Va Form 502 Instructions

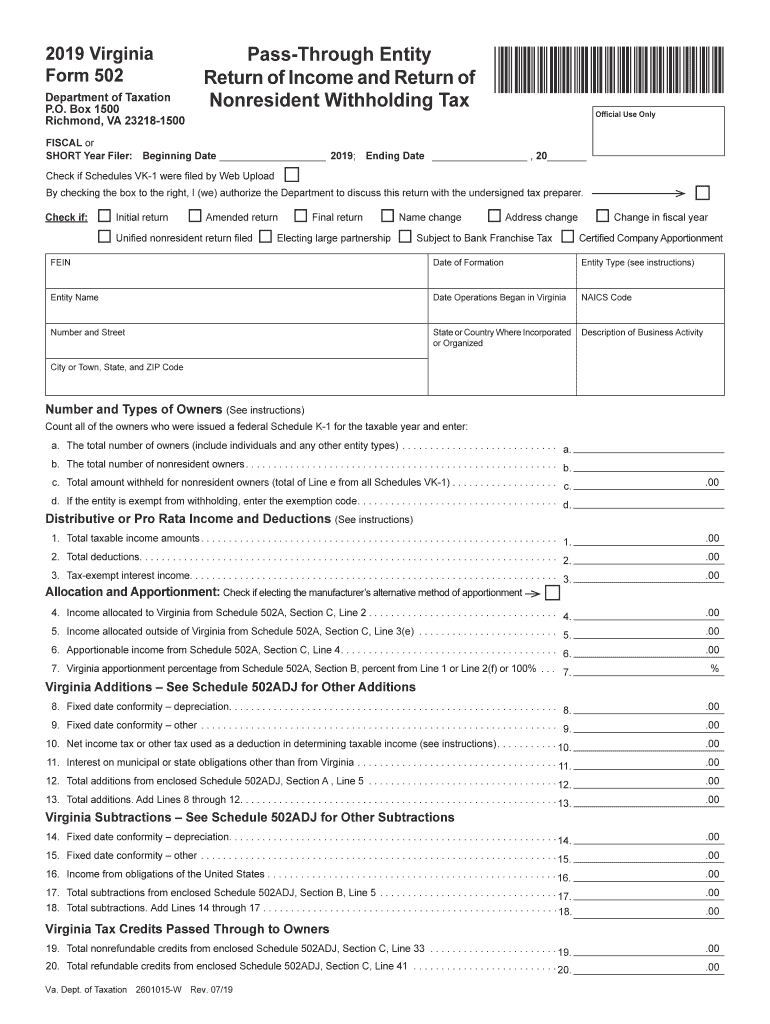

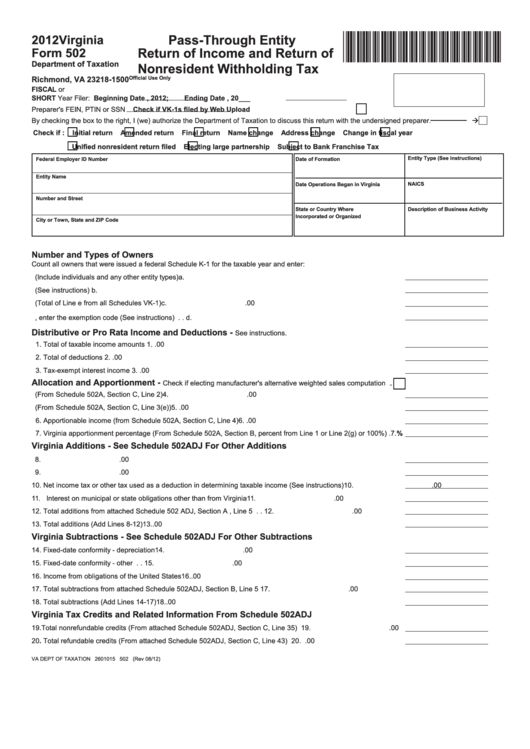

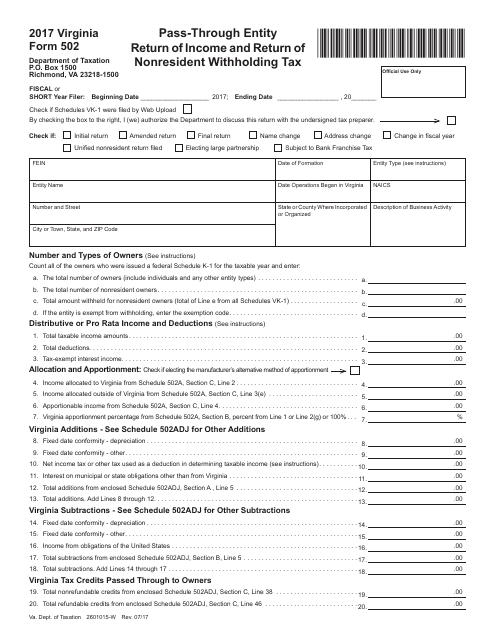

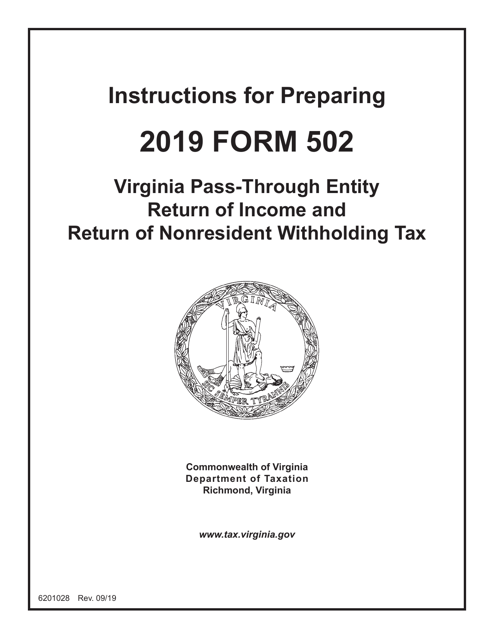

Va Form 502 Instructions - Web making the election. Application for physicians, dentists, podiatrists, optometrists and chiropractors related to: Veterans with toxic exposure may now be eligible for va benefits and health care. Web please enter your payment details below. (1) during tax year 2022, filing form. If a form 502ptet has not been filed for the taxable year, the. Authorization to release protected health information to state/local public health authorities related to:. There are four ways for a qualifying pte to elect to pay the pte tax (ptet) for the tax year, including: Quickly access top tasks for frequently downloaded va forms. If your bank requires authorization for the department of taxation to debit a payment from your checking account, you must. Of taxation $ 2601206 rev. Application for physicians, dentists, podiatrists, optometrists and chiropractors related to: (1) during tax year 2022, filing form. You can download or print. Number and types of owners (see. Web search for va forms by keyword, form name, or form number. Veterans with toxic exposure may now be eligible for va benefits and health care. Web making the election. To make a withholding payment prior to filing. If a form 502ptet has not been filed for the taxable year, the. If your bank requires authorization for the department of taxation to debit a payment from your checking account, you must. Web filing a ptet return (“form 502ptet”) on or before the extended due date for the taxable year. Application for physicians, dentists, podiatrists, optometrists and chiropractors related to: Not filed contact us 502ez. Web please enter your payment details below. You can download or print. (1) during tax year 2022, filing form. Web filing a ptet return (“form 502ptet”) on or before the extended due date for the taxable year. Number and types of owners (see. The virginia form 502ptet is a new form for the 2022 tax year. There are four ways for a qualifying pte to elect to pay the pte tax (ptet) for the tax year, including: Application for physicians, dentists, podiatrists, optometrists and chiropractors related to: Quickly access top tasks for frequently downloaded va forms. You can download or print. Web search for va forms by keyword, form name, or form number. You can download or print. Quickly access top tasks for frequently downloaded va forms. Web please enter your payment details below. Web fein date of formation entity type (see instructions) entity name date operations began in virginia naics code number and street stateor countrywhereincorporated. (1) during tax year 2022, filing form. Web virginia department of taxation rev. There are four ways for a qualifying pte to elect to pay the pte tax (ptet) for the tax year, including: If a form 502ptet has not been filed for the taxable year, the. Web making the election. Authorization to release protected health information to state/local public health authorities related to:. Authorization to release protected health information to state/local public health authorities related to:. Ad find out how expanded eligibility for va benefits and care may impact you. To make a withholding payment prior to filing. Number and types of owners (see. If a form 502ptet has not been filed for the taxable year, the. Number and types of owners (see. Ad find out how expanded eligibility for va benefits and care may impact you. Of taxation $ 2601206 rev. You can download or print. Web fein date of formation entity type (see instructions) entity name date operations began in virginia naics code number and street stateor countrywhereincorporated. To make a withholding payment when a pte has an approved waiver to file on paper rather than electronically. Ad find out how expanded eligibility for va benefits and care may impact you. The virginia form 502ptet is a new form for the 2022 tax year. Web fein date of formation entity type (see instructions) entity name date operations began. You can download or print. Web making the election. Of taxation $ 2601206 rev. Web please enter your payment details below. Web search for va forms by keyword, form name, or form number. Authorization to release protected health information to state/local public health authorities related to:. Ad find out how expanded eligibility for va benefits and care may impact you. Web virginia department of taxation rev. Number and types of owners (see. Employment or jobs at va form. Veterans with toxic exposure may now be eligible for va benefits and health care. Not filed contact us 502ez. (1) during tax year 2022, filing form. To make a withholding payment prior to filing. If a form 502ptet has not been filed for the taxable year, the. The virginia form 502ptet is a new form for the 2022 tax year. If your bank requires authorization for the department of taxation to debit a payment from your checking account, you must. To make a withholding payment when a pte has an approved waiver to file on paper rather than electronically. Application for physicians, dentists, podiatrists, optometrists and chiropractors related to: There are four ways for a qualifying pte to elect to pay the pte tax (ptet) for the tax year, including:Md 502 instructions 2018 Fill out & sign online DocHub

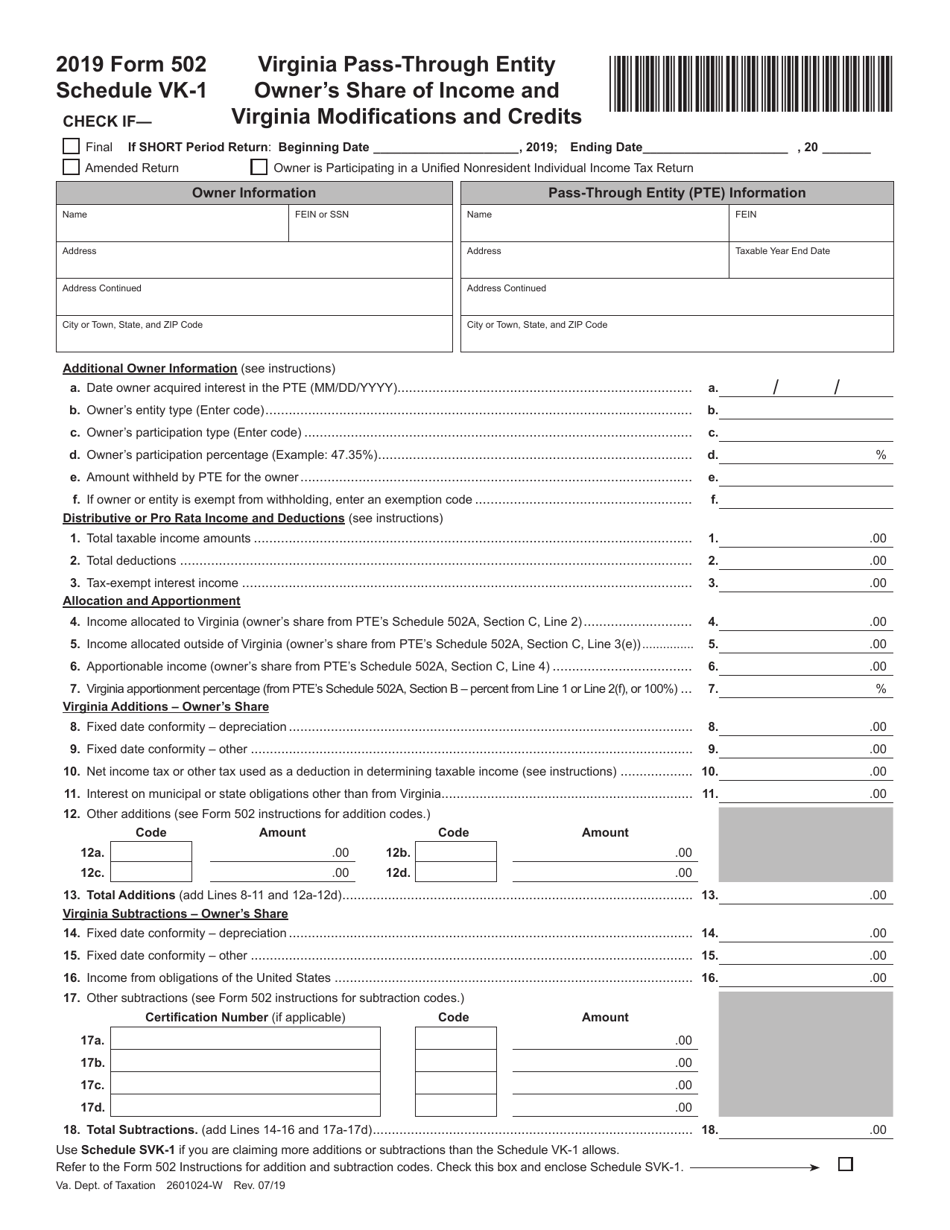

Form 502 Schedule VK1 Download Fillable PDF or Fill Online Virginia

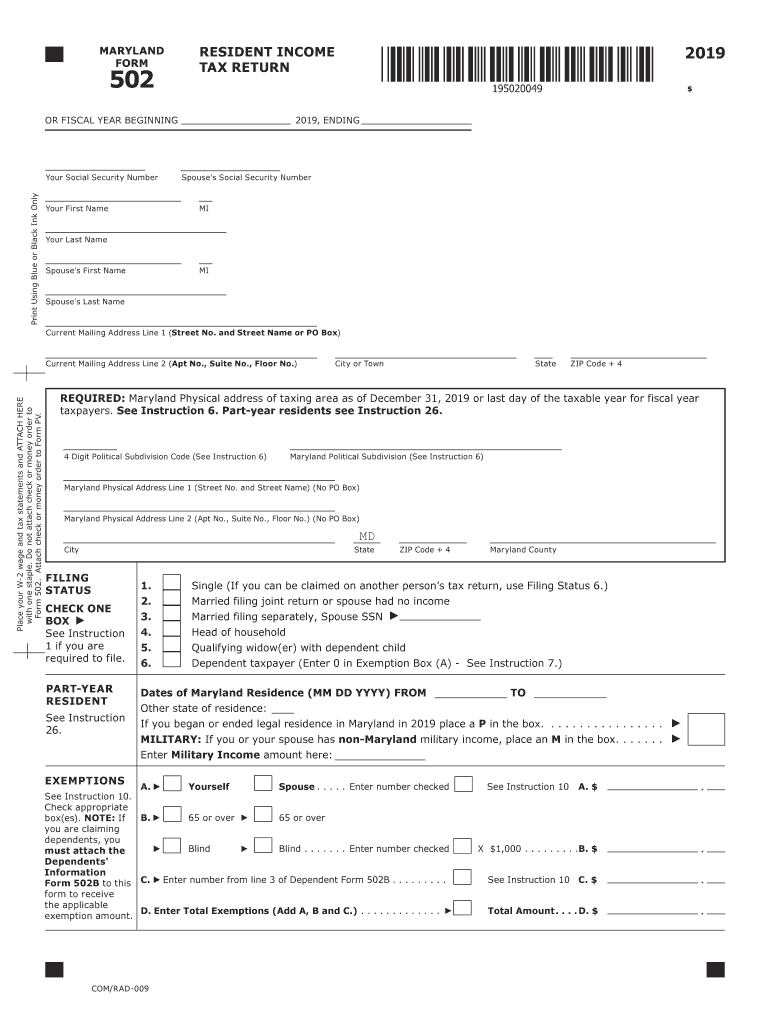

Maryland Form 502 Instructions 2019

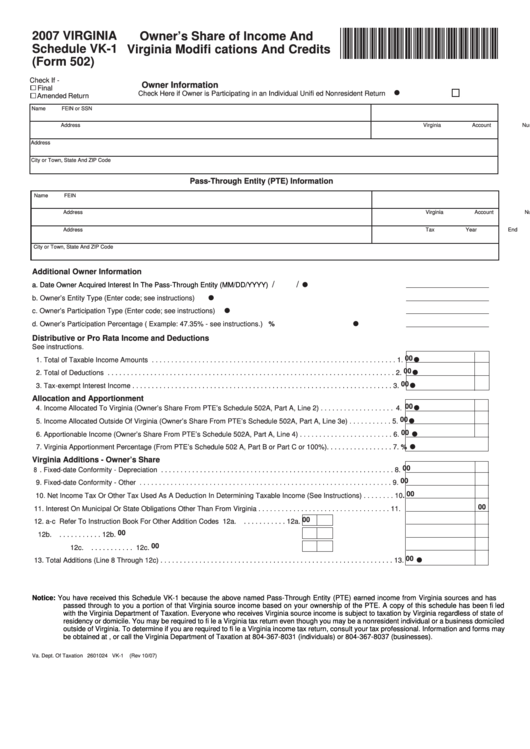

Schedule Vk1 (Form 502) Owner'S Share Of And Virginia Modifi

Va 502 Instructions 2022 Form Fill Out and Sign Printable PDF

Fillable Online 2021 Form 502 Instructions, Virginia PassThrough

Maryland Form 502 Instructions ESmart Tax Fill Out and Sign Printable

Fillable Virginia Form 502 PassThrough Entity Return Of And

Form 502 Download Fillable PDF or Fill Online PassThrough Entity

Download Instructions for Form 502 PassThrough Entity Return of

Related Post: