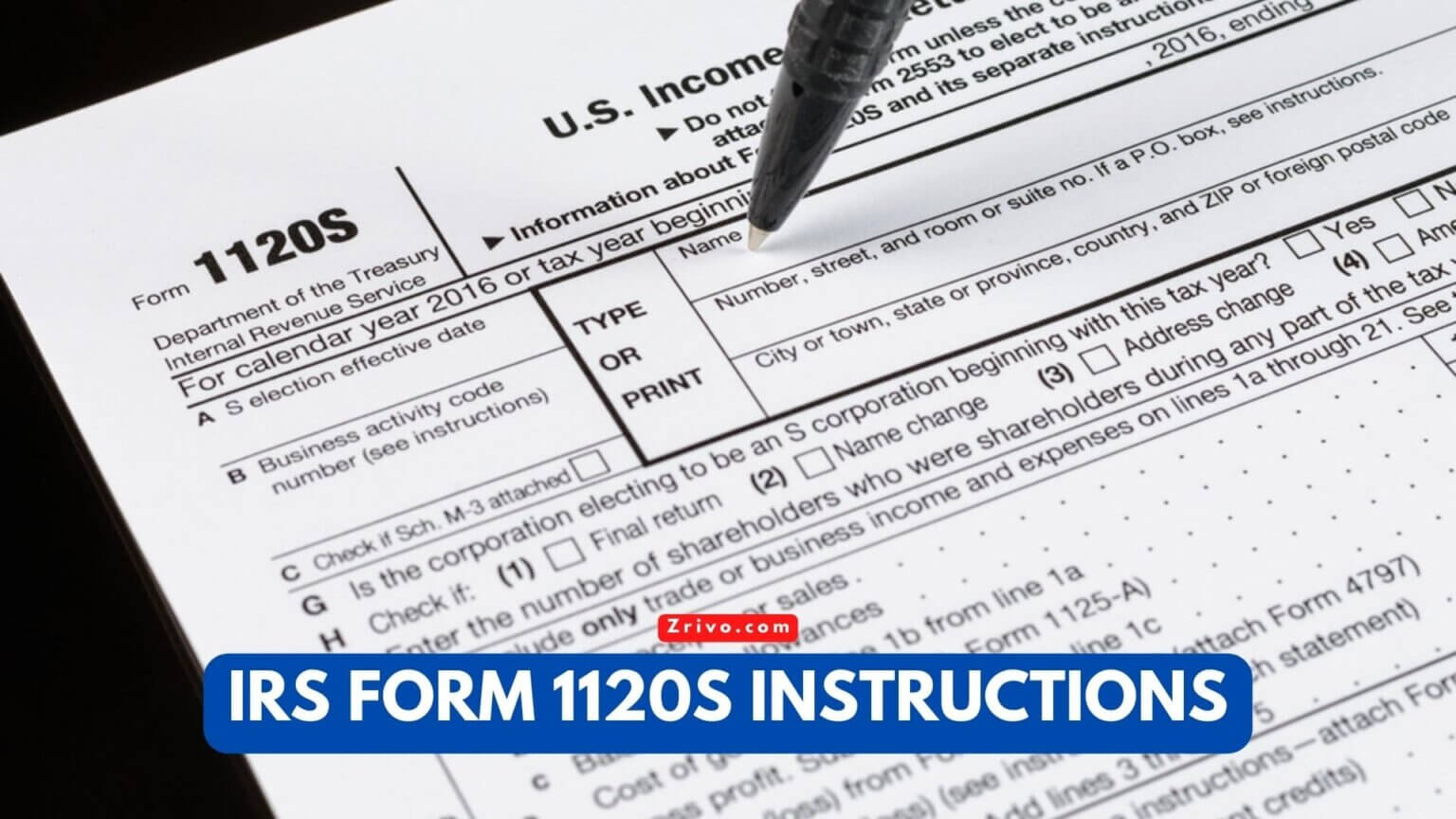

Form 1120-S Instructions

Form 1120-S Instructions - Agriculture, forestry, fishing and hunting. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the. If form 2220 is completed, enter. Do not file this form unless the corporation has filed or is attaching. Department of the treasury internal revenue service. Department of the treasury internal revenue service. If the corporation's principal business, office, or agency is located in: Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the. Income tax return for an s corporation. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the. Department of the treasury internal revenue service. If the corporation's principal business, office, or agency is located in: Web other items you may find useful. Department of the treasury internal revenue service. Information about form 1120, u.s. Ad easy guidance & tools for c corporation tax returns. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between. Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Department of the treasury internal revenue service. If form 2220 is completed, enter. Department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Web instructions for form 1120s userid: Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. If the corporation's principal business, office, or agency is located in: Information about form 1120, u.s. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between. Income tax return for an s corporation. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between. If form 2220 is completed, enter. Corporation income tax return, including recent updates, related forms and instructions on how to file. Do not file this form unless the. 9.5 draft ok to print pager/xmlfileid:c:\documents and settings\ny3hb\my. Corporation income tax return, including recent updates, related forms and instructions on how to file. Department of the treasury internal revenue service. Department of the treasury internal revenue service. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany. Income tax return for an s corporation, for use in tax years beginning in 2020, as well as draft instructions for the. And the total assets at the end of the tax year are: 9.5 draft ok to print pager/xmlfileid:c:\documents and settings\ny3hb\my. Information about form 1120, u.s. For calendar year 2022 or tax year beginning, 2022, ending. For calendar year 2022 or tax year beginning, 2022, ending. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the. Ad easy guidance & tools for c corporation tax returns. Web instructions for form 1120s userid: If form 2220 is completed, enter. Property and casualty insurance company income tax return, to report the income, gains, losses, deductions,. Web instructions for form 1120s userid: Do not file this form unless the corporation has filed or is attaching. Get ready for tax season deadlines by completing any required tax forms today. For calendar year 2022 or tax year beginning, 2022, ending. Department of the treasury internal revenue service. Ad easy guidance & tools for c corporation tax returns. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the. If form 2220 is completed, enter. Corporation income tax return, including recent updates, related forms and instructions on how to file. Get ready for tax season deadlines by completing any required tax forms today. Do not file this form unless the corporation has filed or is attaching. Web other items you may find useful. Complete, edit or print tax forms instantly. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Department of the treasury internal revenue service. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between. Department of the treasury internal revenue service. And the total assets at the end of the tax year are: Property and casualty insurance company income tax return, to report the income, gains, losses, deductions,. Department of the treasury internal revenue service. Income tax return for an s corporation. Income tax return for an s corporation, for use in tax years beginning in 2020, as well as draft instructions for the. Do not file this form unless the corporation has filed or is attaching. Corporation income tax return, including recent updates, related forms and instructions on how to file. Agriculture, forestry, fishing and hunting. If form 2220 is completed, enter. Information about form 1120, u.s. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the. Income tax return for an s corporation.IRS Form 1120S Instructions 2022 2023

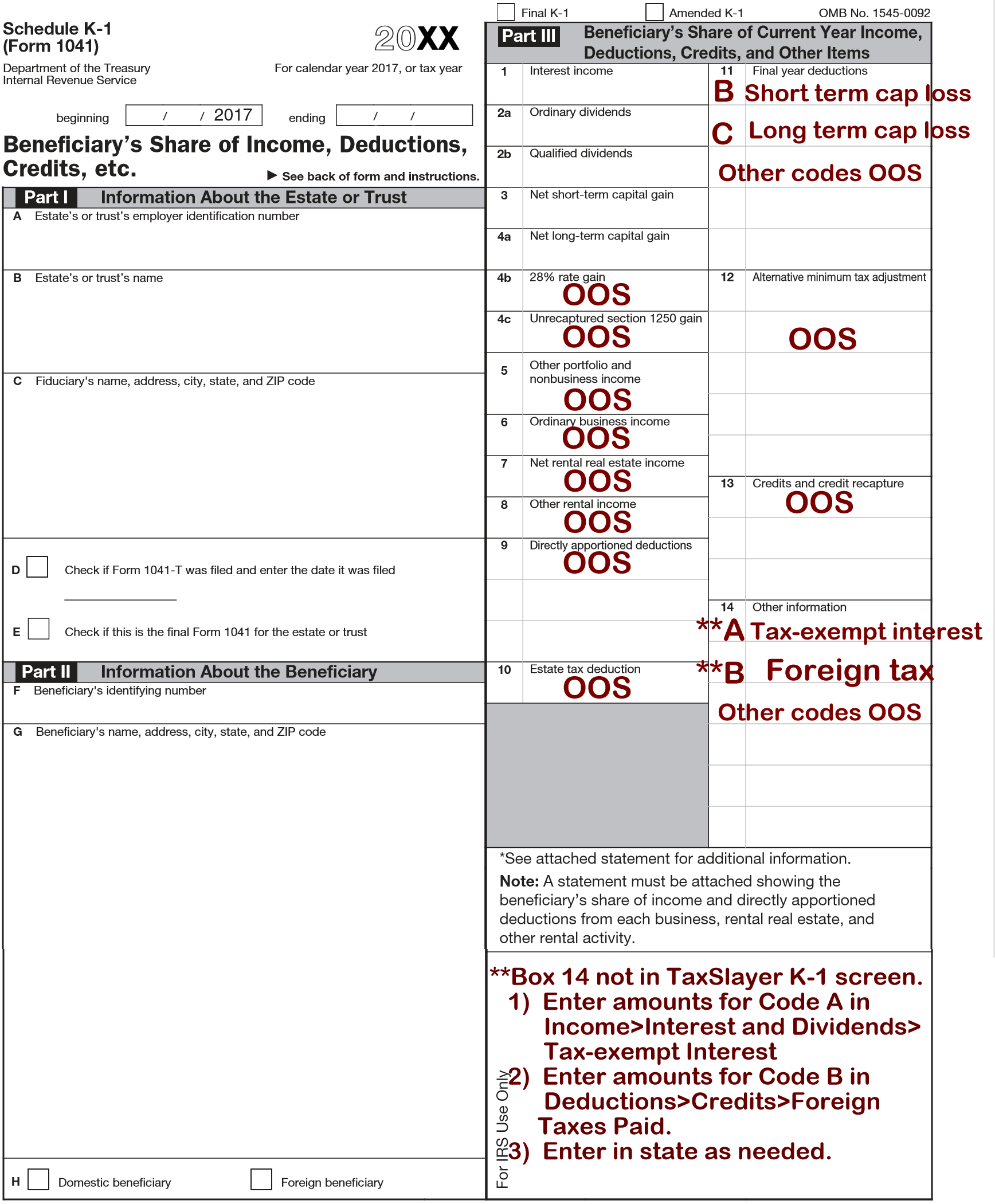

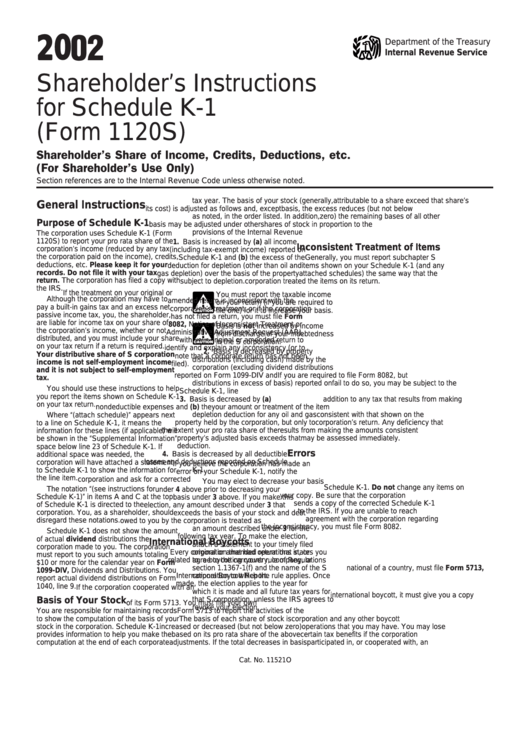

Form 1120S K 1 Instructions 2016 2018 Codes Line 17 —

How to Complete Form 1120S Tax Return for an S Corp

How to Fill Out Form 1120S for 2021. StepbyStep Instructions YouTube

Irs Instructions Form 1120s Fillable and Editable PDF Template

1120s Instructions Fill Online, Printable, Fillable, Blank pdfFiller

Form 1120 S What IRS Form 1120 S Is & How to Fill It Out

What is Form 1120S and How Do I File It? Ask Gusto

Instructions For Schedule K1 (Form 1120s) Shareholder'S Share Of

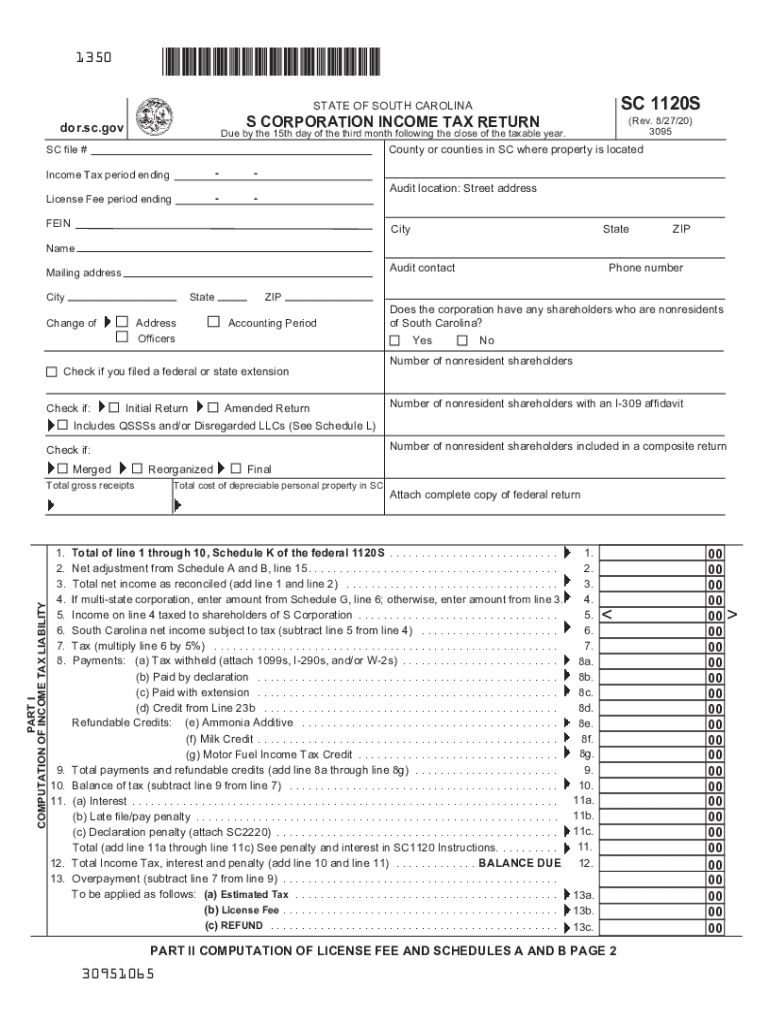

Sc 1120s Fill out & sign online DocHub

Related Post: