Utah Tax Form Tc 40

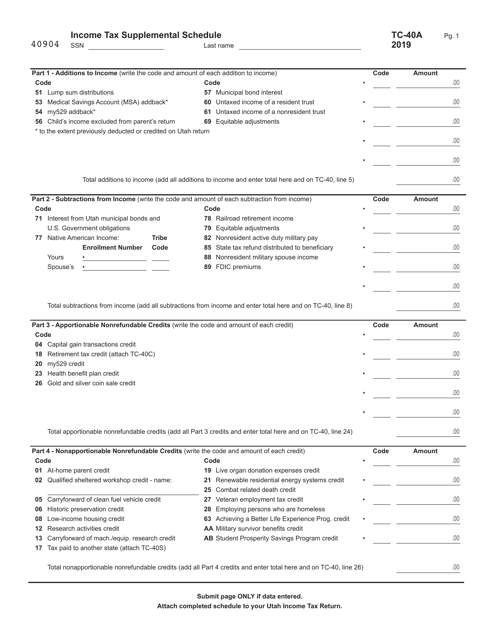

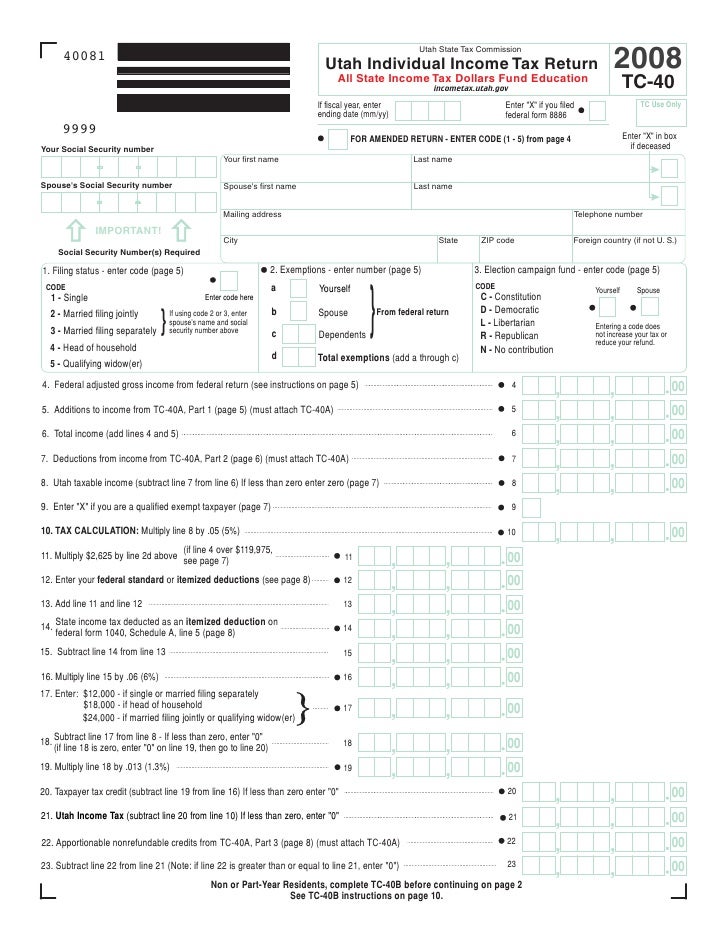

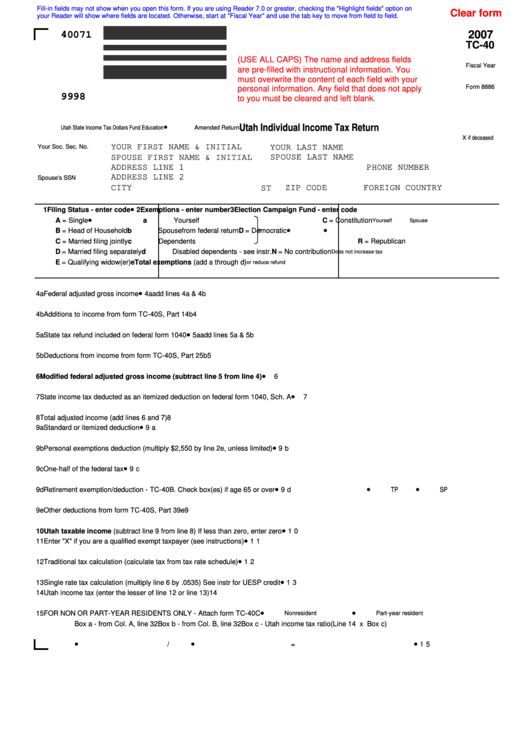

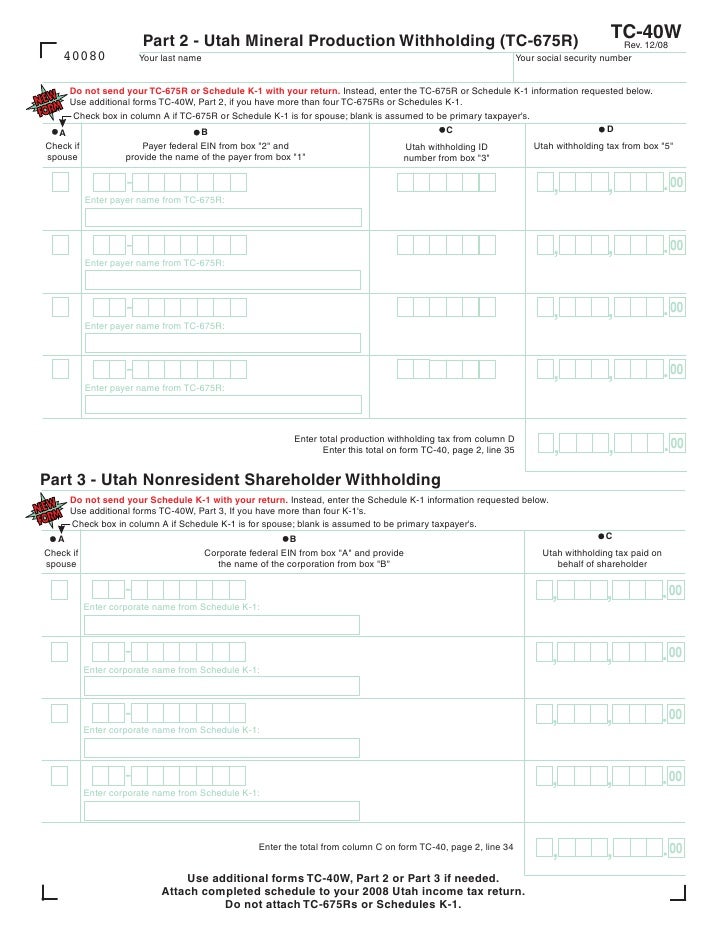

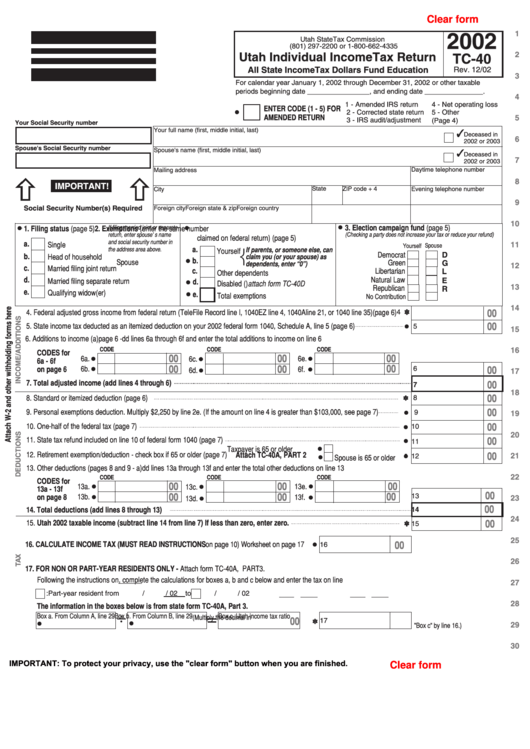

Utah Tax Form Tc 40 - Web how to amend a 2022 return. For more information about the utah income tax, see the utah income tax page. Visit utah.gov (opens in new window). The utah income tax rate for tax year 2022 is 4.85%. Do not send this form with your return. Also see residency and domicile. Silver lake, big cottonwood canyon, by colton matheson. $15,548 (if single or married filing separately); Enter all other amounts as shown on your original return. Individual income tax prepayment coupon (this is not an. Write the code and amount of each subtraction from income in part 2. Do not send this form with your return. Enter the corrected figures on the return and/or schedules. This form is for income earned in tax year 2022, with tax returns due in april 2023. $15,548 (if single or married filing separately); Web how to amend a 2022 return. Individual income tax prepayment coupon (this is not an. Do not send this form with your return. For more information about the utah income tax, see the utah income tax page. Enter all other amounts as shown on your original return. Silver lake, big cottonwood canyon, by colton matheson. Do not send this form with your return. Enter all other amounts as shown on your original return. Also see residency and domicile. Filing your income tax return doesn't need to be complex or difficult. This form is for income earned in tax year 2022, with tax returns due in april 2023. For more information about the utah income tax, see the utah income tax page. Visit utah.gov (opens in new window). Filing your income tax return doesn't need to be complex or difficult. Want a refund of any income tax overpaid. To fi le a utah return, fi rst complete your federal return, even Also see residency and domicile. Utah individual income tax return tax return: Printable utah state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. For more information about the utah income tax, see the utah. We will update this page with a new version of the form for 2024 as soon as it is made available by the utah government. The utah income tax rate for tax year 2022 is 4.85%. Write the code and amount of each subtraction from income in part 2. We've put together information to help you understand your state tax. This form is for income earned in tax year 2022, with tax returns due in april 2023. Do not send this form with your return. Individual income tax prepayment coupon (this is not an. Want a refund of any income tax overpaid. The utah income tax rate for tax year 2022 is 4.85%. This form is for income earned in tax year 2022, with tax returns due in april 2023. $15,548 (if single or married filing separately); For more information about the utah income tax, see the utah income tax page. This form is for income earned in tax year 2022, with tax returns due in april 2023. We've put together information to. Web these 2021 forms and more are available: Filing your income tax return doesn't need to be complex or difficult. This form is for income earned in tax year 2022, with tax returns due in april 2023. $15,548 (if single or married filing separately); Enter all other amounts as shown on your original return. Utah individual income tax return tax return: $14,879 (if single or married filing separately); To fi le a utah return, fi rst complete your federal return, even Enter all other amounts as shown on your original return. Individual income tax prepayment coupon (this is not an. Follow the links below for more information. Want a refund of any income tax overpaid. $22,318 (if head of household); Printable utah state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Also see residency and domicile. Enter all other amounts as shown on your original return. Web these 2021 forms and more are available: Enter the corrected figures on the return and/or schedules. To fi le a utah return, fi rst complete your federal return, even Silver lake, big cottonwood canyon, by colton matheson. The utah income tax rate for tax year 2022 is 4.85%. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web how to amend a 2022 return. This form is for income earned in tax year 2022, with tax returns due in april 2023. Utah individual income tax return tax return: For more information about the utah income tax, see the utah income tax page. We've put together information to help you understand your state tax requirements. Do not send this form with your return. How to obtain income tax and related forms and schedules. Individual income tax prepayment coupon (this is not an.Form TC40A Schedule A 2019 Fill Out, Sign Online and Download

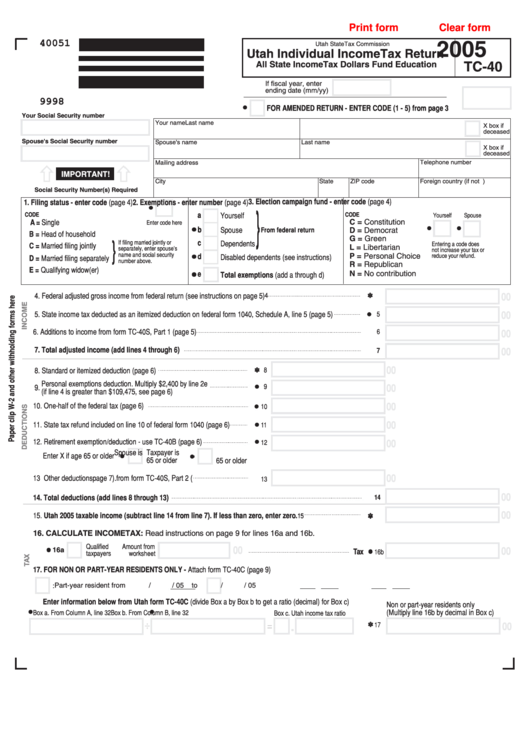

Fillable Form Tc40 Utah Individual Tax Return 2005

tax.utah.gov forms current tc tc40wplain

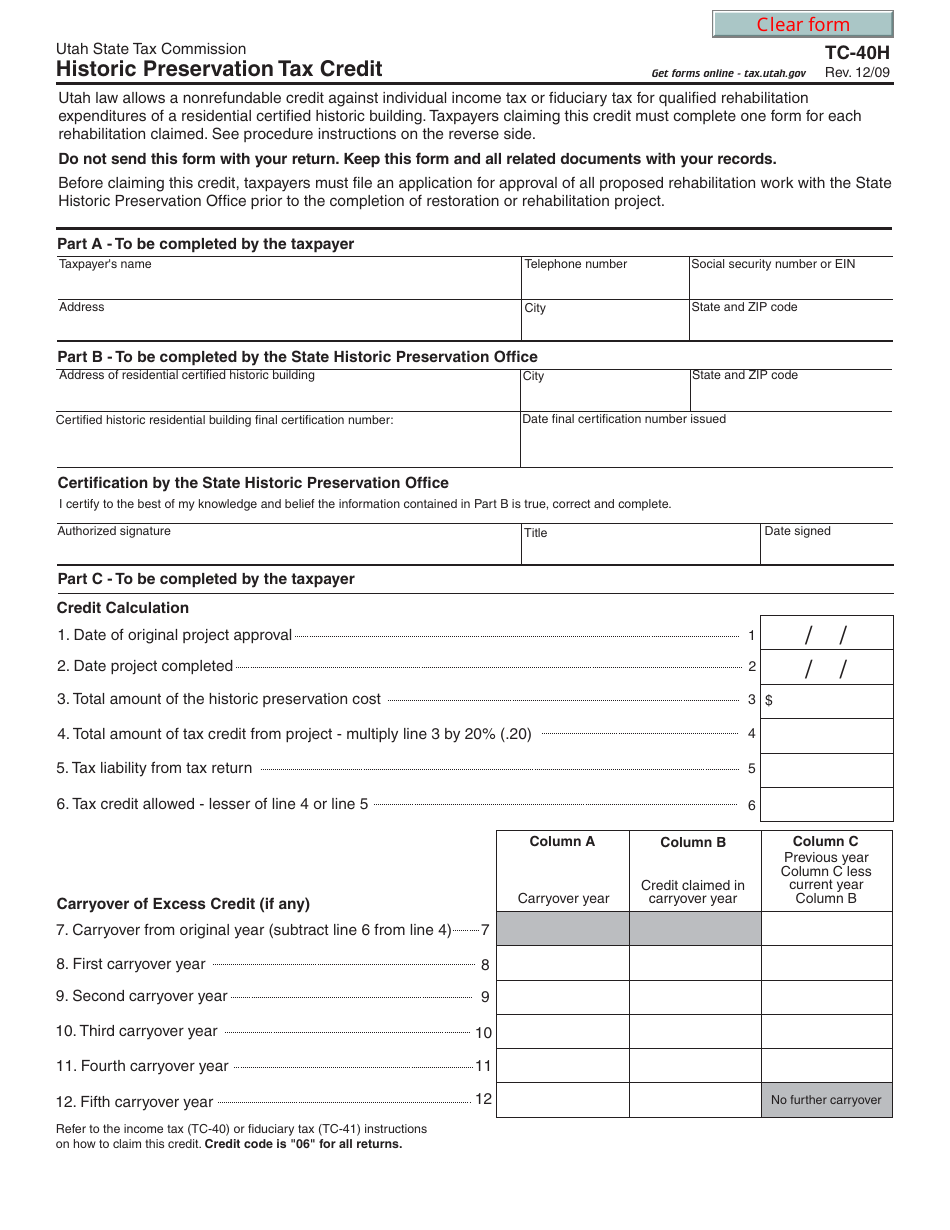

Form TC40H Download Fillable PDF or Fill Online Historic Preservation

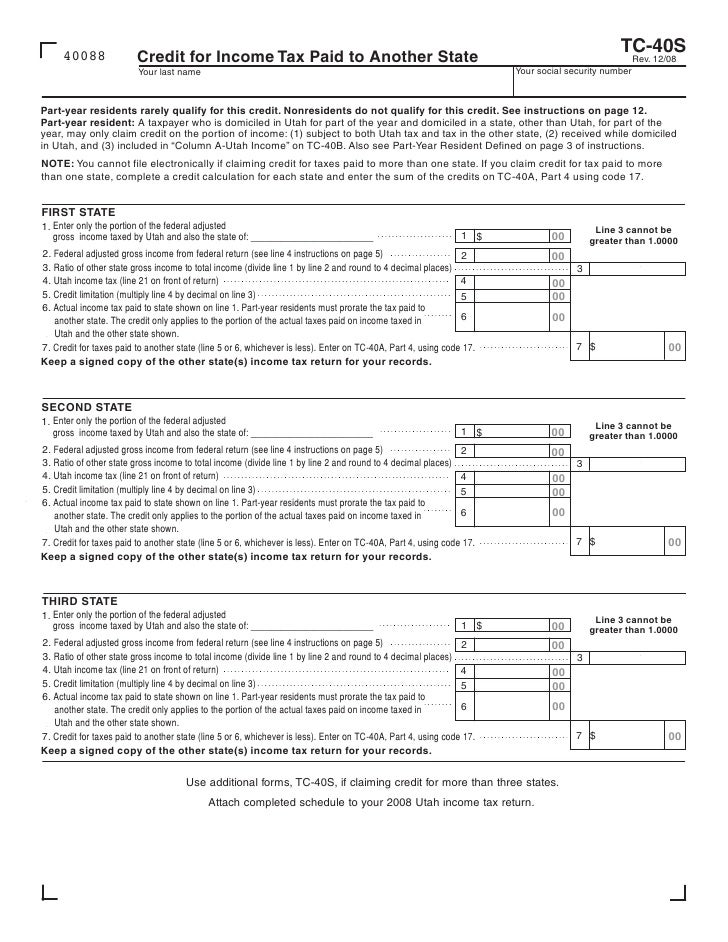

tax.utah.gov forms current tc tc40splain

tax.utah.gov forms current tc tc40plain

Fillable Form Tc40 Utah Individual Tax Return 2007

tax.utah.gov forms current tc tc40wplain

Fillable Form Tc40 Utah Individual Tax Return 2002

Utah tax form tc 40b Fill out & sign online DocHub

Related Post: