Form 3522 Due Date

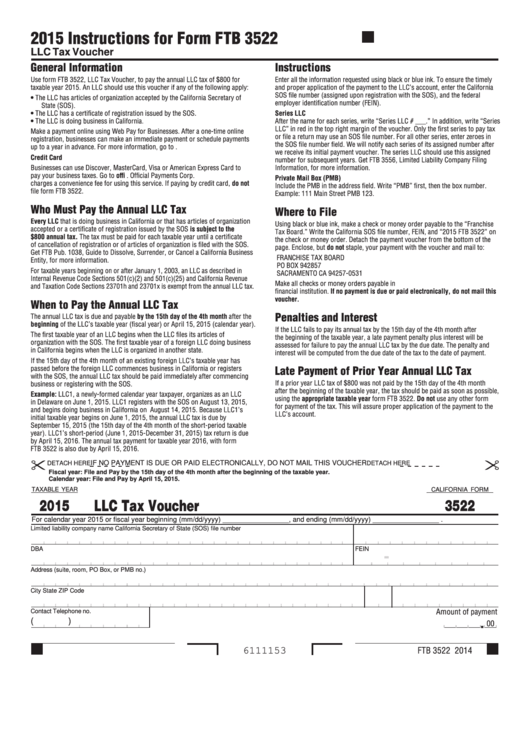

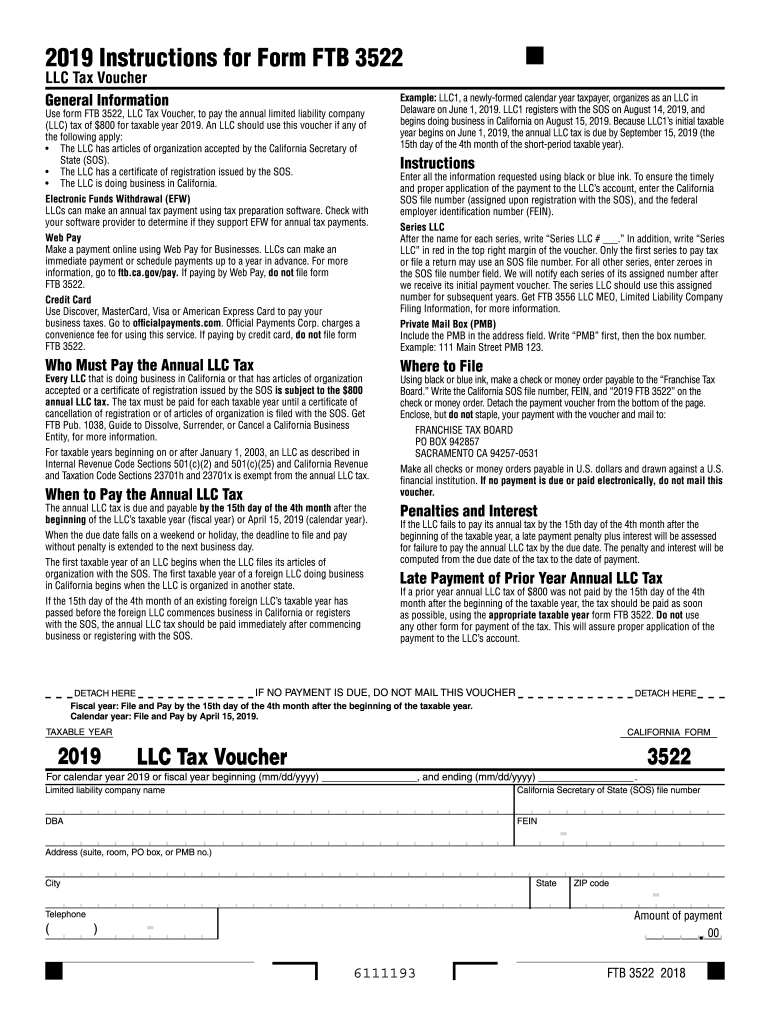

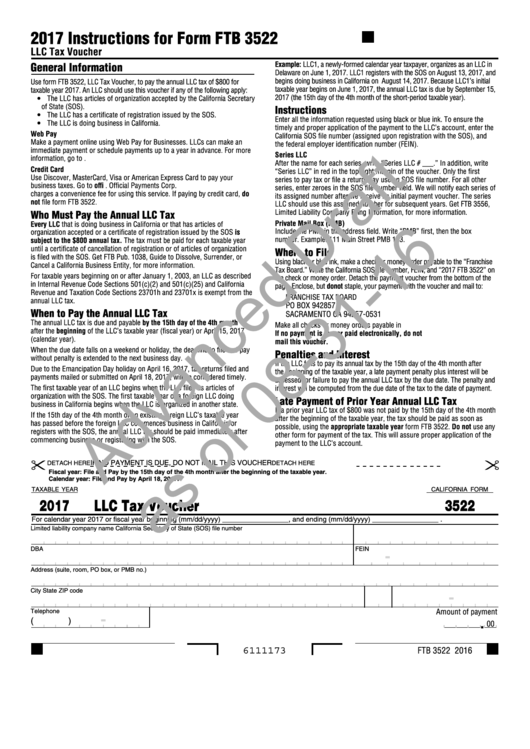

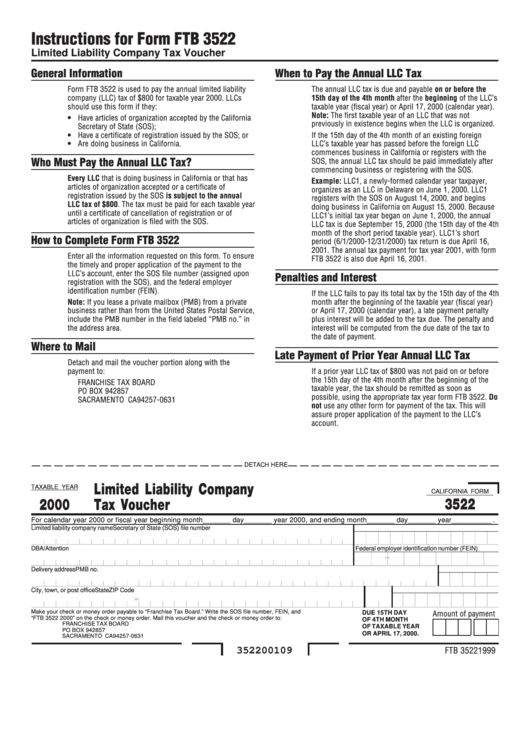

Form 3522 Due Date - Late payment of prior year annual llc tax. Web california llcs must file form 3522 (llc tax voucher) to pay the california franchise tax. Ad fill out any legal form in minutes. Web the annual tax due date for payment is april 15 of every taxable year. Web you’ll need to submit your first statement of information within 90 days after the state approves your llc. Get ready for tax season deadlines by completing any required tax forms today. Amount of 2022 overpayment to apply to 2023 tax. Web the annual llc tax is due and payable by the 15th day of the 4th month after the beginning of the llc’s taxable year (fiscal year) or april 15, 2020 (calendar year). Ad access irs tax forms. The penalty and interest will be computed from the due date of the return to the date of the payment. Web use this section to calculate next year’s (2023) llc tax payment and estimated fee. Use form 3522, limited liability company tax voucher to pay the annual tax. Web the annual tax due date for payment is april 15 of every taxable year. Suppress printing of form 3522 (for 2023 tax). Web the corporation is in good standing with the. Afterwards, you must submit it every 2 years. Use form 3522, limited liability company tax voucher to pay the annual tax. Get ready for tax season deadlines by completing any required tax forms today. The corporation files form 3522 prior to. Web the 20 21 form 3522 (current year) prints along with 20 20 form 568 and is due by. Any llc doing business in california that has over $250,000 in gross income attributable to california must pay an annual llc. The corporation files form 3522 prior to. Web april 07, 2020 by alex oxford, cmi. Web the corporation is in good standing with the california secretary of state and the franchise tax board on the due date of form. Web computed from the due date of the tax to the date of payment. Suppress printing of form 3522 (for 2023 tax). Ad access irs tax forms. You’re required to pay an annual fee. Web the 20 21 form 3522 (current year) prints along with 20 20 form 568 and is due by the fifteenth day of the fourth month. Ad access irs tax forms. Web up to $40 cash back how to fill out california form ftb 3522: Web the annual tax due date for payment is april 15 of every taxable year. Web every year after this point, the llc franchise tax and form 3522 are due on april 15. A business may pay by the next business. Concerning the form (565 or 568) that should be filed along with the ft 3522, the yearly llc tax is due by the 15th day of the 4th month. Web the 20 21 form 3522 (current year) prints along with 20 20 form 568 and is due by the fifteenth day of the fourth month following the beginning of the. Web up to $40 cash back how to fill out california form ftb 3522: Any llc doing business in california that has over $250,000 in gross income attributable to california must pay an annual llc. Web the annual tax due date for payment is april 15 of every taxable year. Web every year after this point, the llc franchise tax. Web the annual tax is due on the 15th day of the fourth month after the beginning of the tax year. Concerning the form (565 or 568) that should be filed along with the ft 3522, the yearly llc tax is due by the 15th day of the 4th month. The due date for the california tax is. Web the. Late payment of prior year annual llc tax. Concerning the form (565 or 568) that should be filed along with the ft 3522, the yearly llc tax is due by the 15th day of the 4th month. Web you’ll need to submit your first statement of information within 90 days after the state approves your llc. Web due date of. Web the annual tax is due on the 15th day of the fourth month after the beginning of the tax year. The $800 franchise tax for california llcs is due in the fourth month after llc approval and annually on april 15th. A business may pay by the next business day if the due date falls on a weekend or. The penalty and interest will be computed from the due date of the return to the date of the payment. Get ready for tax season deadlines by completing any required tax forms today. Web april 07, 2020 by alex oxford, cmi. Detach here if no payment is due, do. Ad fill out any legal form in minutes. The $800 franchise tax for california llcs is due in the fourth month after llc approval and annually on april 15th. 2022 fourth quarter estimated tax payments due for individuals. Complete, edit or print tax forms instantly. Web the annual tax is due on the 15th day of the fourth month after the beginning of the tax year. Easy to use, save, & print. Web use this section to calculate next year’s (2023) llc tax payment and estimated fee. 15th day of the 4th month after the beginning of your tax year. Due to the federal emancipation day. Web up to $40 cash back how to fill out california form ftb 3522: Suppress printing of form 3522 (for 2023 tax). Begin by gathering all the necessary information and documents required to complete the form, including your business. Web every year after this point, the llc franchise tax and form 3522 are due on april 15. Afterwards, you must submit it every 2 years. Web the annual tax due date for payment is april 15 of every taxable year. The amount will be based on total income from.California Form 3522 Llc Tax Voucher 2015 printable pdf download

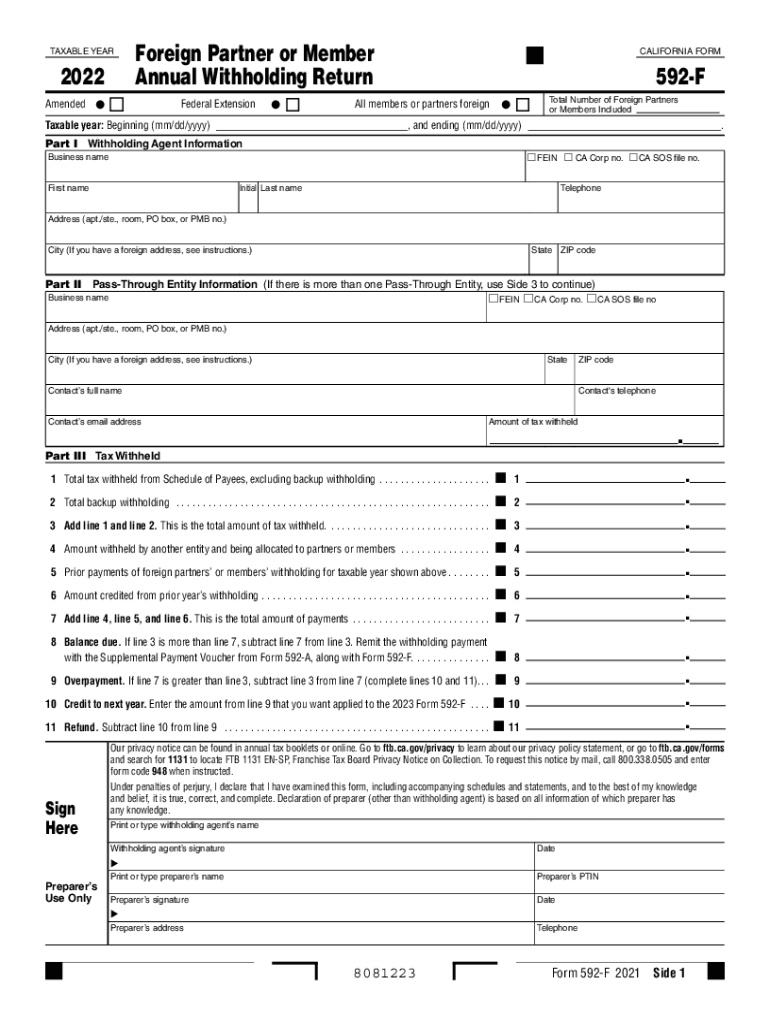

592 F Fill Out and Sign Printable PDF Template signNow

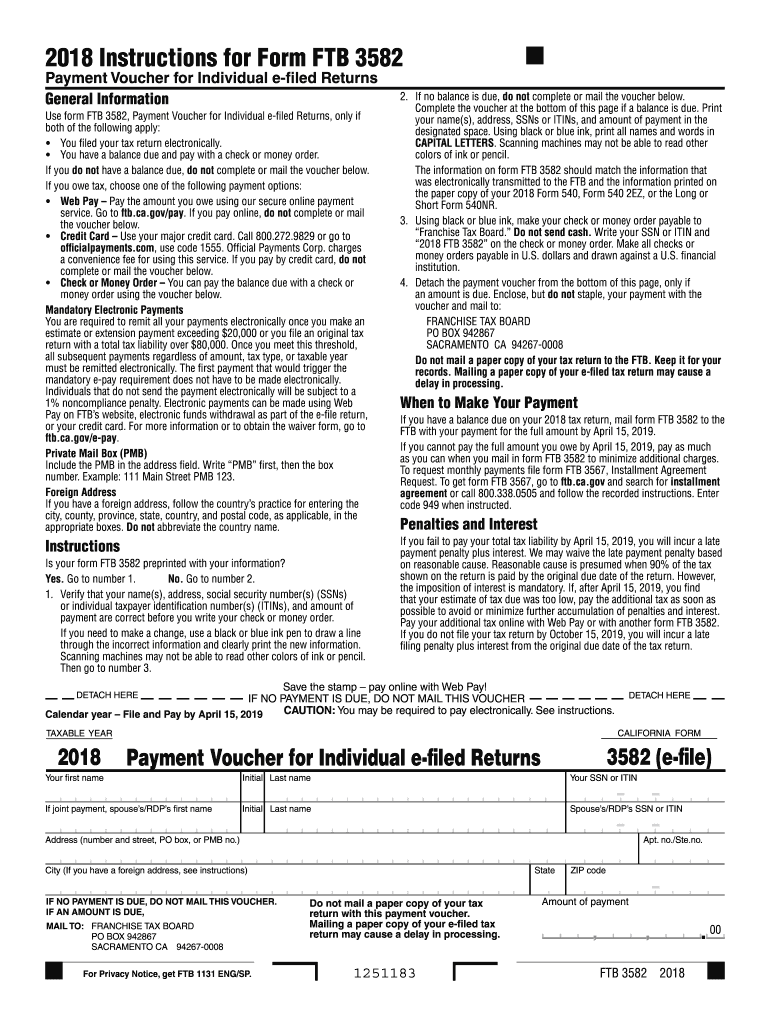

Ftb 3582 Fill Out and Sign Printable PDF Template signNow

Form 3522 Fill Out and Sign Printable PDF Template signNow

California Form 3522 (Draft) Llc Tax Voucher 2017 printable pdf

Business CA LLC entity 800 minimum Annual Tax Payment (Form 3522

2020 Form CA FTB 540Fill Online, Printable, Fillable, Blank pdfFiller

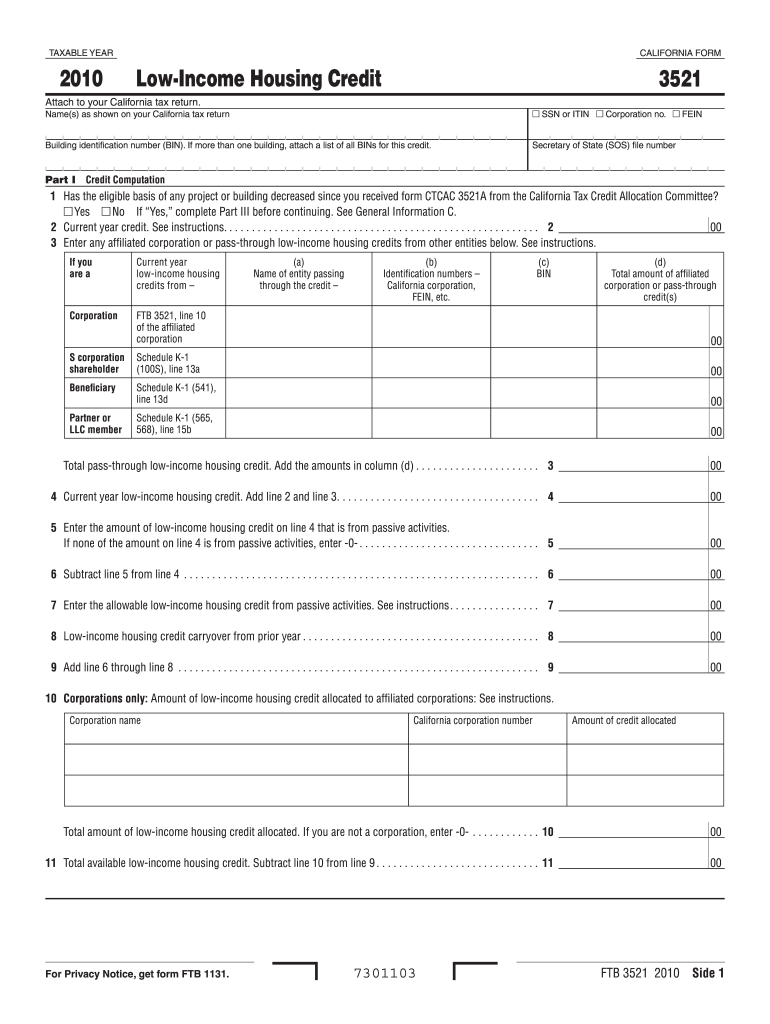

Form 3521 Fill Online, Printable, Fillable, Blank pdfFiller

Business CA LLC entity 800 minimum Annual Tax Payment (Form 3522

Form Ftb 3522 Limited Liability Company Tax Voucher 2000 printable

Related Post: