Coinbase Form 8949

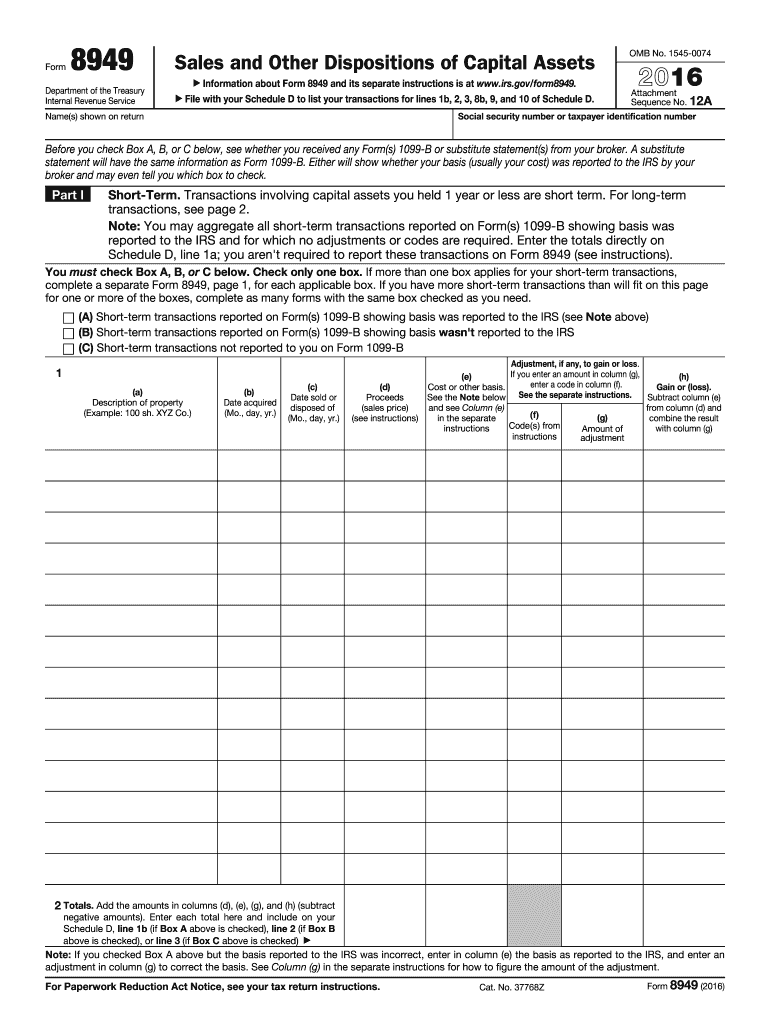

Coinbase Form 8949 - Web who should use form 8949? Web form 8949 captures the details of every sale triggering a gain or loss. You must use form 8949 to report each crypto sale that occurred during the. But i do have a completed form 8949 for turbotax. You need to know your capital gains, losses, income and expenses. Web form 8949 a majority of investors own crypto as capital assets, and use “sales and other dispositions of capital assets, form 8949” to report all their individual crypto. Web coinbase says a 1099b was not generated for me because my proceeds were less than $600. Go to www.irs.gov/form8949 for instructions and the latest information. Web page last reviewed or updated: Web individuals use form 8949 to report the following. Web form 8949 a majority of investors own crypto as capital assets, and use “sales and other dispositions of capital assets, form 8949” to report all their individual crypto. Go to www.irs.gov/form8949 for instructions and the latest information. Web how to fill out form 8949 for cryptocurrency. The first step is to take account of all transactions with cryptocurrency you.. Sell, trade, send to a third party, etc.). Web how to fill out form 8949 for cryptocurrency. Go to www.irs.gov/form8949 for instructions and the latest information. The 8949 is used to calculate. It’s important to understand that you won’t owe any tax on cryptocurrency if you haven’t realized a taxable gain. Web page last reviewed or updated: Any gains or losses must be reported. But i do have a completed form 8949 for turbotax. Go to www.irs.gov/form8949 for instructions and the latest information. Web for as little as $12.00, clients of coinbase can use the services of form8949.com to generate irs schedule d and form 8949. Web who should use form 8949? Web form 8949 (sales and other dispositions of capital assets) with a complete list of every cryptocurrency disposal you have had (e.g. Form 8949 captures detail of every sale triggering a gain or loss, with all the. Web use form 8949 to report sales and exchanges of capital assets. This worksheet is relevant to. The first step is to take account of all transactions with cryptocurrency you. This worksheet is relevant to your capital gains or losses from selling, converting, or otherwise disposing of your crypto. But i do have a completed form 8949 for turbotax. Sell, trade, send to a third party, etc.). Web who should use form 8949? Sell, trade, send to a third party, etc.). Information about form 8949, sales and other dispositions of capital assets, including recent updates, related forms. Sales and other dispositions of capital assets. The details supporting the final calculation, include, but are not limited to, asset identity, date acquired, date. Web who should use form 8949? Web coinbase says a 1099b was not generated for me because my proceeds were less than $600. Web form 8949 captures the details of every sale triggering a gain or loss. Web for as little as $12.00, clients of coinbase can use the services of form8949.com to generate irs schedule d and form 8949. But i do have a completed. Form 8949 is an irs worksheet relevant to your capital gains or losses from selling, converting, or otherwise disposing of your crypto. Web to report your crypto tax to the irs, follow 5 steps: It’s important to understand that you won’t owe any tax on cryptocurrency if you haven’t realized a taxable gain. But i do have a completed form. Form 8949 is an irs worksheet relevant to your capital gains or losses from selling, converting, or otherwise disposing of your crypto. The details supporting the final calculation, include, but are not limited to, asset identity, date acquired, date. Taxpayers with a significant number of crypto transactions and/or assets. This worksheet is relevant to your capital gains or losses from. Sales and other dispositions of capital assets. This is where you list out each capital gain or loss from crypto investments. Web this is also the only form coinbase will provide — specifically for users with $600 or more in crypto income from activities like rewards or airdrops. Web to report your crypto tax to the irs, follow 5 steps:. Web who should use form 8949? The 8949 is used to calculate. Web use form 8949 to report sales and exchanges of capital assets. You must use form 8949 to report each crypto sale that occurred during the. Web individuals use form 8949 to report the following. Web form 8949 (sales and other dispositions of capital assets) with a complete list of every cryptocurrency disposal you have had (e.g. Web for as little as $12.00, clients of coinbase can use the services of form8949.com to generate irs schedule d and form 8949. It’s important to understand that you won’t owe any tax on cryptocurrency if you haven’t realized a taxable gain. Information about form 8949, sales and other dispositions of capital assets, including recent updates, related forms. Web the irs form 8949 is the tax form used to report cryptocurrency capital gains and losses. • the sale or exchange of a capital asset not reported on another form or schedule. The first step is to take account of all transactions with cryptocurrency you. The details supporting the final calculation, include, but are not limited to, asset identity, date acquired, date. Web form 8949 a majority of investors own crypto as capital assets, and use “sales and other dispositions of capital assets, form 8949” to report all their individual crypto. Sell, trade, send to a third party, etc.). Web how to fill out form 8949 for cryptocurrency. But i do have a completed form 8949 for turbotax. You need to know your capital gains, losses, income and expenses. Form 8949 captures detail of every sale triggering a gain or loss, with all the. Any gains or losses must be reported.Instructions For Form 8949 2016 printable pdf download

Need To Report Cryptocurrency On Your Taxes? Here's How To Use Form

2016 form 8949 Fill out & sign online DocHub

Coinbase 8949

How To Fill Out Crypto Tax Form 8949 in HR Block Tax Software (2021

Fillable Irs Form 8949 Printable Forms Free Online

Irs Form 8949 Printable Printable Forms Free Online

How to Fill Out Form 8949 for Cryptocurrency in 6 Steps CoinLedger

In the following Form 8949 example,the highlighted section below shows

IRS Form 8949 instructions.

Related Post:

.jpeg)