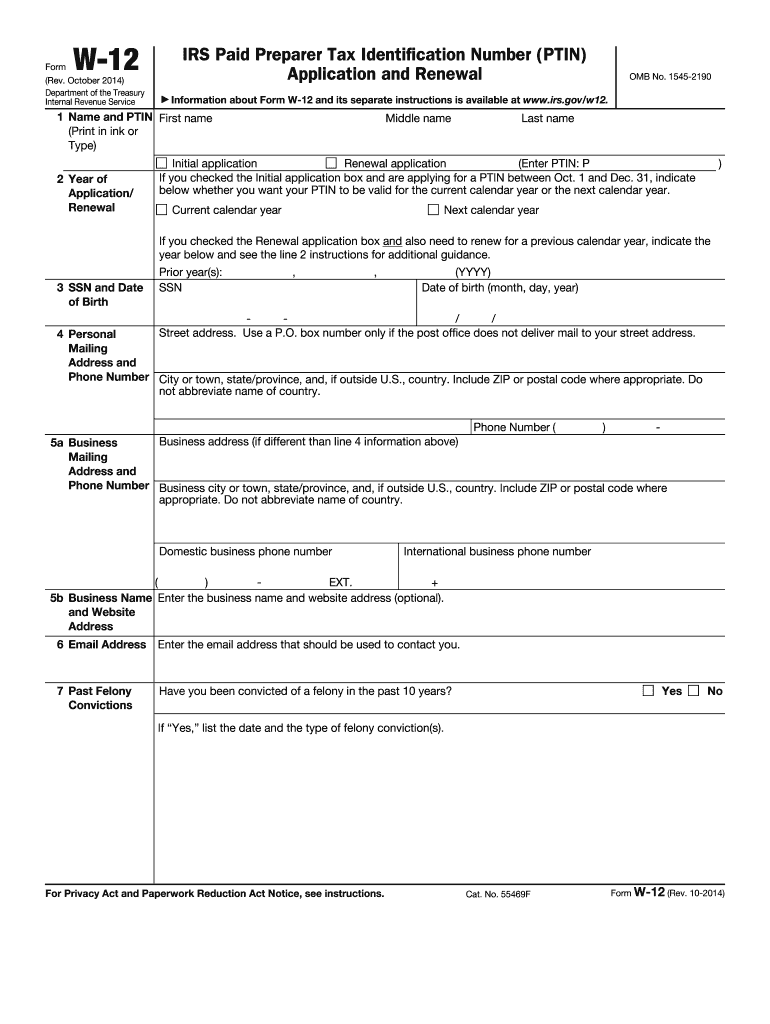

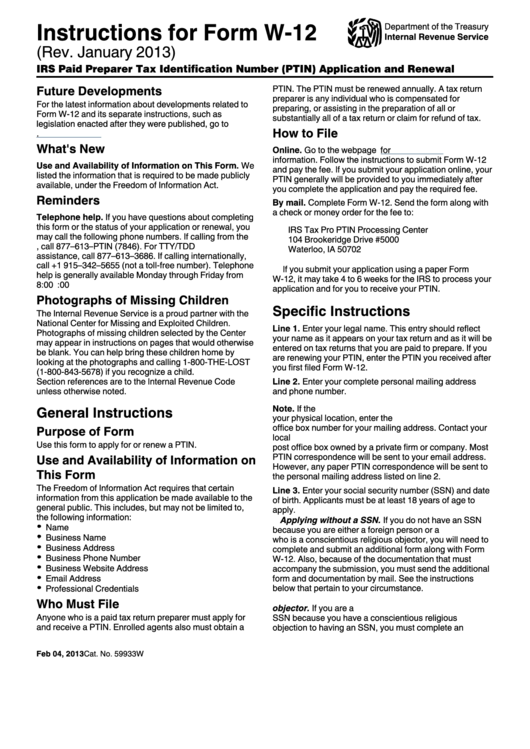

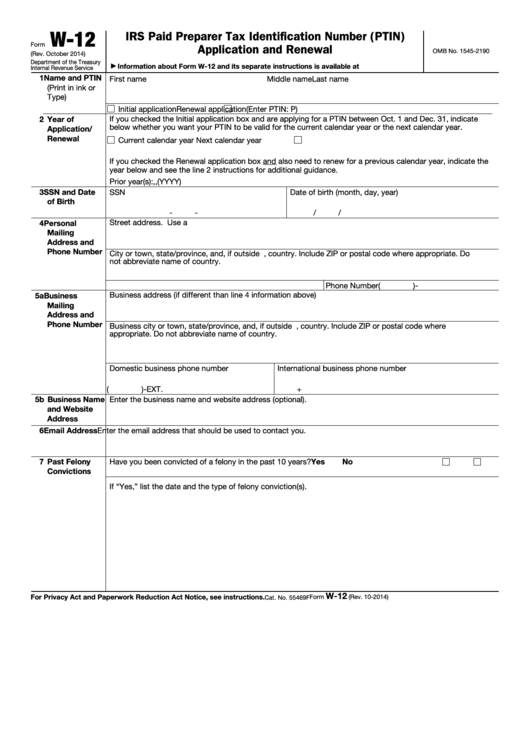

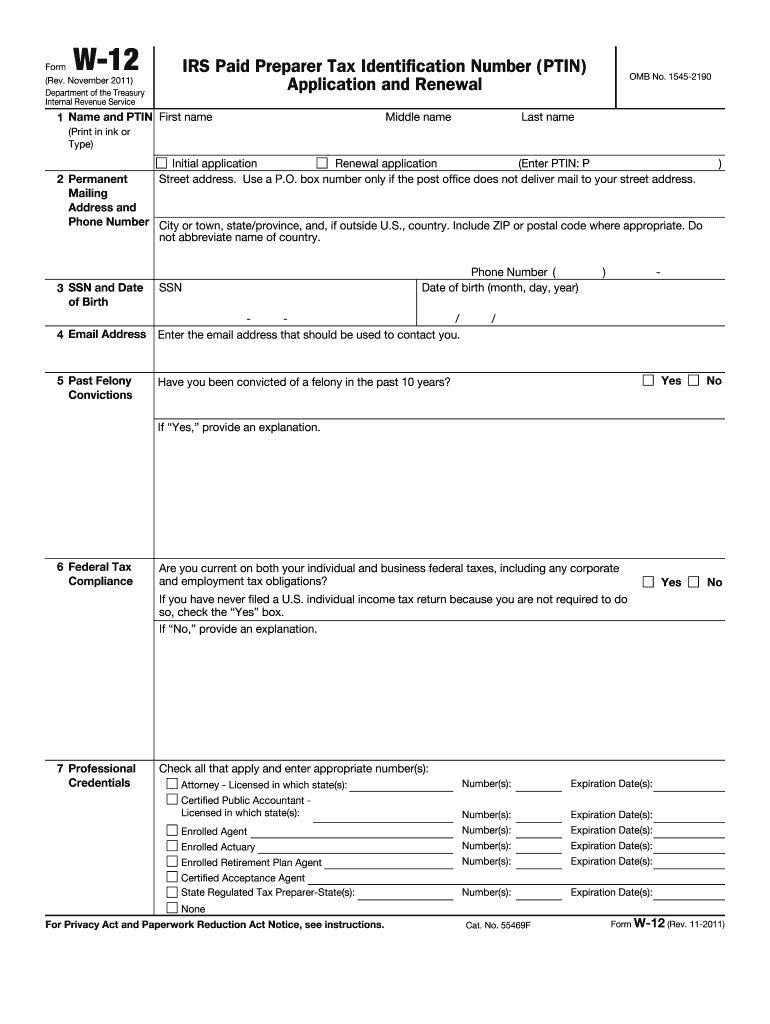

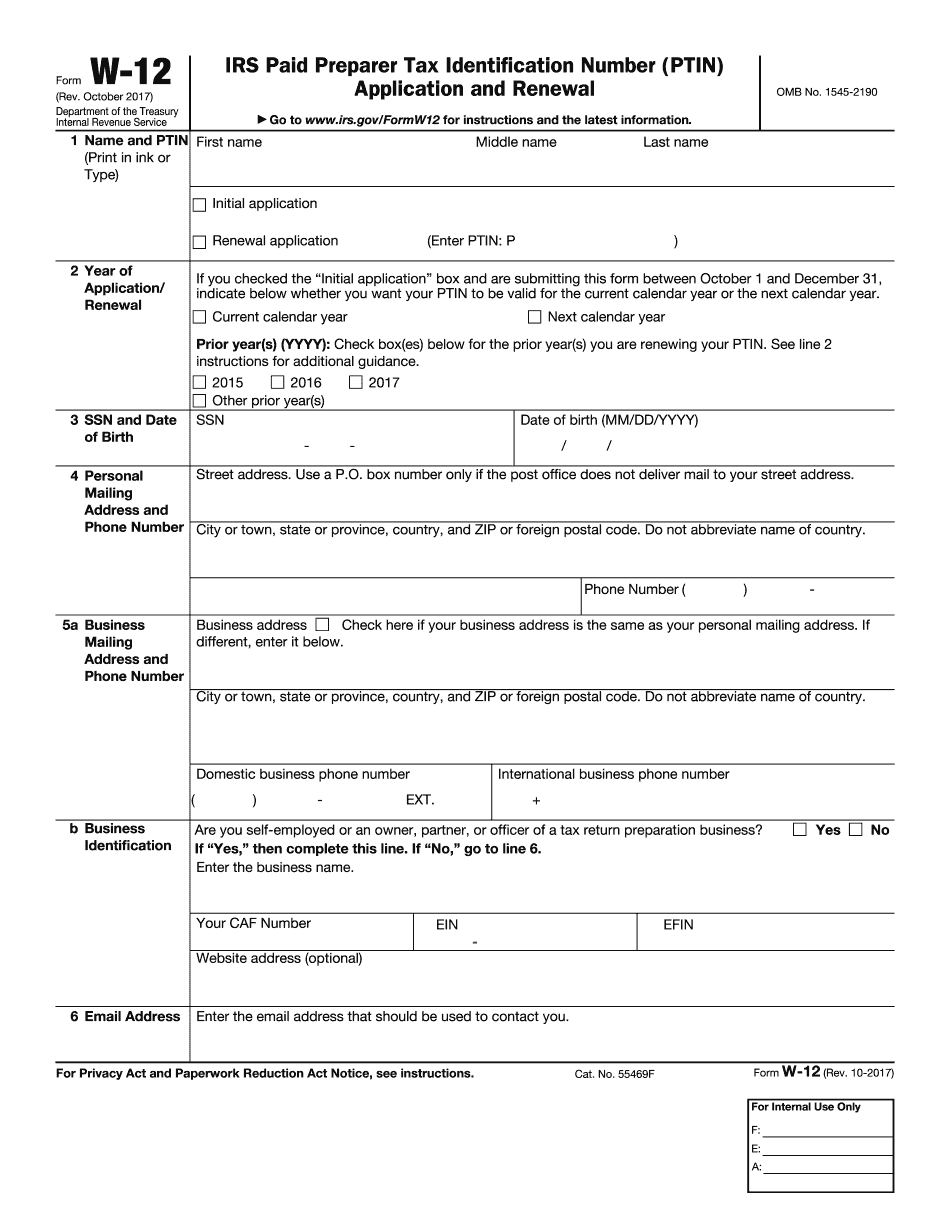

Form W-12

Form W-12 - Web you will be asked to attest whether or not returns were prepared during the expired year. Web i am the individual that is the beneficial owner (or am authorized to sign for the individual that is the beneficial owner) of all the income or proceeds to which this form relates or. May 2021) department of the treasury internal revenue service. Questions answered every 9 seconds. Web form w12, preparer tax identification number application and renewal is the tax form for applying or renewing ptin numbers. The fee to renew or obtain a ptin. Specifically, it’s a tax statement. Web paid tax return preparers need to get a ptin to prepare form 1040 series tax returns, in whole or part, or claims of refund. 29 with changes made to reflect a new. Irs tax professional ptin processing center 1605 george dieter pmb 678 el paso, tx 79936 make sure to follow the detailed. Questions answered every 9 seconds. Regulations were recently issued to state, among other things,. A tax agent will answer in minutes! Ask a tax professional anything right now. Web tax return preparers with a 2022 ptin should use the online renewal process, which takes about 15 minutes to complete. Ad forms, deductions, tax filing and more. Regulations were recently issued to state, among other things,. The paid tax preparers must renew their ptin for. The fee to renew or obtain a ptin. Ask a tax professional anything right now. Web tax preparers with a 2021 ptin should use the online renewal process, which takes about 15 minutes to complete. Irs paid preparer tax identification number (ptin) application and renewal. Regulations were recently issued to state, among other things,. Web i am the individual that is the beneficial owner (or am authorized to sign for the individual that is the. Web you will be asked to attest whether or not returns were prepared during the expired year. Web top week 6 nfl predictions. A tax agent will answer in minutes! The irs has an exhaustive list of tax forms. However, the paper form can take four to six weeks to process. May 2021) department of the treasury internal revenue service. 29 with changes made to reflect a new. Web the paper application form for applying for a preparer tax identification number has been released by the irs. Ask a tax professional anything right now. Ad forms, deductions, tax filing and more. However, the irs notes that the paper application takes four to six. The fee to renew or obtain a ptin. Specifically, it’s a tax statement. Ad forms, deductions, tax filing and more. Regulations were recently issued to state, among other things,. The paid tax preparers must renew their ptin for. Web top week 6 nfl predictions. Ad forms, deductions, tax filing and more. Ask a tax professional anything right now. A tax agent will answer in minutes! The paid tax preparers must renew their ptin for. Web i am the individual that is the beneficial owner (or am authorized to sign for the individual that is the beneficial owner) of all the income or proceeds to which this form relates or. Specifically, it’s a tax statement. Web the paper application form for applying for a preparer tax. Web paid tax return preparers need to get a ptin to prepare form 1040 series tax returns, in whole or part, or claims of refund. Web tax preparers with a 2021 ptin should use the online renewal process, which takes about 15 minutes to complete. Specifically, it’s a tax statement. Irs tax professional ptin processing center 1605 george dieter pmb. Regulations were recently issued to state, among other things,. However, the paper form can take four to six weeks to process. May 2021) department of the treasury internal revenue service. Web tax return preparers with a 2022 ptin should use the online renewal process, which takes about 15 minutes to complete. Irs tax professional ptin processing center 1605 george dieter. Web i am the individual that is the beneficial owner (or am authorized to sign for the individual that is the beneficial owner) of all the income or proceeds to which this form relates or. Web you will be asked to attest whether or not returns were prepared during the expired year. Regulations were recently issued to state, among other things,. Web tax return preparers with a 2022 ptin should use the online renewal process, which takes about 15 minutes to complete. Irs tax professional ptin processing center 1605 george dieter pmb 678 el paso, tx 79936 make sure to follow the detailed. The irs has an exhaustive list of tax forms. Ad forms, deductions, tax filing and more. However, the irs notes that the paper application takes four to six. Web the paper application form for applying for a preparer tax identification number has been released by the irs. Specifically, it’s a tax statement. Ask a tax professional anything right now. The paid tax preparers must renew their ptin for. Web top week 6 nfl predictions. 29 with changes made to reflect a new. Web paid tax return preparers need to get a ptin to prepare form 1040 series tax returns, in whole or part, or claims of refund. Web form w12, preparer tax identification number application and renewal is the tax form for applying or renewing ptin numbers. Web tax preparers with a 2021 ptin should use the online renewal process, which takes about 15 minutes to complete. Irs paid preparer tax identification number (ptin) application and renewal. May 2021) department of the treasury internal revenue service. A tax agent will answer in minutes!Form W12 IRS PTIN Application and Renewal(2015) Free Download

2014 Form IRS W12 Fill Online, Printable, Fillable, Blank pdfFiller

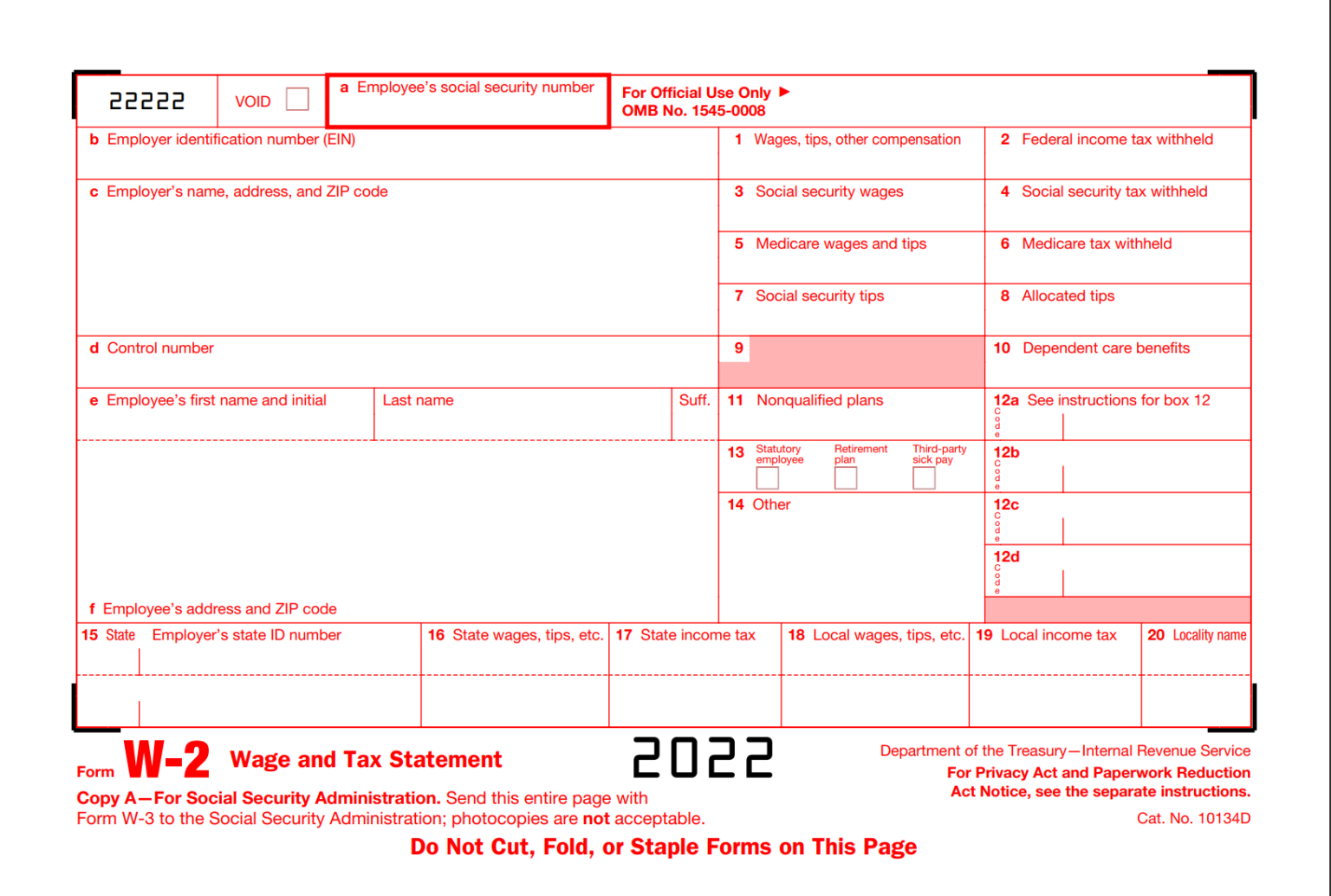

Irs Forms W 2 Printable Form Resume Examples JvDXqmJ5VM

Instructions For Form W12 Irs Paid Preparer Tax Identification

Fillable Form W12 Irs Paid Preparer Tax Identification Number (Ptin

Child Support Withholding Form

Pin on templates

W 12 Form Fill Out and Sign Printable PDF Template signNow

Electronic IRS Form W12 2017 2019 Printable PDF Sample

JB HiFi Employee W2 Form W2 Form 2023

Related Post: