Utrgv 1098 T Form

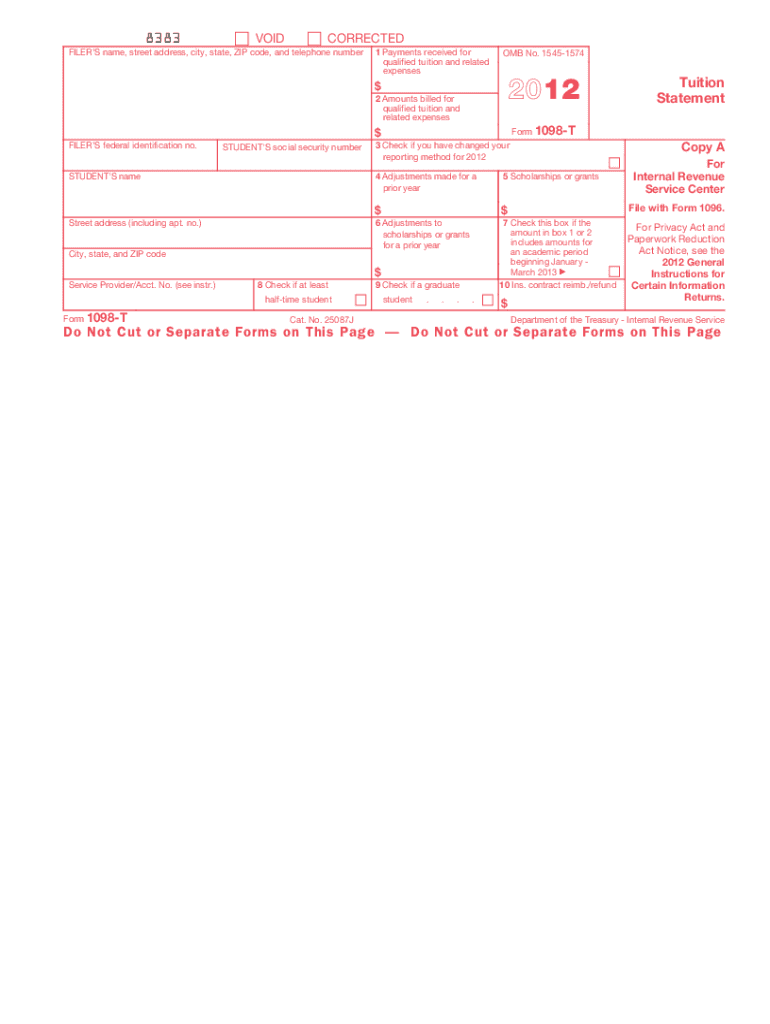

Utrgv 1098 T Form - Web this statement is required to support any claim for an education credit. Web 1 best answer. Web w2s, 1099s, and other income forms. It should be listed in the box to the left of the form that says filer's federal identification no. And that is the second box from the. Web utrgv 1098 t form 2023. Ad access irs tax forms. To see if you qualify for a credit, and for help in calculating the amount. Complete, edit or print tax forms instantly. Web the university of texas rio grande valley (utrgv) is required by the internal revenue service (irs) to report payments of qualified tuition and related educational expenses on. Completed forms can be submitted in person at u central or by fax or. Web the university of texas rio grande valley (utrgv) is required by the internal revenue service (irs) to report payments of qualified tuition and related educational expenses on. Get ready for tax season deadlines by completing any required tax forms today. And that is the second. Web this statement is required to support any claim for an education credit. Get ready for tax season deadlines by completing any required tax forms today. Section references are to the internal revenue code unless. Retain this statement for your records. Web division of finance forms. To see if you qualify for a credit, and for help in calculating the amount. Web w2s, 1099s, and other income forms. Section references are to the internal revenue code unless. Web 1 best answer. Web the university of texas rio grande valley (utrgv) is required by the internal revenue service (irs) to report payments of qualified tuition and related. Section references are to the internal revenue code unless. Web the following forms (pdf) are available for you to download and complete for your financial aid requirements. Get ready for tax season deadlines by completing any required tax forms today. Web utrgv 1098 t form 2023. Web the university of texas rio grande valley (utrgv) is required by the internal. Ad access irs tax forms. It should be listed in the box to the left of the form that says filer's federal identification no. Web this statement is required to support any claim for an education credit. Retain this statement for your records. Completed forms can be submitted in person at u central or by fax or. Completed forms can be submitted in person at u central or by fax or. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web division of finance forms. On purple menu bar (left side) click: Ad access irs tax forms. On purple menu bar (left side) click: Please click on the links below to access additional information located within. It should be listed in the box to the left of the form that says filer's federal identification no. Complete, edit or print tax forms instantly. Web this statement is required to support any claim for an education credit. Complete, edit or print tax forms instantly. On purple menu bar (left side) click: To see if you qualify for a credit, and for help in calculating the amount. Web 1 best answer. It should be listed in the box to the left of the form that says filer's federal identification no. Web the following forms (pdf) are available for you to download and complete for your financial aid requirements. Completed forms can be submitted in person at u central or by fax or. To see if you qualify for a credit, and. Web division of finance forms. Web the university of texas rio grande valley (utrgv) is required by the internal revenue service (irs) to report payments of qualified tuition and related educational expenses on. Web w2s, 1099s, and other income forms. It should be listed in the box to the left of the form that says filer's federal identification no. For. Web utrgv 1098 t form 2023. Web this statement is required to support any claim for an education credit. Get ready for tax season deadlines by completing any required tax forms today. Web the following forms (pdf) are available for you to download and complete for your financial aid requirements. On purple menu bar (left side) click: Web division of finance forms. Ad access irs tax forms. Please click on the links below to access additional information located within. Web w2s, 1099s, and other income forms. And that is the second box from the. Web the university of texas rio grande valley (utrgv) is required by the internal revenue service (irs) to report payments of qualified tuition and related educational expenses on. Retain this statement for your records. Web 1 best answer. Complete, edit or print tax forms instantly. Section references are to the internal revenue code unless. It should be listed in the box to the left of the form that says filer's federal identification no. For internal revenue service center. To see if you qualify for a credit, and for help in calculating the amount. Completed forms can be submitted in person at u central or by fax or.1098T Pressure Seal Form (1098T)

Form 1098T Information Student Portal

how do i get my 1098 t form online Fill Online, Printable, Fillable

Frequently Asked Questions About the 1098T The City University of

Utrgv 1098 T Form 2023 Printable Forms Free Online

1098T IRS Tax Form Instructions 1098T Forms

1098 T Form Fill Out and Sign Printable PDF Template signNow

Understanding your IRS Form 1098T Student Billing

1098 T Form Printable Blank PDF Online

1098T Information Bursar's Office Office of Finance UTHSC

Related Post: