What Is 2210 Tax Form

What Is 2210 Tax Form - Department of the treasury internal revenue service. Penalty for underpaying taxes while everyone living in the united states is expected to pay income taxes to the irs in some form, not everyone pays standard. The form doesn't always have to be. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Web to complete form 2210 within the program, please follow the steps listed below. Department of the treasury internal revenue service. Web by default, the software calculates the estimated tax penalty and displays it on form 1040, line 38 (line 24 in drake19, line 23 in drake18, line 79 in drake17 and prior). Helping make your project a reality. Your income varies during the year. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the. Web form 2210 is a federal individual income tax form. Late returns are subject to penalty. Web more about the federal form 2210 estimated. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Helping make your project a reality. This form calculates any penalty due based. You may not have had to file form 2210 last year. Helping make your project a reality. Web if you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out irs form 2210. Eligibility to participate in the pilot will be limited. Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough. Millions of people file every year for an. (5) before mailing a reporting. Time’s up for millions of americans: You can, however, use form 2210 to figure your penalty if you wish and include the penalty. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Underpayment of estimated tax by individuals, estates, and trusts. This form calculates any penalty due based. The irs will generally figure your penalty for you and you should. • form 940 • form 940 schedule r. Department of the treasury internal revenue service. The form doesn't always have to be. Helping make your project a reality. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Millions of people file every year for an. This form is for income. This form calculates any penalty due based. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a. (5) before mailing a reporting. Taxpayers may complete form ftb 3516 and write the name of the disaster. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. The irs is currently working on building its own free tax filing program. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Web if. Your income varies during the year. Millions of people file every year for an. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Web form 2210 is a tax form that you use to see if you owe a penalty for underpaying. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web form 2210 is a federal individual income tax form. The irs will generally figure your penalty for you and you should not file form 2210. Web tax gap $688 billion. This form calculates any penalty due based. Web if you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out irs form 2210. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Web form 2210 is used by individuals (as well as estates and trusts) to determine if. Web tax gap $688 billion. Call us for a free consultation (5) before mailing a reporting. Department of the treasury internal revenue service. The final deadline to file your 2022 taxes is october 16. Taxpayers may complete form ftb 3516 and write the name of the disaster. Department of the treasury internal revenue service. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Ad register and subscribe now to work on your irs form 2210 & more fillable forms. Penalty for underpaying taxes while everyone living in the united states is expected to pay income taxes to the irs in some form, not everyone pays standard. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Complete part iv to figure the. The irs has also put a plan in motion to digitize. Web if you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out irs form 2210. Web by default, the software calculates the estimated tax penalty and displays it on form 1040, line 38 (line 24 in drake19, line 23 in drake18, line 79 in drake17 and prior). We last updated federal form 2210 in december 2022 from the federal internal revenue service. This form is for income. Ad tax credit consulting, syndication legal & financial structuring. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. You may not have had to file form 2210 last year.IRS Form 2210 A Guide to Underpayment of Tax

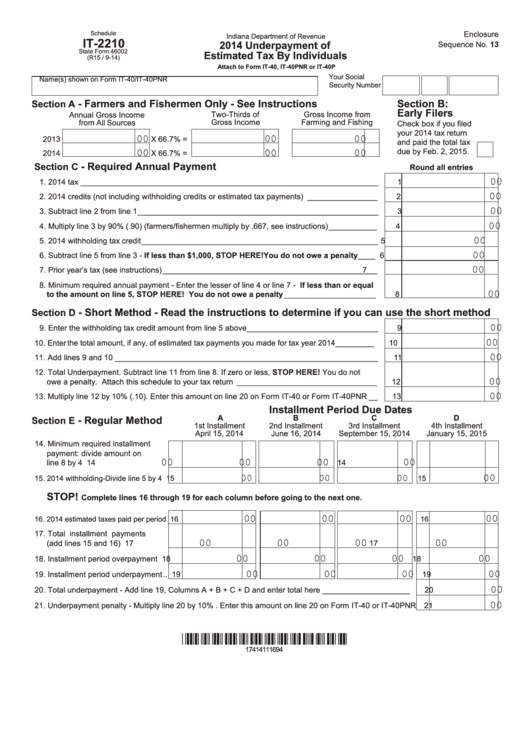

Fillable Schedule It2210 Underpayment Of Estimated Tax By

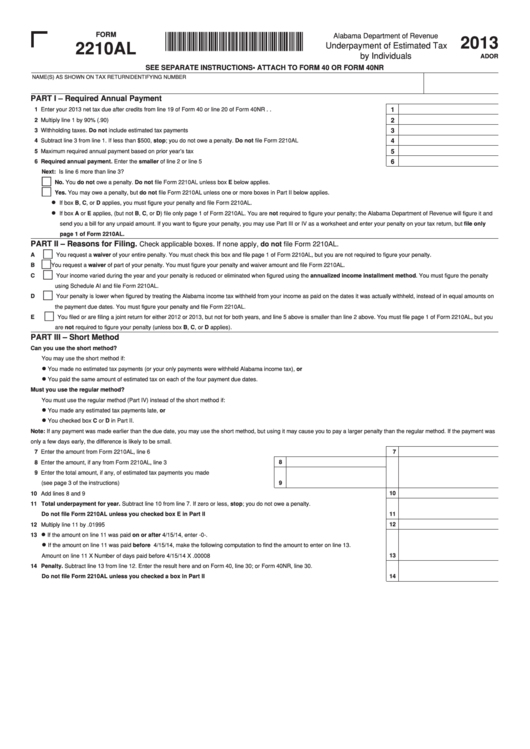

Fillable Form 2210al Underpayment Of Estimated Tax By Individuals

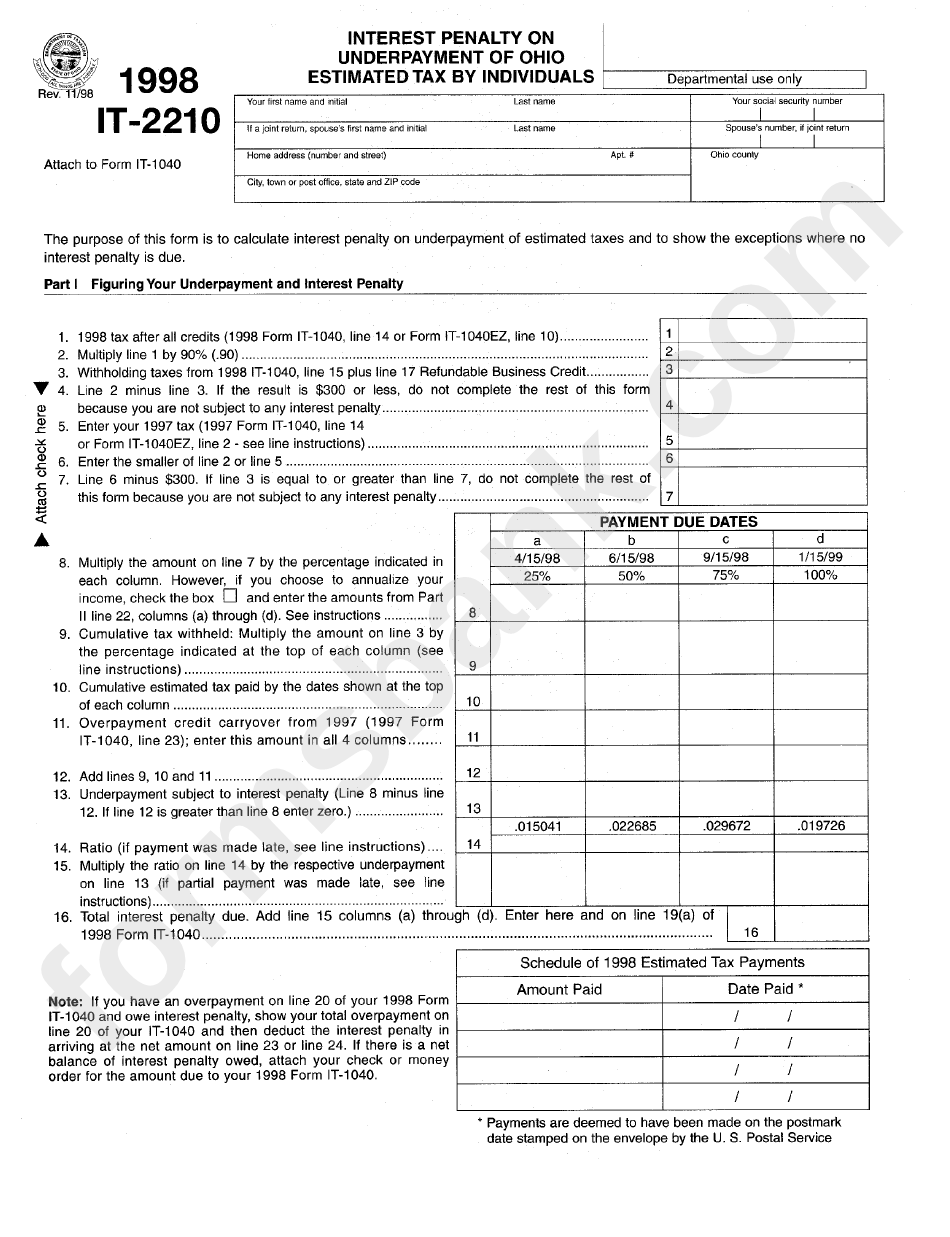

Fillable Form It2210 Interest Penalty On Underpayment Of Ohio

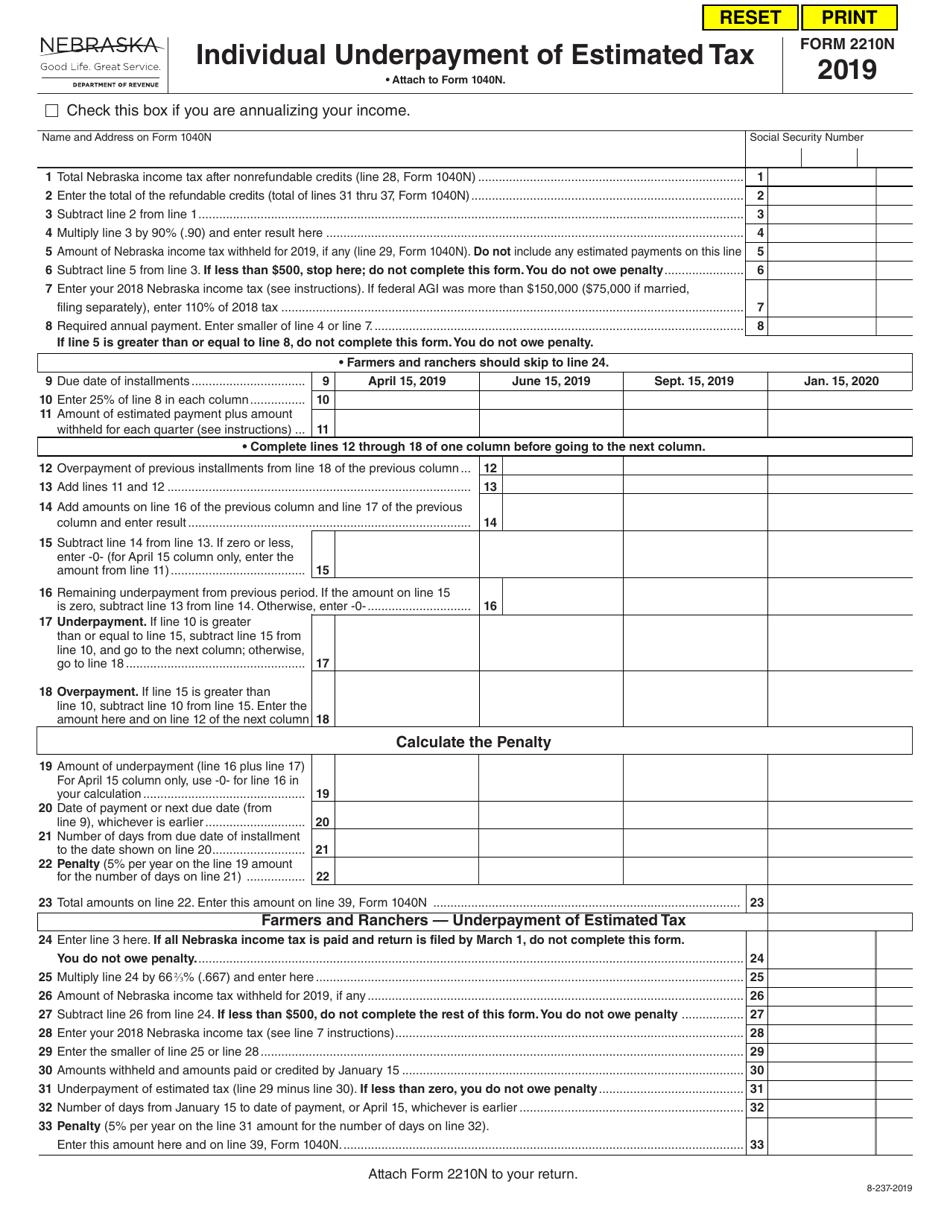

Form 2210N 2019 Fill Out, Sign Online and Download Fillable PDF

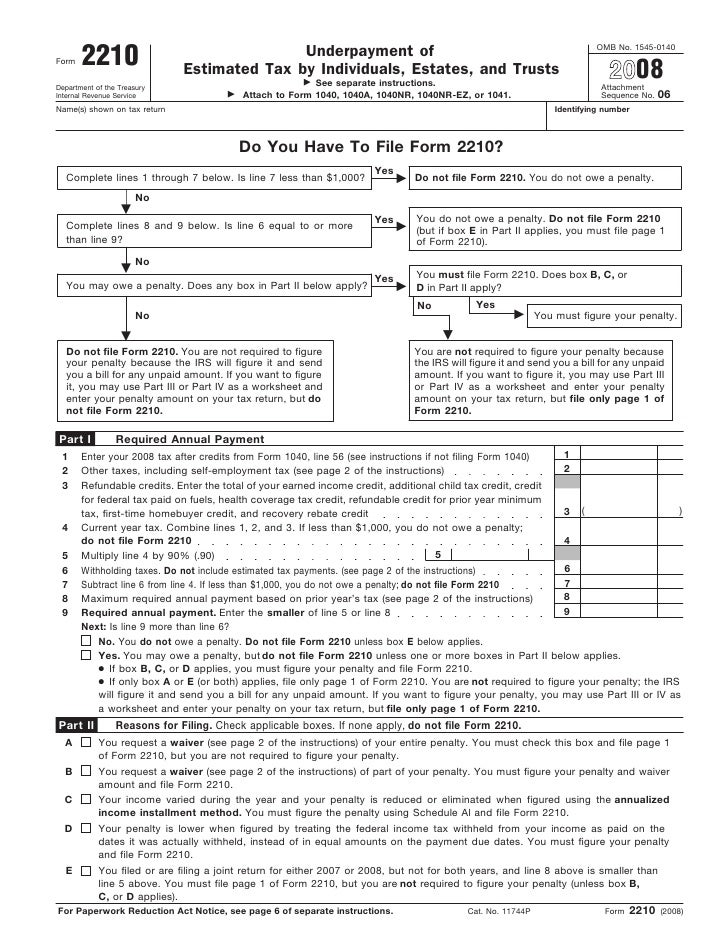

Form 2210Underpayment of Estimated Tax

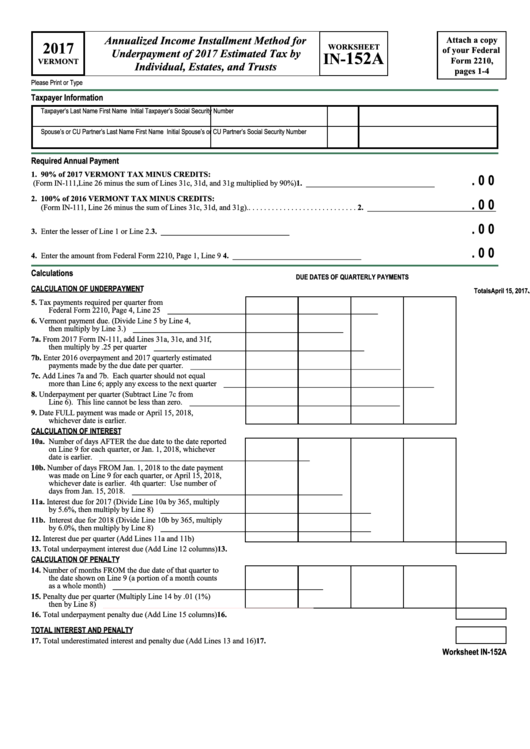

Form 2210 Worksheet In152a Annualized Installment Method

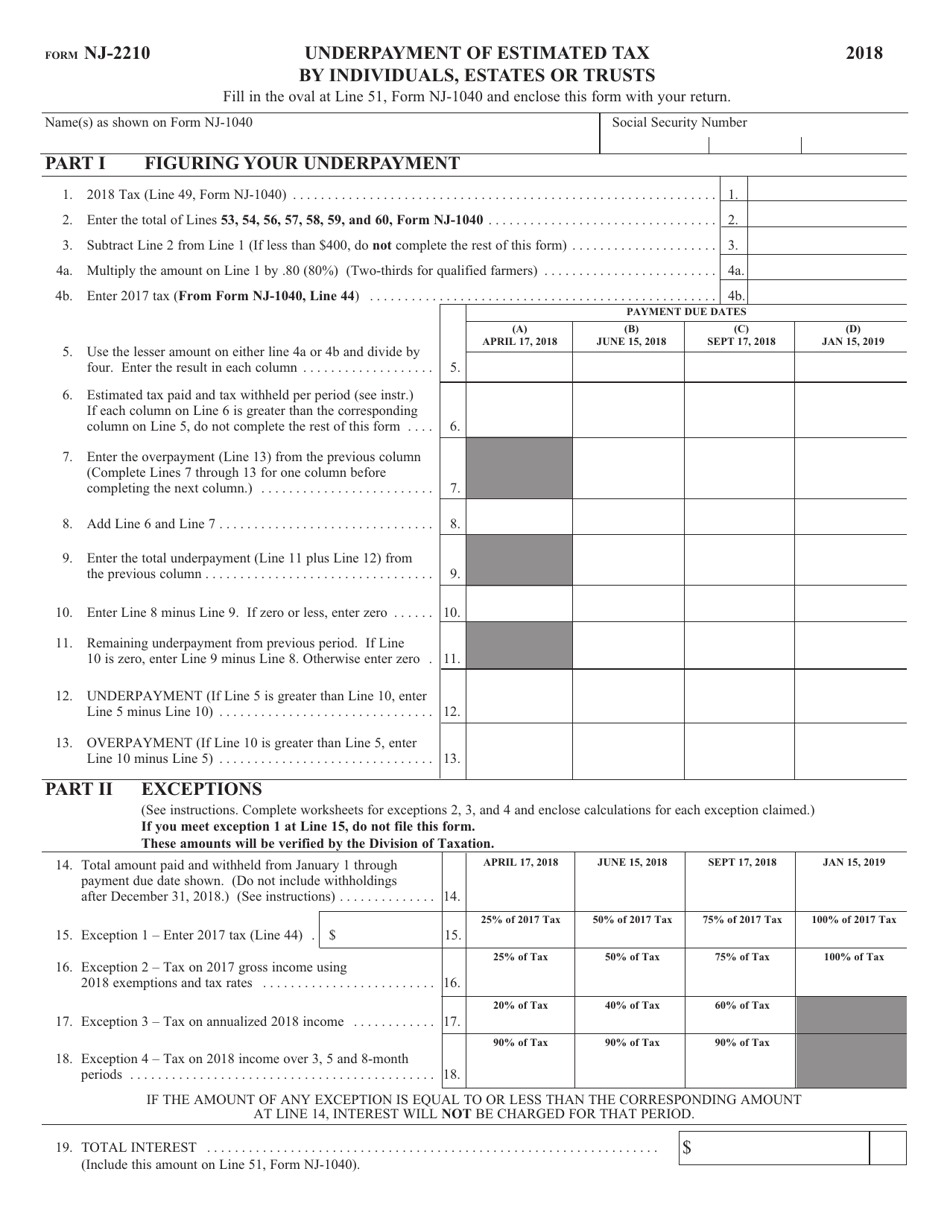

Form NJ2210 Download Fillable PDF or Fill Online Underpayment of

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals

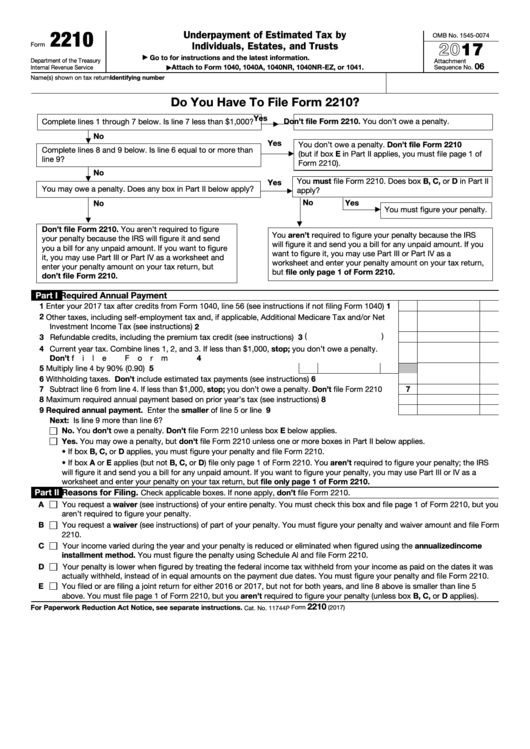

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Related Post: