Turbotax Form 5405

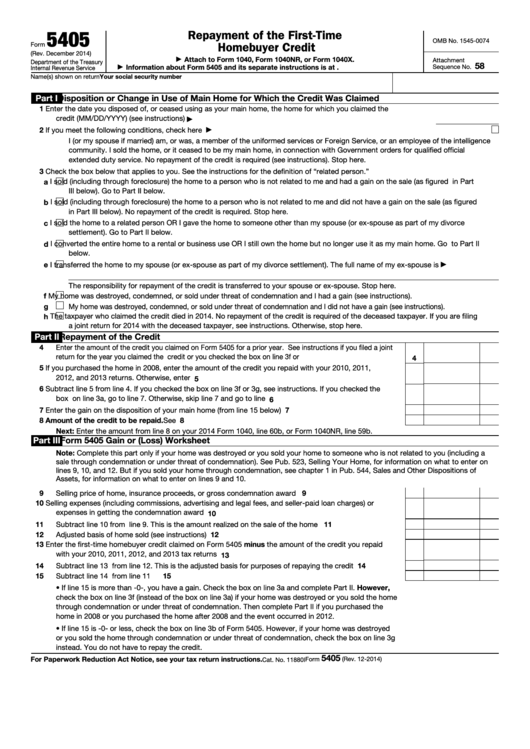

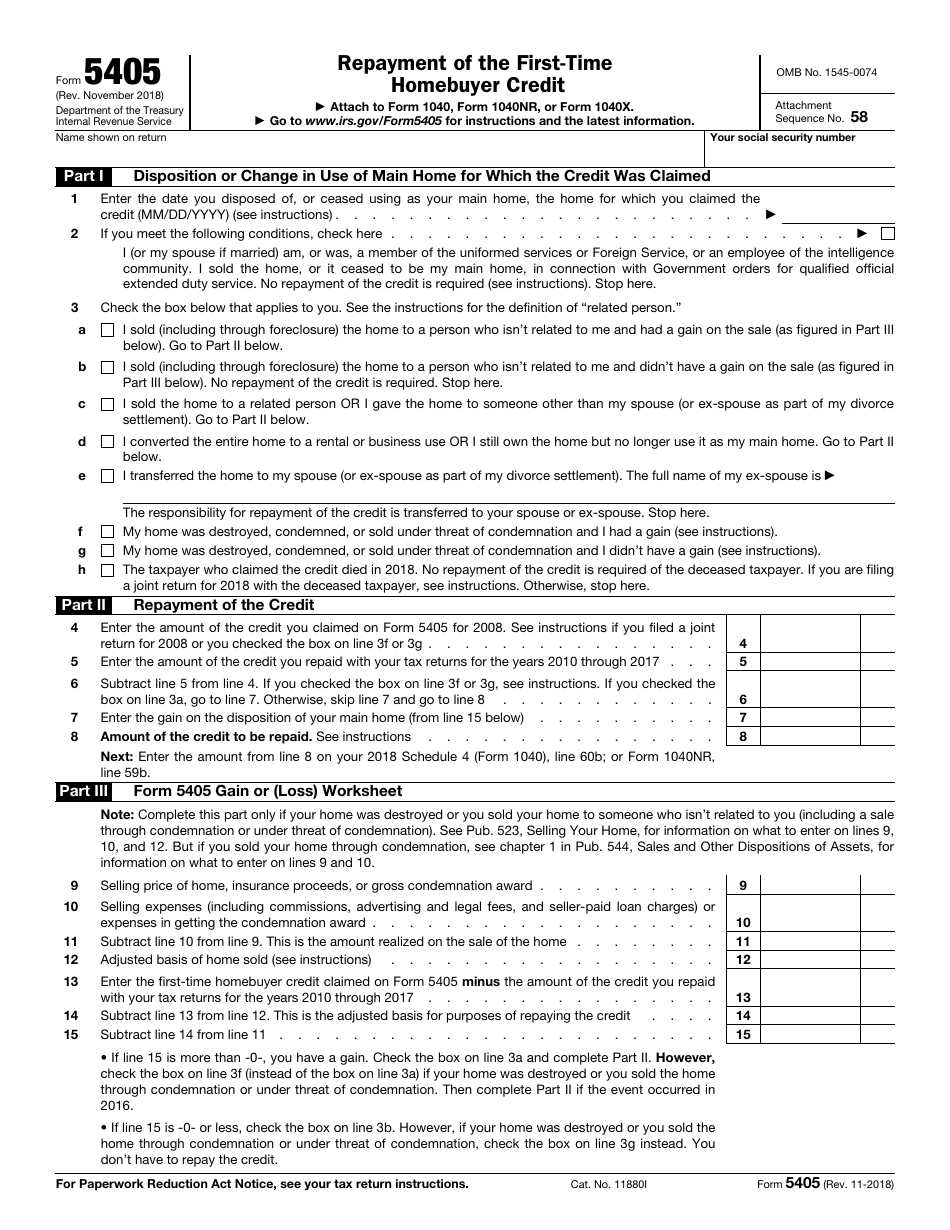

Turbotax Form 5405 - Web complete the repayment of the first time homebuyer credit section to figure the amount of the credit you must repay with your 2021 tax return or let the irs know you disposed of. Ad save time and money with professional tax planning & preparation services. Web when continuing, turbotax said it is deleting form 5405. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. You sold or otherwise disposed of that home for a. You disposed of it in 2021. Web per the irs instructions for form 5405: Web the submitted form 5405 should have data then entered in section two but is blank. Ad explore the collection of software at amazon & take your skills to the next level. Enjoy great deals and discounts on an array of products from various brands. Figure the amount of the credit. The form is used for the credit received if you bought a. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. You indicated to turbotax that the home was not your main home during 2019 by selecting. You disposed of it in 2022. Use this toolto look up when your individual tax forms will be available in turbotax. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. You indicated to turbotax that the home was not your main home during 2019 by selecting yes,. I had to override the entry for line 60b and was informed that the form was incomplete and should not. Web the irs requires you to prepare irs form 5405 before you can claim the credit. Complete, edit or print tax forms instantly. Web a simple tax return is one that's filed using irs form 1040 only, without having to. If you sold the home in a year before 2020, the interview will not let you make a $500 payment and it will kick. You disposed of it in 2022. Web you must file form 5405 with your 2021 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web a simple tax. November 2022) department of the treasury internal revenue service. Easily sort by irs forms to find the product that best fits your tax. If you sold the home in a year before 2020, the interview will not let you make a $500 payment and it will kick. Web complete the repayment of the first time homebuyer credit section to figure. You must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following. Web complete the repayment of the first time homebuyer credit section to figure the amount of the credit you must repay with your 2021 tax return or let the irs know you disposed of. You indicated. Enjoy great deals and discounts on an array of products from various brands. Minimize potential audit risks and save time when filing taxes each year Web why does turbotax keep looping out of the question? Web the irs requires you to prepare irs form 5405 before you can claim the credit. I can understand why turbotax does nothing then with. Web solved•by turbotax•3033•updated january 13, 2023. You must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following. Ad save time and money with professional tax planning & preparation services. Web when continuing, turbotax said it is deleting form 5405. Ad explore the collection of software at amazon. Figure the amount of the credit. Web per the irs instructions for form 5405: Solved • by turbotax • 2322 • updated january 13, 2023 form 5405 (repayment of. Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your main home. Web to complete form 5405 due to the disposition. Complete, edit or print tax forms instantly. November 2022) department of the treasury internal revenue service. Web when continuing, turbotax said it is deleting form 5405. Web why does turbotax keep looping out of the question? Web to complete form 5405 due to the disposition of the home or due to it no longer being the main home, from the. Web the submitted form 5405 should have data then entered in section two but is blank. Web to complete form 5405 due to the disposition of the home or due to it no longer being the main home, from the main menu of the tax return (form 1040), select: Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Get ready for tax season deadlines by completing any required tax forms today. Web the irs requires you to prepare irs form 5405 before you can claim the credit. Only certain taxpayers are eligible. You must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following. Web why does turbotax keep looping out of the question? Web if you made a qualifying home purchase in 2008 and owned and used the home as a principal residence in all of 2022, you must enter the additional federal income tax on. You indicated to turbotax that the home was not your main home during 2019 by selecting yes, but the home we received the credit for. Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your main home. Complete, edit or print tax forms instantly. Ad explore the collection of software at amazon & take your skills to the next level. You disposed of it in 2022. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Web per the irs instructions for form 5405: Enjoy great deals and discounts on an array of products from various brands. Web when continuing, turbotax said it is deleting form 5405. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web use this form to:Fillable Form 5405 Repayment Of The FirstTime Homebuyer Credit

IRS Form 5405 Download Fillable PDF or Fill Online Repayment of the

Form 5405 Repayment of the FirstTime Homebuyer Credit (2014) Free

form 8949 turbotax 2022 Fill Online, Printable, Fillable Blank form

form 8915 e instructions turbotax Renita Wimberly

IRS Form 5405 Irs Tax Forms Public Finance

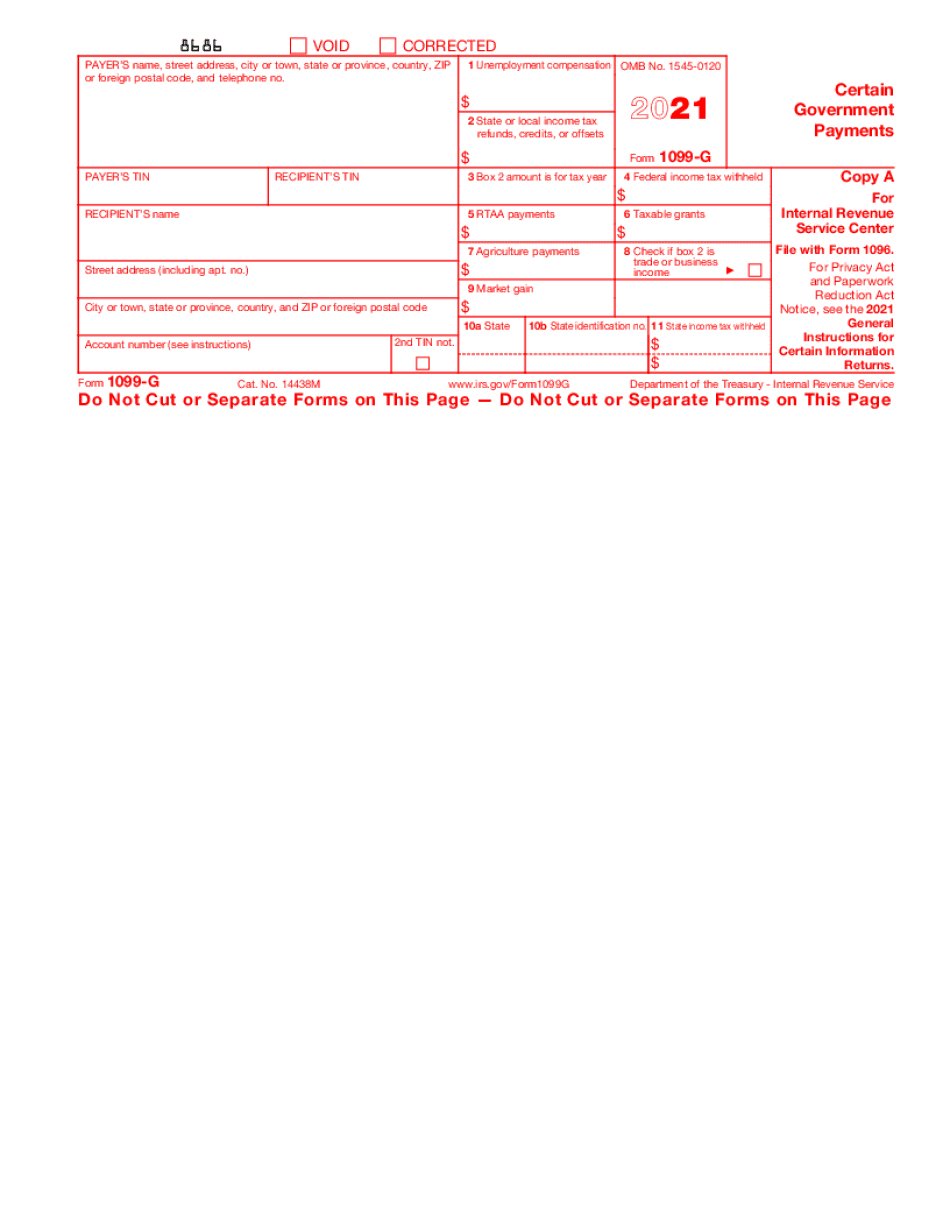

1099g california turbotax Fill Online, Printable, Fillable Blank

Turbotax Worksheet

1065 tax return turbo tax welllasopa

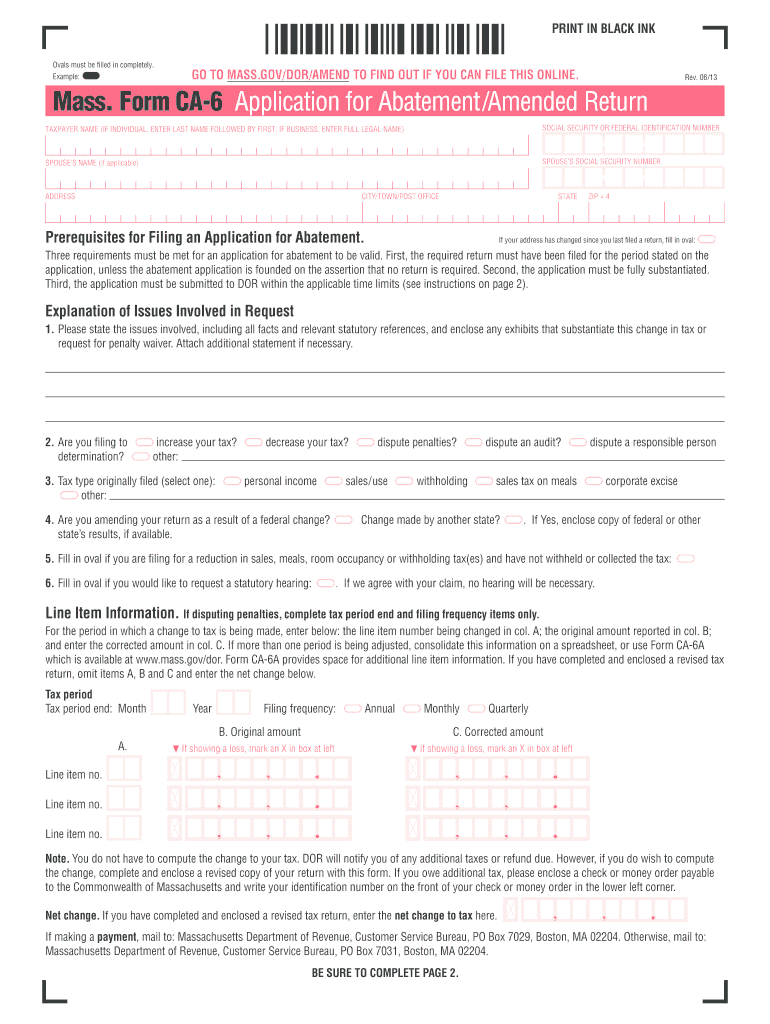

What Is The Form CA 6 TurboTax Support Fill Out and Sign Printable

Related Post: