Ca Form 100

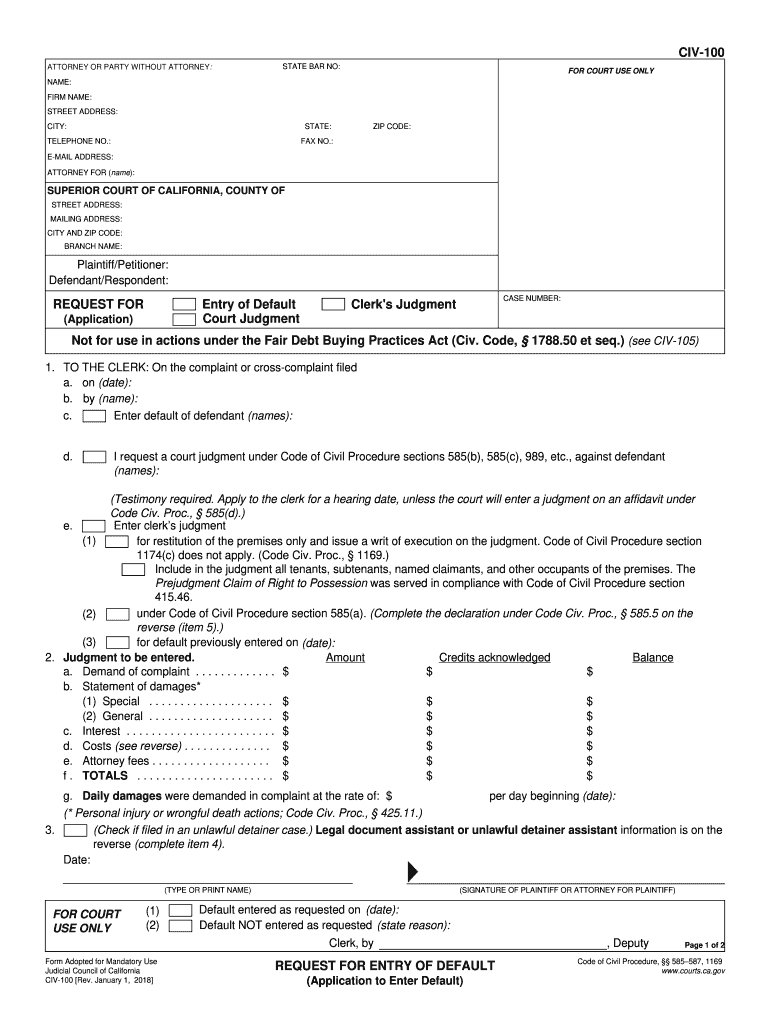

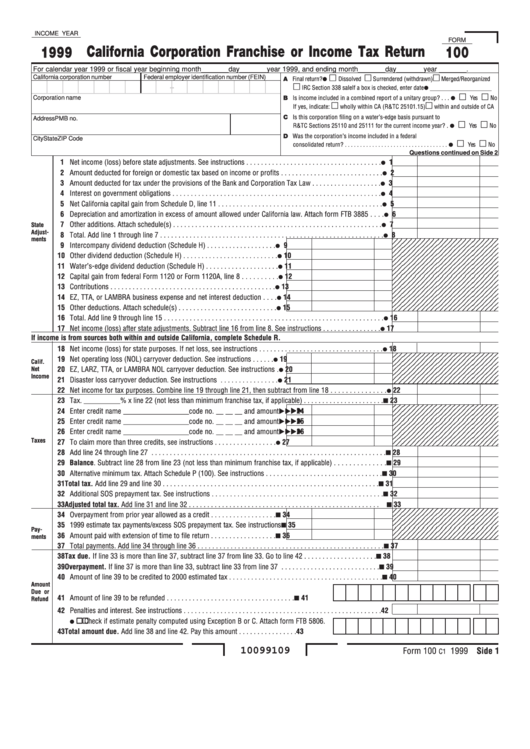

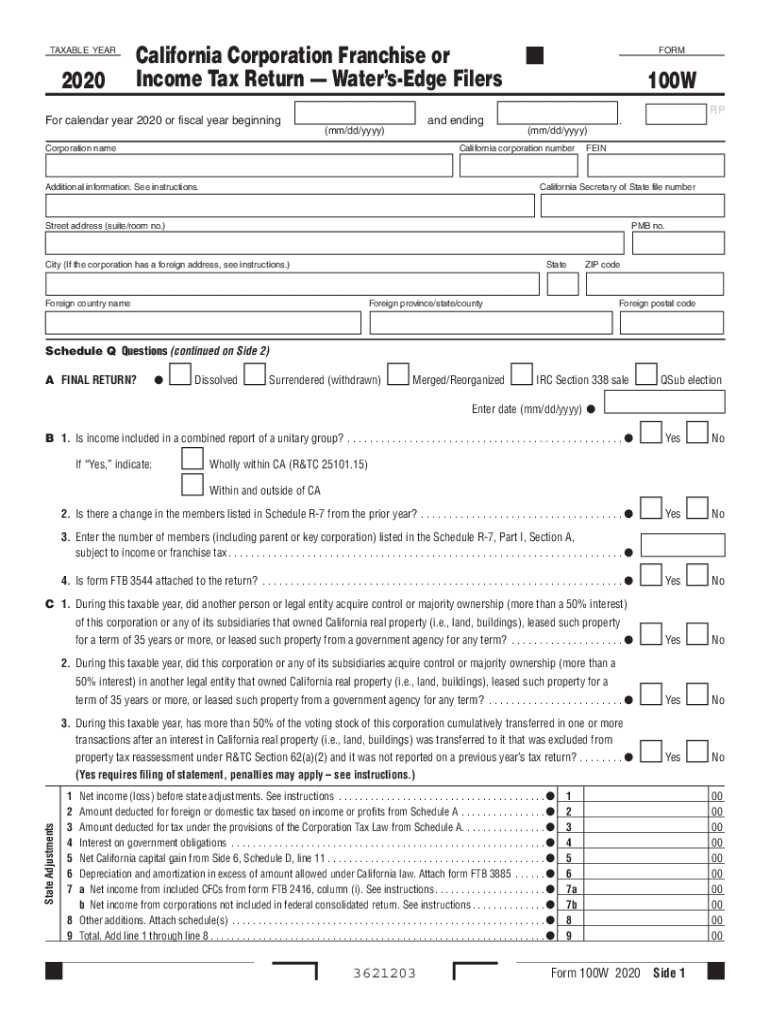

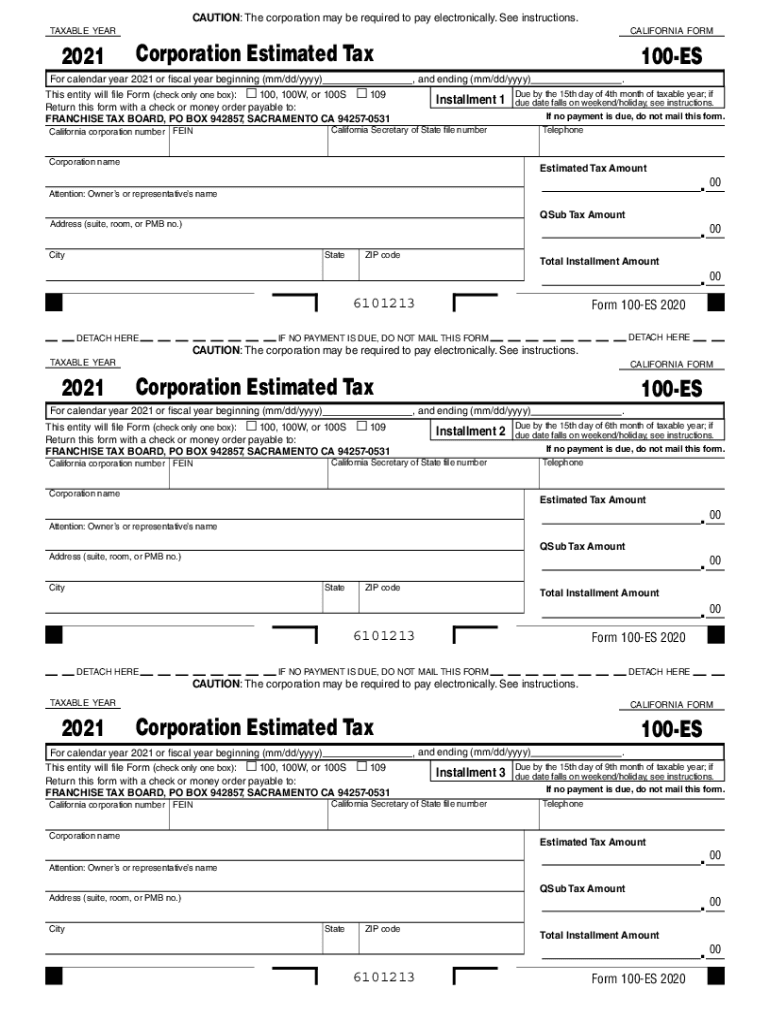

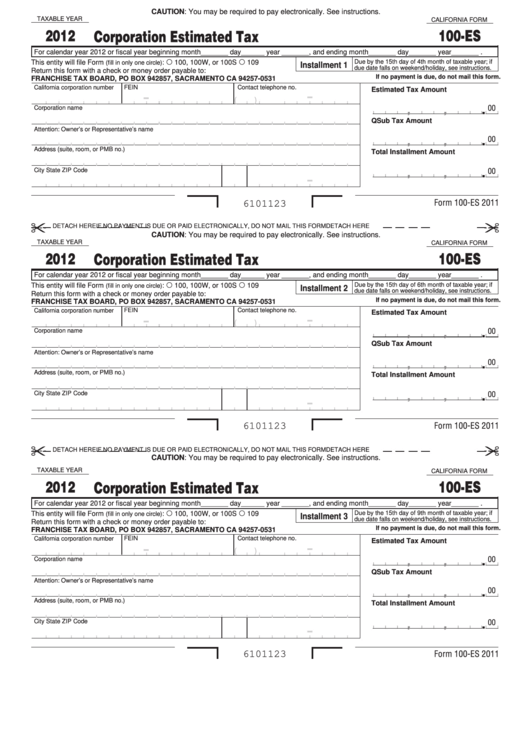

Ca Form 100 - Using black or blue ink, make the check or money order payable to the franchise tax board. write the california corporation number and. To begin care act proceedings. Web welcome to bizfile california, the secretary of state’s online portal to help businesses file, search, and order business records. As it is of record with the california secretary of state. Web since the s corporation is doing business in both nevada and california, it must file form 100s (california s corporation franchise or income tax return) and use schedule r to. Original due date is the 15th day of the 4th month after the close of the taxable year and extended due date is the 15th day of the 11th month after the close of the. See the links below for the california ftb form instructions. Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). We last updated the california s corporation franchise or income tax return in january 2023,. Attach federal schedule c, (california. Web ca form 100s, california s corporation franchise or income tax return. To begin care act proceedings. Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). Whether you are filing a financing. November 1, 2021, mandatory form code of civil procedure, §§ 116.110 et seq., 116.220(c), 116.340(g) plaintiff's claim and. Web 3601203 form 100 2020 side 1 taxable year 2020 california corporation franchise or income tax return form 100 schedule q questions (continued on side 2) a final. Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). Enter the name of the corporation. Original due date is the 15th day. Web we last updated the california corporation franchise or income tax return in january 2023, so this is the latest version of form 100, fully updated for tax year 2022. Enter the name of the corporation. Whether you are filing a financing. Web cost of goods sold. Statement of information (california nonprofit, credit union and. Web 3601203 form 100 2020 side 1 taxable year 2020 california corporation franchise or income tax return form 100 schedule q questions (continued on side 2) a final. Whether you are filing a financing. See the links below for the california ftb form instructions. Subtract line 2 from line 1c: Web we last updated the california corporation franchise or income. All federal s corporations subject to california laws must file form 100s. Web 3601203 form 100 2020 side 1 taxable year 2020 california corporation franchise or income tax return form 100 schedule q questions (continued on side 2) a final. Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). Web. Subtract line 2 from line 1c: Enter the name of the corporation. To begin care act proceedings. Web we last updated california form 100 in january 2023 from the california franchise tax board. All federal s corporations subject to california laws must file form 100s. Web since the s corporation is doing business in both nevada and california, it must file form 100s (california s corporation franchise or income tax return) and use schedule r to. Microsoft released the following nonsecurity updates for office in october 2023. Subtract line 2 from line 1c: See the links below for the california ftb form instructions. Web all. Whether you are filing a financing. Web since the s corporation is doing business in both nevada and california, it must file form 100s (california s corporation franchise or income tax return) and use schedule r to. Subtract line 2 from line 1c: Microsoft released the following nonsecurity updates for office in october 2023. See the links below for the. Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). Enter the name of the corporation. Weber, ph.d., california secretary of state 1500 11th street sacramento, california 95814 office: Statement of information (california nonprofit, credit union and. Web in addition, any time there are information changes in between statutory filing periods, an. All federal s corporations subject to california laws must file form 100s. When do i file my corporation return? To begin care act proceedings. Web ca form 100s, california s corporation franchise or income tax return. Web 3601203 form 100 2020 side 1 taxable year 2020 california corporation franchise or income tax return form 100 schedule q questions (continued on. Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). Enter the name of the corporation. See the links below for the california ftb form instructions. Web 3601203 form 100 2020 side 1 taxable year 2020 california corporation franchise or income tax return form 100 schedule q questions (continued on side 2) a final. Using black or blue ink, make the check or money order payable to the franchise tax board. write the california corporation number and. Web form 100 is california’s tax return for corporations, banks, financial corporations, real estate mortgage investment conduits (remics), regulated investment companies (rics),. Attach federal schedule c, (california. Web in addition, any time there are information changes in between statutory filing periods, an updated statement should be filed. Whether you are filing a financing. Original due date is the 15th day of the 4th month after the close of the taxable year and extended due date is the 15th day of the 11th month after the close of the. Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). Web 2021 form 100s california s corporation franchise or income tax return. Subtract line 2 from line 1c: During this taxable year, did another person or legal entity. Web judicial council of california, rev. Web welcome to bizfile california, the secretary of state’s online portal to help businesses file, search, and order business records. Web we last updated california form 100 in january 2023 from the california franchise tax board. This form is for income earned in tax year 2022, with tax returns due in april. As it is of record with the california secretary of state. To begin care act proceedings.20182020 Form CA CIV100 Fill Online, Printable, Fillable, Blank

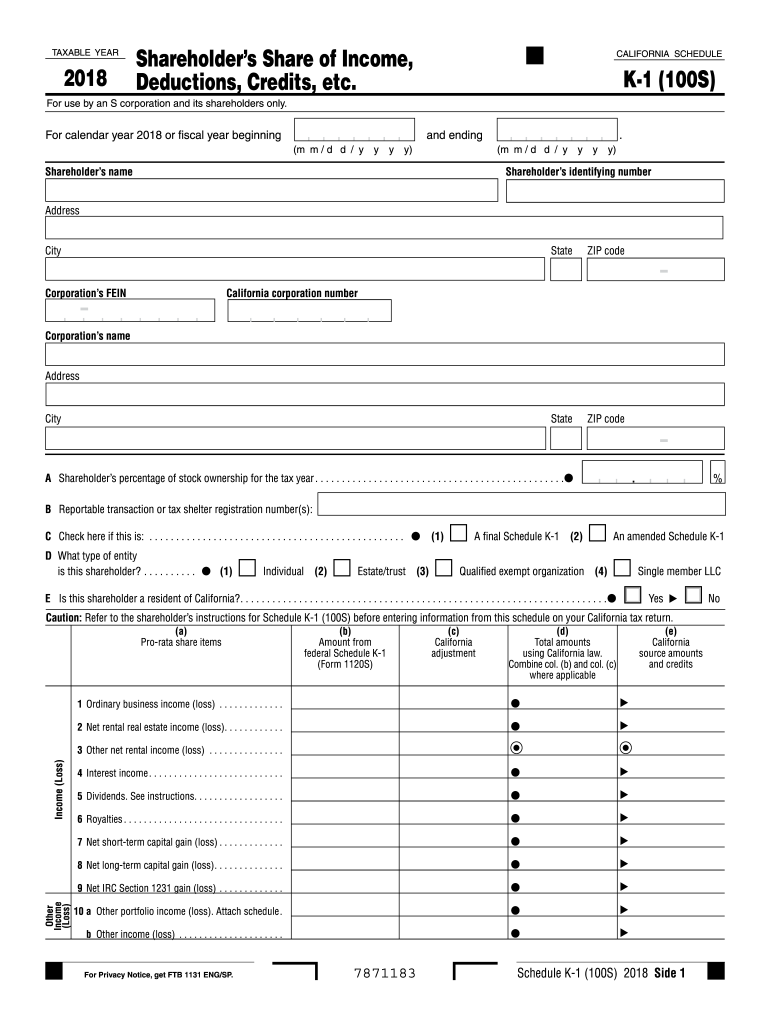

Ca 100s sch k 1 Fill out & sign online DocHub

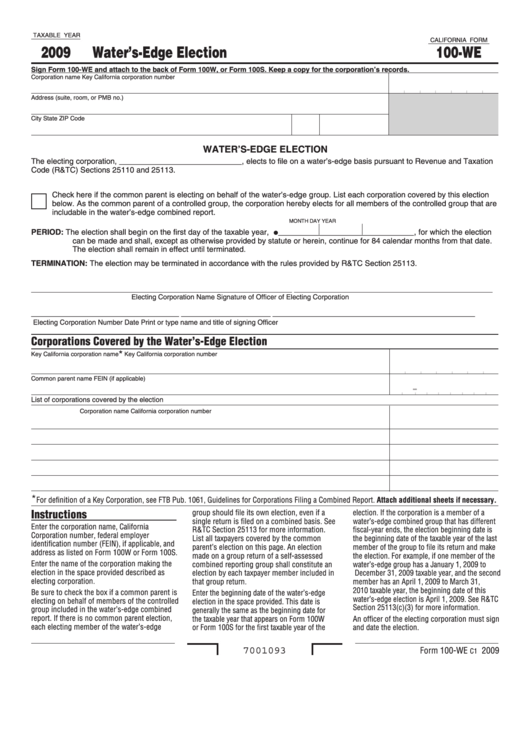

California Form 100We Water'SEdge Election 2009 printable pdf

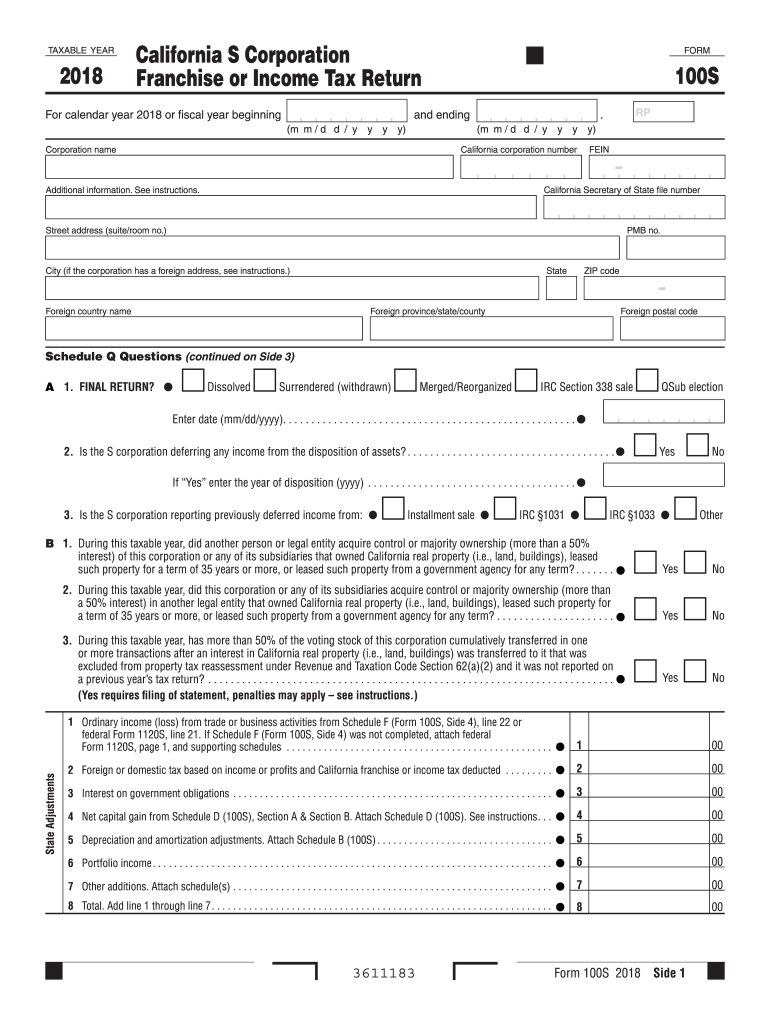

2018 Ca Form 100S Inputable Fill Out and Sign Printable PDF Template

Fillable Form 100 California Corporation Franchise Or Tax

2020 Form CA FTB 100W Fill Online, Printable, Fillable, Blank pdfFiller

100 ca Fill out & sign online DocHub

2014 Form CA CH100 Fill Online, Printable, Fillable, Blank pdfFiller

CA FL100 Form The Basics

Fillable California Form 100Es Corporation Estimated Tax 2012

Related Post: