Fansly 1099 Form

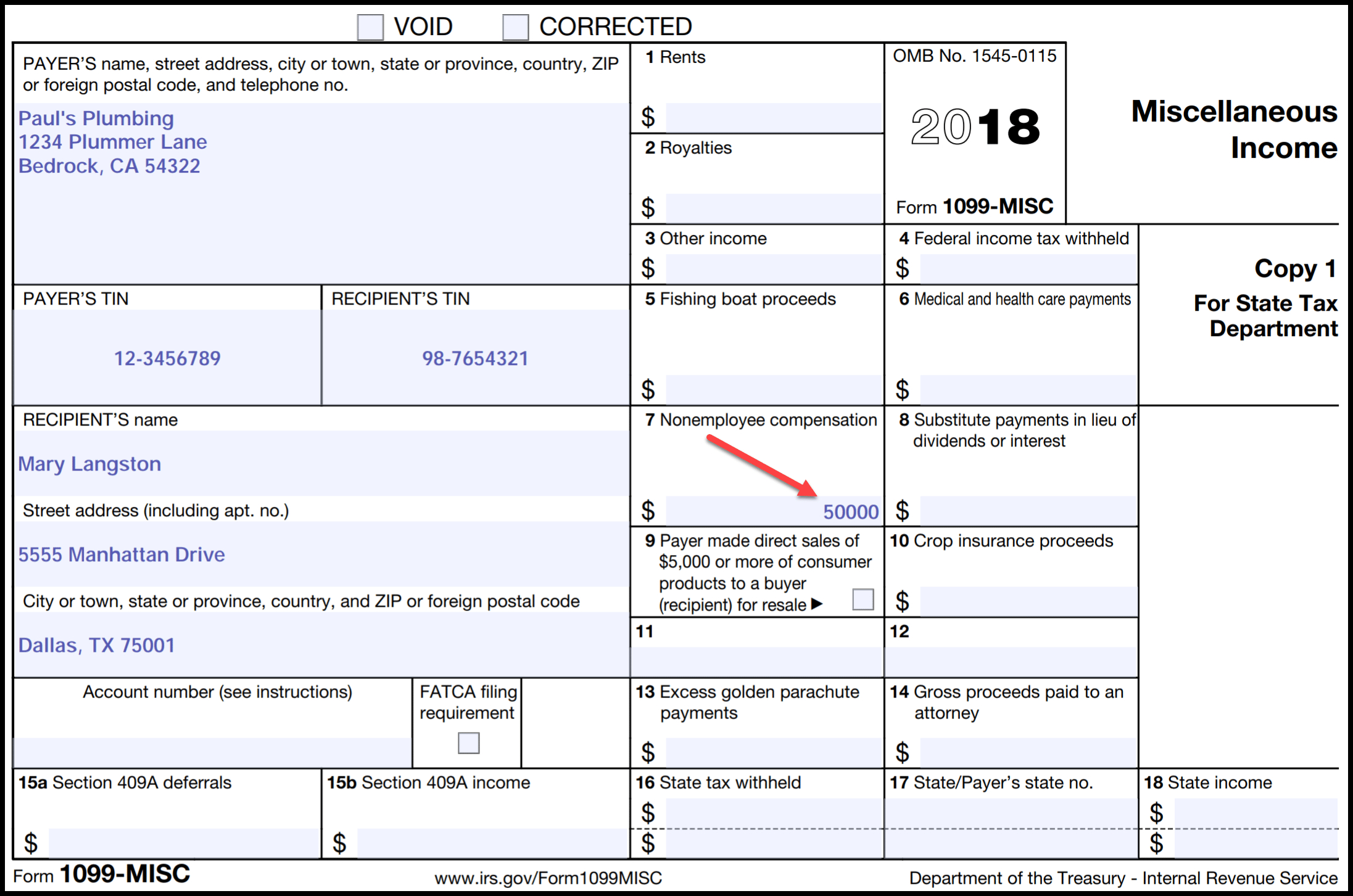

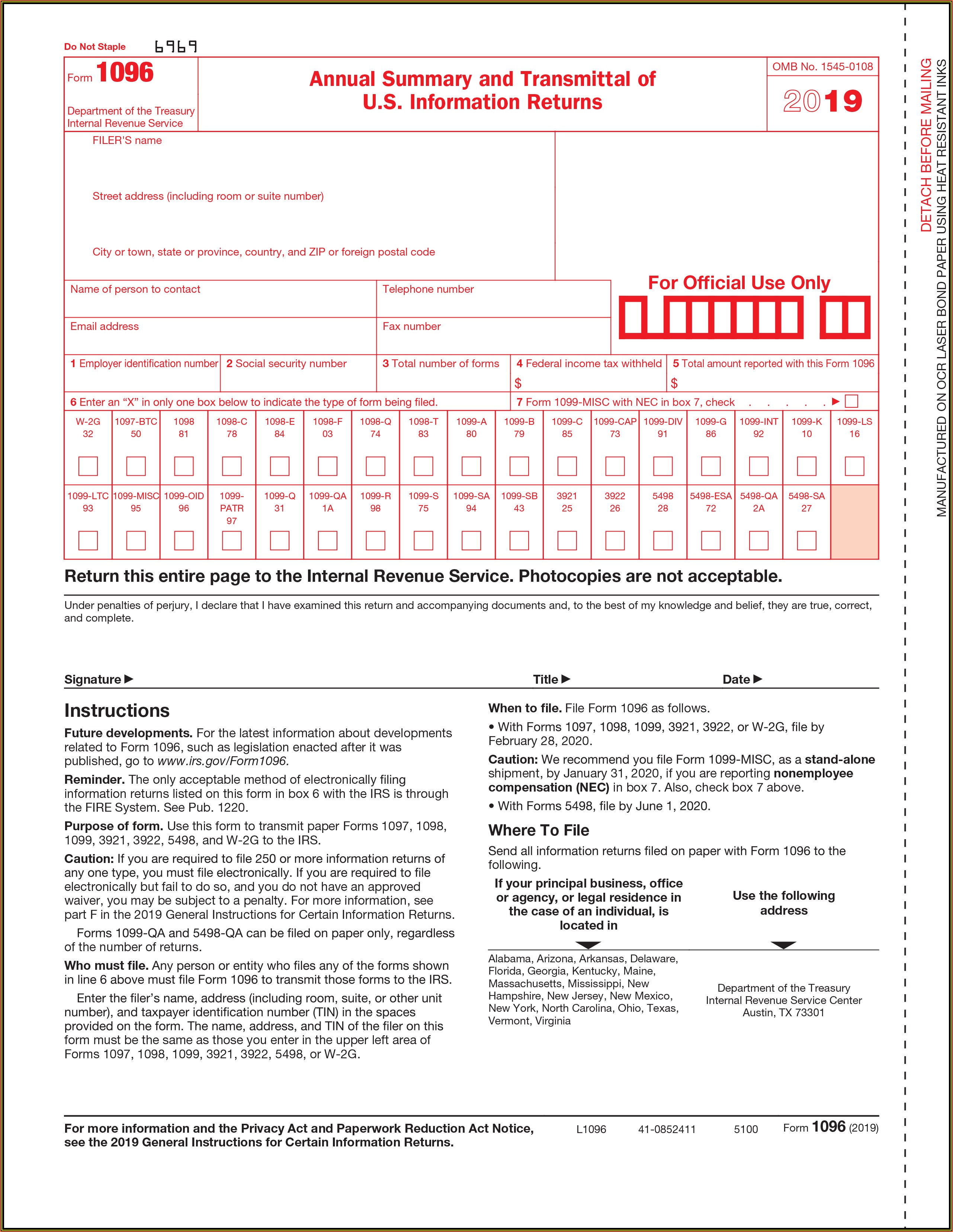

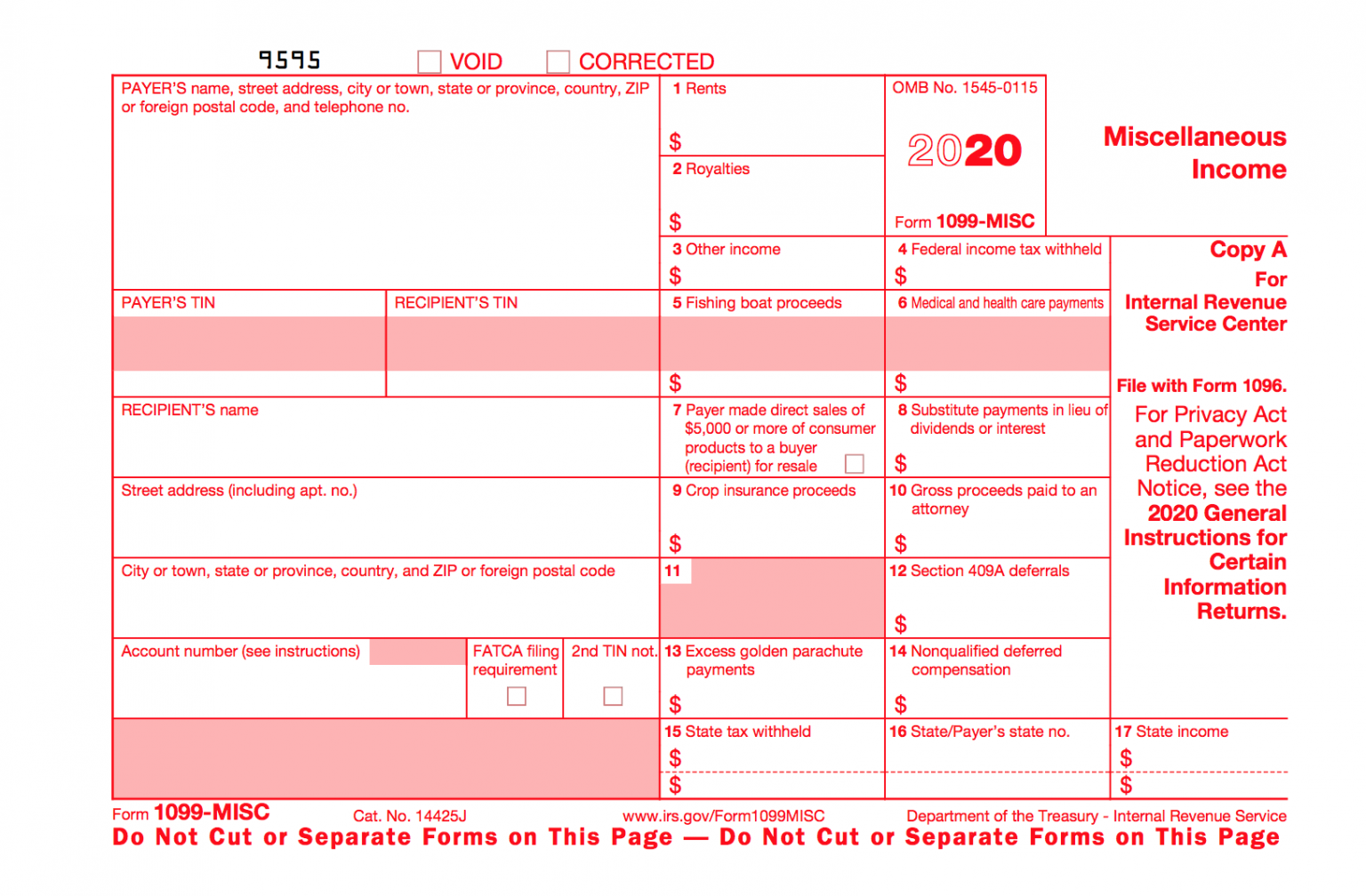

Fansly 1099 Form - Web interact with your fans today and start selling content. If you make less than $600, onlyfans won't send you. Web form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income other. Web the majority of 1099 forms are due to you, the payee, by january 31. The form is required for us content creators. Web professionals from the kpmg information reporting & withholding tax practice will discuss: Web onlyfans will send you a 1099 nec only if you make more than $600 over the year and are a u.s. Web yes, fansly does provide a w9 tax form to us content creators. Web you are being redirected. I've messaged fansly about this and am waiting on a response but i know they are swarmed. That should give you plenty of time to make sure those 1099 forms are accurate in reporting. Web the w9 form is specifically for our creators that must file an annual tax return to the irs within the usa. If this applies to you, then please return the completed w9 form to. Web it’s only necessary to issue a 1099. Web the majority of 1099 forms are due to you, the payee, by january 31. Web you are being redirected. Web 1099's/tax forms responsibilities for additional person on content. The form is required for us content creators. Web yes, fansly does provide a w9 tax form to us content creators. Tips and advice on running a fansly account But even if they don't give 1099s for creators making under $20,000, i would assume you can still claim your earnings by using payment statements or even your bank account. If the content creator earns over $20,000 a year, he will be provided with a w9 tax form. Web onlyfans will send. Sign up today and make a free account. Web the majority of 1099 forms are due to you, the payee, by january 31. That should give you plenty of time to make sure those 1099 forms are accurate in reporting. If you do, you must send the 1099 to the irs as well. But even if they don't give 1099s. Web as an onlyfans independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings. Web send us a model release form, picture of their government issued picture id, and selfie holding their id and a piece of paper with their name, the current date, and for. Web onlyfans will send you a. Web i'm very new to fansly, so i can't speak on how they report income. That should give you plenty of time to make sure those 1099 forms are accurate in reporting. Web a 1099 tax form is used to report income from sources other than regular wages, salaries, or tips. Web the majority of 1099 forms are due to. Web interact with your fans today and start selling content. Web as an onlyfans independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings. Both the forms and instructions will be updated as. I've messaged fansly about this and am waiting on a response but i know they are swarmed. Web the. Web it’s only necessary to issue a 1099 if you earn $600 or more during the tax year. Web form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income other. Both the forms and instructions will be updated as.. Web the majority of 1099 forms are due to you, the payee, by january 31. Web as an onlyfans independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings. Web professionals from the kpmg information reporting & withholding tax practice will discuss: If you earned more than $600, you’ll. Both the forms. If you earned more than $600, you’ll. If you make less than $600, onlyfans won't send you. But even if they don't give 1099s for creators making under $20,000, i would assume you can still claim your earnings by using payment statements or even your bank account. Web interact with your fans today and start selling content. Web i'm very. If you do, you must send the 1099 to the irs as well. But even if they don't give 1099s for creators making under $20,000, i would assume you can still claim your earnings by using payment statements or even your bank account. If this applies to you, then please return the completed w9 form to. Web you are being redirected. Web i'm very new to fansly, so i can't speak on how they report income. That should give you plenty of time to make sure those 1099 forms are accurate in reporting. Tips and advice on running a fansly account Sign up today and make a free account. Web send us a model release form, picture of their government issued picture id, and selfie holding their id and a piece of paper with their name, the current date, and for. Web 1099's/tax forms responsibilities for additional person on content. Web as an onlyfans independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings. If you earned more than $600, you’ll. I've messaged fansly about this and am waiting on a response but i know they are swarmed. Web the w9 form is specifically for our creators that must file an annual tax return to the irs within the usa. The form is required for us content creators. If you make less than $600, onlyfans won't send you. Web interact with your fans today and start selling content. If the content creator earns over $20,000 a year, he will be provided with a w9 tax form. Web yes, fansly does provide a w9 tax form to us content creators. Web 38k subscribers in the fansly_advice community.What Is a 1099 Form, and How Do I Fill It Out? Bench Accounting

Free Printable 1099 Misc Forms Free Printable

Form 1099div 20192023 Fill online, Printable, Fillable Blank

Order 1099 Forms From Irs Form Resume Examples BpV5WprK91

What Are 1099s and Do I Need to File Them? Singletrack Accounting

1099 Form Irs 2015 Universal Network

Forms 1099 The Basics You Should Know Kelly CPA

What is a 1099Misc Form? Financial Strategy Center

Irs Form 1099 Contract Labor Form Resume Examples

Irs Printable 1099 Form Printable Form 2023

Related Post: