Form 990 Pf Instructions

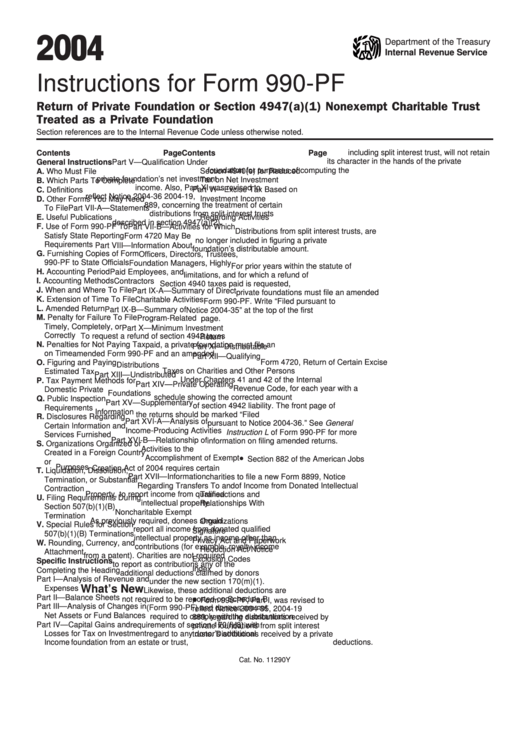

Form 990 Pf Instructions - For instructions and the latest information. Ad access irs tax forms. To figure the tax based on investment income, and to report charitable distributions and activities. Get ready for tax season deadlines by completing any required tax forms today. The form consists of sixteen sections covering. Complete, edit or print tax forms instantly. It is an information return used to calculate the tax based on investment. Complete, edit or print tax forms instantly. If the information necessary to file the return is not available by the deadline, the organization may file one. Web 21 rows instructions. Get ready for tax season deadlines by completing any required tax forms today. For paperwork reduction act notice, see the. Web instructions for these schedules are combined with the schedules. If the information necessary to file the return is not available by the deadline, the organization may file one. For instructions and the latest information. Web 21 rows instructions. • to figure the tax based on investment income, and • to report charitable distributions and activities. If the information necessary to file the return is not available by the deadline, the organization may file one. To figure the tax based on investment income, and to report charitable distributions and activities. Web information about form 990,. Web 21 rows instructions. Ad access irs tax forms. To figure the tax based on investment income, and to report charitable distributions and activities. As required by section 3101 of the taxpayer first. Get ready for tax season deadlines by completing any required tax forms today. To figure the tax based on investment income, and to report charitable distributions and activities. Web instructions for these schedules are combined with the schedules. As required by section 3101 of the taxpayer first. Web do not enter social security numbers on this form as it may be made public. Web information about form 990, return of organization exempt from. Complete, edit or print tax forms instantly. • to figure the tax based on investment income, and • to report charitable distributions and activities. The form consists of sixteen sections covering. The irs requires private foundations to file form 990. For instructions and the latest information. Complete, edit or print tax forms instantly. Web instructions for these schedules are combined with the schedules. • to figure the tax based on investment income, and • to report charitable distributions and activities. The irs requires private foundations to file form 990. To figure the tax based on investment income, and to report charitable distributions and activities. Ad access irs tax forms. Complete, edit or print tax forms instantly. It is an information return used to calculate the tax based on investment. If the information necessary to file the return is not available by the deadline, the organization may file one. Web general instructions purpose of form. Web 21 rows instructions. As required by section 3101 of the taxpayer first. Ad access irs tax forms. • to figure the tax based on investment income, and • to report charitable distributions and activities. It is an information return used to calculate the tax based on investment. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. For instructions and the latest information. Complete, edit or print tax forms instantly. Web do not enter social security numbers on this form as it may be made public. • to figure the tax based on investment. Web 21 rows instructions. Web instructions for these schedules are combined with the schedules. It is an information return used to calculate the tax based on investment. For instructions and the latest information. If the information necessary to file the return is not available by the deadline, the organization may file one. Web do not enter social security numbers on this form as it may be made public. Web 21 rows instructions. The form consists of sixteen sections covering. Get ready for tax season deadlines by completing any required tax forms today. Web general instructions purpose of form. Complete, edit or print tax forms instantly. Web instructions for these schedules are combined with the schedules. Complete, edit or print tax forms instantly. As required by section 3101 of the taxpayer first. For instructions and the latest information. It is an information return used to calculate the tax based on investment. If the information necessary to file the return is not available by the deadline, the organization may file one. • to figure the tax based on investment income, and • to report charitable distributions and activities. The irs requires private foundations to file form 990. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. For paperwork reduction act notice, see the. To figure the tax based on investment income, and to report charitable distributions and activities. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms.Instructions For Form 990Pf Return Of Private Foundation Or Section

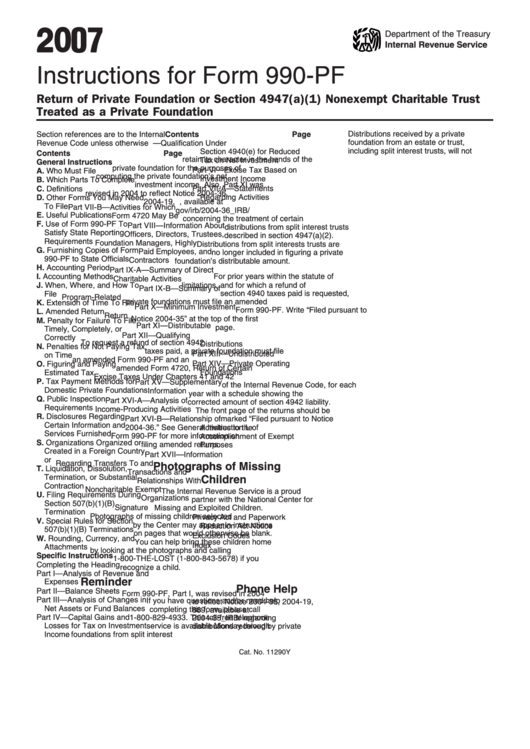

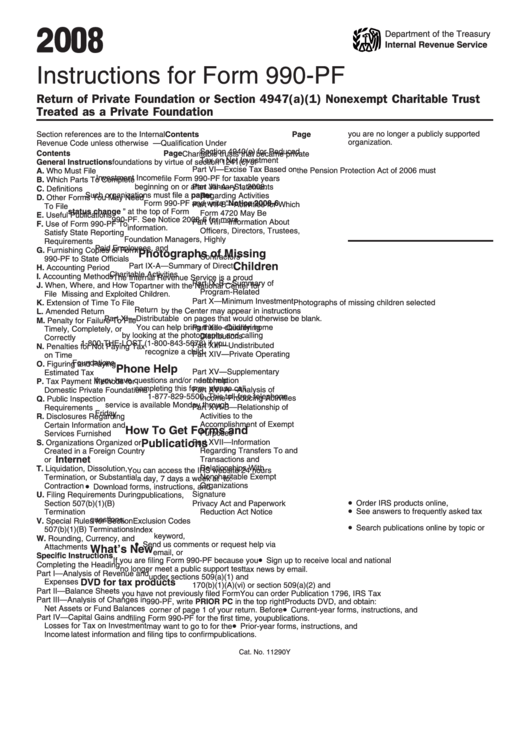

Editable IRS Instructions 990PF 2018 2019 Create A Digital Sample

Instructions For Form 990Pf Return Of Private Foundation Or Section

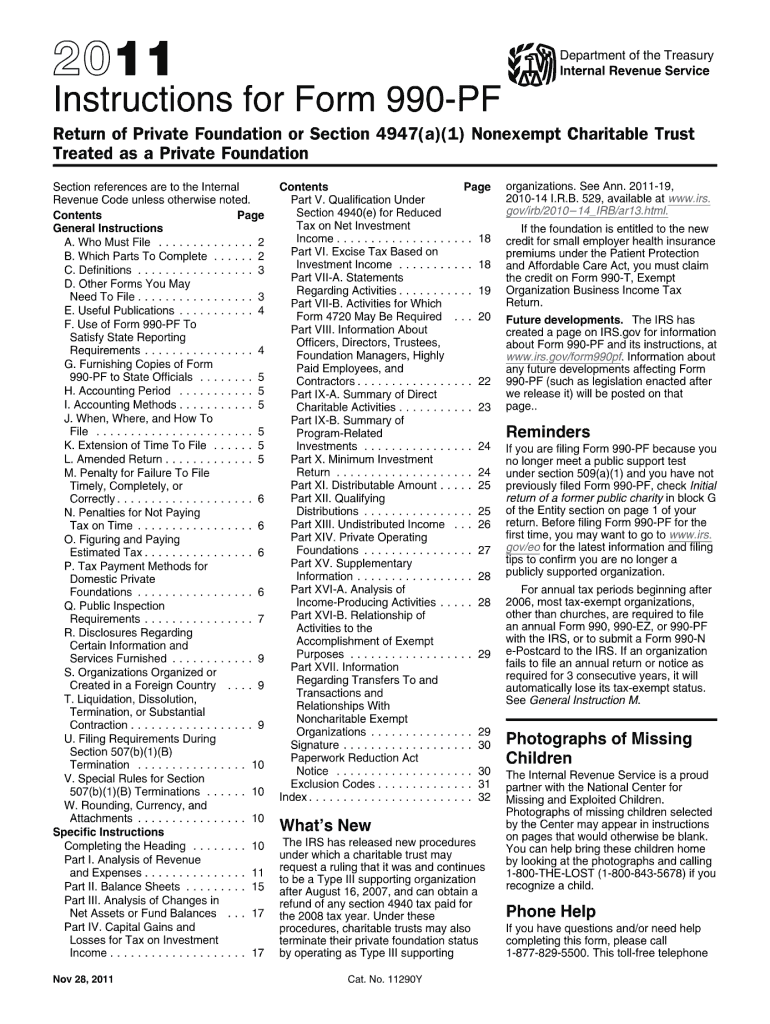

2011 Form IRS 990PF Instructions Fill Online, Printable, Fillable

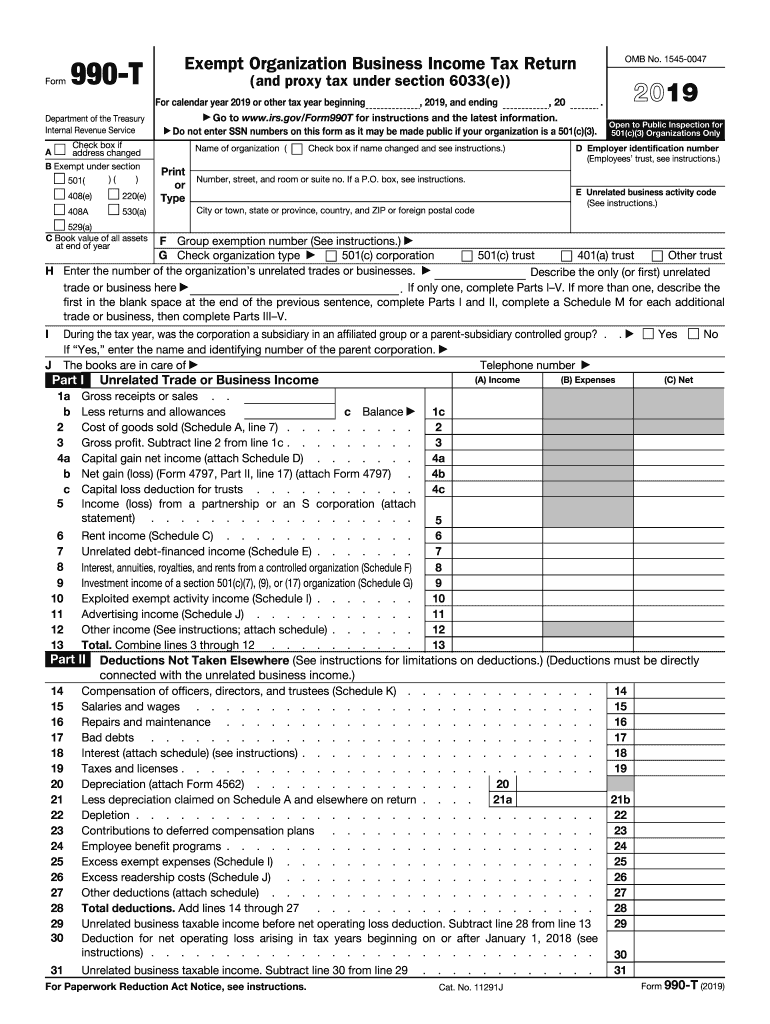

990 T Fill Out and Sign Printable PDF Template signNow

Efile Form 990PF 2021 IRS Form 990PF Online Filing

Instructions to file your Form 990PF A Complete Guide

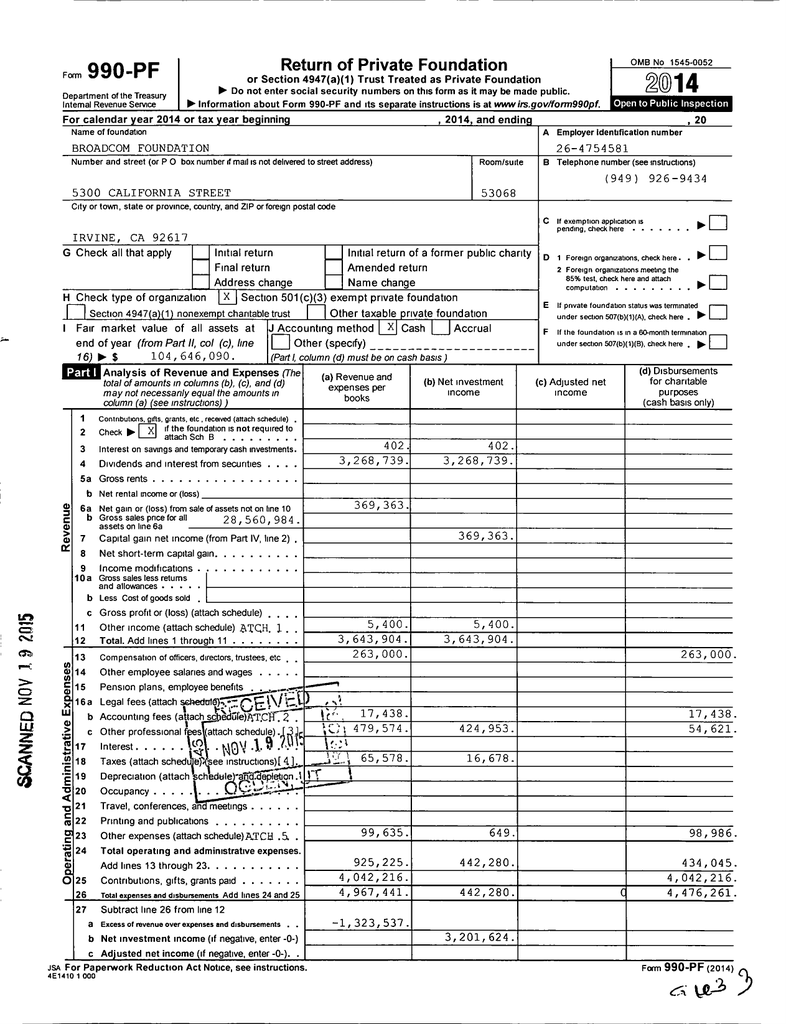

Form 990PF Return of Private Foundation (2014) Free Download

Instructions For Form 990Pf Return Of Private Foundation Or Section

Form 990 PF Return of Private Foundation

Related Post: