Form M 3 Instructions

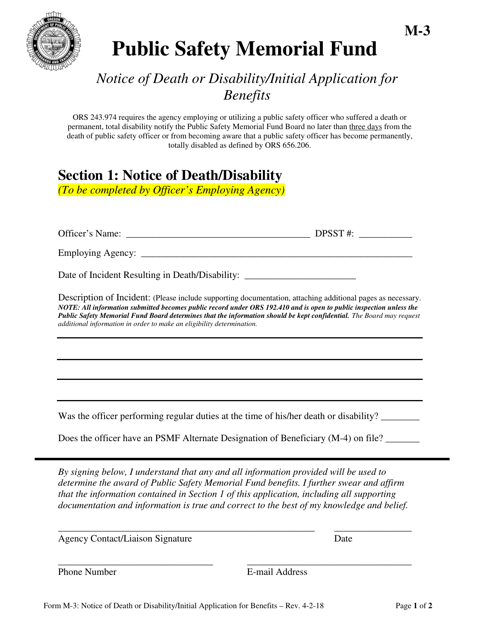

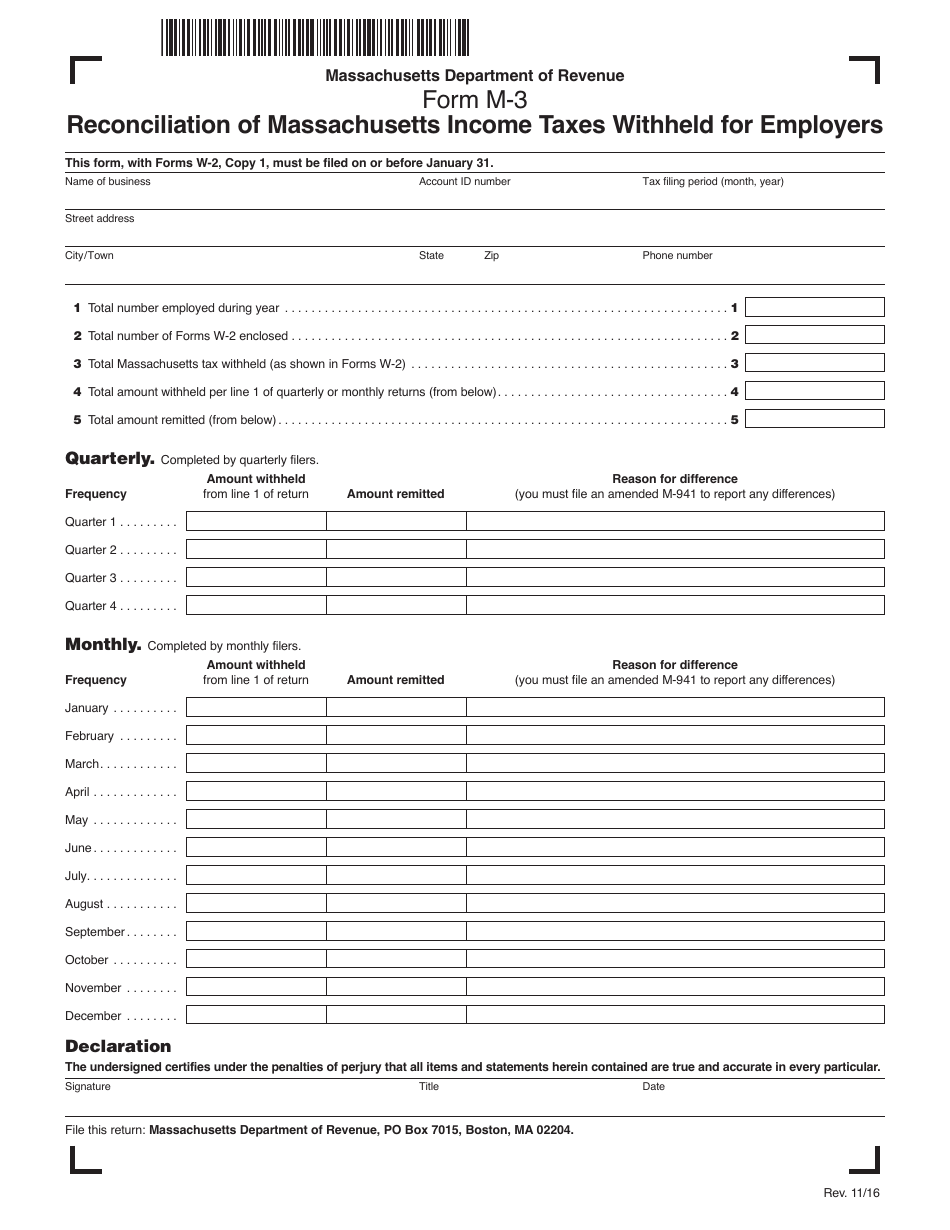

Form M 3 Instructions - Reconciliation of massachusetts income taxes withheld for employers (english, pdf 39.92 kb) Corporation (or consolidated tax group, if applicable), as reported on. Any domestic corporation or group of corporations required to file form 1120. Net income (loss) reconciliation for corporations with total assets. Web massachusetts form m 3 instructions. Tax filing period (month, year) street address. Web open the record with our advanced pdf editor. Skip lines 2 through 6 of form m1. Get massachusetts form m 3 instructions. Include graphics, crosses, check and. Ad pdffiller.com has been visited by 1m+ users in the past month Partnership tax declaration for electronic filing. Web massachusetts form m 3 instructions. Open form follow the instructions. Get massachusetts form m 3 instructions. December 2021) department of the treasury internal revenue service. Tax filing period (month, year) street address. Here you will find an updated listing of all. Dor tax forms and instructions. Open form follow the instructions. Web reconciliation of massachusetts income taxes withheld for employers. December 2019) department of the treasury internal revenue service. Get massachusetts form m 3 instructions. Section references are to the. Place an x in the box. Here you will find an updated listing of all. Web open the record with our advanced pdf editor. Web table of contents: Easily sign the form with your finger. Enter the amount from line 1 of form m1 on line 18 of schedule m1m and on line 7 of form m1. December 2021) department of the treasury internal revenue service. December 2021) department of the treasury internal revenue service. Reconciliation of massachusetts income taxes withheld for employers (english, pdf 39.92 kb) Enter the amount from line 1 of form m1 on line 18 of schedule m1m and on line 7 of form m1. December 2019) department of the treasury internal revenue. Easily sign the form with your finger. Ad pdffiller.com has been visited by 1m+ users in the past month Any domestic corporation or group of corporations required to file form 1120. Net income (loss) reconciliation for certain partnerships. December 2019) department of the treasury internal revenue service. Partnership tax declaration for electronic filing. Dor tax forms and instructions. Tax filing period (month, year) street address. Open form follow the instructions. Net income (loss) reconciliation for corporations with total assets. Web reconciliation of massachusetts income taxes withheld for employers. Web massachusetts form m 3 instructions. Section references are to the. A corporation that (a) is. Easily sign the form with your finger. Skip lines 2 through 6 of form m1. Web reconciliation of massachusetts income taxes withheld for employers. Section references are to the. Any domestic corporation or group of corporations required to file form 1120. Ad pdffiller.com has been visited by 1m+ users in the past month December 2021) department of the treasury internal revenue service. Open form follow the instructions. Ad pdffiller.com has been visited by 1m+ users in the past month Place an x in the box. Tax filing period (month, year) street address. A corporation that (a) is. Any domestic corporation or group of corporations required to file form 1120. Section references are to the. Dor tax forms and instructions. Easily sign the form with your finger. Net income (loss) reconciliation for certain partnerships. Web open the record with our advanced pdf editor. Web reconciliation of massachusetts income taxes withheld for employers. December 2021) department of the treasury internal revenue service. Here you will find an updated listing of all. Tax filing period (month, year) street address. Partnership tax declaration for electronic filing. Place an x in the box. Include graphics, crosses, check and. December 2019) department of the treasury internal revenue service. Enter the amount from line 1 of form m1 on line 18 of schedule m1m and on line 7 of form m1. Get massachusetts form m 3 instructions. Corporation (or consolidated tax group, if applicable), as reported on. Skip lines 2 through 6 of form m1. Net income (loss) reconciliation for corporations with total assets.Form M3 Download Printable PDF or Fill Online Notice of Death or

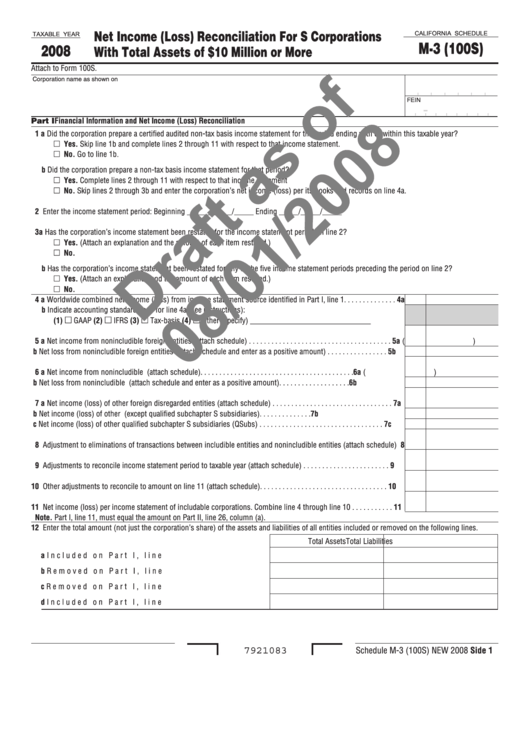

Form M3 (100s) Draft Net (Loss) Reconciliation For S

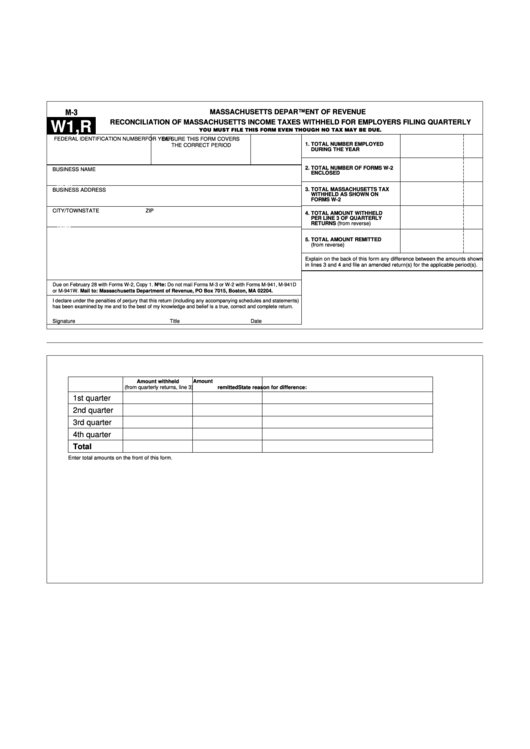

Form M3 Reconciliation Of Massachusetts Taxes Withheld For

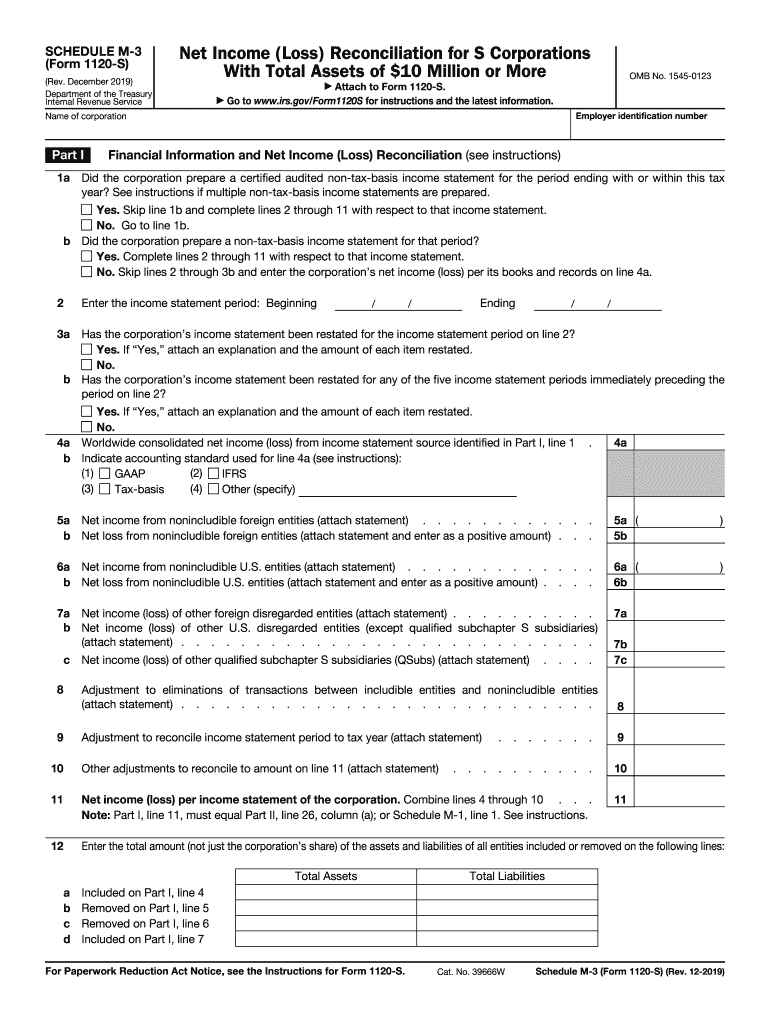

Schedule M3 Form Fill Out and Sign Printable PDF Template signNow

Inst 1120PC (Schedule M3)Instructions for Schedule M3 (Form 1120…

Fillable Form M3 Agreement To Extend The Time Limit To Complete The

Schedule M 3 Instructions 1065 Blank Sample to Fill out Online in PDF

Form M3 Download Printable PDF or Fill Online Reconciliation of

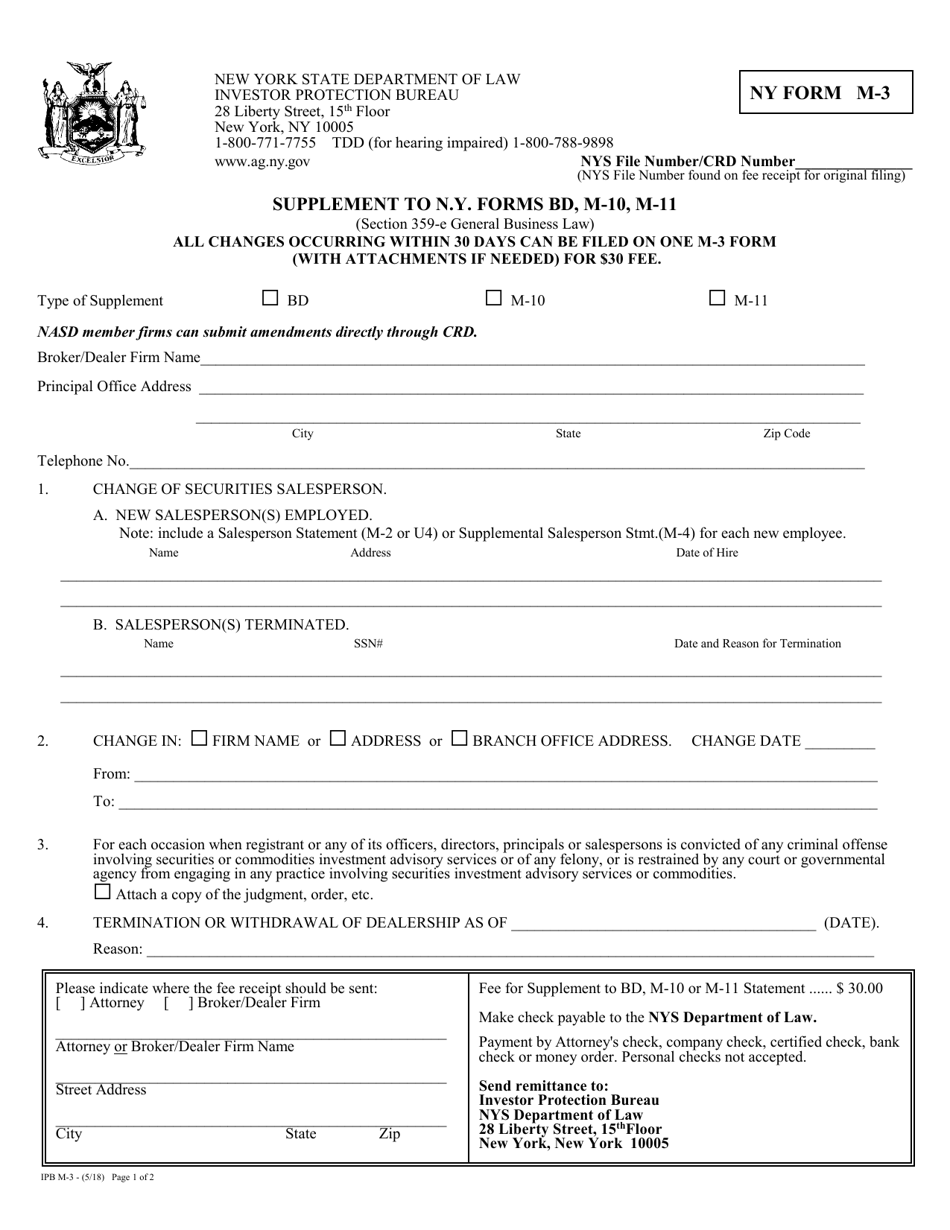

Form M3 Fill Out, Sign Online and Download Fillable PDF, New York

Form 1065 (Schedule M3) Net (Loss) Reconciliation for Certain

Related Post: