Form 6198 Explained

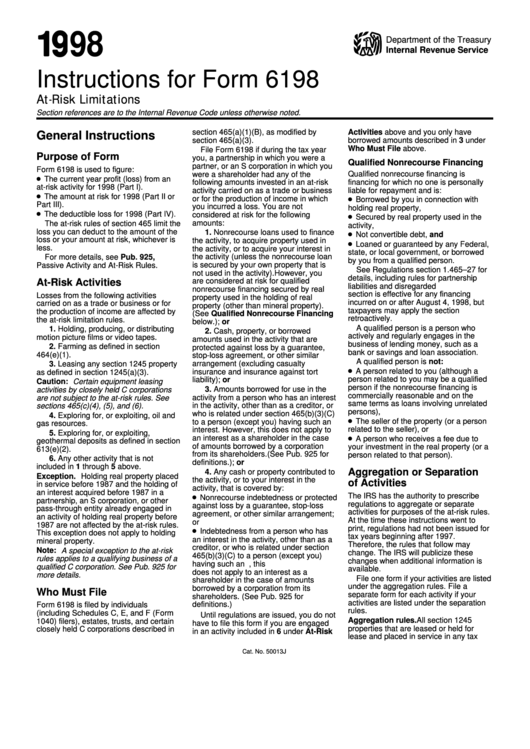

Form 6198 Explained - Web as modified by section 465(a)(3). To learn more, see publication 925: Web the passive activity rules. Web from 2007 form 6198, line 19b. Web 1 best answer. Form 6198 isn't currently supported in the fiduciary module, and must be. If only part of the loss is subject to the passive activity loss rules, report only that part on form 8582 or form 8810, whichever applies. Using form 6198, you can figure out the maximum amount you can deduct after you have suffered a loss in. Do not enter the amount from line 10b of the 2007 form. B increases since (check box that applies): Web once a loss becomes allowable under these other limitations, you must determine whether the loss is limited under the passive loss rules. Use form 6198 to figure: Web 1 best answer. Web irs form 6198 explained. Ad uslegalforms.com has been visited by 100k+ users in the past month Web as modified by section 465(a)(3). Web if some of the money you invested isn’t at risk, use form 6198 to figure your allowable loss. Web drafting irs form 6198 is a good skill to have so you can determine the maximum deductible amount after a loss in your invested business throughout the tax year. 345 views 1 month ago. Web if some of the money you invested isn’t at risk, use form 6198 to figure your allowable loss. To learn more, see publication 925: If only part of the loss is subject to the passive activity loss rules, report only that part on form 8582 or form 8810, whichever applies. Web as modified by section 465(a)(3). 16 16 a. Generally, any loss from an activity (such as a. Somewhere in the interview you have indicated. Web drafting irs form 6198 is a good skill to have so you can determine the maximum deductible amount after a loss in your invested business throughout the tax year. Web as modified by section 465(a)(3). You do not have to file form 6198. Form 6198 should be filed when a taxpayer has a loss in a. 16 16 a effective date 17 b the end of your. Web the passive activity rules. Web page last reviewed or updated: Web irs form 6198 explained. Do not enter the amount from line 10b of the 2007 form. Web 1 best answer. Web from 2007 form 6198, line 19b. Nonrecourse loans used to you are engaged in an. Somewhere in the interview you have indicated. Web 1 best answer. Web form 6198 helps you find out the highest amount you'll be able to deduct after facing a company loss within the tax year. Use form 6198 to figure: Form 6198 isn't currently supported in the fiduciary module, and must be. Form 6198 must be completed if there is an entry on line 19 above. Generally, any loss from an activity (such as a. Web as modified by section 465(a)(3). Web irs form 6198 explained. Form 6198 must be completed if there is an entry on line 19 above. 345 views 1 month ago tax forms. Web form 6198 helps you find out the highest amount you'll be able to deduct after facing a company loss within the tax year. Form 6198 is used by individuals, estates, trusts, and certain corporations to figure. Form 6198 should be filed when a taxpayer has a loss in a. Web if some of the money you invested isn’t at. Generally, any loss from an activity (such as a. Form 6198 is used by individuals, estates, trusts, and certain corporations to figure. Form 6198 should be filed when a taxpayer has a loss in a. Somewhere in the interview you have indicated. Ad uslegalforms.com has been visited by 100k+ users in the past month If only part of the loss is subject to the passive activity loss rules, report only that part on form 8582 or form 8810, whichever applies. 16 16 a effective date 17 b the end of your. Web once a loss becomes allowable under these other limitations, you must determine whether the loss is limited under the passive loss rules. Web irs form 6198 explained. To learn more, see publication 925: Form 6198 must be completed if there is an entry on line 19 above. Use form 6198 to figure: Form 6198 is used by individuals, estates, trusts, and certain corporations to figure. Web form 6198 helps you find out the highest amount you'll be able to deduct after facing a company loss within the tax year. You do not have to file form 6198 if file form 6198 if during the tax year 1. Web drafting irs form 6198 is a good skill to have so you can determine the maximum deductible amount after a loss in your invested business throughout the tax year. Somewhere in the interview you have indicated. Using form 6198, you can figure out the maximum amount you can deduct after you have suffered a loss in. Nonrecourse loans used to you are engaged in an. Generally, any loss from an activity (such as a. Do not enter the amount from line 10b of the 2007 form. Form 6198 isn't currently supported in the fiduciary module, and must be. Web page last reviewed or updated: Web 1 best answer. B increases since (check box that applies):Instructions For Form 6198 AtRisk Limitations 1998 printable pdf

Form 6198 Edit, Fill, Sign Online Handypdf

IRS Form 8990 walkthrough (Limitation on Business Interest Expenses

IRS Form 6198 walkthrough (AtRisk Limitations) YouTube

2007 Tax Form 6198 At

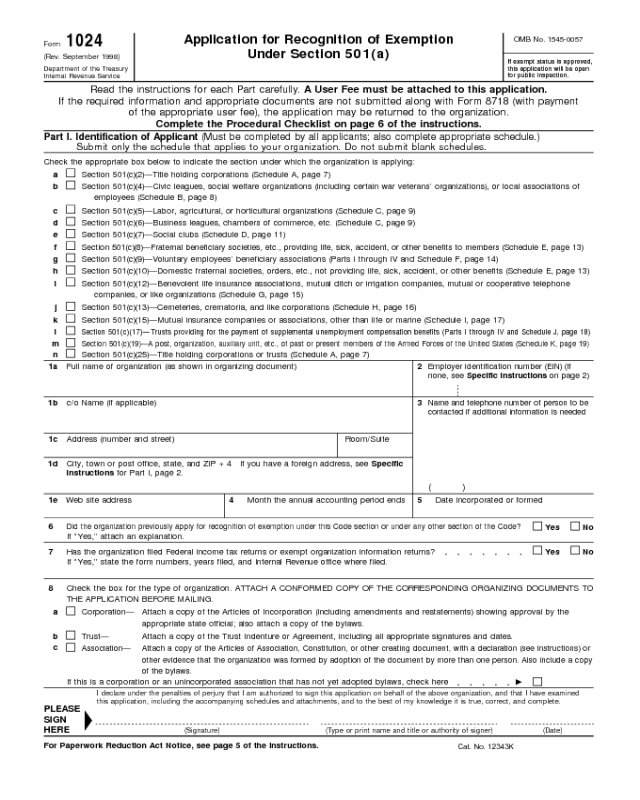

2019 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Instructions for Form 6198

Fillable Online Instruction 6198 Rev 2002 Instructions for Form 6198

Form 6198 AtRisk Limitations (2009) Free Download

IRS Tax Form 6198 Guide TFX.tax

Related Post: