What Is Irs Form 8915-F

What Is Irs Form 8915-F - Updates to the software are. Web generally, any u.s. See worksheet 1b, later, to determine whether you must use worksheet 1b. In the left menu, select tax tools and then tools. I can't even get to the part where i have the last 3rd of my 2020 disaster distribution (covid). The last day of the qualified distribution repayment period for most qualified 2021 disasters and many qualified 2022 disasters is june 27, 2023. Print, save, download 100% free! Web the qualified distribution repayment period for each disaster still begins on the day the disaster began. Person holding an interest in specified foreign financial assets with an aggregate value exceeding $50,000 at the end of the tax year or $75,000. You can choose to use worksheet 1b even if you are not required to do so. Estimate how much you could potentially save in just a matter of minutes. If a covid distribution was from an ira plan, enter the amount from the 2020 form. Updates to the software are. And the schedule a (form 1040/sr) page is at irs.gov/schedulea. Person holding an interest in specified foreign financial assets with an aggregate value exceeding $50,000 at. Ad real estate forms, contracts, tax forms & more. I would like to file cares act 401k withdrawal made in 2020. Starting in tax year 2022,. Web 501 page is at irs.gov/pub501; And the schedule a (form 1040/sr) page is at irs.gov/schedulea. Person holding an interest in specified foreign financial assets with an aggregate value exceeding $50,000 at the end of the tax year or $75,000. Starting in tax year 2022,. The irs released new instructions for this form. The last day of the qualified distribution repayment period for most qualified 2021 disasters and many qualified 2022 disasters is june 27, 2023.. The last day of the qualified distribution repayment period for most qualified 2021 disasters and many qualified 2022 disasters is june 27, 2023. Web generally, any u.s. If typing in a link above instead of. Updates to the software are. Person holding an interest in specified foreign financial assets with an aggregate value exceeding $50,000 at the end of the. I can't even get to the part where i have the last 3rd of my 2020 disaster distribution (covid). Ad we help get taxpayers relief from owed irs back taxes. Create, edit, and print your business and legal documents quickly and easily! Estimate how much you could potentially save in just a matter of minutes. Person holding an interest in. Estimate how much you could potentially save in just a matter of minutes. The last day of the qualified distribution repayment period for most qualified 2021 disasters and many qualified 2022 disasters is june 27, 2023. Web generally, any u.s. Web 501 page is at irs.gov/pub501; If a covid distribution was from an ira plan, enter the amount from the. And the schedule a (form 1040/sr) page is at irs.gov/schedulea. The irs released new instructions for this form. Ad real estate forms, contracts, tax forms & more. See worksheet 1b, later, to determine whether you must use worksheet 1b. Web generally, any u.s. Web the qualified distribution repayment period for each disaster still begins on the day the disaster began. Create, edit, and print your business and legal documents quickly and easily! The irs released new instructions for this form. Updates to the software are. In the left menu, select tax tools and then tools. Create, edit, and print your business and legal documents quickly and easily! Updates to the software are. I can't even get to the part where i have the last 3rd of my 2020 disaster distribution (covid). Print, save, download 100% free! Person holding an interest in specified foreign financial assets with an aggregate value exceeding $50,000 at the end of. I would like to file cares act 401k withdrawal made in 2020. You can choose to use worksheet 1b even if you are not required to do so. Updates to the software are. Web open or continue your return in turbotax. If a covid distribution was from an ira plan, enter the amount from the 2020 form. If typing in a link above instead of. Updates to the software are. Web the qualified distribution repayment period for each disaster still begins on the day the disaster began. Estimate how much you could potentially save in just a matter of minutes. Starting in tax year 2022,. Web open or continue your return in turbotax. Ad real estate forms, contracts, tax forms & more. You can choose to use worksheet 1b even if you are not required to do so. Create, edit, and print your business and legal documents quickly and easily! I would like to file cares act 401k withdrawal made in 2020. In the left menu, select tax tools and then tools. Print, save, download 100% free! I can't even get to the part where i have the last 3rd of my 2020 disaster distribution (covid). The last day of the qualified distribution repayment period for most qualified 2021 disasters and many qualified 2022 disasters is june 27, 2023. Person holding an interest in specified foreign financial assets with an aggregate value exceeding $50,000 at the end of the tax year or $75,000. The irs released new instructions for this form. See worksheet 1b, later, to determine whether you must use worksheet 1b. Web 501 page is at irs.gov/pub501; Ad we help get taxpayers relief from owed irs back taxes. Web generally, any u.s.8915e tax form instructions Somer Langley

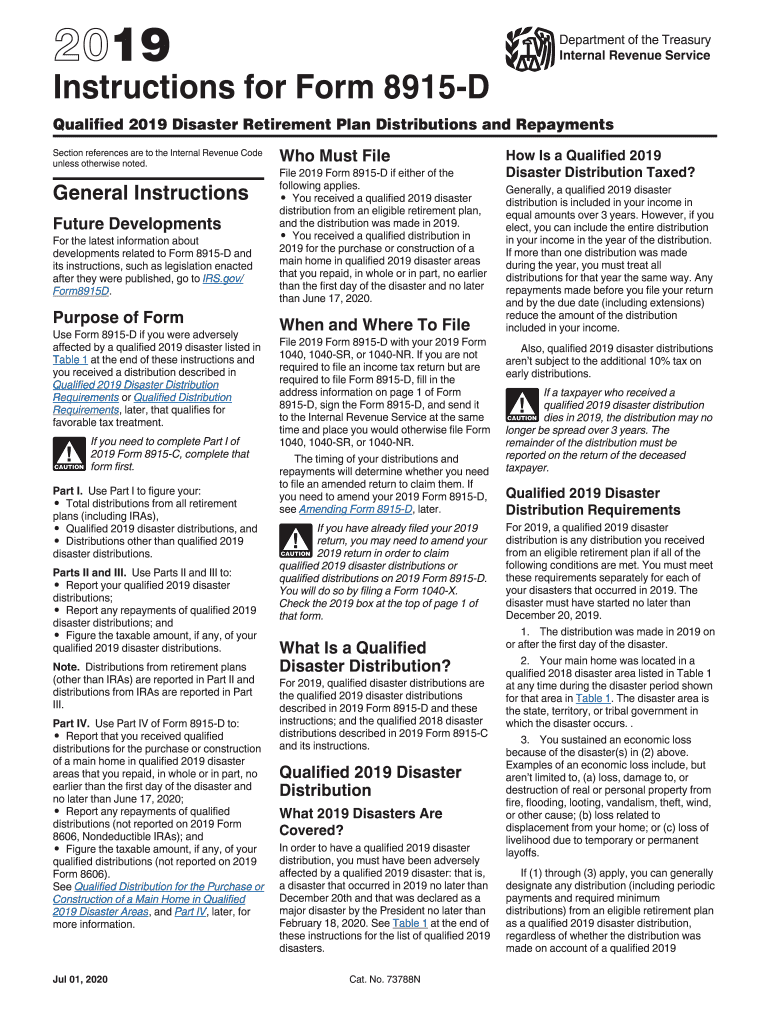

2022 Form IRS Instructions 8915DFill Online, Printable, Fillable

8915 F 2020 Coronavirus Distributions for 2021 Tax Returns YouTube

'Forever' form 8915F issued by IRS for retirement distributions Newsday

Where can I find the 8915 F form on the TurboTax app?

About Form 8915F, Qualified Disaster Retirement Plan Distributions and

Instructions 8915 Fill Out and Sign Printable PDF Template signNow

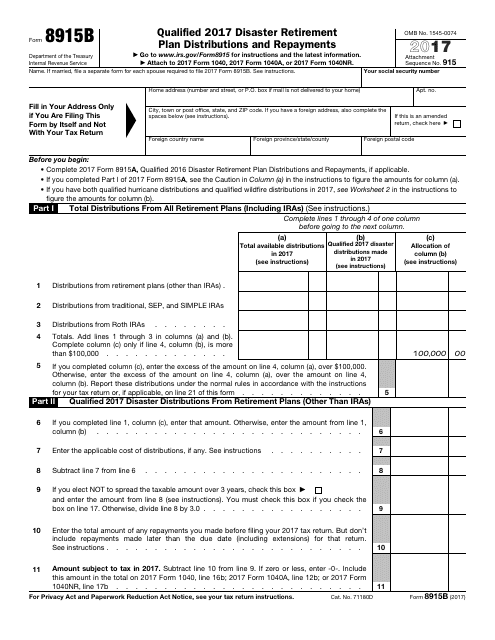

Fill Free fillable F8915bdft 2019 Form 8915B PDF form

IRS Form 8915B Download Fillable PDF or Fill Online Qualified 2017

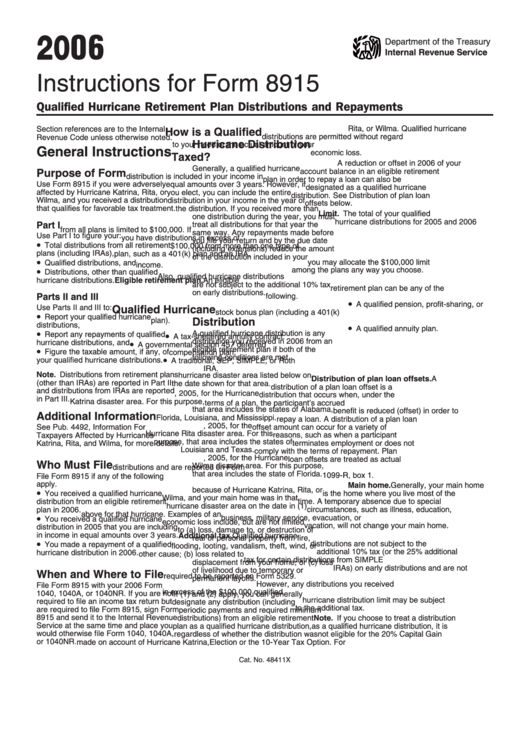

Instructions For Form 8915 2006 printable pdf download

Related Post: