Stockx Tax Form

Stockx Tax Form - With respect to this, i have a. As a buyer on stockx, you are responsible for paying processing fees, as well as import duties and sales tax based on your shipping address. Web $600 threshold stockx tax form 1099 just wanted to clarify for stockx, goat, and even ebay. Don’t see on stadium goods website and called, but person had no idea what i was talking about. Web up to 4% cash back hellstar waxed nylon athletic shorts black. This office is the major stockx tempe, az area location. Web united states tax exemption form. With 49 years of continuous dividend raises, fortis. United states tax exemption form; Yet the stockx website says. With respect to this, i have a. Web stockx will send you a tax for all sales completed in 2022 (if you sell over $600). Web as you may be aware, new irs regulations in 2022 require stockx to generate a form 1099 for sellers that meet or exceed $600 in gross sales within the. At the heel, a hello. Web some regions outside of the united states may impose tax on the transaction in the form of value added tax (vat). Web up to 4% cash back the upper is constructed of a light blue neoprene upper with hello kitty graphics and a semi translucent tpu lace cage. Vat may apply on both the revenue and the. If you're. They will also send that same form to the irs. Asks, sell now, shipping, verification and payment info. If you purchased last year and sell in 2022, it will. Web $600 threshold stockx tax form 1099 just wanted to clarify for stockx, goat, and even ebay. Kith res ipsa tapestry coaches. Web mine went to my checking account. Web see all 116 interviews. As a buyer on stockx, you are responsible for paying processing fees, as well as import duties and sales tax based on your shipping address. Web employee tax expert hello gabriel, the income you receive would need to be reported on your tax return and taxed there are. Asks, sell now, shipping, verification and payment info. Web see all 116 interviews. Web does stadium goods issue 1099 tax forms over $600 in sales? Web $600 threshold stockx tax form 1099 just wanted to clarify for stockx, goat, and even ebay. The only exceptions are as listed below: Web some regions outside of the united states may impose tax on the transaction in the form of value added tax (vat). Kith res ipsa tapestry coaches. Web employee tax expert hello gabriel, the income you receive would need to be reported on your tax return and taxed there are 2 ways to report the income. Web does stadium goods. See the federal income tax brackets for. The only exceptions are as listed below: Web does stadium goods issue 1099 tax forms over $600 in sales? Web up to 4% cash back hellstar waxed nylon athletic shorts black. With respect to this, i have a. Web currently, stockx collects taxes in 44 of the united states and washington d.c. United states tax exemption form; Web united states tax exemption form. As a buyer on stockx, you are responsible for paying processing fees, as well as import duties and sales tax based on your shipping address. With respect to this, i have a. As a buyer on stockx, you are responsible for paying processing fees, as well as import duties and sales tax based on your shipping address. Kith res ipsa tapestry coaches. Web employee tax expert hello gabriel, the income you receive would need to be reported on your tax return and taxed there are 2 ways to report the income. Web. Bids, buy now, how to pay and deliveries. Web choose the kind of help you need. This is an overview of the stockx tempe campus or office location. With the delay, only sellers that exceed. Don’t see on stadium goods website and called, but person had no idea what i was talking about. Web does stadium goods issue 1099 tax forms over $600 in sales? Web up to 4% cash back hellstar waxed nylon athletic shorts black. The only exceptions are as listed below: The $600 threshold is for the amount you receive aka payout (after seller fees). United states tax exemption form; Web stockx and taxes as 2020 comes to an end us sellers should have taxes on their mind, as they will soon be receiving their 1099 forms (if eligible). Web as you may be aware, new irs regulations in 2022 require stockx to generate a form 1099 for sellers that meet or exceed $600 in gross sales within the. It must be 200+ sales and 20k+ to automatically get a 1099. Vat may apply on both the revenue and the. Web united states tax exemption form. Asks, sell now, shipping, verification and payment info. See the federal income tax brackets for. This office is the major stockx tempe, az area location. As a buyer on stockx, you are responsible for paying processing fees, as well as import duties and sales tax based on your shipping address. With 49 years of continuous dividend raises, fortis. With the delay, only sellers that exceed. Web $600 threshold stockx tax form 1099 just wanted to clarify for stockx, goat, and even ebay. Web up to 4% cash back the upper is constructed of a light blue neoprene upper with hello kitty graphics and a semi translucent tpu lace cage. Web employee tax expert hello gabriel, the income you receive would need to be reported on your tax return and taxed there are 2 ways to report the income. If you purchased last year and sell in 2022, it will.How Long Can Parents Claim You On Taxes

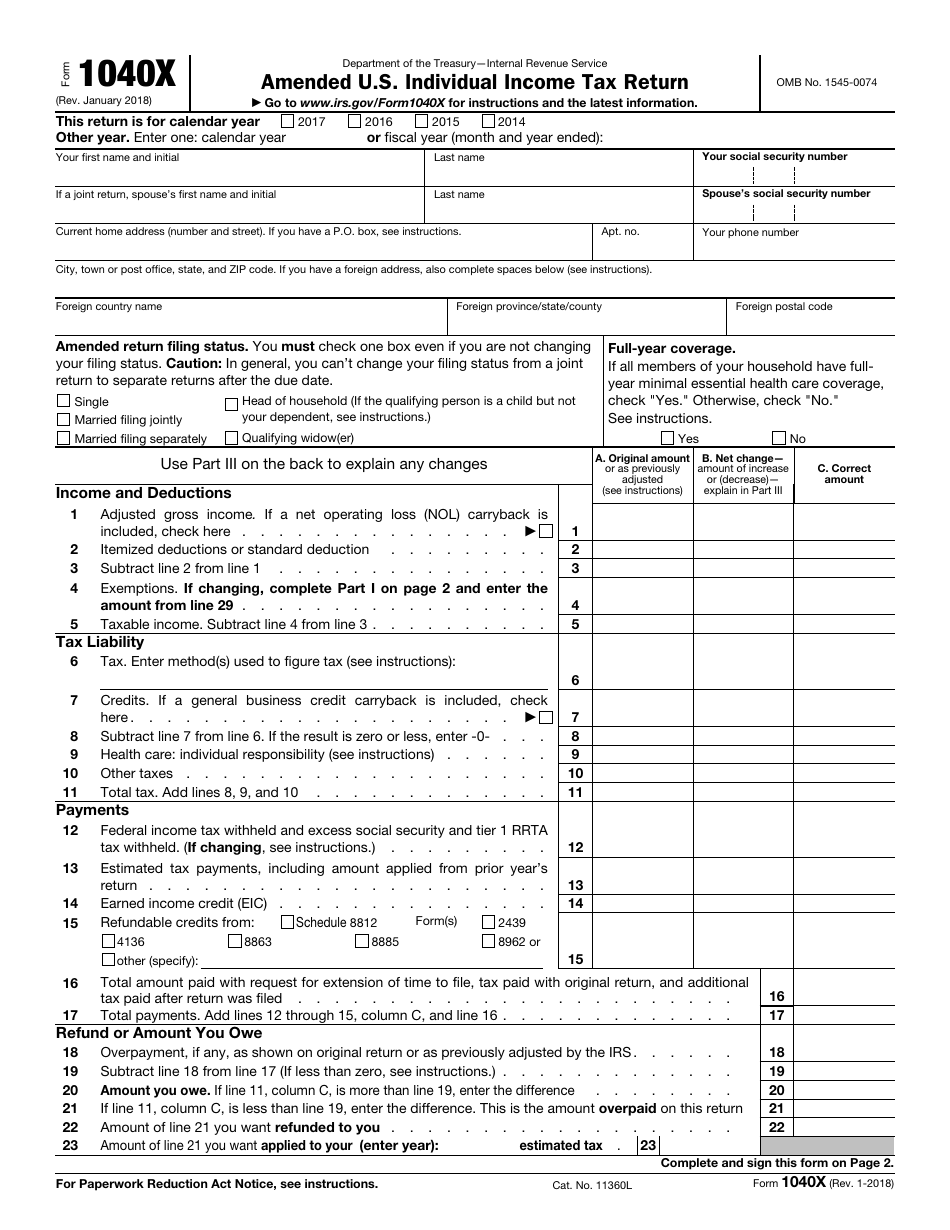

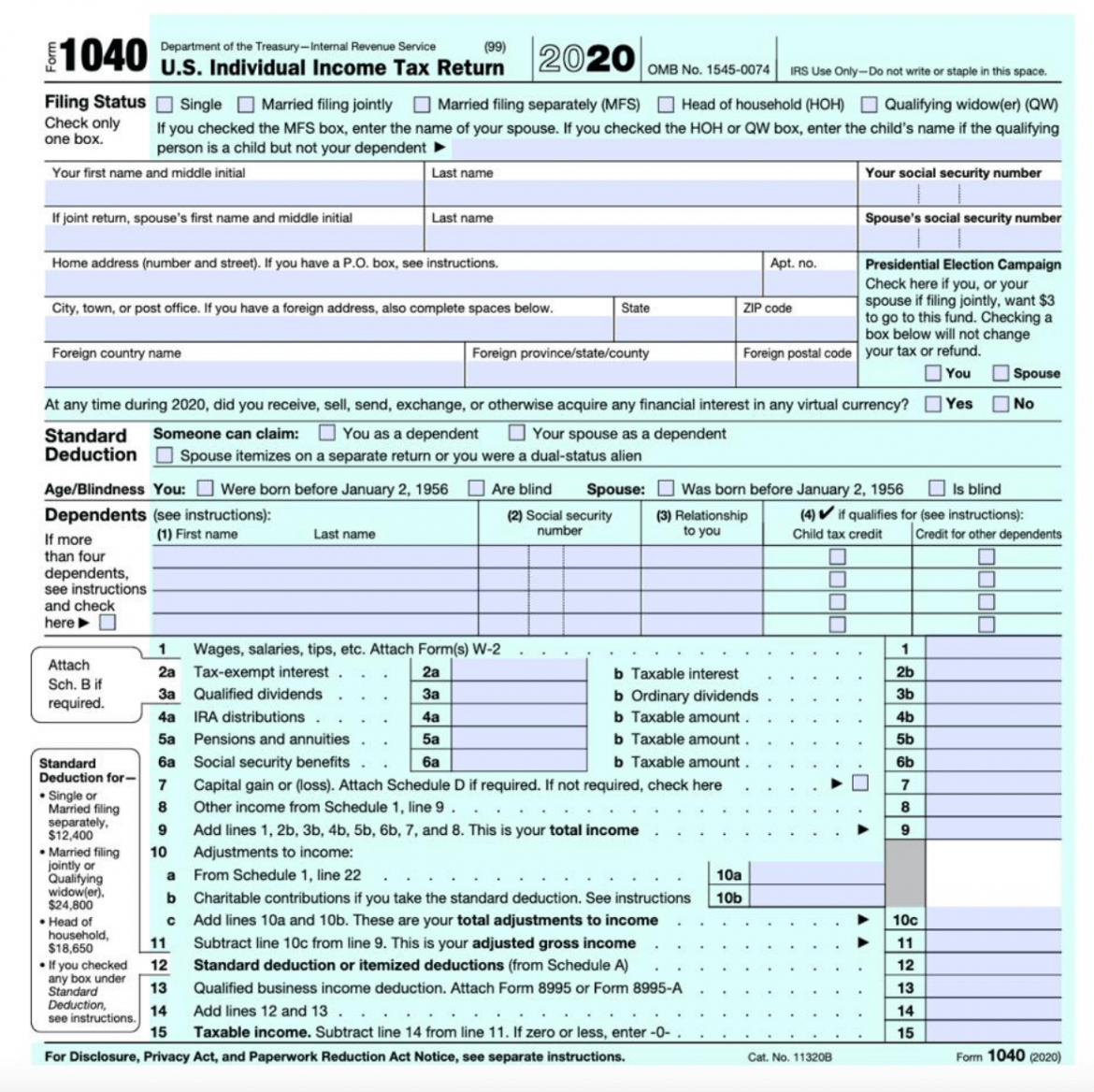

IRS Form 1040X Download Fillable PDF or Fill Online Amended U.S

Stockx Receipt Template Master of Documents

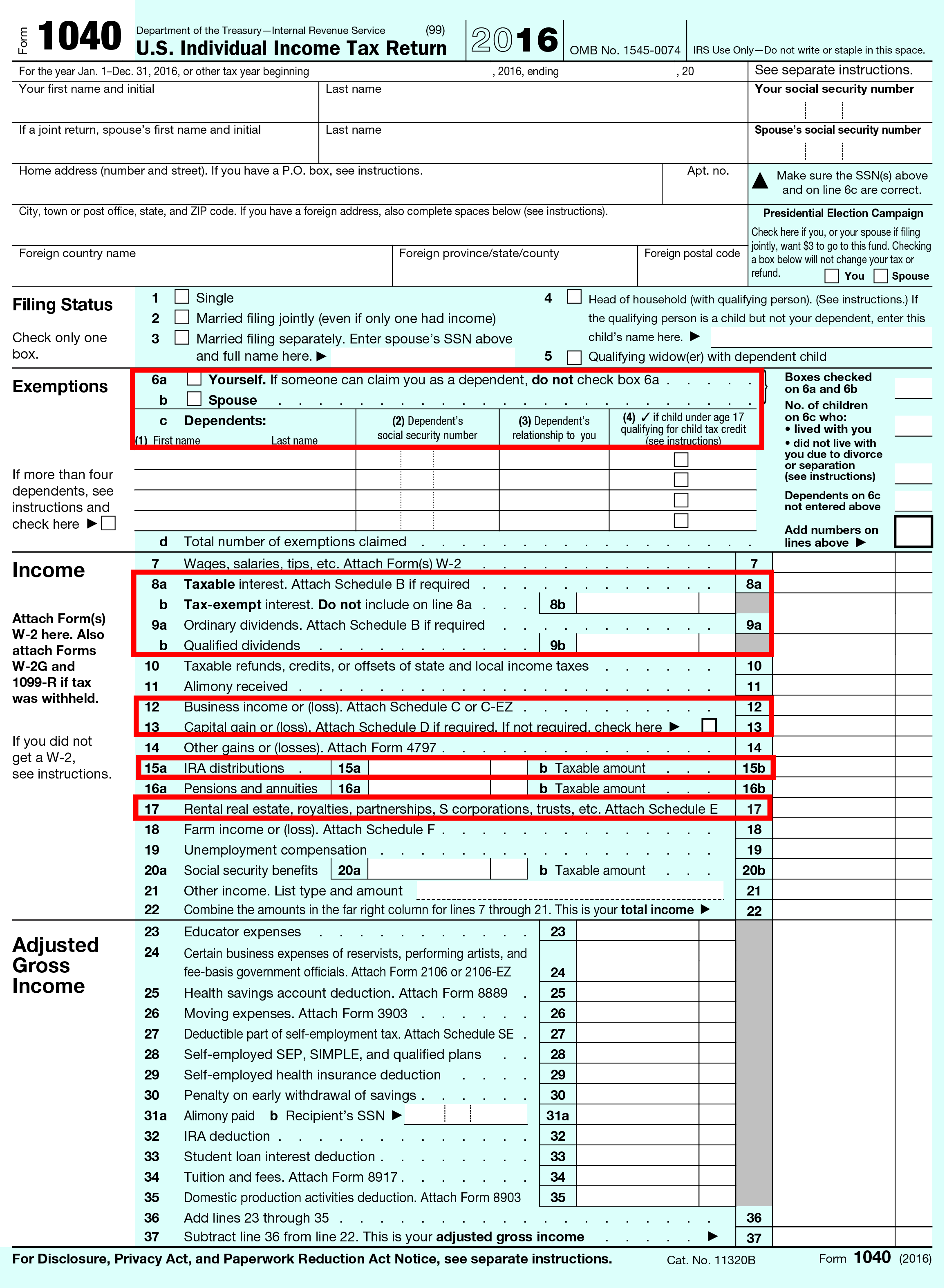

Form 1040 gets an overhaul under tax reform Putnam Wealth Management

IRS urges electronic filing as tax season begins Friday, amid mail

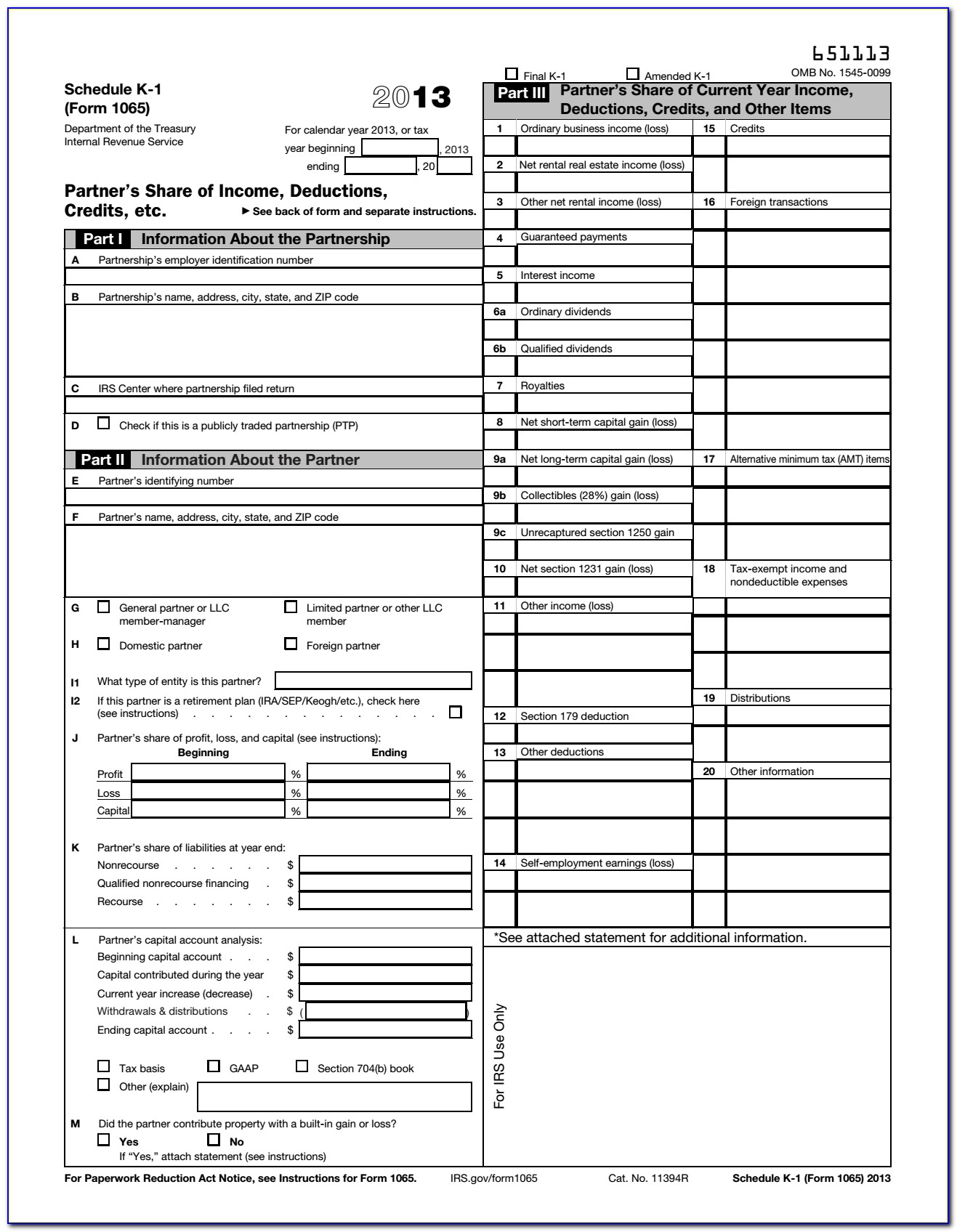

What Is A K1 Form For Taxes Form Resume Examples 86O78v7kBR

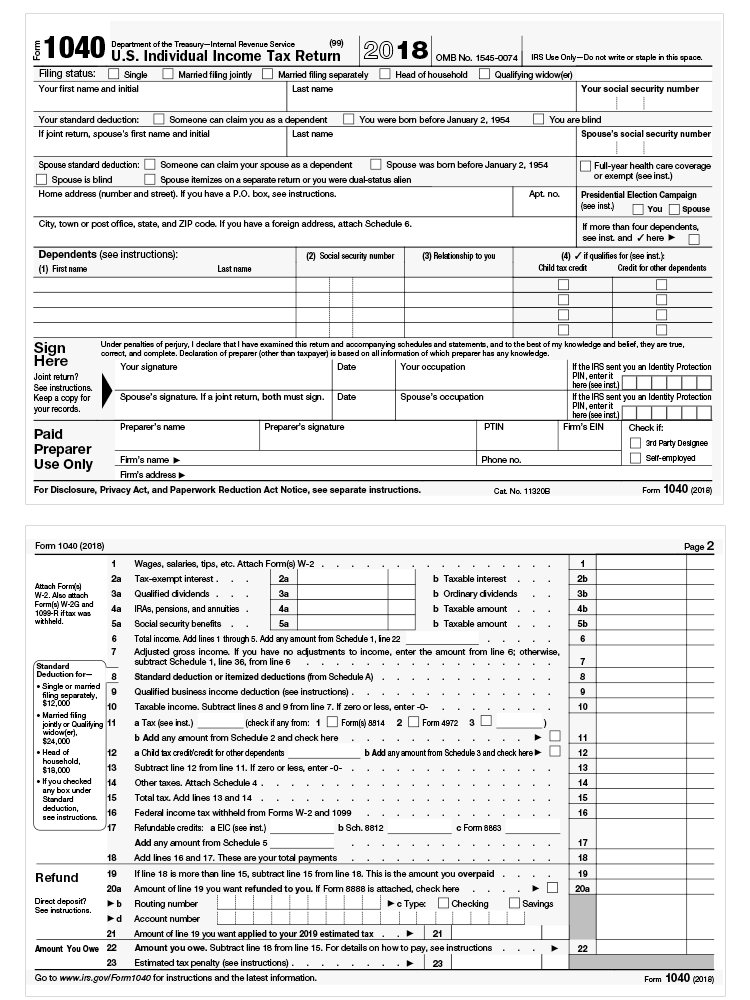

Simplified Tax Form? NESA

California State Tax Forms By Mail Form Resume Examples EY39y4d32V

StockX receipt Invoicewriter

Irs Form W4V Printable Federal Form W 4v Voluntary Withholding

Related Post: