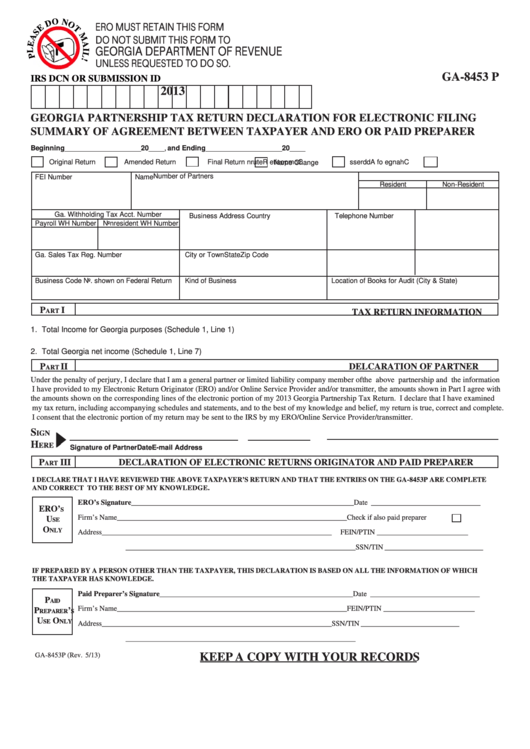

Fillable Form Ga8453 P Partnership Tax Return Declaration

How to manually add ERO information in the EF Originators database in

How to manually add ERO information in the EF Originators database in

Fillable Form Ga8453 Individual Tax Declaration For

Related Post:

.jpg)