Form 2210 Tax

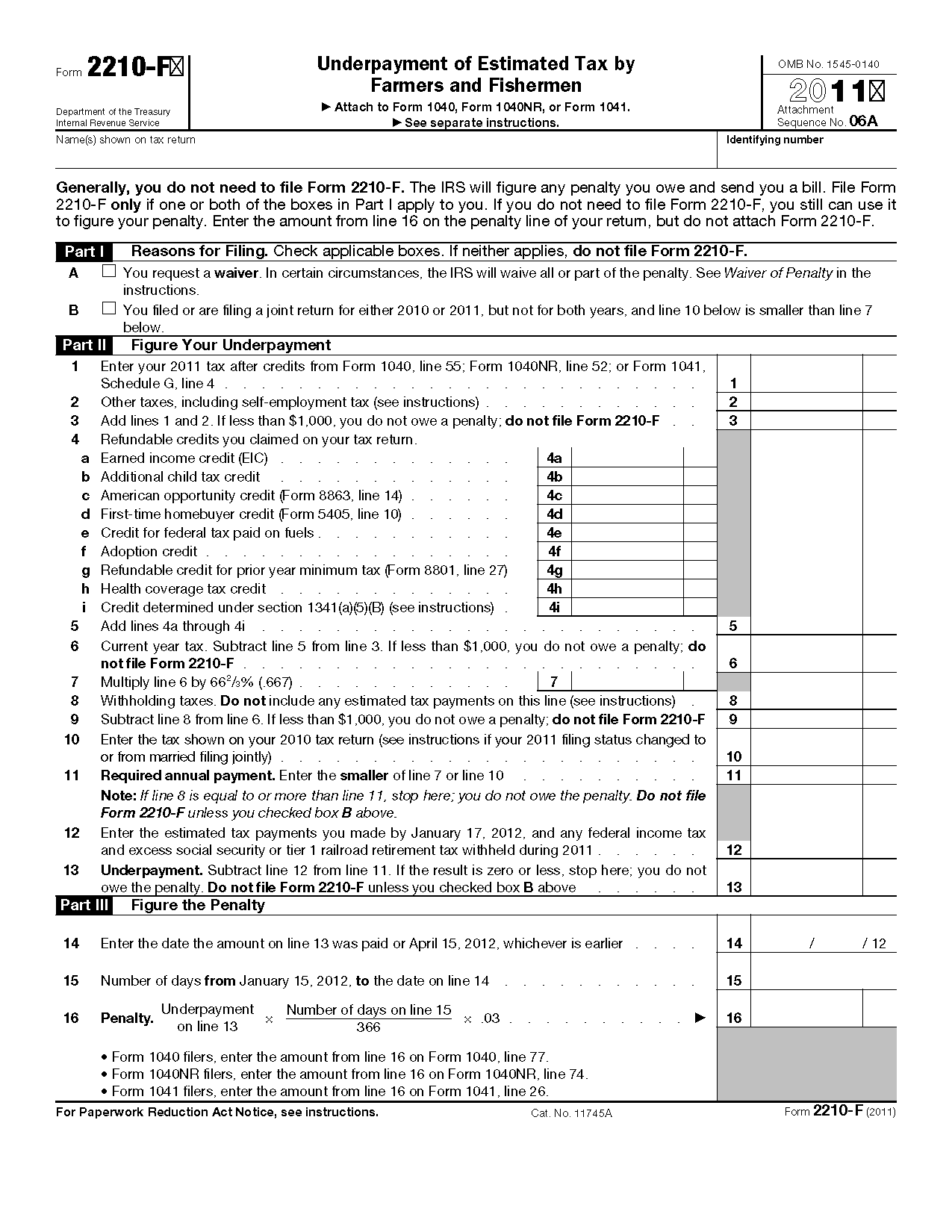

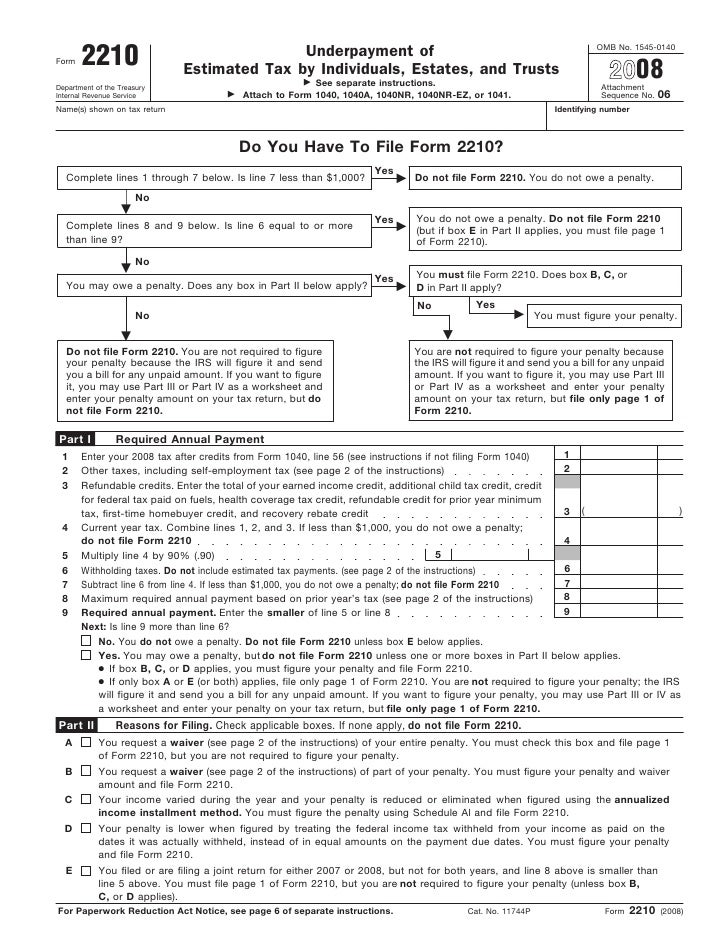

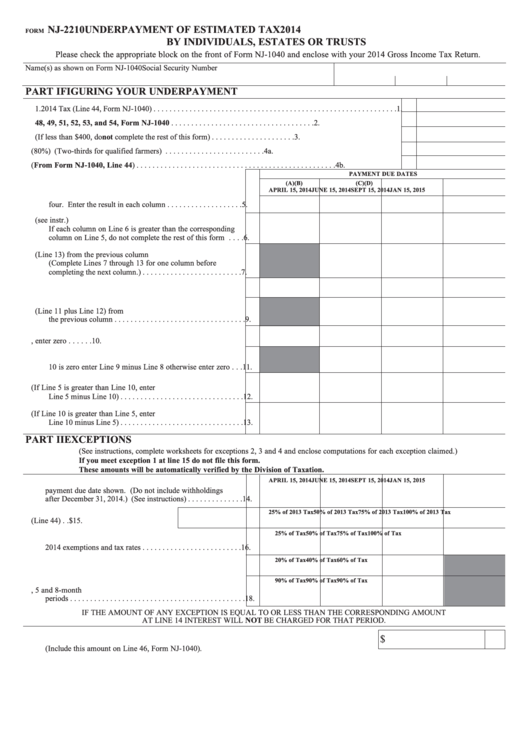

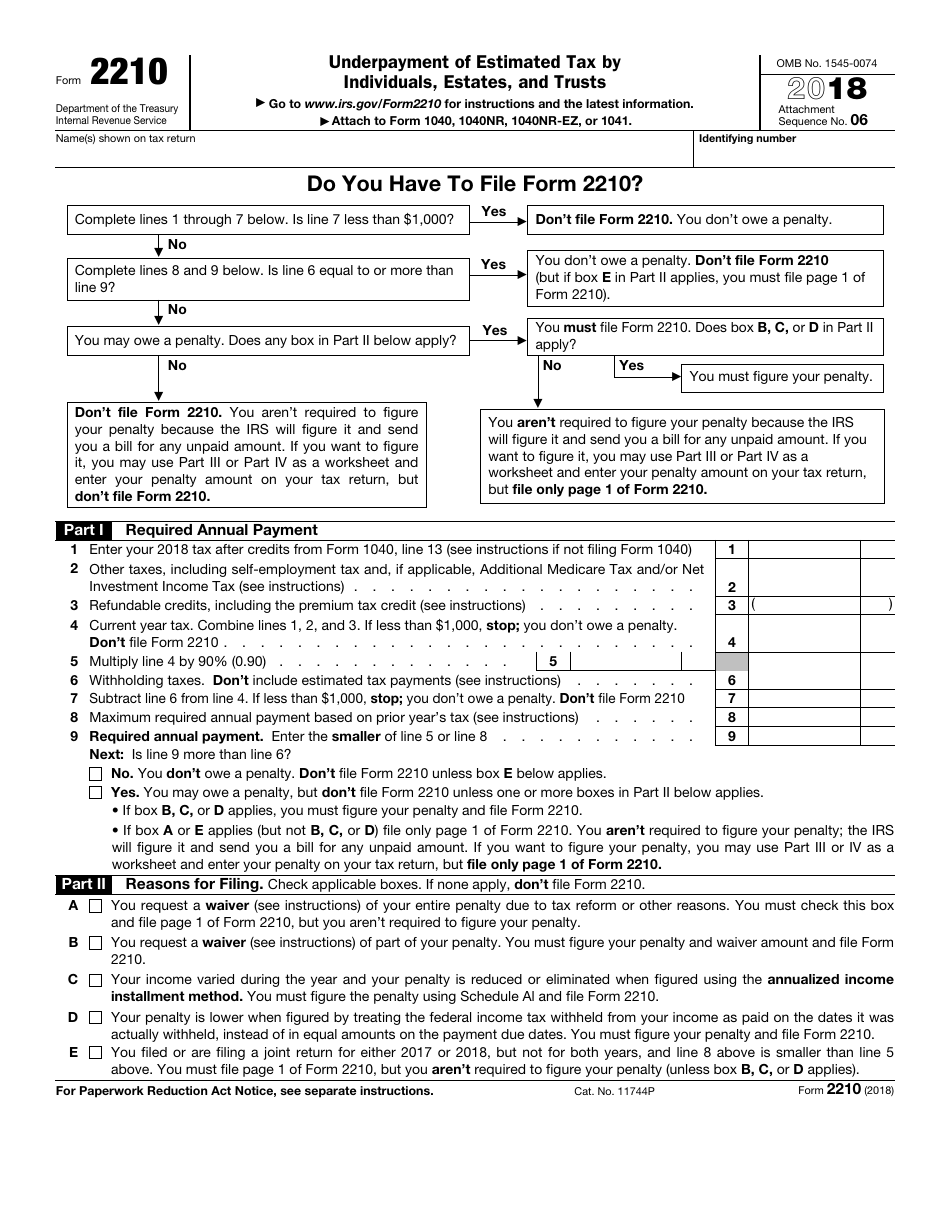

Form 2210 Tax - Web if your adjusted gross income was $150,000 or more (or $75,000 if you’re married filing separately) then you may not be subject to the penalty if you paid the lower of 90% of the. Web forms and instructions. Underpayment of estimated tax by individuals, estates, and trusts. What are tax underpayment penalties? Ad register and subscribe now to work on your irs form 2210 & more fillable forms. If you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out irs form. Web city of phoenix arizona sales tax form 2010. It appears you don't have a pdf plugin for this. Incorporating the 2.2 percent january 2022 general schedule. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Ad register and subscribe now to work on your irs form 2210 & more fillable forms. If you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out irs form. Department of the treasury internal revenue service. What is irs form 2210? Section references are to the internal revenue. For the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were. Solved • by turbotax • 2479 • updated january 13, 2023 irs form 2210 (underpayment of estimated tax by individuals, estates, and. Web how do i add form 2210? If you’re filing an income tax return and haven’t paid enough. Instructions for form 2210 (2022) underpayment of estimated tax by individuals, estates, and trusts. While everyone living in the. For the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were. Your income varies during the year. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Who must file irs form 2210? Web instructions for form 2210. When estimated tax payments are late, filing tax form 2210 is mandatory. Department of the treasury internal revenue service. Web forms and instructions. Web how do i add form 2210? Instructions for form 2210 (2022) underpayment of estimated tax by individuals, estates, and trusts. Form 2210 is typically used by. Incorporating the 2.2 percent january 2022 general schedule. Web instructions for form 2210. It appears you don't have a pdf plugin for this. Web if your adjusted gross income was $150,000 or more (or $75,000 if you’re married filing separately) then you may not be subject to the penalty if you paid the lower of 90% of the. Web how do i add form 2210? Web form 2210 is used to determine how. Web city of phoenix arizona sales tax form 2010. Federal — underpayment of estimated tax by individuals, estates, and trusts. If you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out irs form. Web how do i add form 2210? For the latest information about developments related to. Web how do i add form 2210? Underpayment of estimated tax by individuals, estates and trusts. Web form 2210 is a federal individual income tax form. What are tax underpayment penalties? While everyone living in the. Web forms and instructions. What is irs form 2210? Who must file irs form 2210? Section references are to the internal revenue code unless otherwise noted. Ad register and subscribe now to work on your irs form 2210 & more fillable forms. Check box #3 as the reason for exemption. Who must file irs form 2210? Individual estimated tax payment booklet. Complete, edit or print tax forms instantly. Web instructions for form 2210. Web there were 10 million people in 2017 paying penalties for underpayment of taxes. Who must pay underpayment tax penalties? Web forms and instructions. Complete, edit or print tax forms instantly. Web city of phoenix arizona sales tax form 2010. Underpayment of estimated tax by individuals, estates, and trusts. Form 2210 is typically used by. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Check box #3 as the reason for exemption. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. It appears you don't have a pdf plugin for this. Incorporating the 2.2 percent january 2022 general schedule. When estimated tax payments are late, filing tax form 2210 is mandatory. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. While everyone living in the. Web how do i add form 2210? Who must file irs form 2210? Individual estimated tax payment booklet. Department of the treasury internal revenue service. Ad register and subscribe now to work on your irs form 2210 & more fillable forms.Form 2210 F Underpayment Of Estimated Tax By Farmers And 1040 Form

Form 2210Underpayment of Estimated Tax

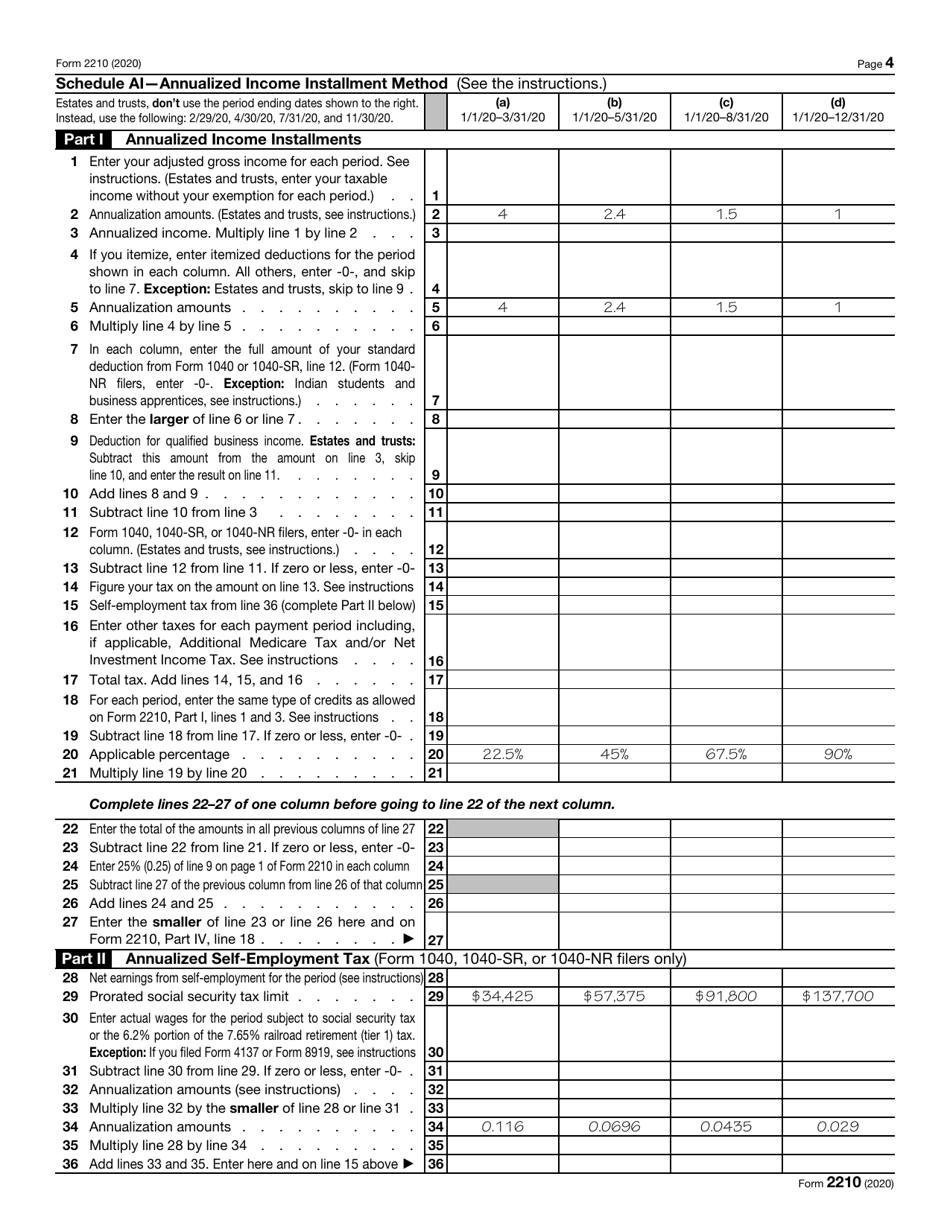

Ssurvivor Irs Form 2210 Ai Instructions

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Fillable Form Nj2210 Underpayment Of Estimated Tax By Individuals

IRS Form 2210 Download Fillable PDF or Fill Online Underpayment of

IRS Form 2210 Download Fillable PDF or Fill Online Underpayment of

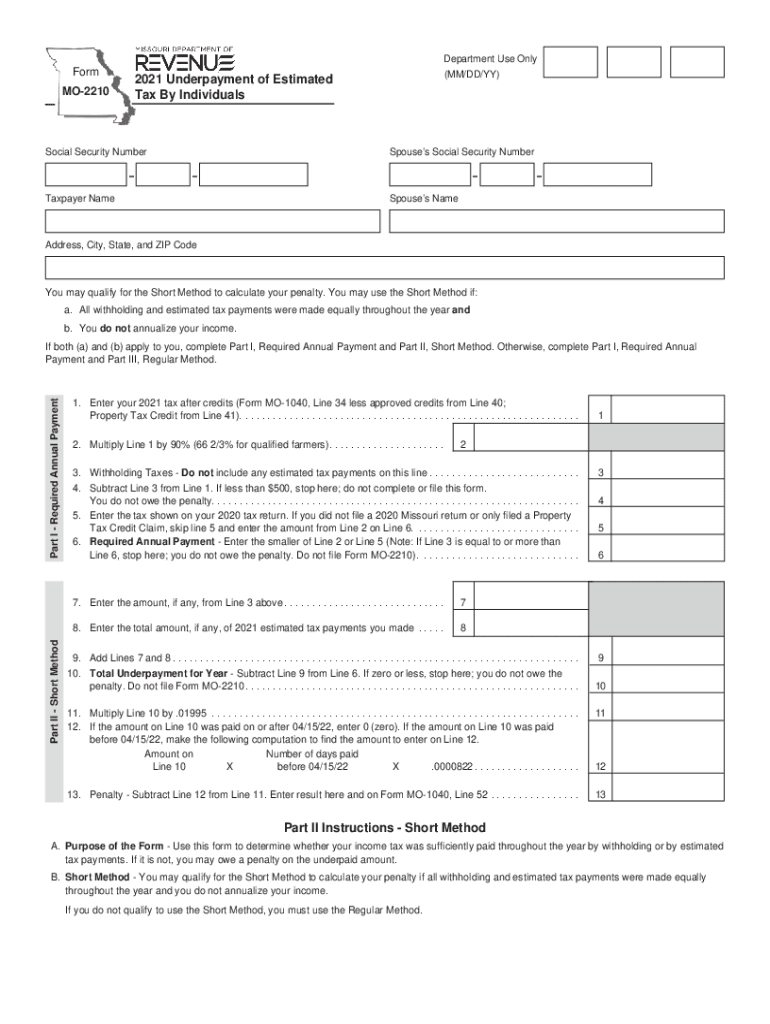

Mo 2210 Fill Out and Sign Printable PDF Template signNow

2017 form 2220 Fill out & sign online DocHub

Form 2210F Underpayment of Estimated Tax by Farmers and Fishermen

Related Post: