Tax Form Ct 1040

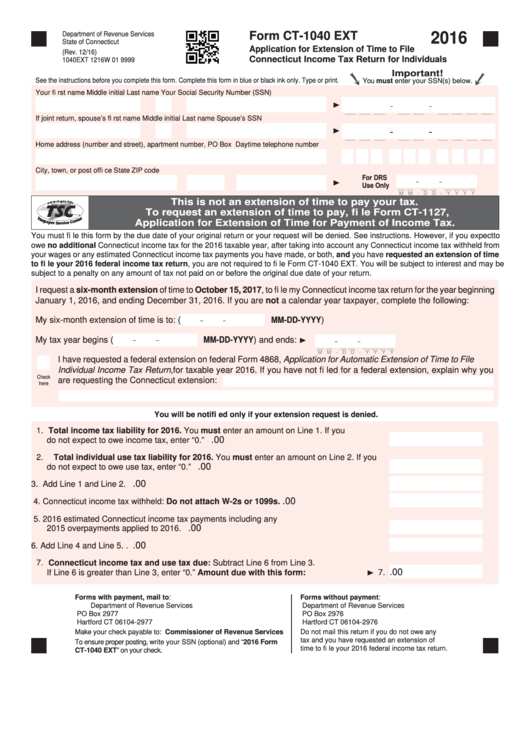

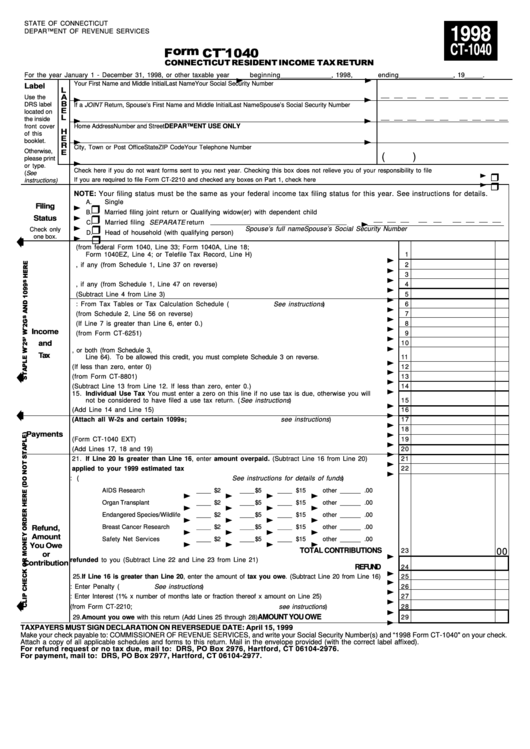

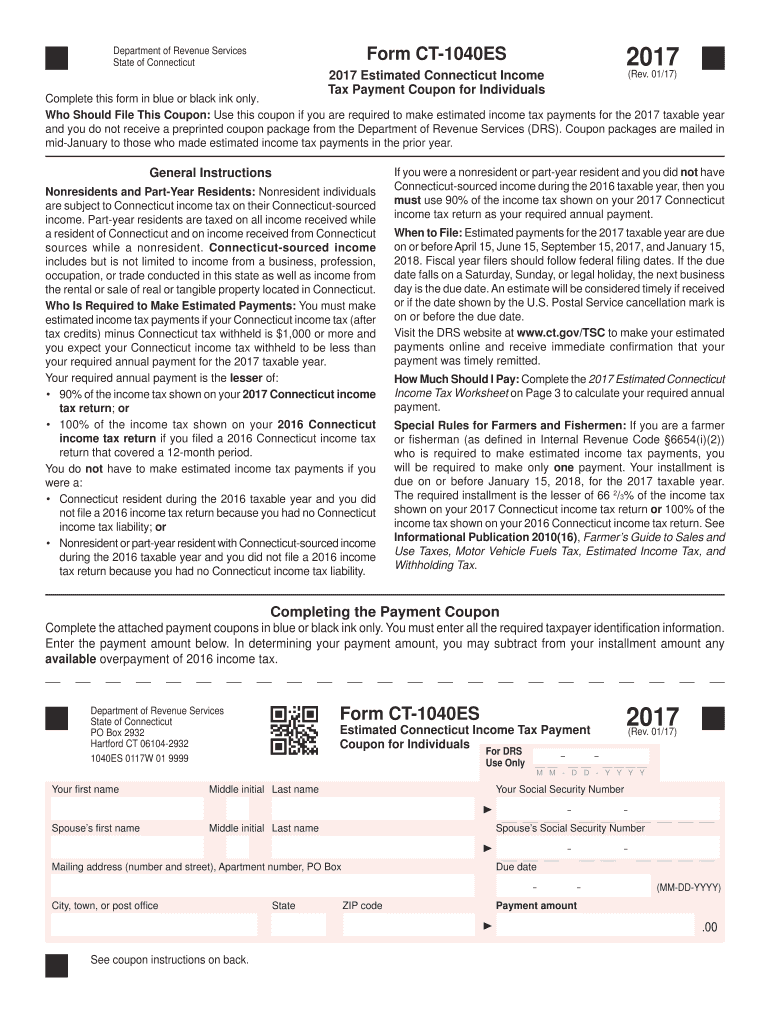

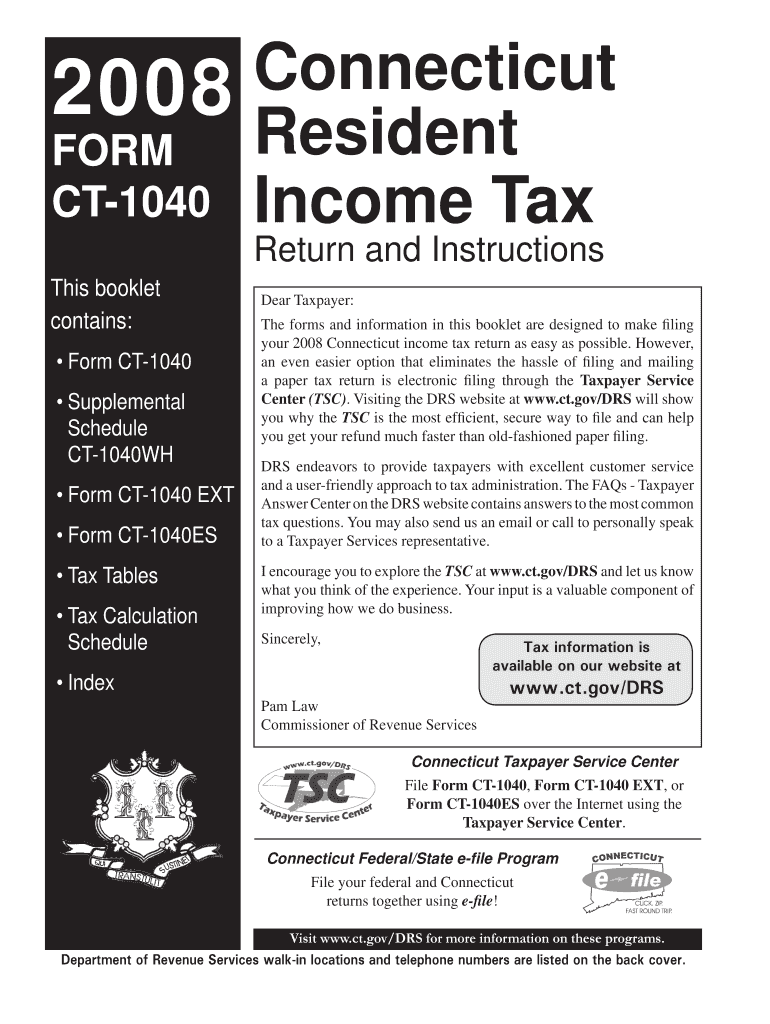

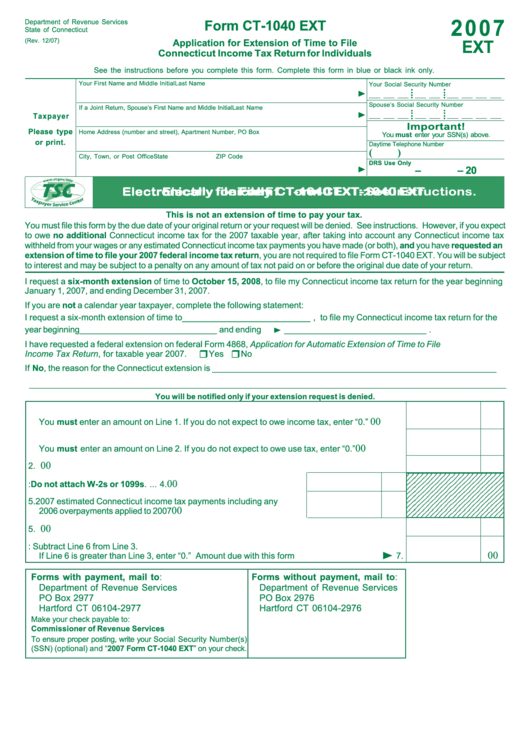

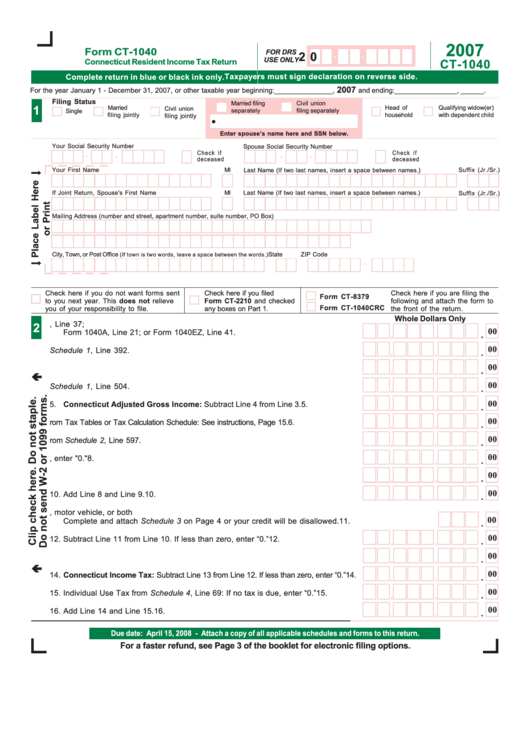

Tax Form Ct 1040 - Generally, your filing status on your connecticut return must match your federal income tax filing status. Ad discover helpful information and resources on taxes from aarp. Add line 12 and line 13. Estimate your taxes and refunds easily with this free tax calculator from aarp. Form 1040 is a form that you fill out and send to the irs reporting your income, deductions,. Individual tax return form 1040 instructions; This booklet contains information or instructions for the following forms and schedules: It will begin with a page having the following. Amended income tax return for individuals: Benefits to electronic filing include: Use this calculator to determine your connecticut income tax. Web no, form 1040 and form 1099 are two different federal tax forms. Web print your state of connecticut tax return. You can download or print. Generally, this is the last four or five pages of the pdf file you received from your reviewer. Estimate your taxes and refunds easily with this free tax calculator from aarp. Simple, secure, and can be completed from the comfort of your home. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. These 2021 forms and more are available:. Web file your 2022 connecticut income tax return online! Generally, this is the last four or five pages of the pdf file you received from your reviewer. We last updated the connecticut resident income tax return in january 2023, so this is the. You can download or print. Add line 12 and line 13. We last updated the connecticut resident income tax return in january 2023, so this is. Total allowable credits from schedule ct‑it credit, part i, line 11 15. Use this calculator to determine your connecticut income tax. We last updated the connecticut resident income tax return in january 2023, so this is the. It will begin with a page having the following. Application for extension of time for payment of income tax: Estimate your taxes and refunds easily with this free tax calculator from aarp. This form is most often used by individuals who have lived and/or worked in. Add line 12 and line 13. Web no, form 1040 and form 1099 are two different federal tax forms. Web department of revenue services. Web connecticut tax forms select a different state: You can download or print. We last updated the connecticut resident income tax return in january 2023, so this is the. Web print your state of connecticut tax return. Web it appears you don't have a pdf plugin for this browser. Web no, form 1040 and form 1099 are two different federal tax forms. This form is for income earned in tax year 2022, with. Web connecticut tax forms select a different state: Application for extension of time for payment of income tax: Simple, secure, and can be completed from the comfort of your home. Web print your state of connecticut tax return. Ad discover helpful information and resources on taxes from aarp. Add line 12 and line 13. These 2021 forms and more are available:. Benefits to electronic filing include: Simple, secure, and can be completed from the comfort of your home. Web print your state of connecticut tax return. We last updated the connecticut resident income tax return in january 2023, so this is the. Web no, form 1040 and form 1099 are two different federal tax forms. Web it appears you don't have a pdf plugin for this. This booklet contains information or instructions for the following forms and schedules: Web connecticut tax forms select a different state: Web no, form 1040 and form 1099 are two different federal tax forms. Web file your 2022 connecticut income tax return online! Web print your state of connecticut tax return. Web no, form 1040 and form 1099 are two different federal tax forms. Application for extension of time for payment of income tax: These 2021 forms and more are available:. We last updated the connecticut resident income tax return in january 2023, so this is the. Simple, secure, and can be completed from the comfort of your home. Web department of revenue services. You can download or print. Web it appears you don't have a pdf plugin for this browser. Web check the appropriate box to indicate your filing status. Results in an immediate confirmation that your submission has been received by. Total allowable credits from schedule ct‑it credit, part i, line 11 15. Use this calculator to determine your connecticut income tax. This booklet contains information or instructions for the following forms and schedules: Amended income tax return for individuals: Estimate your taxes and refunds easily with this free tax calculator from aarp. It will begin with a page having the following. Web connecticut tax forms select a different state: Benefits to electronic filing include: Web print your state of connecticut tax return. Web file your 2022 connecticut income tax return online!Form Ct1040 Ext Application For Extension Of Time To File

Fillable Form Ct 1040 Connecticut Resident Tax 2021 Tax Forms

Ct 1040Es Fill Out and Sign Printable PDF Template signNow

Instructions for Ct 1040 Form Fill Out and Sign Printable PDF

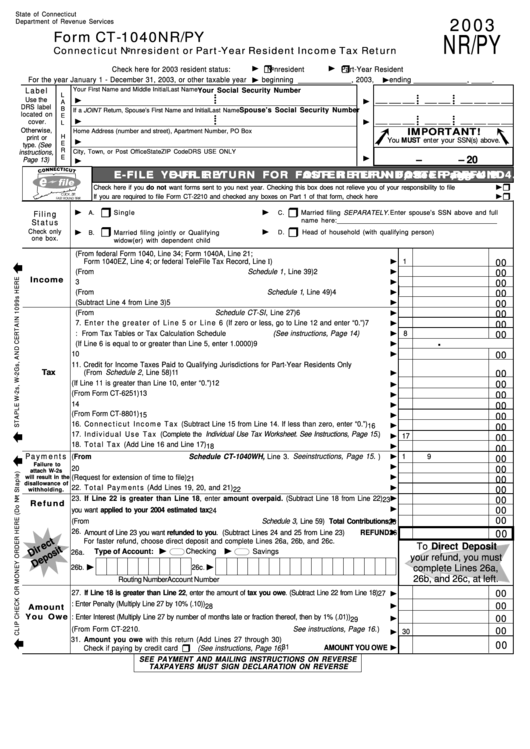

Form Ct1040nr/py Nonresident Or PartYear Resident Tax Return

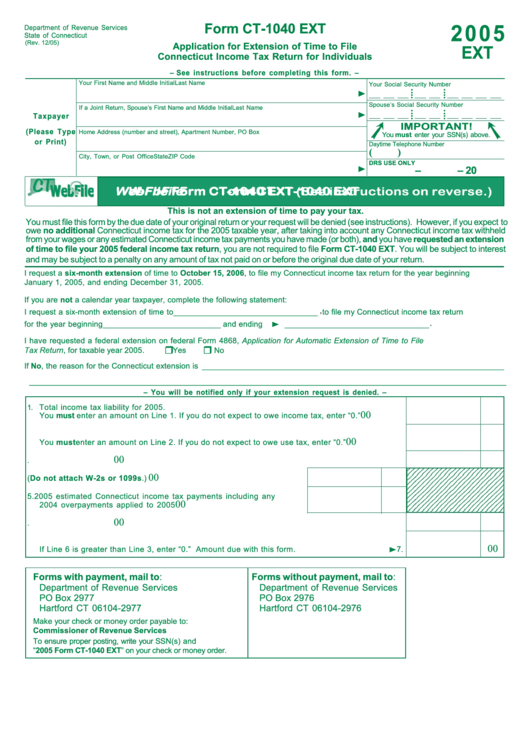

Form Ct1040 Ext Application For Extension Of Time To File

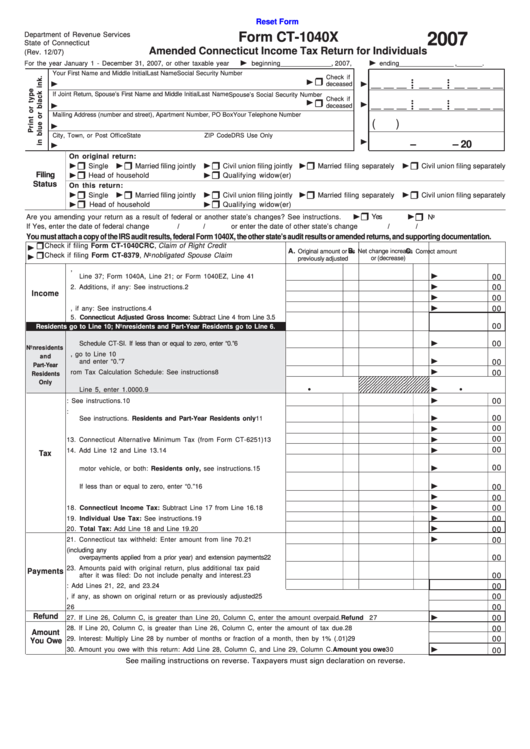

Fillable Form Ct1040x Amended Connecticut Tax Return For

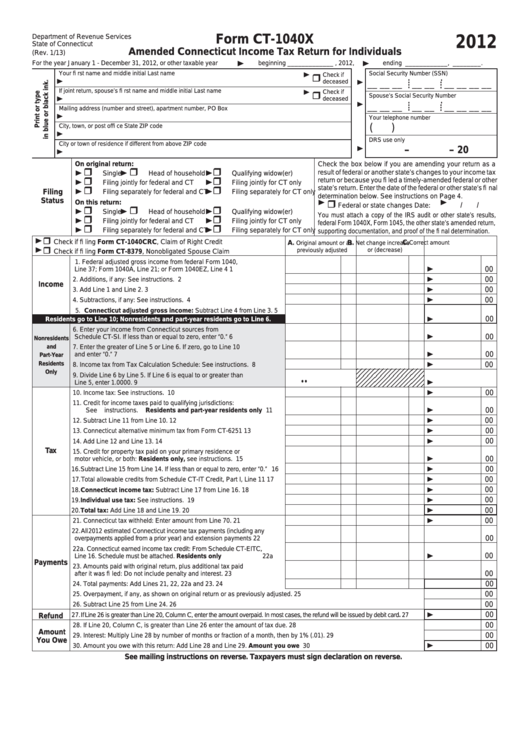

Form Ct1040x Amended Connecticut Tax Return For Individuals

Form Ct1040 Ext Application For Extension Of Time To File

Form Ct 1040 Connecticut Resident Tax Return 2007 printable

Related Post: