What Does Form 8862 Look Like

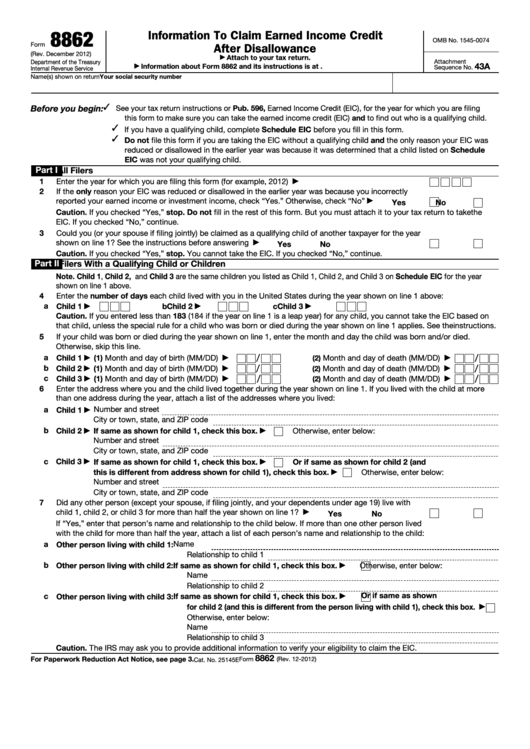

What Does Form 8862 Look Like - Web what is irs form 8862? Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced. Put your name and social security number on the statement and attach it at. Information to claim certain credits after disallowance. Web you need to complete form 8862 and attach it to your tax return if: Irs form 8862, information to claim certain credits after disallowance, is the federal form that a taxpayer may use to claim certain tax. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Solved • by turbotax • 7293 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for. If you file your taxes online, your online tax software will fill it out for you when you indicate you were previously disallowed to claim. Ad download or email irs 8862 & more fillable forms, register and subscribe now! 596, earned income credit (eic), for the year for which. Taxpayers complete form 8862 and attach it to their tax return if: See your tax return instructions or pub. Information to claim earned income credit after disallowance. Try it for free now! Solved • by turbotax • 7293 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for. In some cases, you may not be allowed to claim certain tax credits, like the. Web taxpayers complete form 8862 and attach it to their tax return if: Turbotax can help you fill out your. If you file. Written by a turbotax expert • reviewed by a turbotax cpa. Adhere to our simple actions to get your irs 8862 prepared quickly: Web we last updated the information to claim earned income credit after disallowance in december 2022, so this is the latest version of form 8862, fully updated for tax year. Web what is irs form 8862? 596,. Web you need to complete form 8862 and attach it to your tax return if: Put your name and social security number on the statement and attach it at. Web you can find tax form 8862 on the irs website. Web taxpayers complete form 8862 and attach it to their tax return if: Web you must complete form. Web more about the federal form 8862 tax credit. Information to claim certain credits after disallowance. November 2018) department of the treasury internal revenue service. Where can i find it? See your tax return instructions or pub. Put your name and social security number on the statement and attach it at. Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year. Try it for free now! November 2018) department of the treasury internal revenue service. If you file your taxes online,. Put your name and social security number on the statement and attach it at. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Web how do i enter form 8862? Upload, modify or create forms. Save or instantly send your. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other. Where can i find it? This form is for income. Ad download or email irs 8862 & more fillable forms, register and subscribe now! November 2018) department of the treasury internal revenue service. Where can i find it? November 2018) department of the treasury internal revenue service. December 2022) department of the treasury internal revenue service. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Get ready for tax season deadlines by completing. If you file your taxes online, your online tax software will fill it out for you when you indicate you were previously disallowed to claim. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Web. Irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical. Save or instantly send your ready documents. Upload, modify or create forms. How do i enter form 8862? Web how do i enter form 8862? Web taxpayers complete form 8862 and attach it to their tax return if: Where can i find it? Written by a turbotax expert • reviewed by a turbotax cpa. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced. Taxpayers complete form 8862 and attach it to their tax return if: Web what does form 8862 look like fill online, printable, fillable, blank. Information to claim certain credits after disallowance. Information to claim earned income credit after disallowance. Web taxpayers complete form 8862 and attach it to their tax return if: 596, earned income credit (eic), for the year for which. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other. November 2018) department of the treasury internal revenue service. This form is for income. Solved • by turbotax • 7293 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for.Form 8862 Pdf Fillable Printable Forms Free Online

Form 8862 Information to Claim Earned Credit After

Form 8862 Information to Claim Earned Credit After

Form 8862 Pdf Fillable Printable Forms Free Online

Form 8862Information to Claim Earned Credit for Disallowance

Form 8862 Information to Claim Earned Credit After

Form 8862 Child Tax Credit / Earned Credit (EIC) Workers with

What Does Form 8862 Look Like Fill Online, Printable, Fillable, Blank

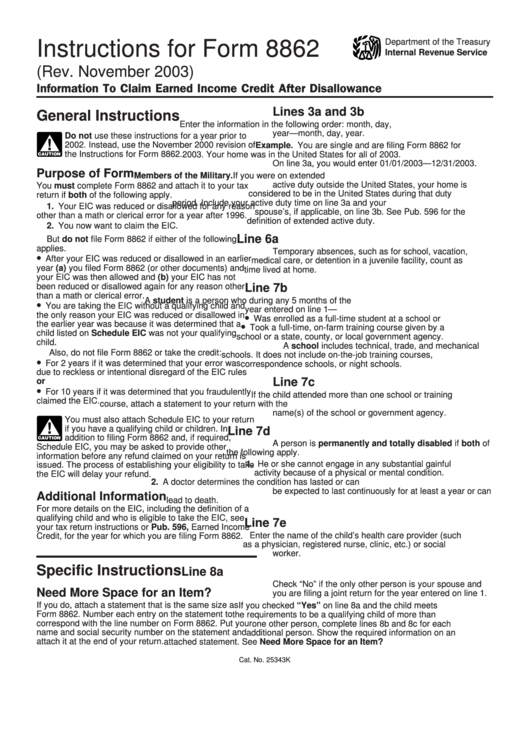

Instructions For Form 8862 Information To Claim Earned Credit

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Related Post:

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/aaa.jpg)