Turbotax Injured Spouse Form

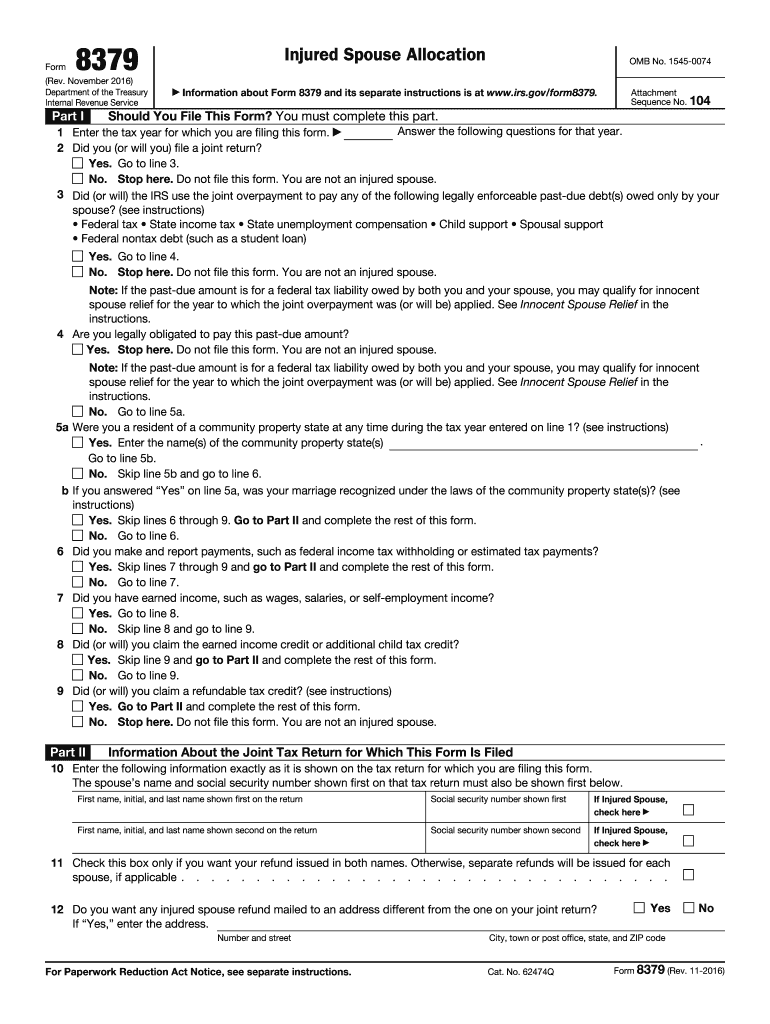

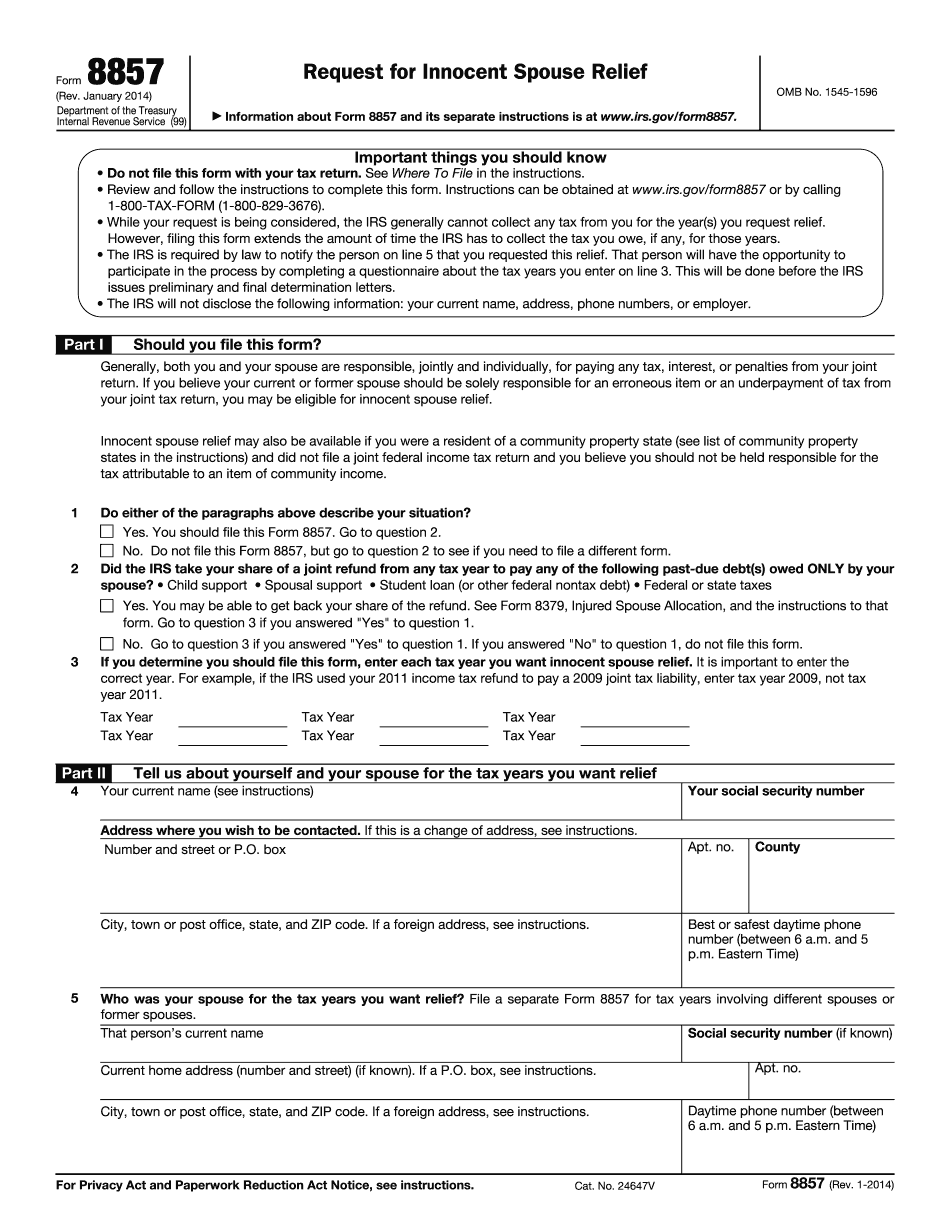

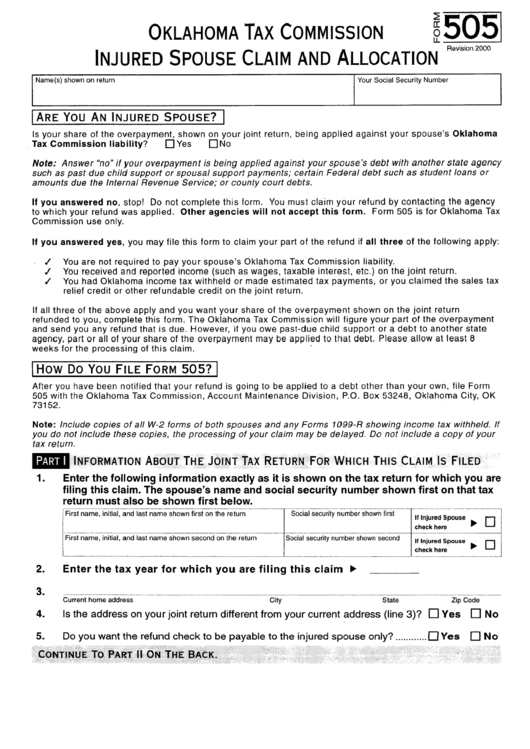

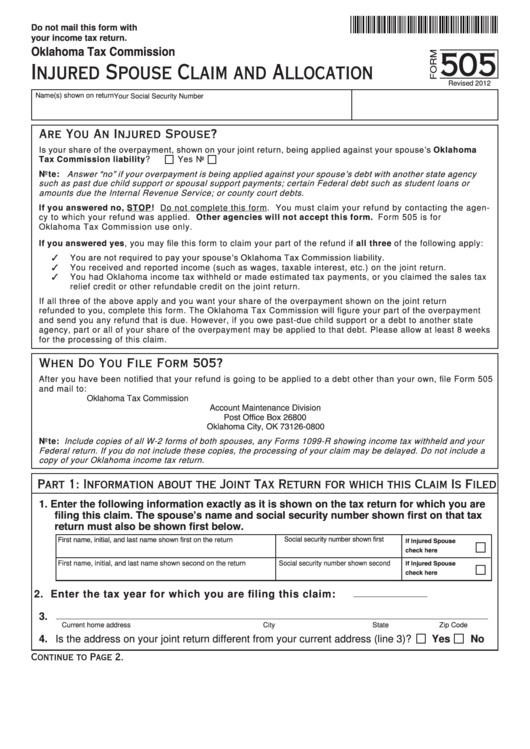

Turbotax Injured Spouse Form - Web to file as an injured spouse, you’ll need to complete form 8379: Web the injured spouse form can be filed separately from your tax return, if you have already filed. November 2021) department of the treasury internal revenue service. We offer a variety of software related to various fields at great prices. Injured spouse claim and allocation. If you’re filing with h&r block, you won’t need to complete this form on. To enter information for the injured spouse allocation in turbotax: Taxpayers file form 8857 to request relief from tax liability, plus related penalties and interest, when they believe only their spouse or former spouse. If some of the boxes were not checked, then turbotax will state you are not eligible to file the form. Injured spouse allocation, reported on form 8379. If you’re filing with h&r block, you won’t need to complete this form on. Information about form 8379, injured spouse allocation, including recent updates, related forms, and. Instantly find & download legal forms drafted by attorneys for your state. Go to www.irs.gov/form8379 for instructions and the latest. They will process it, and issue a refund based on your income items. Web page last reviewed or updated: You must file jointly to use. Web the injured spouse form can be filed separately from your tax return, if you have already filed. Web to delete the innocent spouse form (form 8857): Open (continue) your return in turbotax online. In the left hand navigation, click on the tools link. Injured spouse claim and allocation. Go to www.irs.gov/form8379 for instructions and the latest. Web to delete the innocent spouse form (form 8857): If you filed the form 8379 by itself after a joint return has been processed by the irs, then processing will take about 8 weeks. Taxpayers file form 8857 to request relief from tax liability, plus related penalties and interest, when they believe only their spouse or former spouse. Web form 8379 essentially asks the irs to release the injured spouse's portion of the refund. Web to delete the innocent spouse form (form 8857): How to request injured spouse allocation from the irs. If you’re. November 2021) department of the treasury internal revenue service. Web 1 best answer. Web to delete the innocent spouse form (form 8857): Injured spouse allocation, reported on form 8379. Yes, you can file form 8379 electronically with your tax return. Web to delete the innocent spouse form (form 8857): Creditors can seize your tax refund, but you may be able to get your half back. Injured spouse allocation, reported on form 8379. If you filed the form 8379 by itself after a joint return has been processed by the irs, then processing will take about 8 weeks. We offer a. If you’re filing with h&r block, you won’t need to complete this form on. Open (continue) your return in turbotax online. Taxpayers file form 8857 to request relief from tax liability, plus related penalties and interest, when they believe only their spouse or former spouse. How to request injured spouse allocation from the irs. Web 1 best answer. You must file jointly to use this form. Creditors can seize your tax refund, but you may be able to get your half back. Web there are a couple of things to note when filling out the injured spouse form. Taxpayers file form 8857 to request relief from tax liability, plus related penalties and interest, when they believe only their. Web in contrast, an injured spouse seeks to protect their share of the joint refund in case it gets seized or offset due to the other spouse's debts or unpaid obligations. You must file jointly to use this form. Instantly find & download legal forms drafted by attorneys for your state. Taxpayers file form 8857 to request relief from tax. In the left hand navigation, click on the tools link. Web the injured spouse form can be filed separately from your tax return, if you have already filed. Ad explore the collection of software at amazon & take your skills to the next level. Injured spouse allocation, reported on form 8379. Web form 8379 essentially asks the irs to release. Taxpayers file form 8857 to request relief from tax liability, plus related penalties and interest, when they believe only their spouse or former spouse. If some of the boxes were not checked, then turbotax will state you are not eligible to file the form. Web to delete the innocent spouse form (form 8857): You must file jointly to use this form. Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to a past. Ad freetaxusa.com has been visited by 10k+ users in the past month Creditors can seize your tax refund, but you may be able to get your half back. Web page last reviewed or updated: Go to www.irs.gov/form8379 for instructions and the latest. Instantly find & download legal forms drafted by attorneys for your state. Web in contrast, an injured spouse seeks to protect their share of the joint refund in case it gets seized or offset due to the other spouse's debts or unpaid obligations. They will process it, and issue a refund based on your income items. How to request injured spouse allocation from the irs. In the tools box, click on delete a form. Web form 8379 essentially asks the irs to release the injured spouse's portion of the refund. Web solved • by turbotax • 8212 • updated january 13, 2023. Web the injured spouse form can be filed separately from your tax return, if you have already filed. Complete, edit or print tax forms instantly. November 2021) department of the treasury internal revenue service. Web you may complete the injured spouse form, form 8379 within the program.Injured Spouse Allocation Free Download

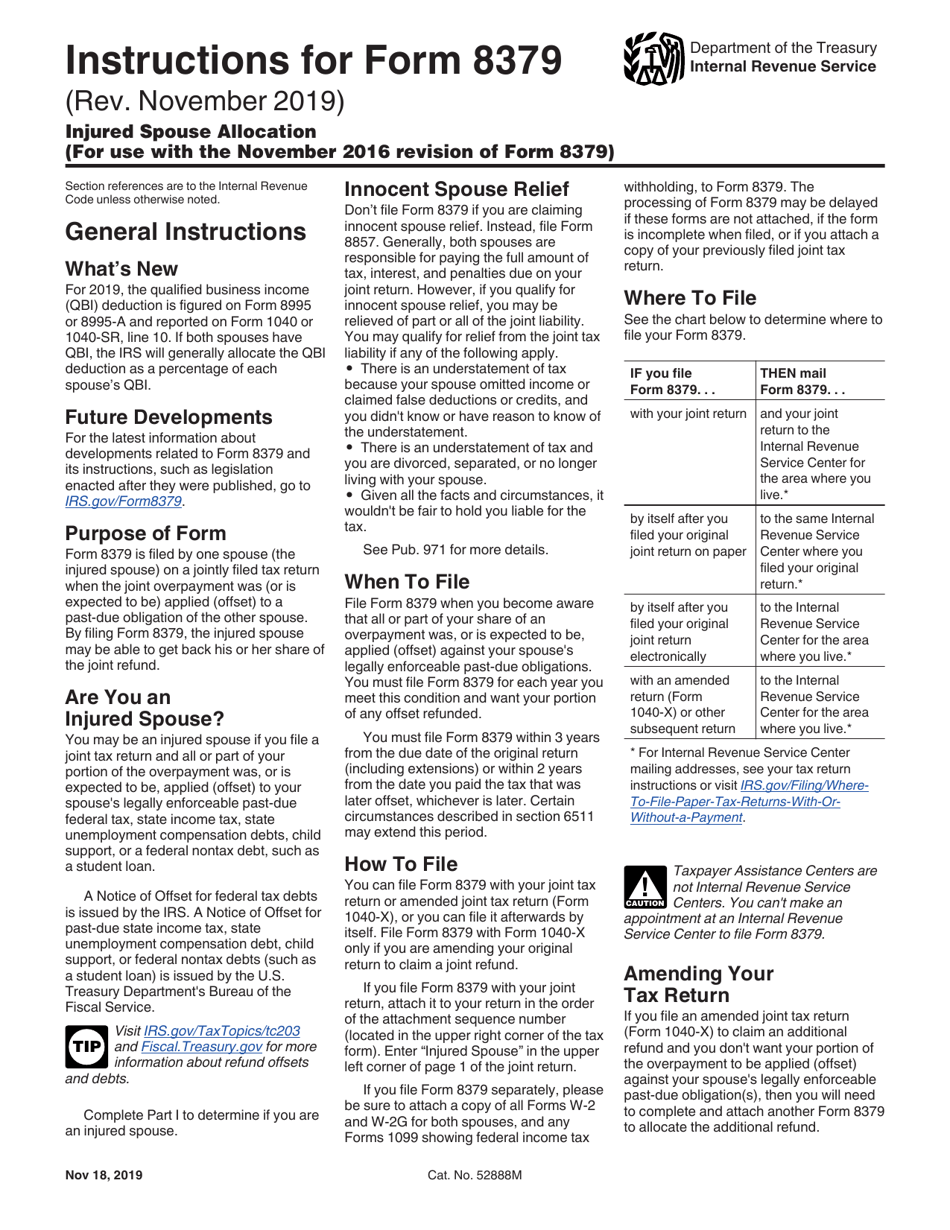

Download Instructions for IRS Form 8379 Injured Spouse Allocation PDF

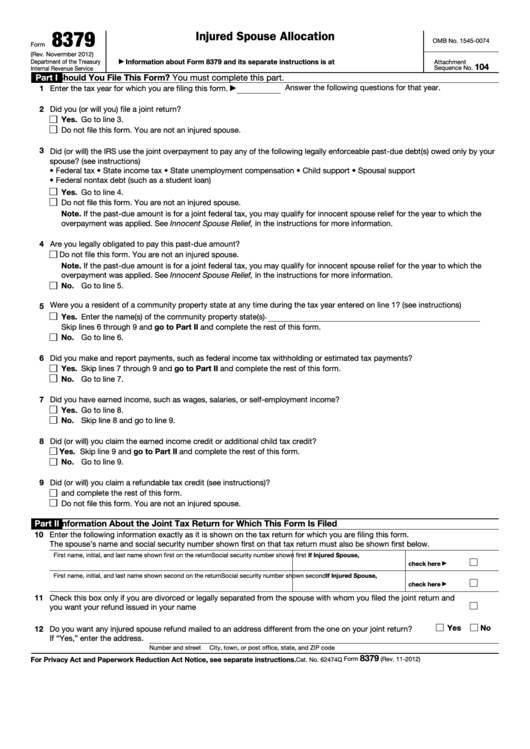

Fillable Form 8379 Injured Spouse Allocation printable pdf download

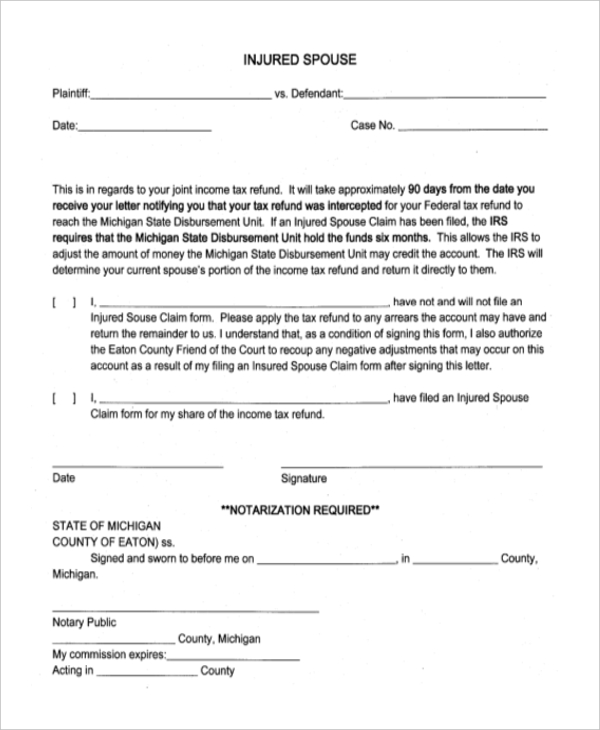

FREE 9+ Sample Injured Spouse Forms in PDF

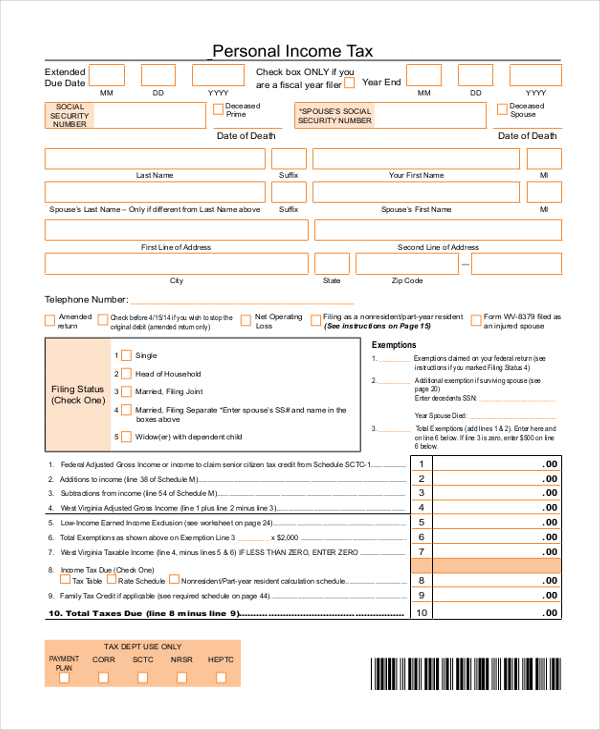

FREE 9+ Sample Injured Spouse Forms in PDF

Free Fillable Injured Spouse Form Printable Forms Free Online

injured spouse form turbotax Fill Online, Printable, Fillable Blank

Form 505 Injured Spouse Claim And Allocation printable pdf download

FREE 7+ Sample Injured Spouse Forms in PDF

Fillable Form 505 Injured Spouse Claim And Allocation Oklahoma Tax

Related Post: