Va Form 502V

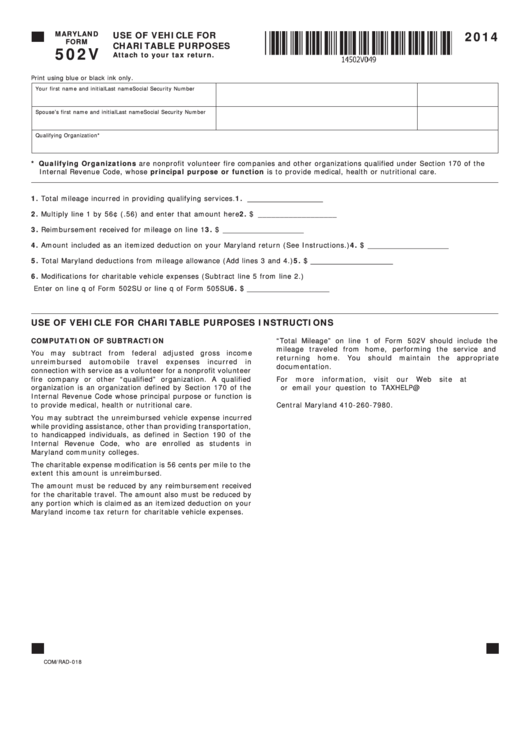

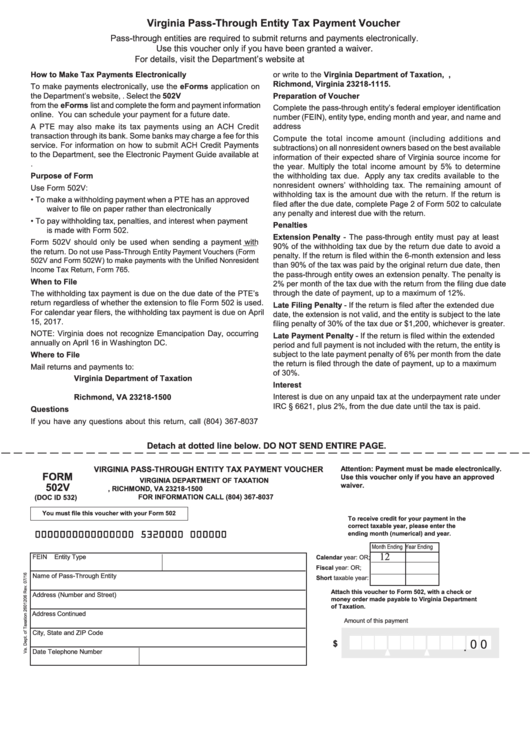

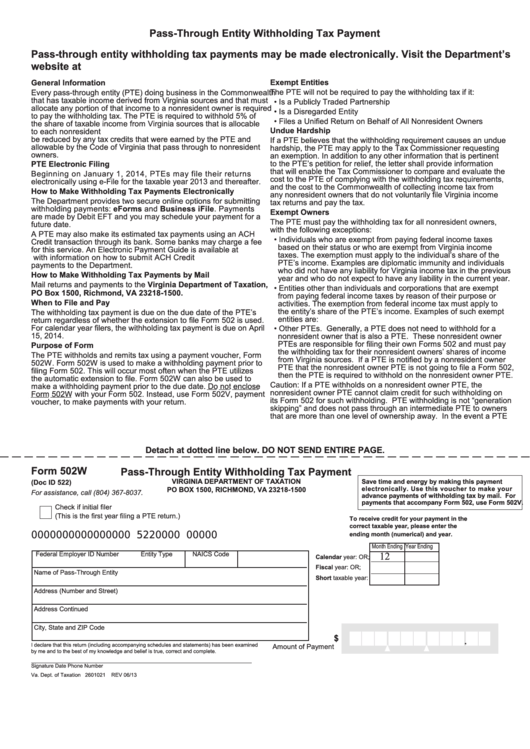

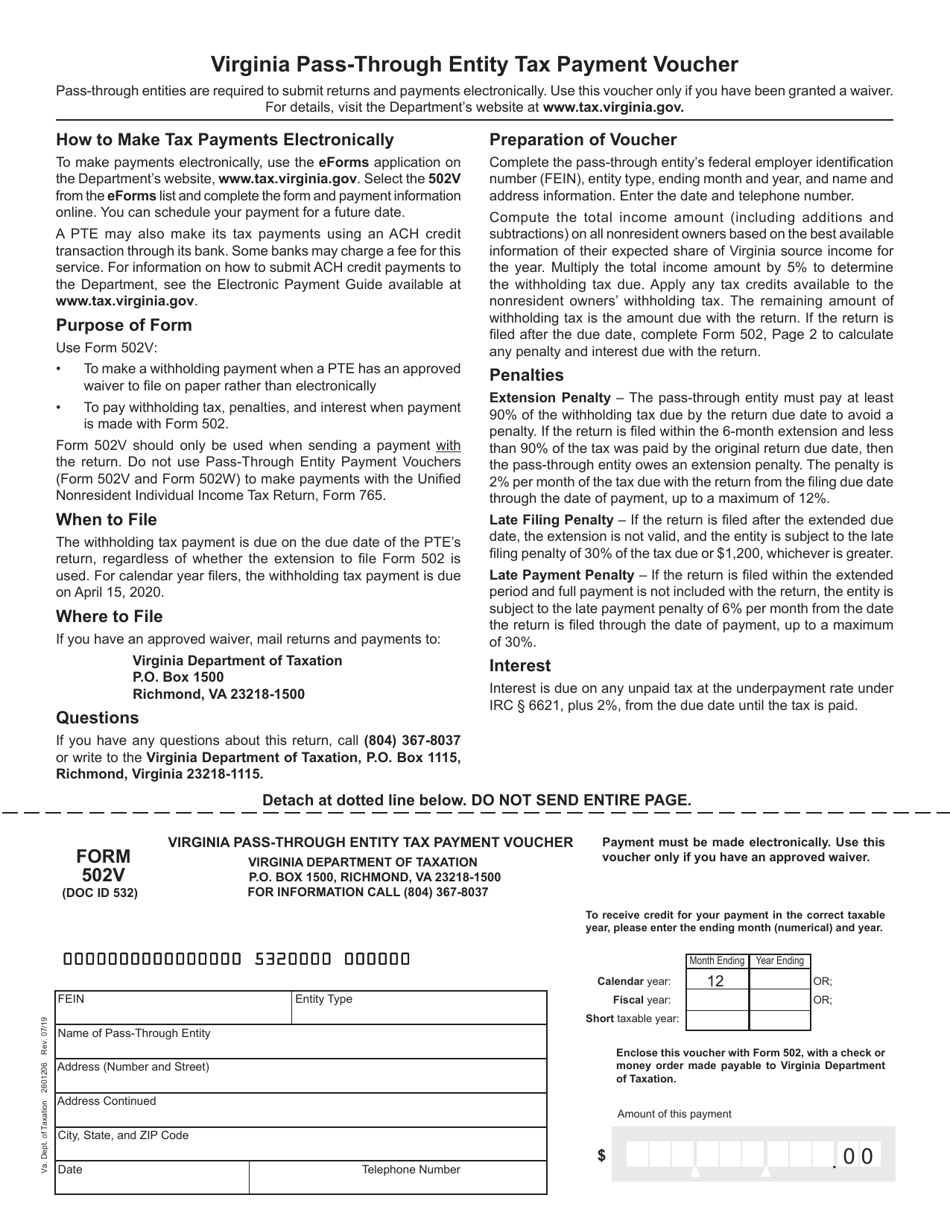

Va Form 502V - Web (1) during tax year 2022, filing form 502v and submitting a payment of ptet; Web purpose of form use form 502w: • to pay withholding tax,. Web search for va forms by keyword, form name, or form number. • to pay withholding tax,. • to make a withholding payment when a pte has an approved waiver to file on paper rather than electronically • to make a withholding. Web if form 502 is filed more than 6 months after the due date or more than 30 days after the federal extended due date, a late payment penalty of 30% of the tax due will apply. Form 502w is used to make a withholding payment prior to iling the return of income, form 502. Web form 502v should only be used when sending a payment with the return. (2) during tax year 2023 and thereafter, making an estimated payment of ptet. Web if form 502 is filed more than 6 months after the due date or more than 30 days after the federal extended due date, a late payment penalty of 30% of the tax due will apply. Web form 502v should only be used when sending a payment with the return. • to pay withholding tax,. Not filed contact us. You will have the option to print a pdf version of your eform once your filing is complete. Quickly access top tasks for frequently downloaded va forms. • to make a withholding payment when a pte has an approved waiver to file on paper rather than electronically. • to pay withholding tax,. Eforms are not intended to be printed directly. Eforms are not intended to be printed directly from your browser. You will have the option to print a pdf version of your eform once your filing is complete. • to make a withholding payment when a pte has an approved waiver to file on paper rather than electronically. • to make a withholding payment when a pte has an. Eforms are not intended to be printed directly from your browser. Web purpose of form use form 502v: Web (1) during tax year 2022, filing form 502v and submitting a payment of ptet; Web purpose of form use form 502w: • to pay withholding tax,. You will have the option to print a pdf version of your eform once your filing is complete. Web if form 502 is filed more than 6 months after the due date or more than 30 days after the federal extended due date, a late payment penalty of 30% of the tax due will apply. Quickly access top tasks for. Web if form 502 is filed more than 6 months after the due date or more than 30 days after the federal extended due date, a late payment penalty of 30% of the tax due will apply. • to pay withholding tax,. Web (1) during tax year 2022, filing form 502v and submitting a payment of ptet; Not filed contact. Web (1) during tax year 2022, filing form 502v and submitting a payment of ptet; Web purpose of form use form 502v: You will have the option to print a pdf version of your eform once your filing is complete. Web virginia income tax brackets. • to make a withholding payment when a pte has an approved waiver to file. The faqs add that while all. Web if form 502 is filed more than 6 months after the due date or more than 30 days after the federal extended due date, a late payment penalty of 30% of the tax due will apply. • to make a withholding payment when a pte has an approved waiver to file on paper. • to pay withholding tax,. Web purpose of form use form 502v: The faqs add that while all. • to pay withholding tax,. • to make a withholding payment when a pte has an approved waiver to file on paper rather than electronically. You will have the option to print a pdf version of your eform once your filing is complete. • to make a withholding payment when a pte has an approved waiver to file on paper rather than electronically. Web purpose of form use form 502w: Web form 502v should only be used when sending a payment with the return. (2). Web (1) during tax year 2022, filing form 502v and submitting a payment of ptet; Web search for va forms by keyword, form name, or form number. Web purpose of form use form 502w: Web if form 502 is filed more than 6 months after the due date or more than 30 days after the federal extended due date, a late payment penalty of 30% of the tax due will apply. Web purpose of form use form 502v: • to make a withholding payment when a pte has an approved waiver to file on paper rather than electronically • to make a withholding. The faqs add that while all. Form 502w is used to make a withholding payment prior to iling the return of income, form 502. Web form 502v should only be used when sending a payment with the return. • to make a withholding payment when a pte has an approved waiver to file on paper rather than electronically. Not filed contact us 502v. Quickly access top tasks for frequently downloaded va forms. Eforms are not intended to be printed directly from your browser. (2) during tax year 2023 and thereafter, making an estimated payment of ptet. You will have the option to print a pdf version of your eform once your filing is complete. • to pay withholding tax,. • to make a withholding payment when a pte has an approved waiver to file on paper rather than electronically. • to pay withholding tax,. Web virginia income tax brackets.Fillable Maryland Form 502v Use Of Vehicle For Charitable Purposes

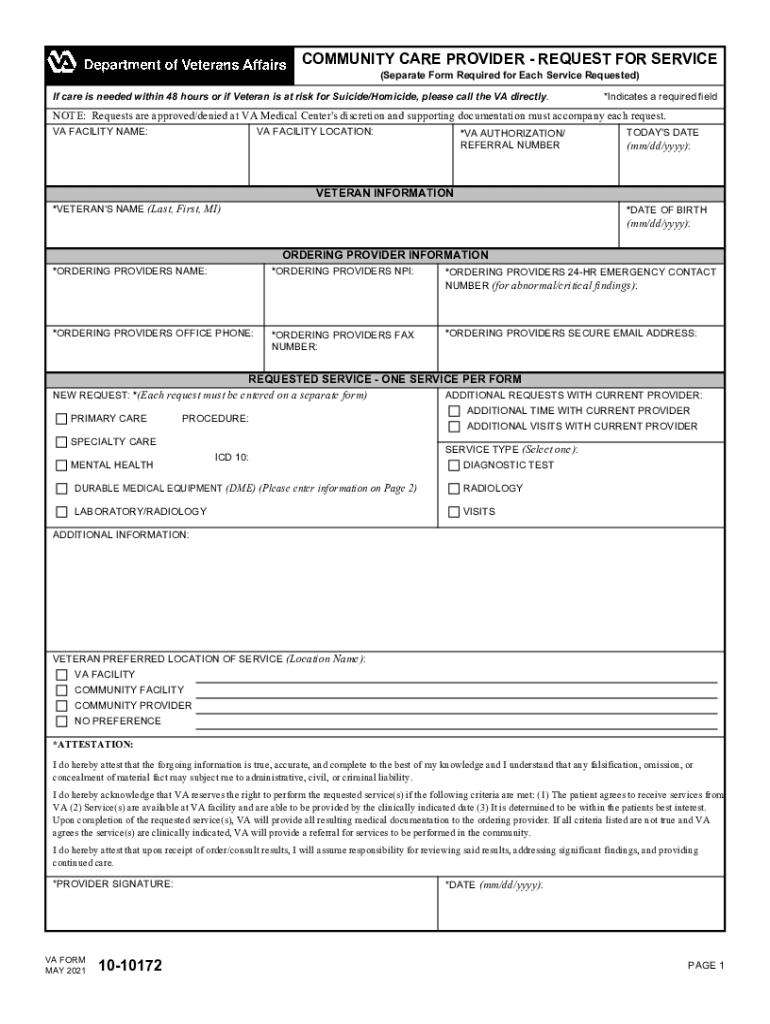

VA Form 1010172 20212022 Fill and Sign Printable Template Online

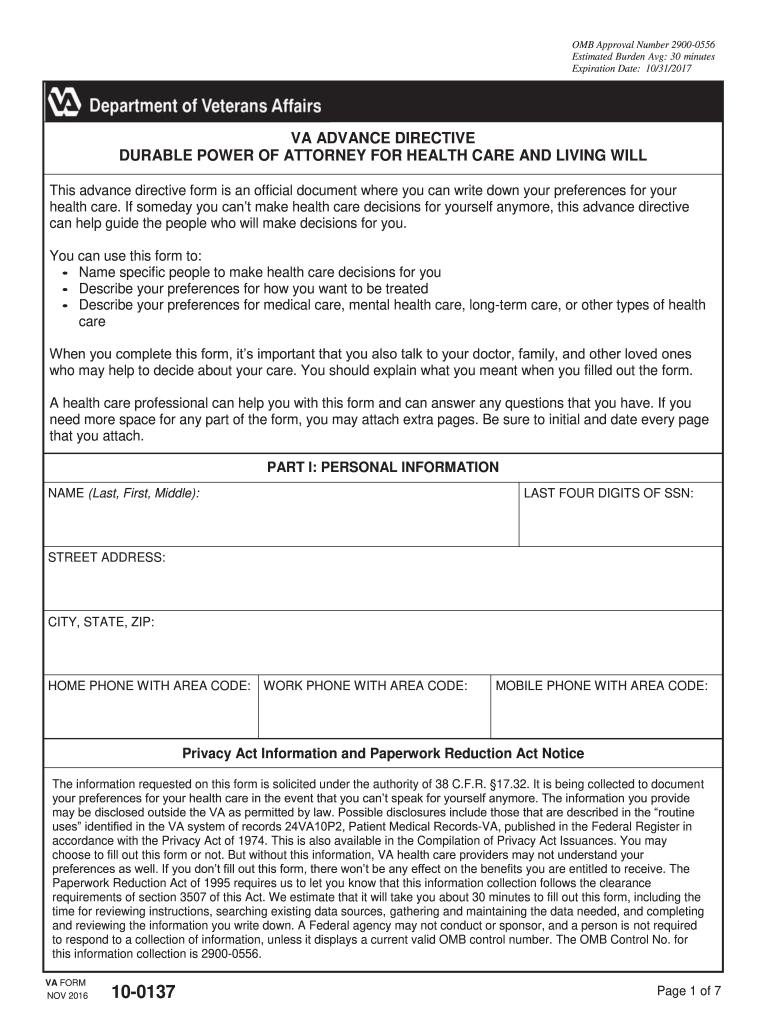

Va Form 10 0137 Fill Out and Sign Printable PDF Template signNow

Free Veterans Affairs Request for and Authorization to Release Medical

2015 Form VA 9 Fill Online, Printable, Fillable, Blank pdfFiller

va form 3482e Fill Online, Printable, Fillable Blank va221999b

Form 502v Virginia PassThrough Entity Tax Payment Voucher printable

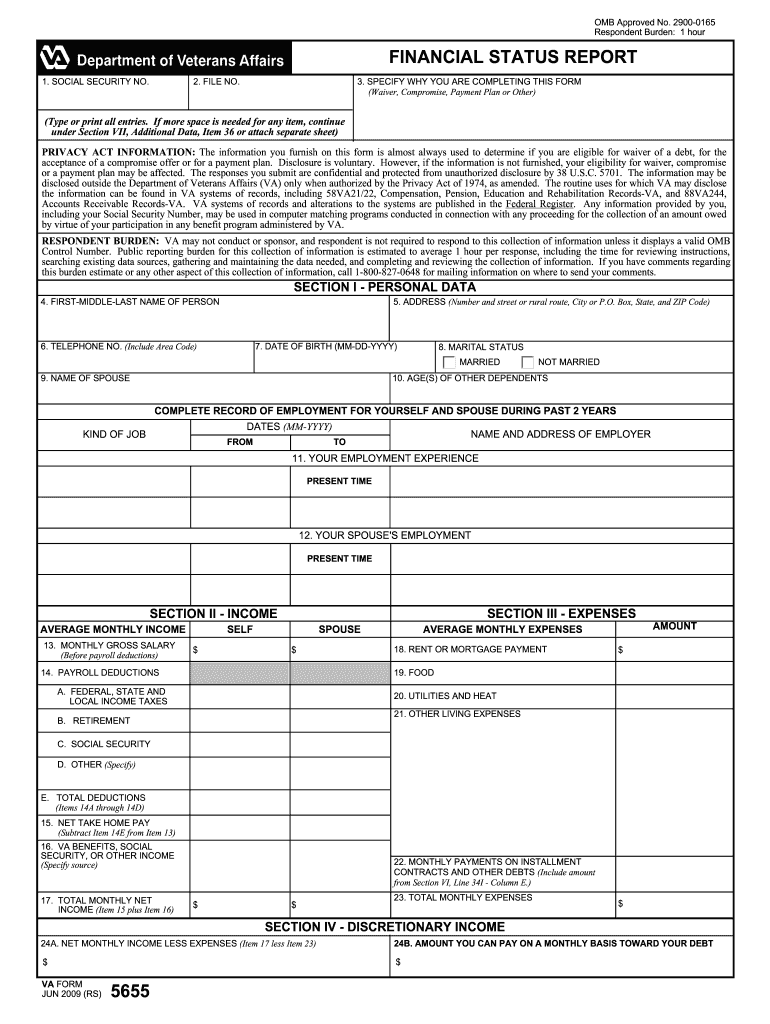

Va Form 5655 Fill Out and Sign Printable PDF Template signNow

Top 11 Virginia Form 502 Templates free to download in PDF format

Form 502V Download Fillable PDF or Fill Online Virginia PassThrough

Related Post: