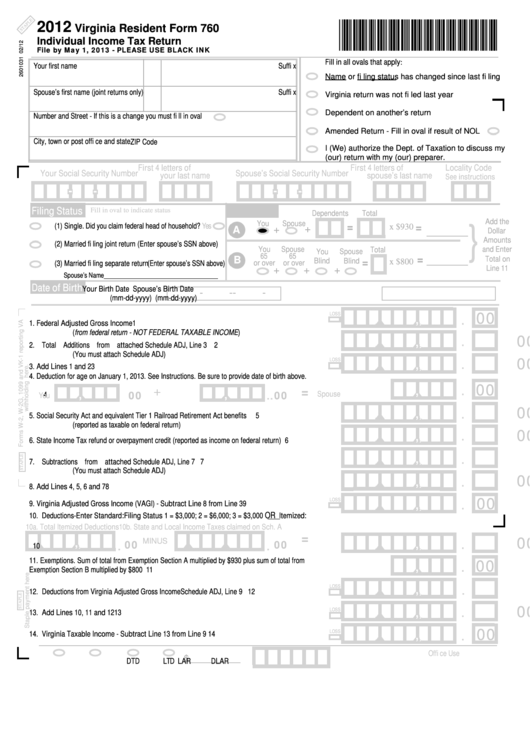

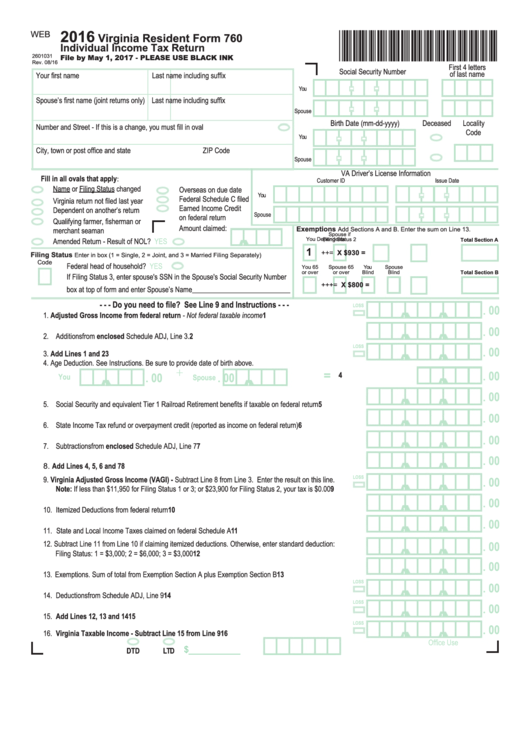

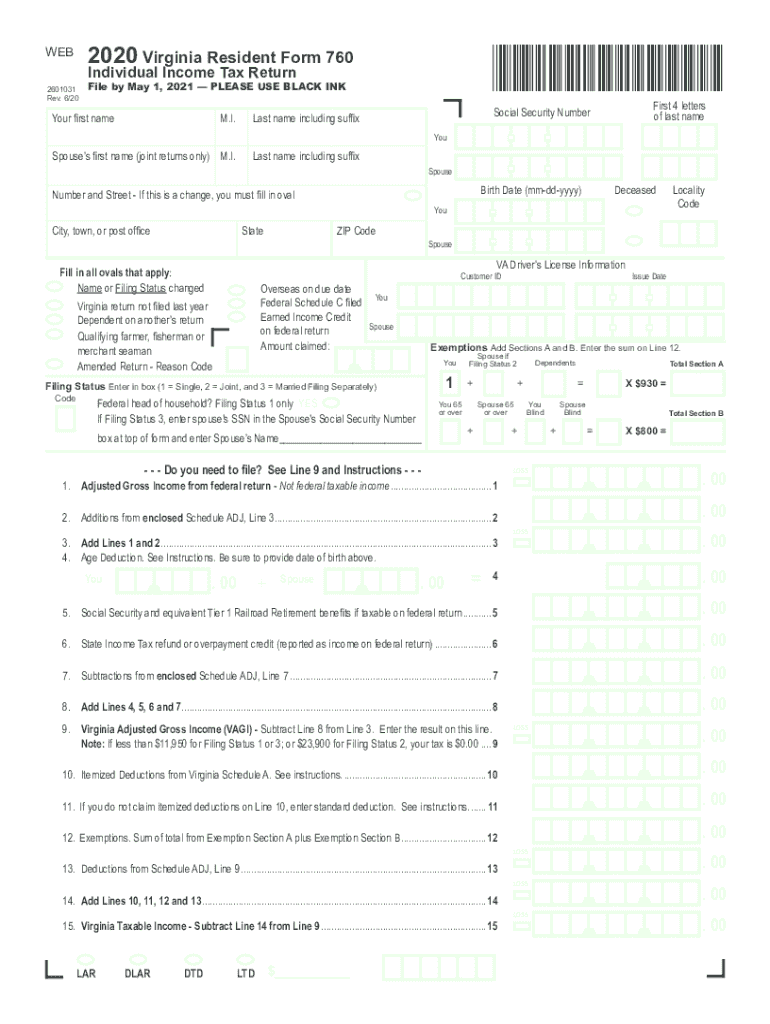

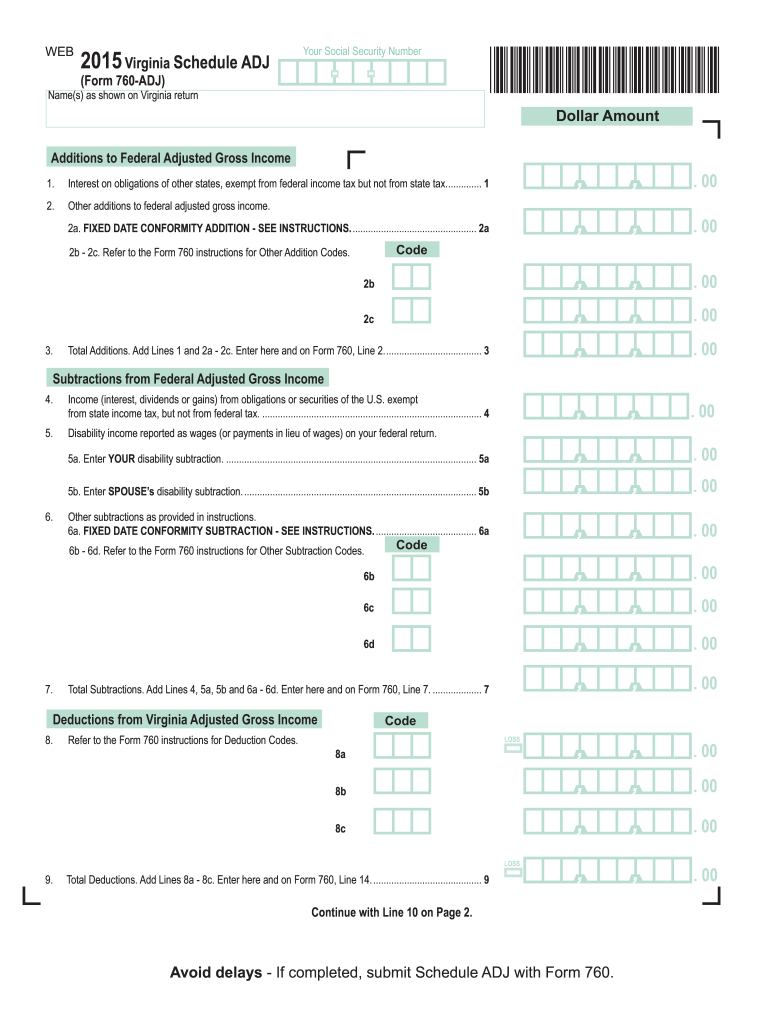

Va Tax Form 760

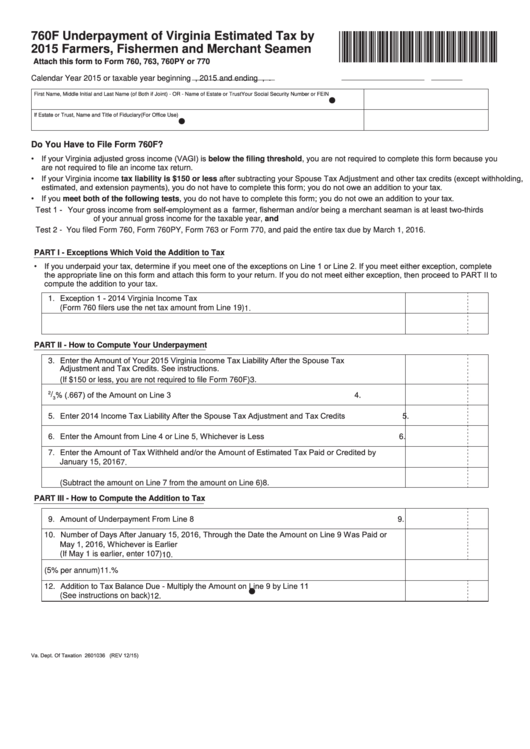

Va Tax Form 760 - 1st quarter (q1) 2nd quarter (q2) 3rd quarter (q3) 4th quarter (q4) demographics. This form is for income earned in tax year 2022, with tax returns due in april. File & pay state taxes online with eforms. If you are a full resident which means you lived in virginia for more than 183 days and/or worked in virginia for more than 6 months, you must file your 1040 for the state. Web virginia resident form 760 *va0760120888* individual income tax return. Corporation and pass through entity tax. File your state tax return. Web we last updated virginia form 760 in january 2023 from the virginia department of taxation. See line 9 and instructions. Choose avalara sales tax rate tables by state or look up individual rates by address. Virginia form 760, also known as individual income tax return is used to review and confirm the person’s tax return. Web 2021 virginia form 760 *va0760121888* resident income tax return 2601031 file by may 1, 2022 — use black ink rev. See line 9 and instructions. Web find forms & instructions by category. Va estimated income tax payment vouchers and. Web find forms & instructions by category. Web do not submit form 760es if no amount is due. Corporation and pass through entity tax. File & pay state taxes online with eforms. File your state tax return. This eform allows you to enter your tax information,. Web find forms & instructions by category. If the amount on line 9 is less than the amount shown below for your filing. If the amount on line 9 is less than the amount shown below for your filing. Web up to $40 cash back fill va form 760 print and. Not filed contact us 760pmt. Be sure to enclose virginia schedule. Ad download avalara sales tax rate tables by state or search tax rates by individual address. Web 2019 virginia resident form 760 individual income tax return author: Web we last updated virginia form 760 in january 2023 from the virginia department of taxation. Web complete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi). Your social security number (ssn) first. 1st quarter (q1) 2nd quarter (q2) 3rd quarter (q3) 4th quarter (q4) demographics. Web if you need to make a payment for your virginia individual income tax return, you can use the 760pmt eform to do it online.. Web 2021 virginia form 760 *va0760121888* resident income tax return 2601031 file by may 1, 2022 — use black ink rev. If you are a full resident which means you lived in virginia for more than 183 days and/or worked in virginia for more than 6 months, you must file your 1040 for the state. Web complete form 760, lines. If the amount on line 9 is less than the amount shown below for your filing. Virginia form 760, also known as individual income tax return is used to review and confirm the person’s tax return. Be sure to enclose virginia schedule. This eform allows you to enter your tax information,. Web complete form 760, lines 1 through 9, to. Web 76 rows form tax year description filing options; This eform allows you to enter your tax information,. Va estimated income tax payment vouchers and instructions for individuals estimated. Web services & resources offered. This form is for income earned in tax year 2022, with tax returns due in april. This eform allows you to enter your tax information,. Web find forms & instructions by category. This form is for income earned in tax year 2022, with tax returns due in april. Web complete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi). Not filed electronic payment guide. Virginia form 760, also known as individual income tax return is used to review and confirm the person’s tax return. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. This form is for income earned in tax year 2022, with tax returns due in april. Web 2021 virginia form 760 *va0760121888* resident income tax return 2601031. File your state tax return. If the amount on line 9 is less than the amount shown below for your filing. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web services & resources offered. Your social security number (ssn) first. Web complete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi). Web do not submit form 760es if no amount is due. Web what is virginia tax form 760? Web 2019 virginia resident form 760 individual income tax return author: If you are a full resident which means you lived in virginia for more than 183 days and/or worked in virginia for more than 6 months, you must file your 1040 for the state. Be sure to enclose virginia schedule. File & pay state taxes online with eforms. This eform allows you to enter your tax information,. Va estimated income tax payment vouchers and instructions for individuals estimated. Not filed electronic payment guide. Web complete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi). Ad download avalara sales tax rate tables by state or search tax rates by individual address. This form is for income earned in tax year 2022, with tax returns due in april. Web up to $40 cash back fill va form 760 print and fillable on line, edit online. Web if state and local income tax is the only federal itemized deduction you are claiming on the virginia return, enter zero on form 760, line 10.2018 Form VA DoT 760 Fill Online, Printable, Fillable, Blank pdfFiller

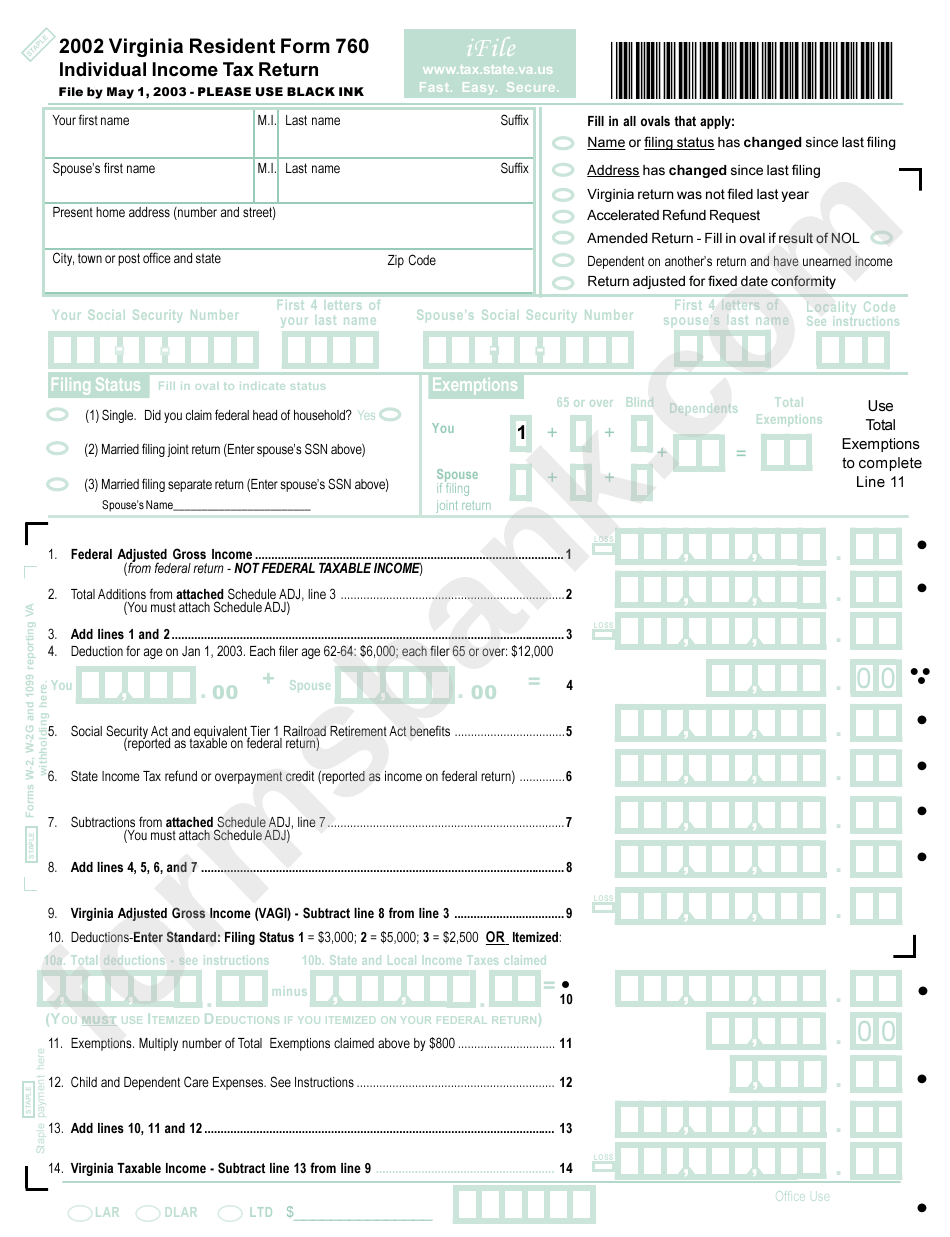

Virginia Resident Form 760 Individual Tax Return 2002

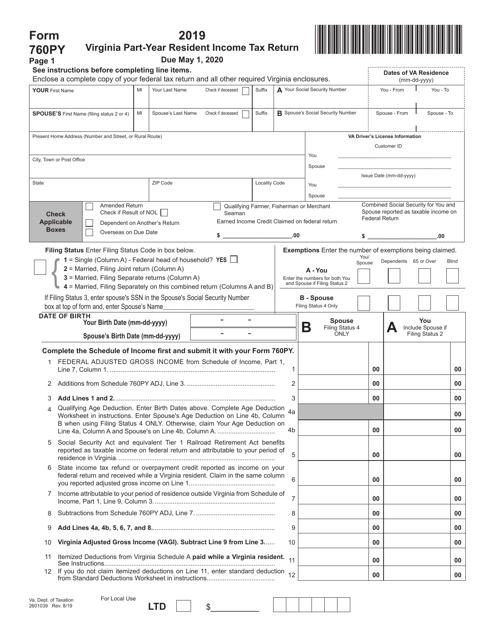

Form 760PY 2019 Fill Out, Sign Online and Download Fillable PDF

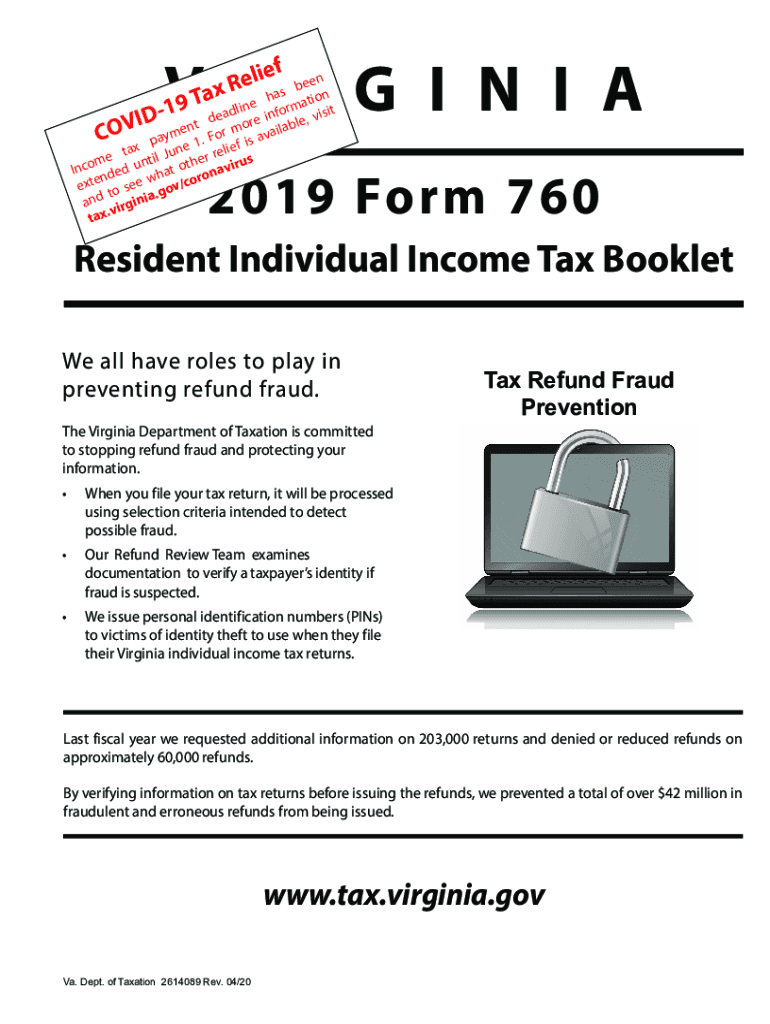

Va tax form 760 2019 Fill out & sign online DocHub

Top 22 Virginia Form 760 Templates free to download in PDF format

VA 760ADJ 2020 Fill out Tax Template Online US Legal Forms

Fillable Virginia Resident Form 760 Individual Tax Return

Fillable Form 760 Virginia Resident Individual Tax Return

Virginia State 760 Form Fill Out and Sign Printable PDF Template

VA 760ADJ 2015 Fill out Tax Template Online US Legal Forms

Related Post: