Irs Form 886-A

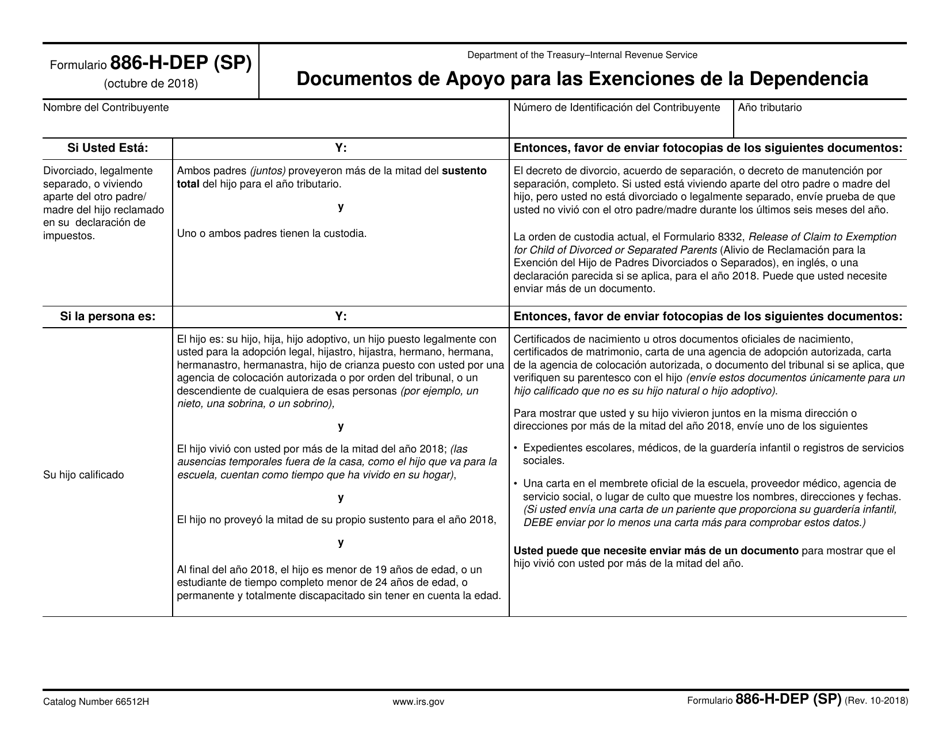

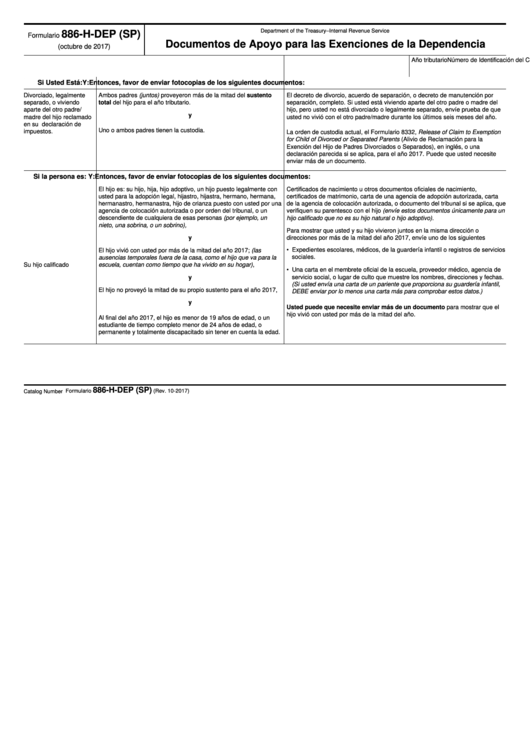

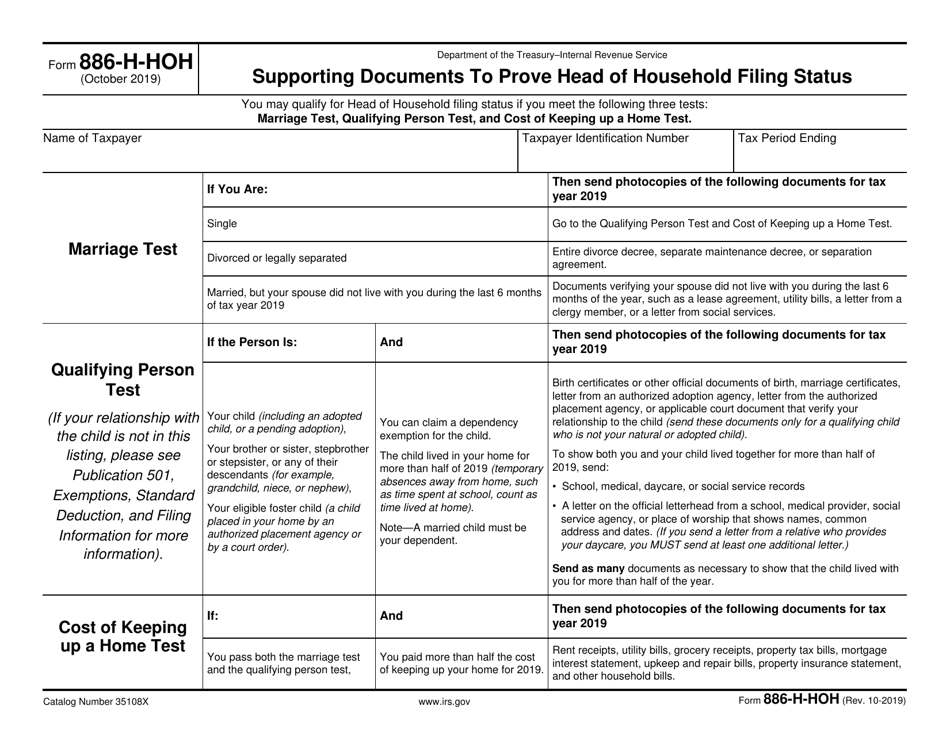

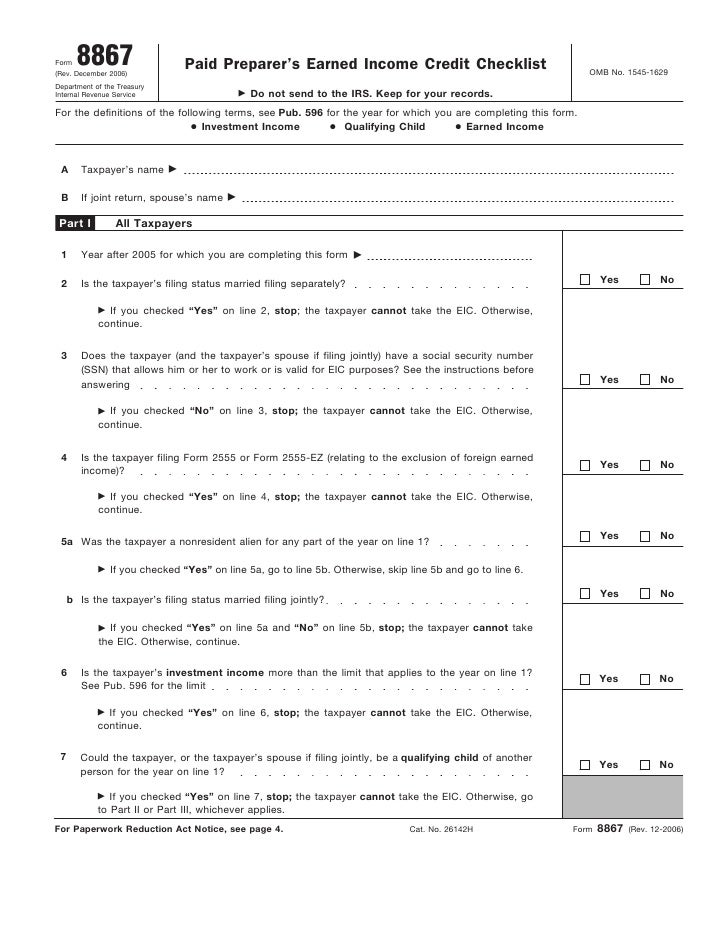

Irs Form 886-A - Easily sign the form with your finger. Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. Send filled & signed form or save. Ad learn about the locations, phone numbers of nearby irs offices. Web employer's quarterly federal tax return. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Most dependent audit procedures will take place through the mail. Earned income includes all the. Open form follow the instructions. Web the title of irs form 886a is explanation of items. To claim a child as a qualifying child for eitc, you must show the child is. Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Ad outgrow.us has been visited by. We need to verify that you. Web documents you need to send to claim the earned income credit on the basis of a qualifying child or children for tax year 2022. This tool is to help you identify what documents you need to provide to the irs, if you are audited, to prove you can claim the earned income. Web. Web most of the forms are available in both english and spanish. Form 8886 is used to. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Click here to check all the information you need for irs offices near you. Most often, form 886a is. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. The noppa contains the revenue agent’s imputed. Most often, form 886a is. Web employer's quarterly federal tax return. Earned income includes all the. Form 8886 is used to. Send filled & signed form or save. Web employer's quarterly federal tax return. Most dependent audit procedures will take place through the mail. Web documents you need to send to claim the earned income credit on the basis of a qualifying child or children for tax year 2022. Form 886a, explanation of items explains specific changes to your return and why the irs didn’t accept your documentation. Web most of the forms are available in both english and spanish. Web the earned income tax credit (eitc) is a tax credit for people who work and whose earned income is within a certain range. Earned income includes all the.. Form 886a, explanation of items explains specific changes to your return and why the irs didn’t accept your documentation. Send filled & signed form or save. Web the title of irs form 886a is explanation of items. Web documents you need to send to claim the earned income credit on the basis of a qualifying child or children for tax. Form 8886 is used to. Ad learn about the locations, phone numbers of nearby irs offices. You may qualify for head of household filing status if you meet the following three tests: Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886.. To claim a child as a qualifying child for eitc, you must show the child is. Most often, form 886a is. We need to verify that you. Form 886a, explanation of items explains specific changes to your return and why the irs didn’t accept your documentation. Form 8886 is used to. Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. Web español | english. Form 8886 is used to. Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. We need to verify that you. Most often, form 886a is. Click here to check all the information you need for irs offices near you. We need to verify that you. Form 886a, explanation of items explains specific changes to your return and why the irs didn’t accept your documentation. Web employer's quarterly federal tax return. Send filled & signed form or save. Most dependent audit procedures will take place through the mail. Ad learn about the locations, phone numbers of nearby irs offices. This tool is to help you identify what documents you need to provide to the irs, if you are audited, to prove you can claim the earned income. Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. To claim a child as a qualifying child for eitc, you must show the child is. Easily sign the form with your finger. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Supporting documents to prove american opportunity credit. Web the title of irs form 886a is explanation of items. Web español | english. Earned income includes all the. Web documents you need to send to claim the earned income credit on the basis of a qualifying child or children for tax year 2022. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay.IRS Formulario 886HDEP Download Fillable PDF or Fill Online

Fillable Form 886HDep (Sp) Supporting Documents For Dependency

Federal Carryover Worksheet

Irs Form 886 A Worksheet Promotiontablecovers

IRS Form 886HHOH Fill Out, Sign Online and Download Fillable PDF

IRS Form 8868 Fill Out, Sign Online and Download Fillable PDF

Irs Form 886 A Worksheet Ivuyteq

36 Irs Form 886 A Worksheet support worksheet

IRS Form 886HEIC 2018 Fill and Sign Printable Template Online US

Irs form 886a may 2023 Fill online, Printable, Fillable Blank

Related Post: