Ubereats Tax Form

Ubereats Tax Form - Web the answer is yes. Web requesting current/previous year tax form(s) all tax documents will be available electronically via the uber eats manager. Web be sure to keep track of these expenses, as you can likely deduct them at tax time. Log in to drivers.uber.com and click the. Answer questions about the uber eats order you want a refund for. The steps to cancel an order depend on how far along in the order process you are. An official irs tax document that includes all gross earnings from meal orders. Web uber sends two tax forms. An unofficial tax document produced by uber and provided to every. If you also opted in to receive your tax forms. Requesting current/previous year tax form (s) help with an incorrect 1099. Web up to $5 cash back there are 4 types of tax documents you could receive from us: An official irs tax document that includes all gross earnings from meal orders. Ad signnow.com has been visited by 100k+ users in the past month Web provide the name and the. What tax documents do i receive? An unofficial tax document produced by uber and provided to every. Web unlike rides with uber, drivers who earn with uber eats are only obligated to register, collect and remit sales tax from the moment they reach $30,000 of revenue over the past 4. Web uber sends two tax forms. How do i access. Not all restaurants will receive a 1099. You can cancel from the order tracking. An official irs tax document that includes all gross earnings from meal orders. Web uber sends two tax forms. This sets uber taxes apart from most other gigs that only issue one tax form. Web if you qualify to receive a 1099, the easiest way to access your document is to download it directly from your driver dashboard. Log in to drivers.uber.com and click the. Web since uber provides this information directly to the irs, you don’t have to include the 1099s forms with your tax return. Ad signnow.com has been visited by 100k+. But you should definitely save your 1099s. Requesting current/previous year tax form (s) help with an incorrect 1099. Log in to drivers.uber.comand click the. When do i receive my 1099? Web vehicle inspection to be completed by vehicle operator ↓ _____ _____ _____ full name phone number How to use your uber 1099s: If you also opted in to receive your tax forms. Not all restaurants will receive a 1099. Web you could receive 3 types of tax documents from us: Web provide the name and the address of your bank. Our refund questionnaire takes less. An unofficial tax document produced by uber and provided to every. Every driver and delivery person on the uber app will receive a tax. Web up to $5 cash back there are 4 types of tax documents you could receive from us: The steps to cancel an order depend on how far along in the. Ad signnow.com has been visited by 100k+ users in the past month The first one is income taxes, both. Get deals and low prices on 1096 tax forms at amazon Web up to $5 cash back consult with your tax professional regarding potential deductions. 100% free federal tax filing. An official irs tax document that includes all gross earnings from meal orders. An unofficial tax document produced by uber and provided to every. 100% free federal tax filing. Web up to $5 cash back there are 4 types of tax documents you could receive from us: But you should definitely save your 1099s. Web be sure to keep track of these expenses, as you can likely deduct them at tax time. 100% free federal tax filing. Answer questions about the uber eats order you want a refund for. The steps to cancel an order depend on how far along in the order process you are. Get deals and low prices on 1096 tax. Ad signnow.com has been visited by 100k+ users in the past month Web vehicle inspection to be completed by vehicle operator ↓ _____ _____ _____ full name phone number The first one is income taxes, both. Web if you qualify to receive a 1099, the easiest way to access your document is to download it directly from your driver dashboard. You can cancel from the order tracking. Web up to $5 cash back there are 4 types of tax documents you could receive from us: Web up to $5 cash back base cash back benefit is between 6% and 2% for gas purchases and between 12% and 4% for ev charging, depending on your uber pro status. Web if you qualify to receive a 1099, the easiest way to access your document is to download it directly from your driver dashboard. Web be sure to keep track of these expenses, as you can likely deduct them at tax time. Every driver and delivery person on the uber app will receive a tax. Web requesting current/previous year tax form(s) all tax documents will be available electronically via the uber eats manager. Answer questions about the uber eats order you want a refund for. This sets uber taxes apart from most other gigs that only issue one tax form. Web up to $5 cash back consult with your tax professional regarding potential deductions. Web uber sends two tax forms. How do i access my 1099 tax form? An official irs tax document that includes all gross earnings from meal orders. An unofficial tax document produced by uber and provided to every. Web since uber provides this information directly to the irs, you don’t have to include the 1099s forms with your tax return. If you also opted in to receive your tax forms.Uber Eats Taxes Your Complete Guide

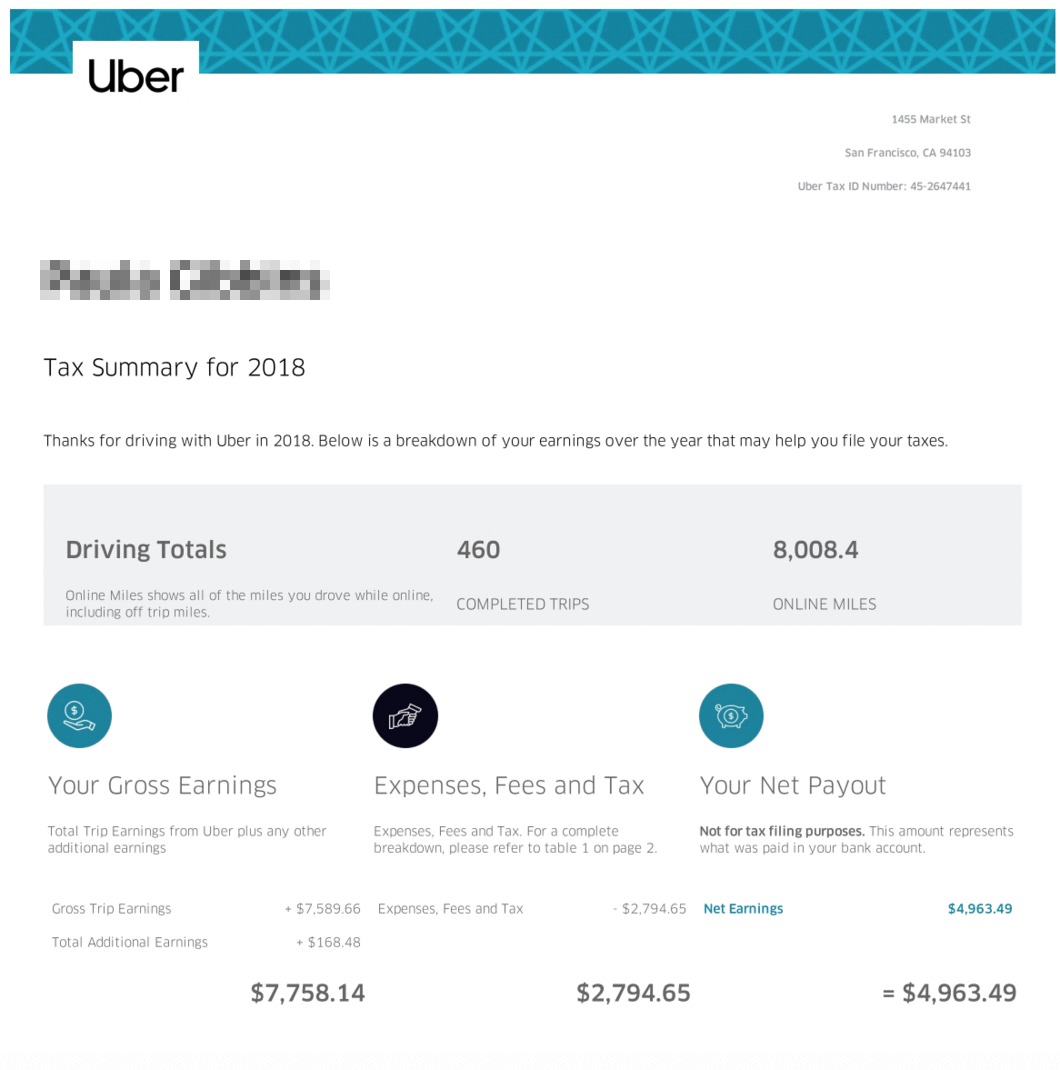

Tax Help for Uber Drivers How to File Your Uber 1099

Tax Return Online English YS Accounting

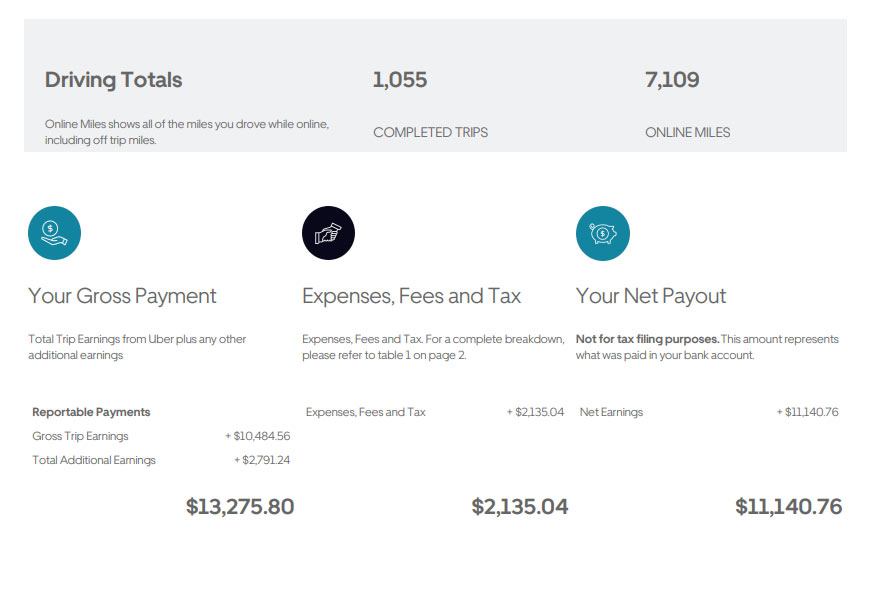

how to get uber eats tax summary Irmgard Talbot

Why does my Uber Eats 1099 or Annual Tax Summary say I made more than I

Uber 1099 Tax Form amulette

how to get uber eats tax summary Irmgard Talbot

Ultimate Tax Guide for Uber & Lyft Drivers (Updated for 2019)

Uber Eats Tax Calculator How Much Extra Will I Pay from Uber Eats

Uber Eats and Other Delivery Drivers Here Are the Tax Deductions to

Related Post: