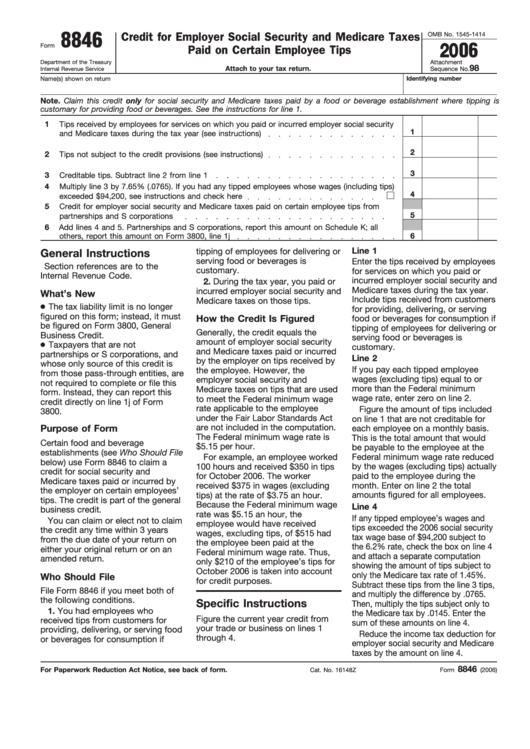

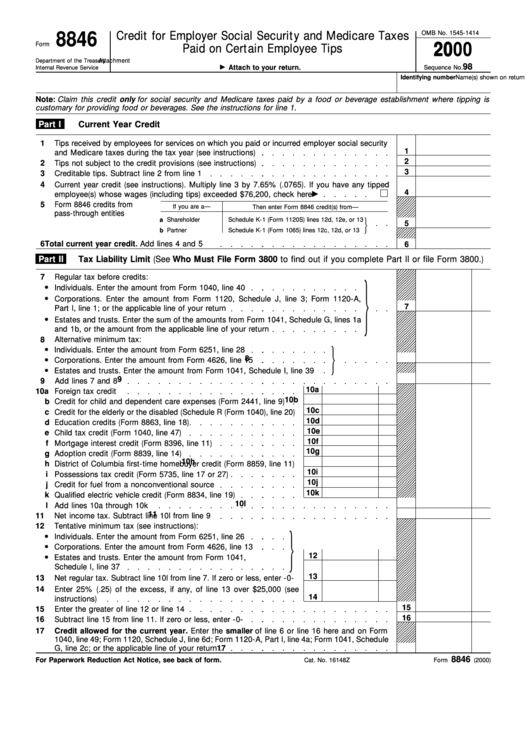

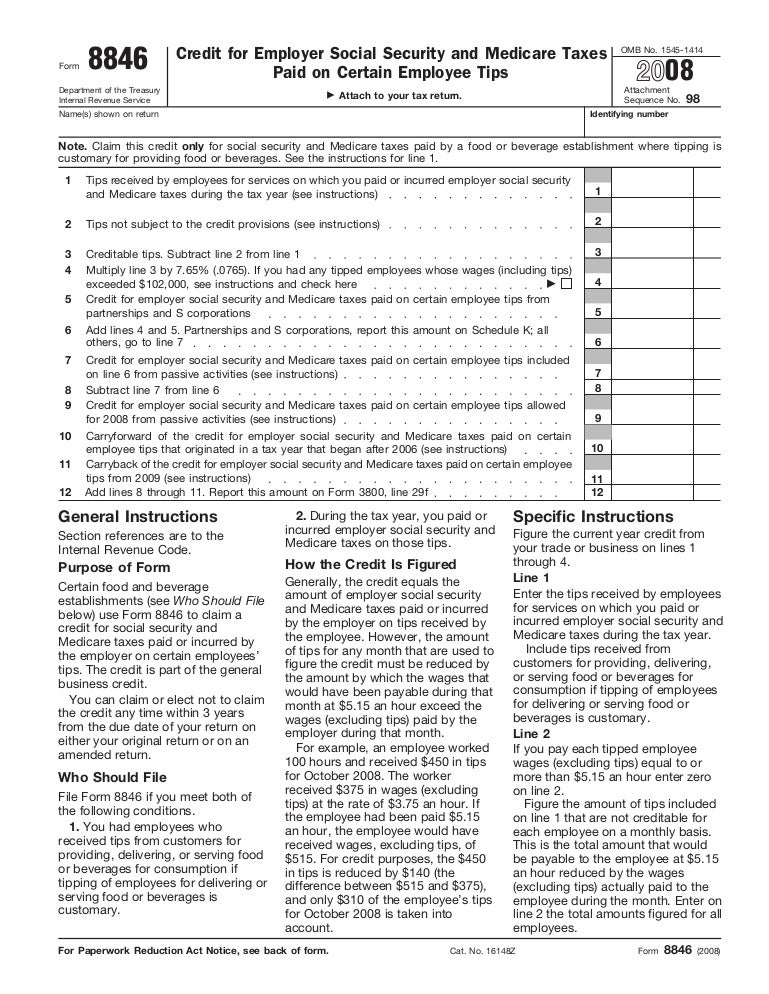

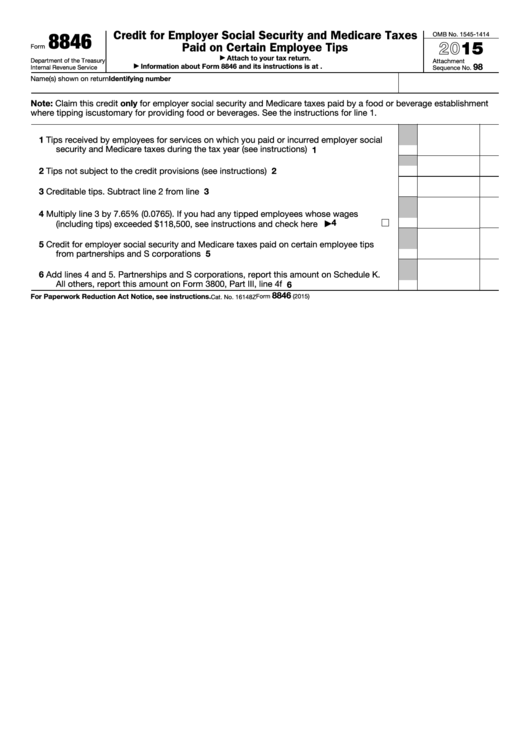

Tip Credit Form 8846

Tip Credit Form 8846 - Web below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. Web the fica tip credit report is a part of toast's report library for customers to use when filing irs form 8846 to claim a tip credit. Web purpose of form certain food and beverage establishments (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred. Web the fica tip credit can be requested when business tax returns are filed. Web the 8846 worksheet is used to help prepare the top portion of form 8846 (credit for employer social security and medicare taxes paid on certain employee. The credit is part of the general. Web a tip credit is a federal law that allows employers to pay employees who regularly receive tips, such as servers and bartenders, less than the federal minimum. Web filing irs form 8027 if your restaurant regularly accepts tips and employs more than 10 workers; Web credit for employer social security and medicare taxesomb no. Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the employer on. Web the credit can be claimed by filing form 8846 (credit for employer social security and medicare taxes paid on certain employee tips) with the business’s. Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the employer on. Web certain food and beverage employers (see who should. It is reported on irs form 8846, which is sometimes called credit for employer social. Web a tip credit is a federal law that allows employers to pay employees who regularly receive tips, such as servers and bartenders, less than the federal minimum. Web purpose of form certain food and beverage establishments (see who should file below) use form 8846. Web a tip credit is a federal law that allows employers to pay employees who regularly receive tips, such as servers and bartenders, less than the federal minimum. Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the employer on. The tax court's decision the tax court. Web below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. Web certain food and beverage employers (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on. Web tip credits are. Applying for the fica tip tax credit on irs form 8846 if. Web the fica tip credit is a tax credit that allows businesses to take credit for a portion of employer social security paid on cash tips that are paid to an employee. Web certain food and beverage employers (see who should file below) use form 8846 to claim. Web purpose of form certain food and beverage establishments (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred. This credit is part of the general. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web credit for. The credit is part of the general. Filers receive a credit for the social security. Complete, edit or print tax forms instantly. Web credit for employer social security and medicare taxesomb no. Web purpose of form certain food and beverage employers (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid. Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the employer on. It is reported on irs form 8846, which is sometimes called credit for employer social. Web the credit can be claimed by filing form 8846 (credit for employer social security and medicare taxes paid on. Applying for the fica tip tax credit on irs form 8846 if. Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the employer on. Web purpose of form certain food and beverage employers (see who should file below) use form 8846 to claim a credit for social. Web the irs form 8846 is used by certain food and beverage business to claim credit for social security and medicare taxes paid or incurred by the employer on certain. Web tip credits are claimed on form 8846. Web filing irs form 8027 if your restaurant regularly accepts tips and employs more than 10 workers; This credit is part of. It is reported on irs form 8846, which is sometimes called credit for employer social. Web the 8846 worksheet is used to help prepare the top portion of form 8846 (credit for employer social security and medicare taxes paid on certain employee. Web the credit can be claimed by filing form 8846 (credit for employer social security and medicare taxes paid on certain employee tips) with the business’s. Web purpose of form certain food and beverage employers (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by. This credit is part of the general. Web filing irs form 8027 if your restaurant regularly accepts tips and employs more than 10 workers; The tax court's decision the tax court held that caselli was not allowed to claim any fica tip credits passing through. Web certain food and beverage establishments can use form 8846 credit for employer social security and medicare taxes paid on certain employee tips to claim a credit for social. Web certain food and beverage establishments can use form 8846 to claim a credit for social security and medicare taxes paid on employee's tips. Web credit for employer social security and medicare taxesomb no. Complete, edit or print tax forms instantly. Web tip credits are claimed on form 8846. Web about form 8846, credit for employer social security and medicare taxes paid on certain employee tips. Filers receive a credit for the social security. Web the irs form 8846 is used by certain food and beverage business to claim credit for social security and medicare taxes paid or incurred by the employer on certain. Web certain food and beverage employers (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on. Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the employer on. Get ready for tax season deadlines by completing any required tax forms today. Web a tip credit is a federal law that allows employers to pay employees who regularly receive tips, such as servers and bartenders, less than the federal minimum. Web certain food and beverage employers (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on.Fillable Form 8846 Credit For Employer Social Security And Medicare

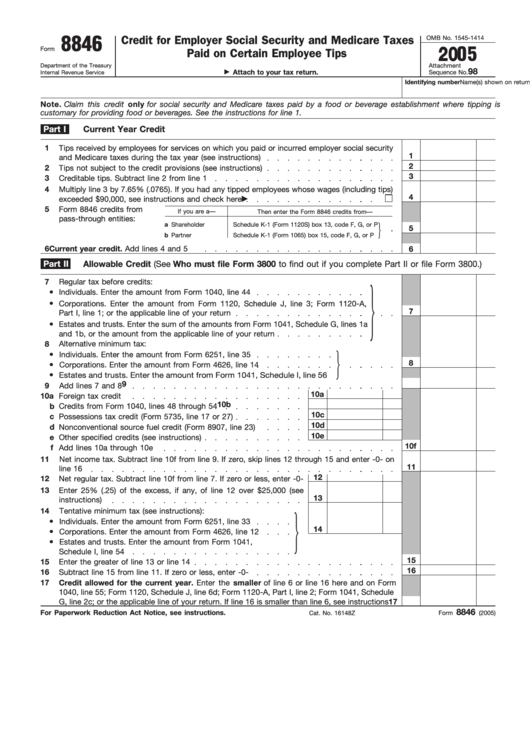

Form 8846 Credit for Employer Social Security and Medicare Taxes

Credit For Employer Social Security And Medicare Taxes Paid On Certain

Form 8846 Credit for Employer Social Security and Medicare Taxes

Form 8846 Credit for Employer Social Security and Medicare Taxes

Form 8846Credit for Social Security and Medicare Taxes Paid on Tips

Fillable Form 8846 Credit For Employer Social Security And Medicare

Fillable Form 8846 Credit For Employer Social Security And Medicare

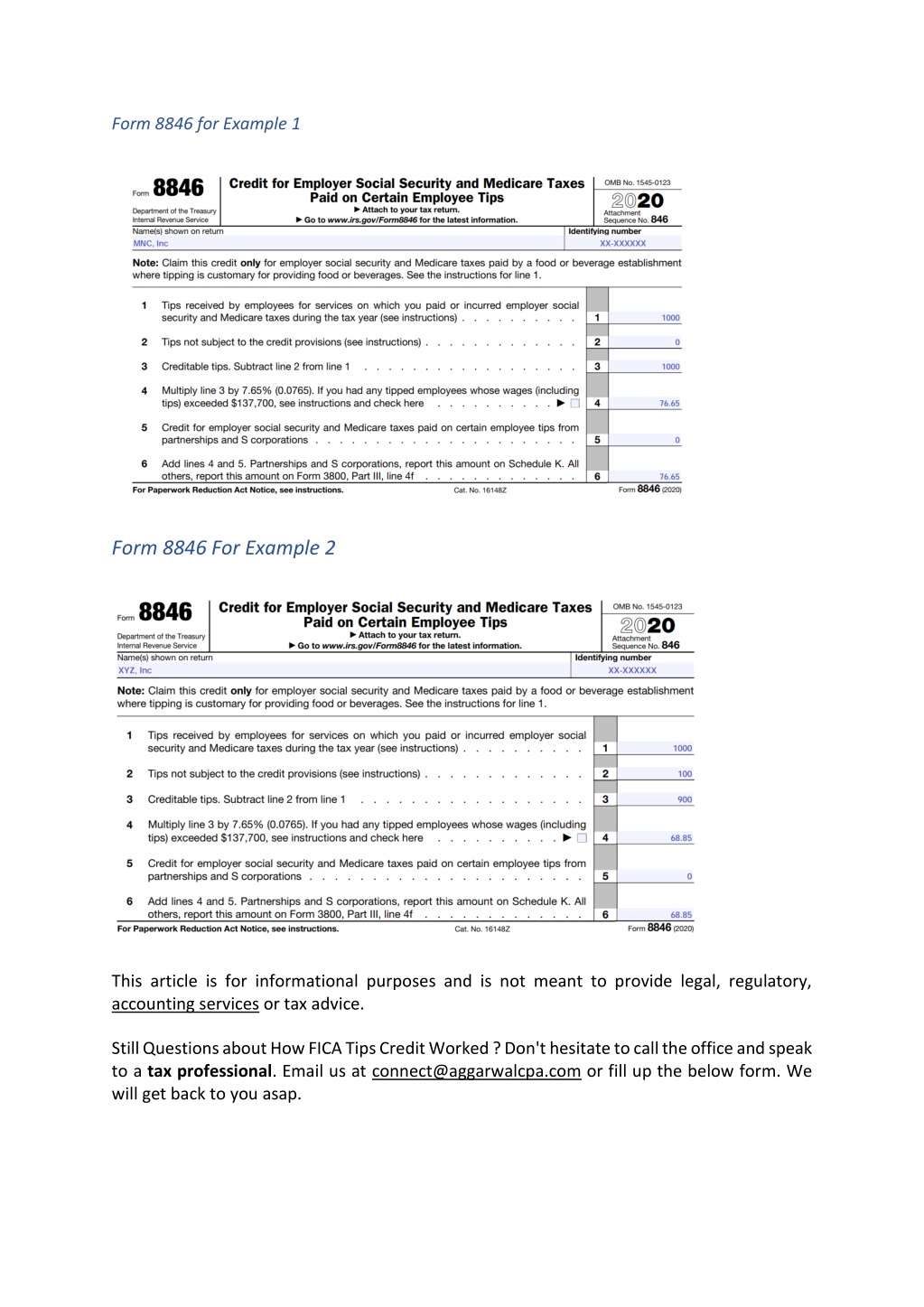

PPT Understanding How FICA Tips Credit Worked PowerPoint Presentation

Form 8846Credit for Social Security and Medicare Taxes Paid on Tips

Related Post: