The Weak Form Of The Efficient Market Hypothesis Implies That:

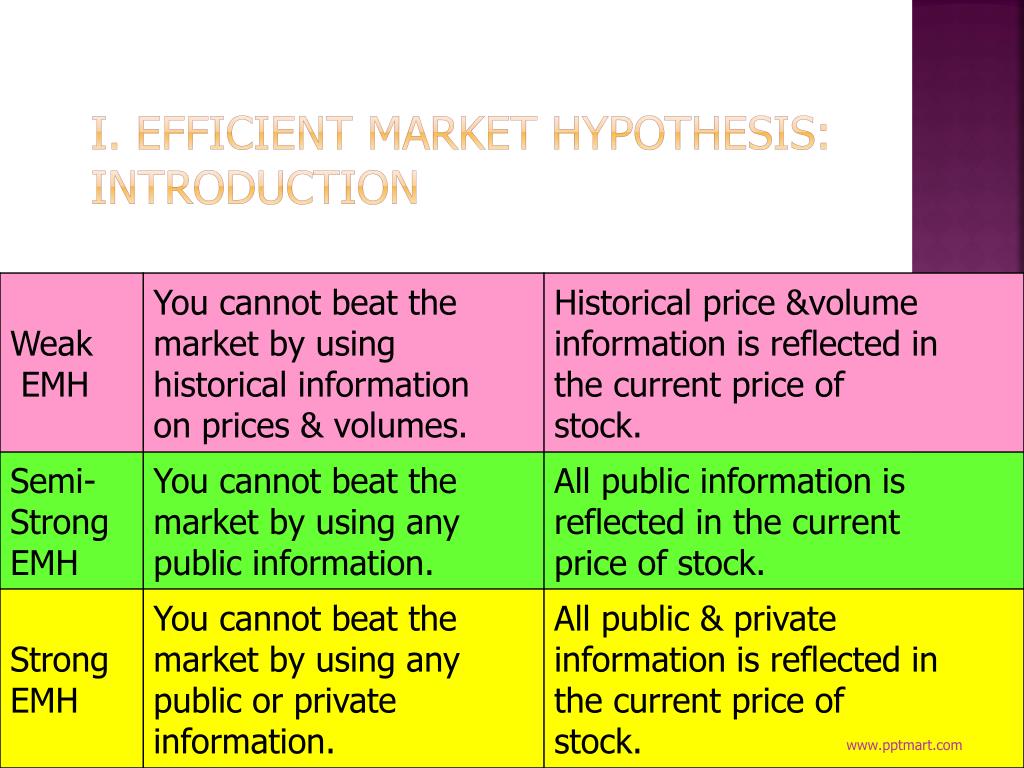

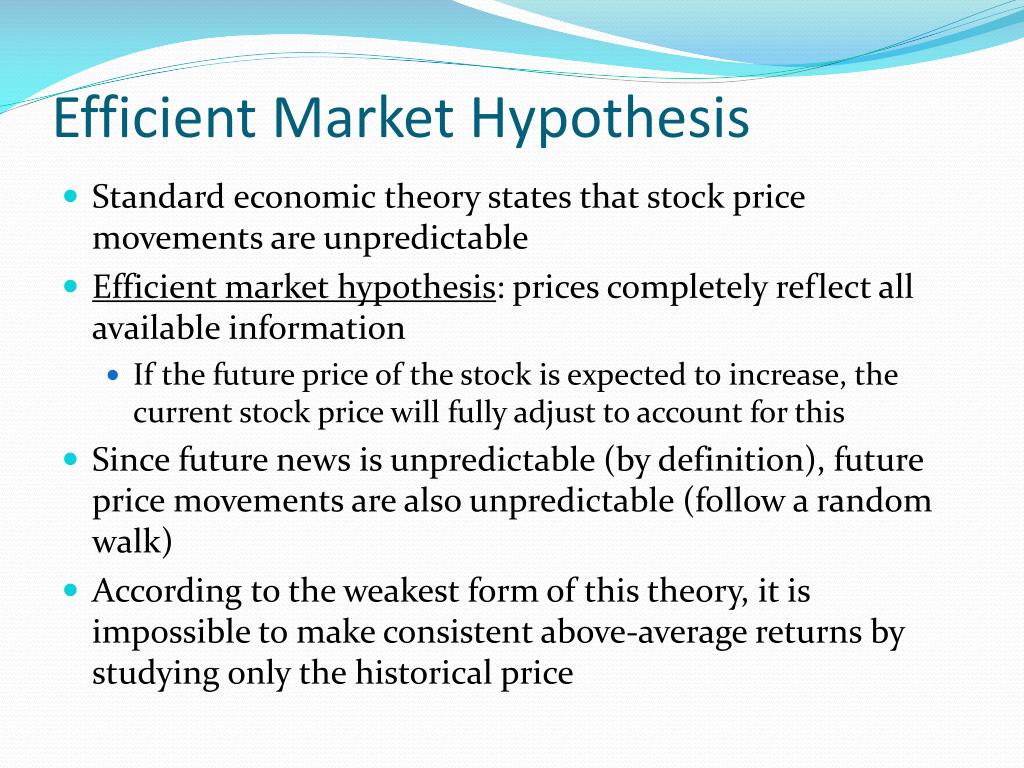

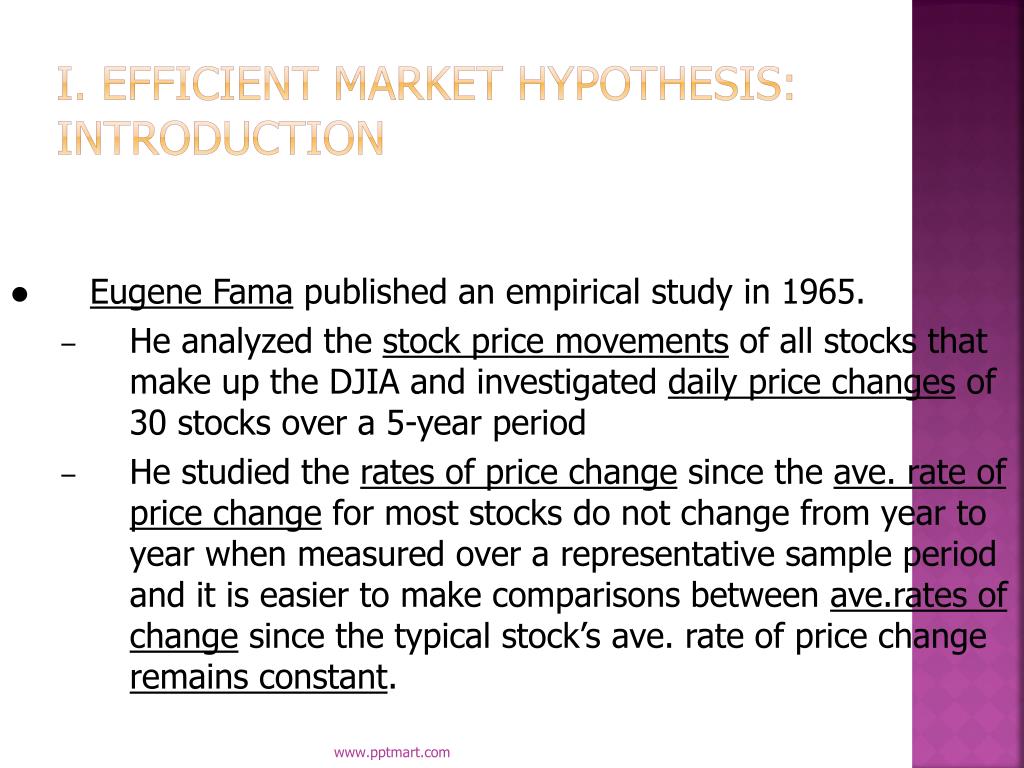

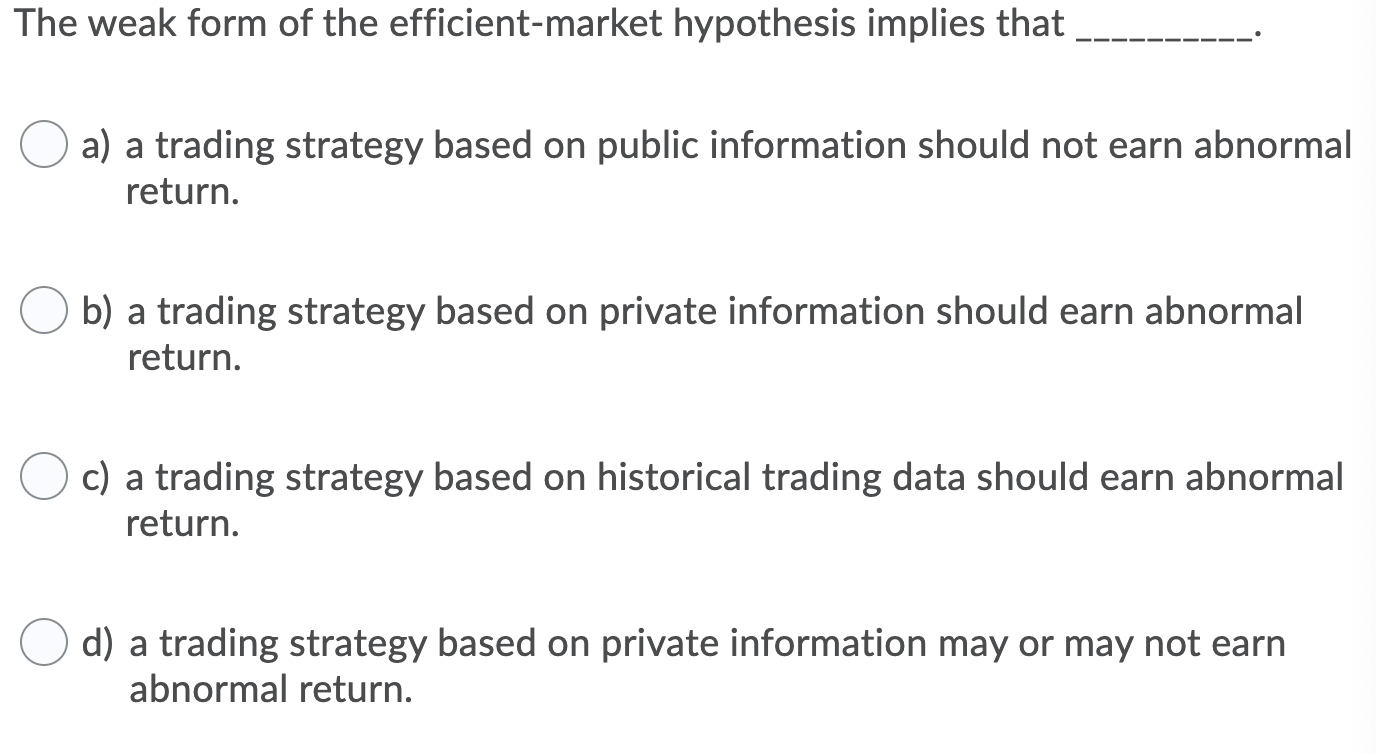

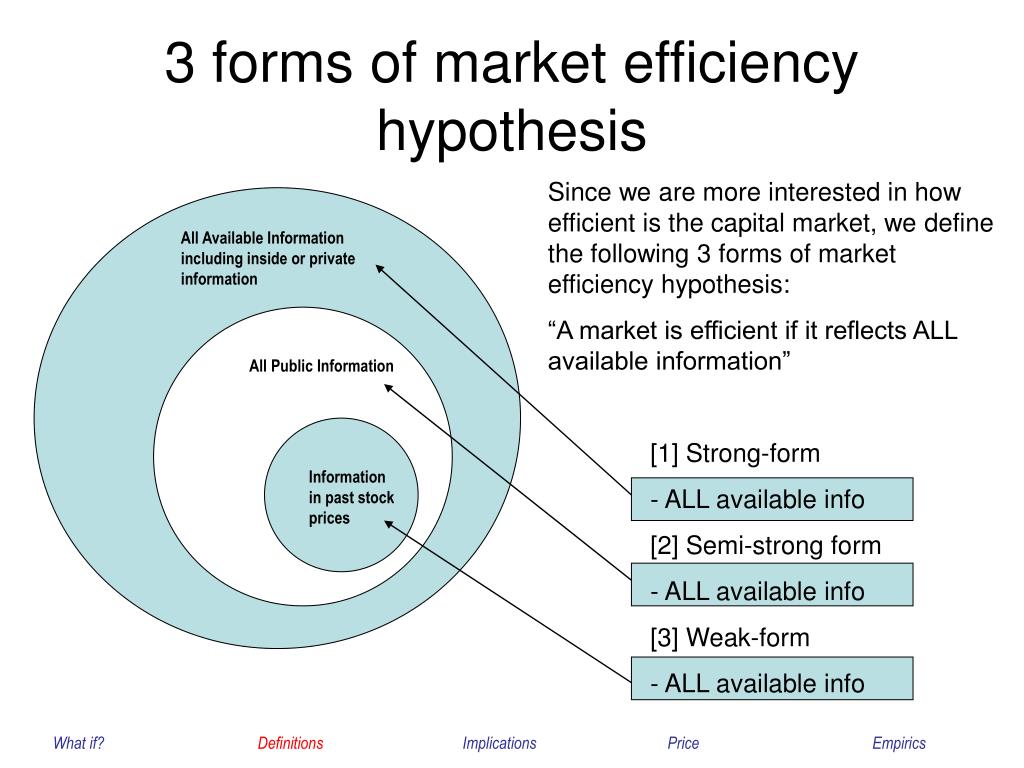

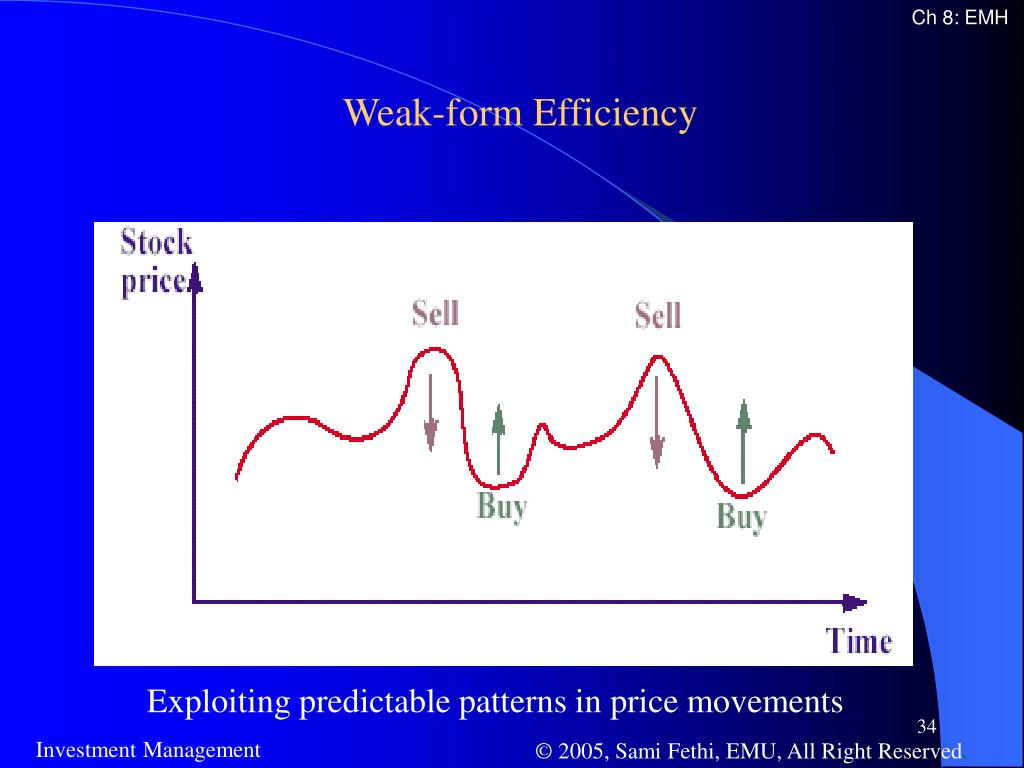

The Weak Form Of The Efficient Market Hypothesis Implies That: - Because the emh is formulated in terms of risk adjustment, it only makes test… This form states that the stock prices indicate the public market information, and the past performance has nothing to do with future costs. Web the weak form of the efficient market hypothesis (emh) asserts that prices fully reflect the information contained in the historical sequence of prices. Weak form efficiency claims that past price movements, volume, and earnings data do not affect a stock’s price and can’t be used to predict its future direction. Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. A.) fundamental analysis b.) technical analysis c.) knowing insider information d.). A theory, which moves beyond the definition of the efficient market hypothesis , that states that new information about any given. Under strong form market efficiency, all stock prices reflect public and private information implying that inside traders cannot make profits. Web there are three tenets to the efficient market hypothesis: The weak form of the efficient market hypothesis implies __________ is a waste of time. The weak form of the efficient market hypothesis implies __________ is a waste of time. The weak form of market efficiency is the weakest form of this. Weak form efficiency is one of the three different degrees of efficient market hypothesis (emh). Web the efficient market hypothesis (emh) is a theory that explores the relationship between the availability of information and. Web the weak form of the efficient market hypothesis (emh) asserts that prices fully reflect the information contained in the historical sequence of prices. The weak form of the efficient market hypothesis implies __________ is a waste of time. Web the weak form of the emh assumes that the prices of securities reflect all available public market information but may. Web weak form efficiency is one of the degrees of efficient market hypothesis that claims all past prices of a stock are reflected in today's stock price. Here's what each says about the market. The weak form of the efficient market hypothesis implies that: The weak form of the efficient market hypothesis implies __________ is a waste of time. Weak. Using price history to predict future prices, often with plots of preliminary data, is called technical or graphical analysis. The weak form of the efficient market hypothesis implies that: The weak form of market efficiency is the weakest form of this. Weak form emh suggests that all past. Web there are three forms of emh: The weak form of the efficient market hypothesis implies __________ is a waste of time. The weak make the assumption that current stock prices. Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. This form states that the stock prices indicate the public market information,. A theory, which moves beyond the definition of the efficient market hypothesis , that states that new information about any given. Under strong form market efficiency, all stock prices reflect public and private information implying that inside traders cannot make profits. Web the weak form of the emh assumes that the prices of securities reflect all available public market information. Weak form efficiency is one of the three different degrees of efficient market hypothesis (emh). B) a trading strategy based. Web the weak form of the emh assumes that the prices of securities reflect all available public market information but may not reflect new information that is not yet publicly available. O no one can achieve abnormal returns using market. Web. A.) fundamental analysis b.) technical analysis c.) knowing insider information d.). Web there are three tenets to the efficient market hypothesis: A theory, which moves beyond the definition of the efficient market hypothesis , that states that new information about any given. Web the weak form of the emh assumes that the prices of securities reflect all available public market. The weak form of the efficient market hypothesis implies __________ is a waste of time. Here's what each says about the market. Weak form efficiency is one of the three different degrees of efficient market hypothesis (emh). Because the emh is formulated in terms of risk adjustment, it only makes test… Web the weak form of the emh assumes that the. A theory, which moves beyond the definition of the efficient market hypothesis , that states that new information about any given. B) a trading strategy based. Web the weak form of the efficient market hypothesis (emh) asserts that prices fully reflect the information contained in the historical sequence of prices. The weak form of the efficient market hypothesis implies that:. The weak make the assumption that current stock prices. Web there are three forms of emh: Weak form efficiency claims that past price movements, volume, and earnings data do not affect a stock’s price and can’t be used to predict its future direction. No one can achieve abnormal returns using market information. The weak form of the efficient market hypothesis implies that: Here's what each says about the market. The weak form of the efficient market hypothesis implies that: Under strong form market efficiency, all stock prices reflect public and private information implying that inside traders cannot make profits. Web the efficient market hypothesis (emh) is a theory that explores the relationship between the availability of information and asset prices. A.) fundamental analysis b.) technical analysis c.) knowing insider information d.). Weak form emh suggests that all past. A theory, which moves beyond the definition of the efficient market hypothesis , that states that new information about any given. This form states that the stock prices indicate the public market information, and the past performance has nothing to do with future costs. Because the emh is formulated in terms of risk adjustment, it only makes test… The weak form of the efficient market hypothesis implies __________ is a waste of time. B) a trading strategy based. Web view the full answer. Web informationally efficient market: Weak form efficiency is one of the three different degrees of efficient market hypothesis (emh). O no one can achieve abnormal returns using market.PPT Efficient Market Hypothesis PowerPoint Presentation, free

According To The Efficient Market Hypothesis slsi.lk

PPT Efficient Market Hypothesis PowerPoint Presentation, free

Solved The weak form of the efficientmarket hypothesis

PPT Efficient Market Hypothesis The concepts PowerPoint Presentation

PPT The Efficient Market Hypothesis PowerPoint Presentation, free

PPT Efficient Market Theory PowerPoint Presentation, free download

Efficient Market Hypothesis (EMH) Definition, History, How it Works

Efficient Market Hypothesis (EMH) Definition, History, How it Works

Efficient Market Hypothesis All You Need To Know

Related Post: