California Form 541 Instructions

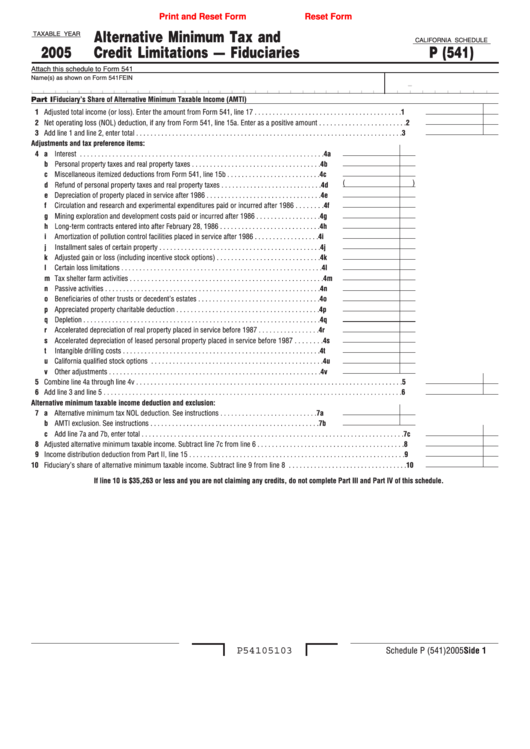

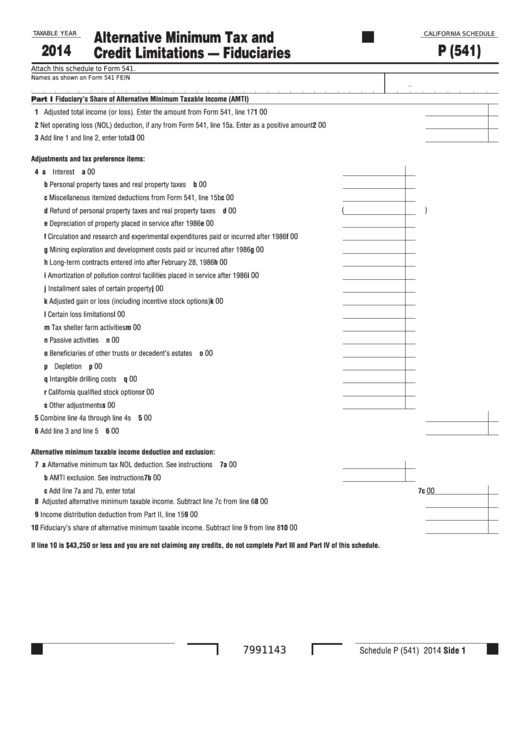

California Form 541 Instructions - Web trust accumulation of 2022 charitable amounts. Web in sum, $75,000 of the trust's income is allocated to california under the apportionment formula. Web 541 california forms & instructions 2021 fiduciary income tax booklet this booklet contains: Web the backbone of the tax return for a california trust is the franchise tax board form 541, california fiduciary income tax return. Schedule g california source income and deduction apportionment. California — california fiduciary income tax return. Part i fiduciary’s share of alternative. Printing and scanning is no longer the best way to manage documents. Complete line 1a through line. 2021 instructions for form 541 fiduciary income 541 tax booklet revised: Complete line 1a through line. Your name, address, and tax identification number, as. Web handy tips for filling out california form 541 online. Web you only need to follow these easy guidelines: Web trust accumulation of 2022 charitable amounts. 2021 instructions for form 541 fiduciary income 541 tax booklet revised: California fiduciary income tax return. Form 565, partnership return of income; Attach this schedule to form 541. Select the template in the library. Web the backbone of the tax return for a california trust is the franchise tax board form 541, california fiduciary income tax return. Web handy tips for filling out california form 541 online. Note, that the trust will be required to file a california form 541. Web 541 california forms & instructions 2021 fiduciary income tax booklet this booklet contains:. Web 2022 instructions for form 541 california fiduciary income tax return. Web in sum, $75,000 of the trust's income is allocated to california under the apportionment formula. Open the document with our advanced pdf editor. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the. Form 541, california fiduciary income tax. Or form 568, limited liability company return of income. Go digital and save time with signnow, the best solution. Web california fiduciary income tax return. Your name, address, and tax identification number, as. Web schedule p (541) 2022. California — california fiduciary income tax return. Open the document with our advanced pdf editor. Printing and scanning is no longer the best way to manage documents. Your name, address, and tax identification number, as. Select the template in the library. 2021 instructions for form 541 fiduciary income 541 tax booklet revised: Web the california franchise tax board (ftb) march 1 released updated 2020 instructions for form 541, california fiduciary income tax return, for trust income,. Part i fiduciary’s share of alternative. Printing and scanning is no longer the best way to manage documents. References in these instructions are to the. Your name, address, and tax identification number, as. Web 2022 instructions for form 541 california fiduciary income tax return. Form 565, partnership return of income; Schedule b income distribution deduction. Go digital and save time with signnow, the best solution. Form 541, california fiduciary income tax return schedule d. California fiduciary income tax return. Note, that the trust will be required to file a california form 541. Open the document with our advanced pdf editor. Type all necessary information in the required fillable. Web you only need to follow these easy guidelines: California — california fiduciary income tax return. The form, 541 is similar to an individual. Web instructions for form 541 california fiduciary income tax return. Fill in the information required in ca ftb 541, utilizing fillable. Complete line 1a through line. Form 565, partnership return of income; Or form 568, limited liability company return of income. Select the template in the library. Web although the california fiduciary income tax return (form 541) and instructions do address the throwback tax, the form and instructions do not fully determine the. Web 541 california forms & instructions 2020 fiduciary income tax booklet this booklet contains: Web the backbone of the tax return for a california trust is the franchise tax board form 541, california fiduciary income tax return. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the. Type all necessary information in the required fillable. Schedule g california source income and deduction apportionment. California fiduciary income tax return. Trust accumulation of charitable amounts. References in these instructions are to the internal revenue code (irc) as of january 1, 2009, and to. It appears you don't have a pdf plugin for this browser. Open the document with our advanced pdf editor. Web trust accumulation of 2022 charitable amounts. Web the california franchise tax board (ftb) march 1 released updated 2020 instructions for form 541, california fiduciary income tax return, for trust income,. Web 2022 instructions for form 541 california fiduciary income tax return. Your name, address, and tax identification number, as. Web schedule p (541) 2022.Fillable California Schedule P (541) Alternative Minimum Tax And

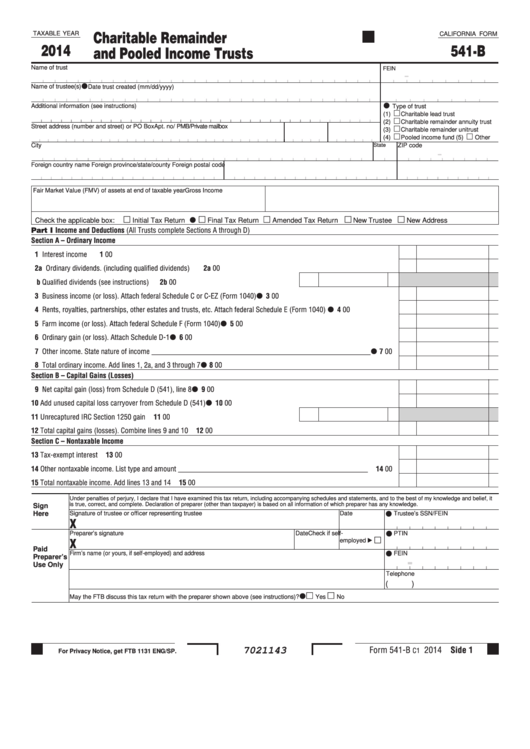

Fillable Online California Form 541 B Instructions Fax Email Print

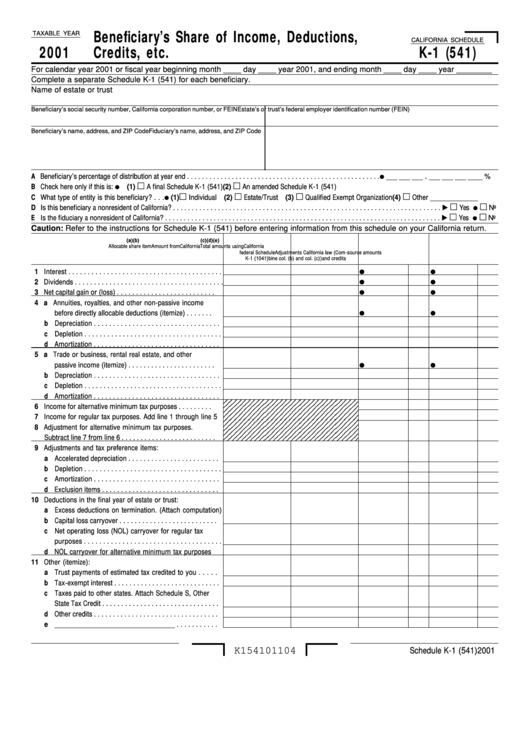

California Schedule K1 (541) Beneficiary'S Share Of

California Form 541B Charitable Remainder And Pooled Trusts

Fillable California Schedule P (541) Attach To Form 541 Alternative

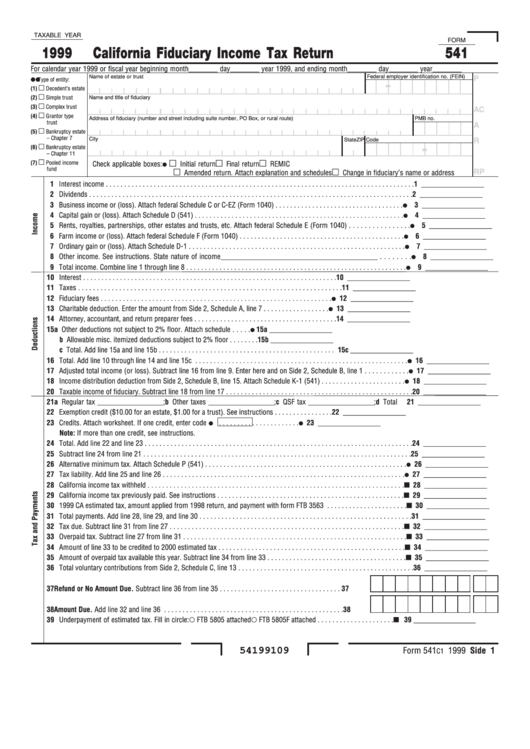

Form 541 California Fiduciary Tax Return 1999 printable pdf

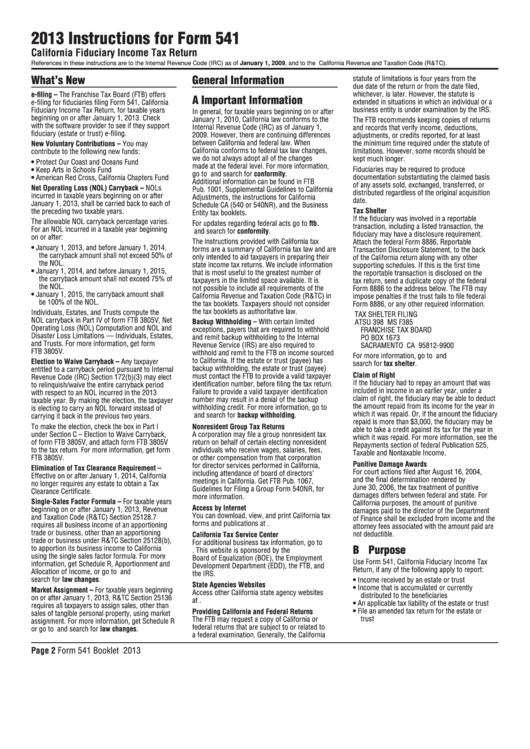

Instructions For Form 541 California Fiduciary Tax Return

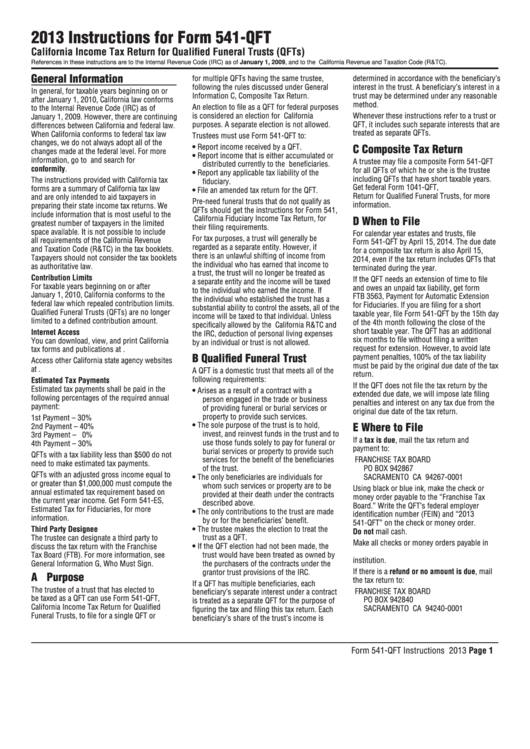

Instructions For Form 541Qft California Tax Return For

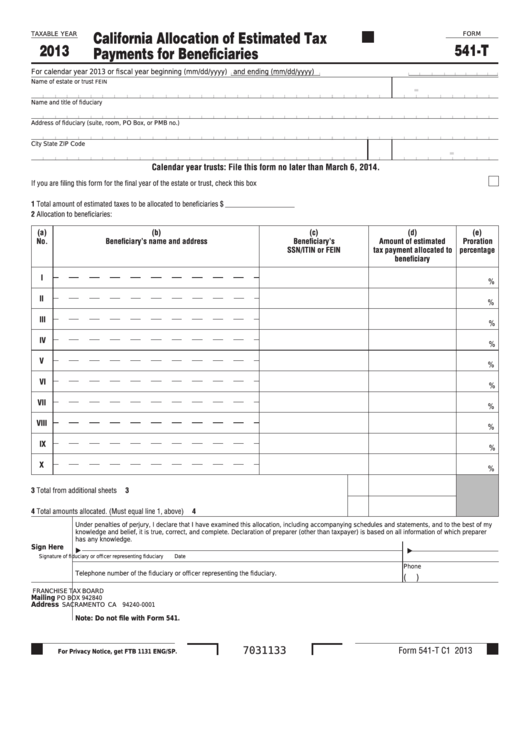

Fillable Form 541T California Allocation Of Estimated Tax Payments

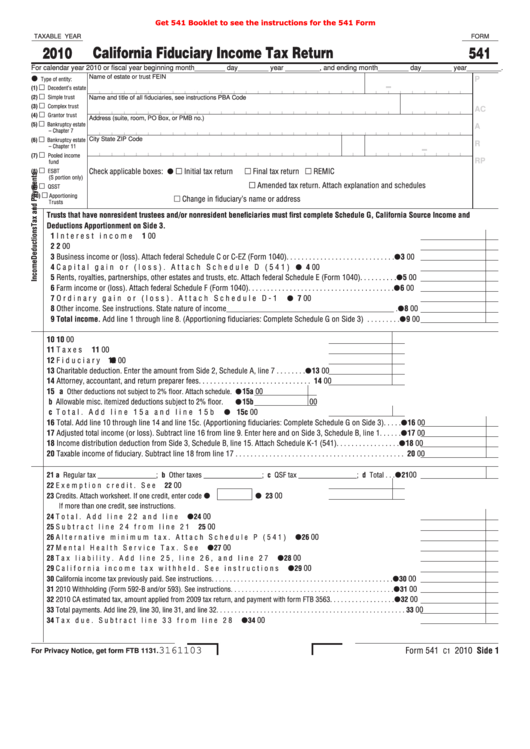

Fillable Form 541 California Fiduciary Tax Return 2010

Related Post: