Tax Form 5695 Instructions

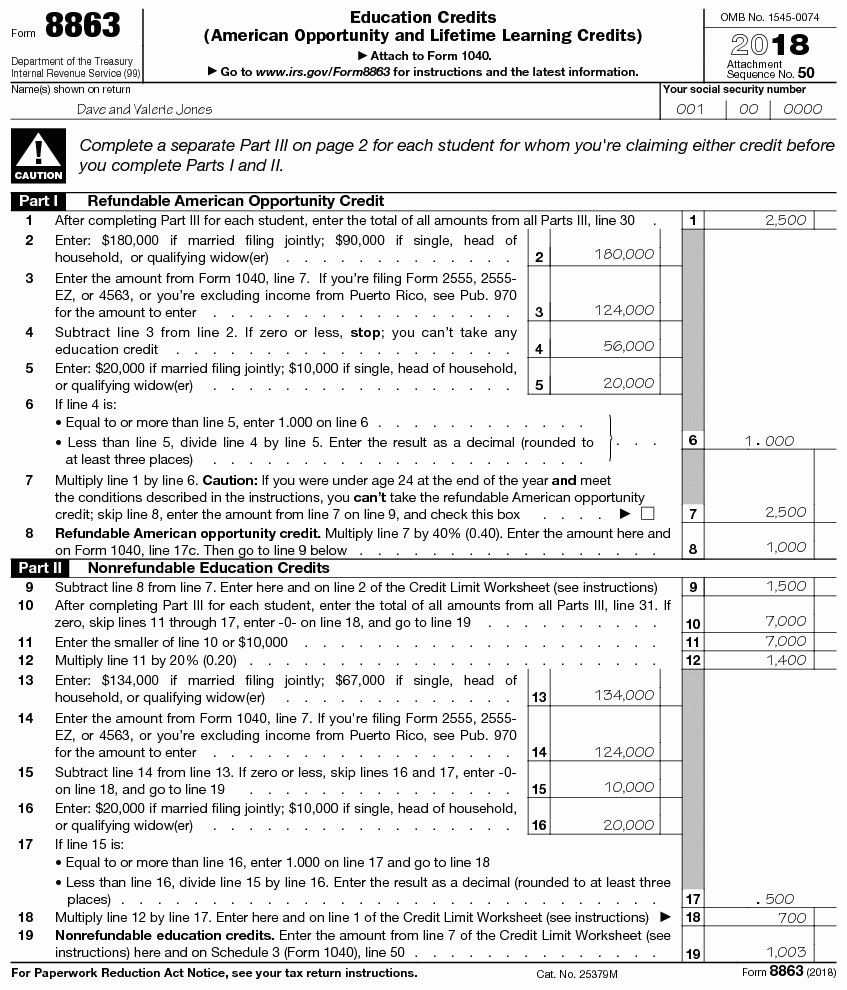

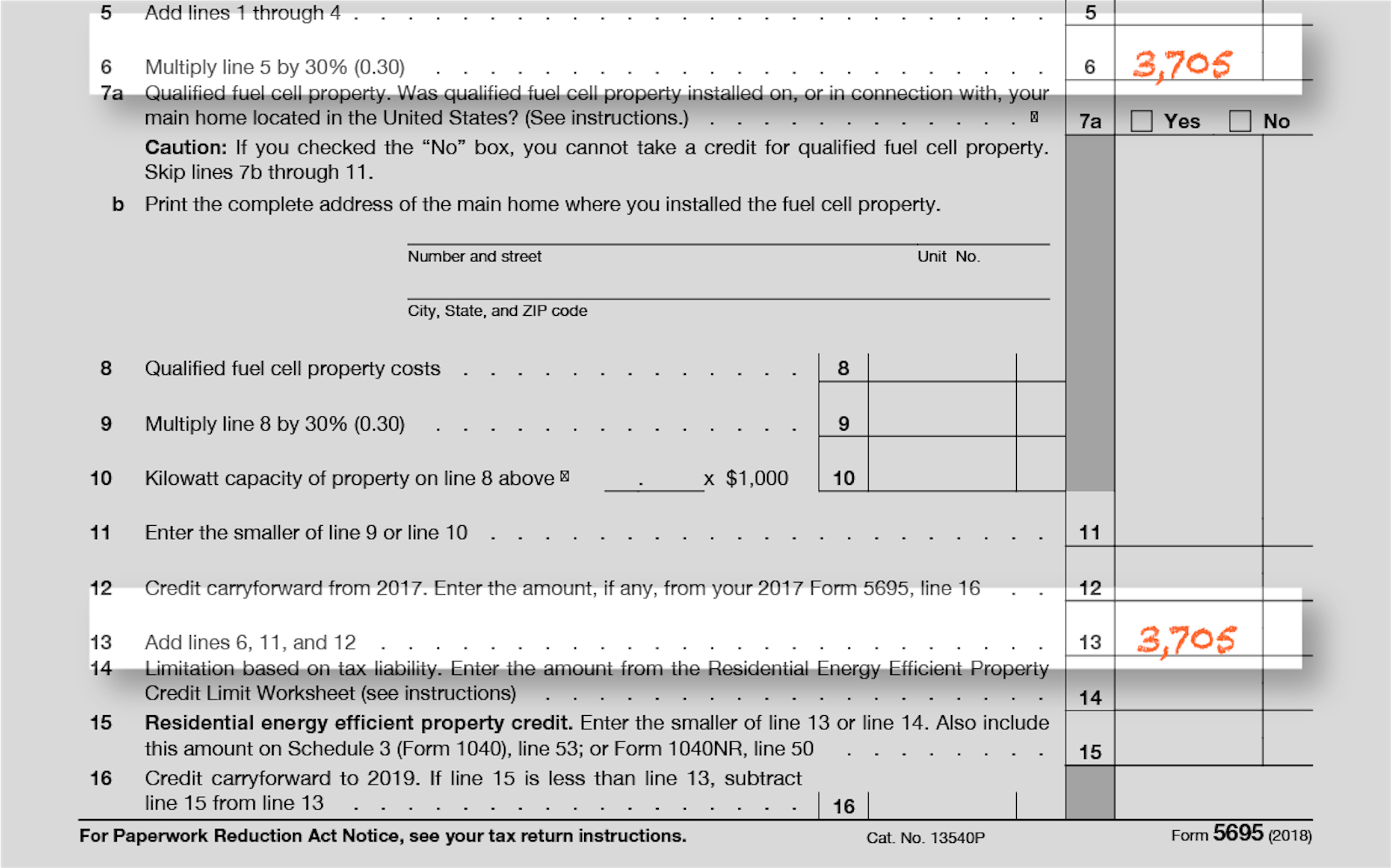

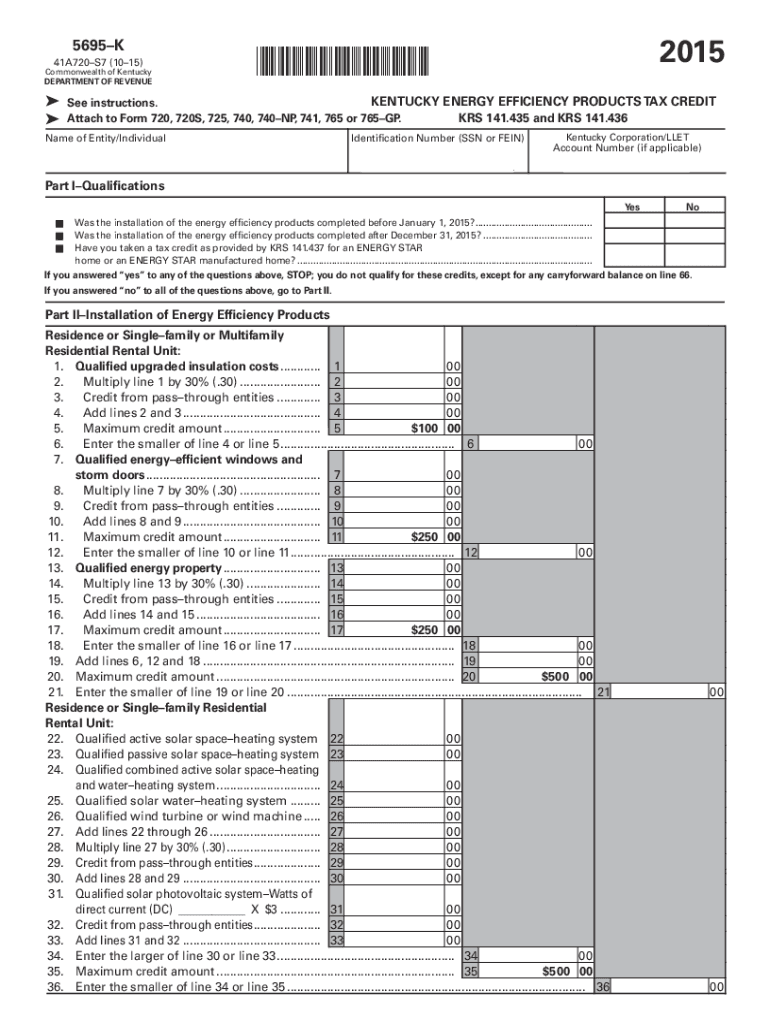

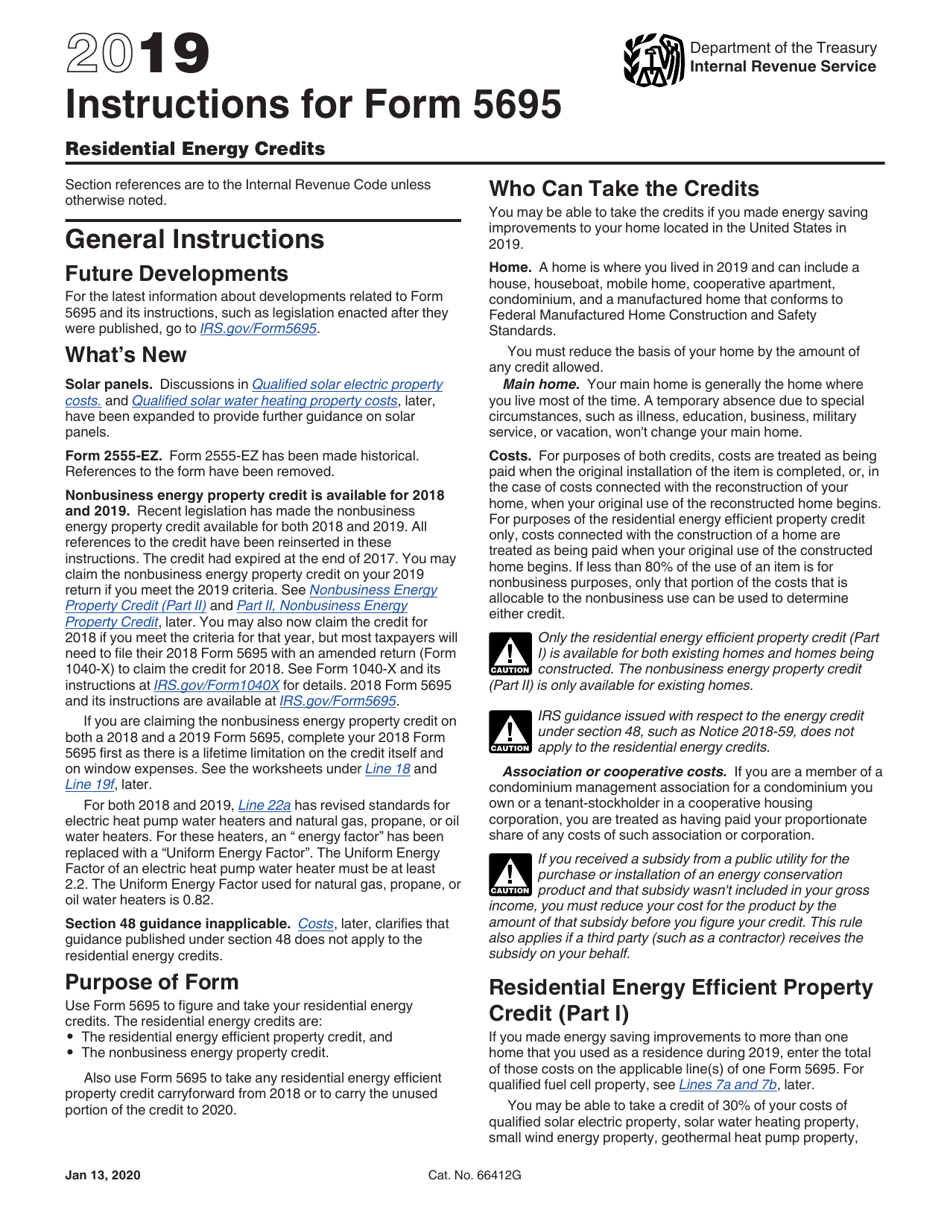

Tax Form 5695 Instructions - Form 8396, mortgage interest credit. Use form 5695 to figure and take your residential energy credits. For paperwork reduction act notice, see your tax return instructions. The consolidated appropriations act, 2021: Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Publication 523, selling your home. Web based on the form 5695 instructions,. Use form 5695 to figure and take your residential energy credits. Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. For instructions and the latest information. Web per irs instructions for form 5695, page 1: Publication 530, tax information for. The residential energy efficient property credit, and. Use form 5695 to figure and take your residential energy credits. The energy efficient home improvement credit. Use form 5695 to figure and take your residential energy credits. Please use the link below to. Add to schedule 3 and form 1040. Web the instructions provide detailed information on the supporting documents required for each type of improvement, ensuring individuals have the necessary proof for. The residential energy credits are: Use form 5695 to figure and take your residential energy credits. Web form 5695 2019 residential energy credits department of the treasury internal revenue service. Department of the treasury internal revenue service. Web per irs instructions for form 5695: Extends the residential energy efficient property credit to qualified biomass fuel property costs on. The residential energy credits are: Estimate how much you could potentially save in just a matter of minutes. Add to schedule 3 and form 1040. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. The residential energy credits are: Use form 5695 to figure and take your residential energy credits. Information about form 5695, residential energy credits, including recent updates, related forms and. The residential energy credits are: Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. The residential energy efficient property credit, and. The energy efficient home improvement credit. The residential clean energy credit, and. It appears you don't have a pdf plugin for this browser. For purposes of column (a), if the ale member offered. Web page last reviewed or updated: For instructions and the latest information. Form 8396, mortgage interest credit. Web based on the form 5695 instructions,. Estimate how much you could potentially save in just a matter of minutes. We offer a variety of software related to various fields at great prices. It appears you don't have a pdf plugin for this browser. The residential clean energy credit, and. Web form 5695 2019 residential energy credits department of the treasury internal revenue service. Department of the treasury internal revenue service. To add or remove this. Web the instructions provide detailed information on the supporting documents required for each type of improvement, ensuring individuals have the necessary proof for. Web per irs instructions for form 5695: The residential clean energy credit, and. Information about form 5695, residential energy credits, including recent updates, related forms and. Web per irs instructions for form 5695, page 1: Max refund and 100% accuracy are guaranteed. For instructions and the latest. We offer a variety of software related to various fields at great prices. Web there are three main steps you'll need to take to benefit from the itc: The energy efficient home improvement credit. The consolidated appropriations act, 2021: Web there are three main steps you'll need to take to benefit from the itc: The residential energy efficient property credit, and. * you need to file irs form 5695 (ask your tax advisor or go to irs.gov) and keep a certification statement from the manufacturer and. The energy efficient home improvement credit. Web purpose of form use form 5695 to figure and take your residential energy credits. Web per irs instructions for form 5695, page 1: For purposes of column (a), if the ale member offered. Use form 5695 to figure and take your residential energy credits. Web per irs instructions for form 5695: Web here’s how to fill out form 5695 by hand: Web form 5695 2019 residential energy credits department of the treasury internal revenue service. Ad free federal tax filing for simple and complex returns. Web page last reviewed or updated: We offer a variety of software related to various fields at great prices. The residential energy credits are: The residential energy credits are: For paperwork reduction act notice, see your tax return instructions. Per irs instructions for form 5695, on page 1: Publication 523, selling your home.Form 5695 Instructions & Information on IRS Form 5695

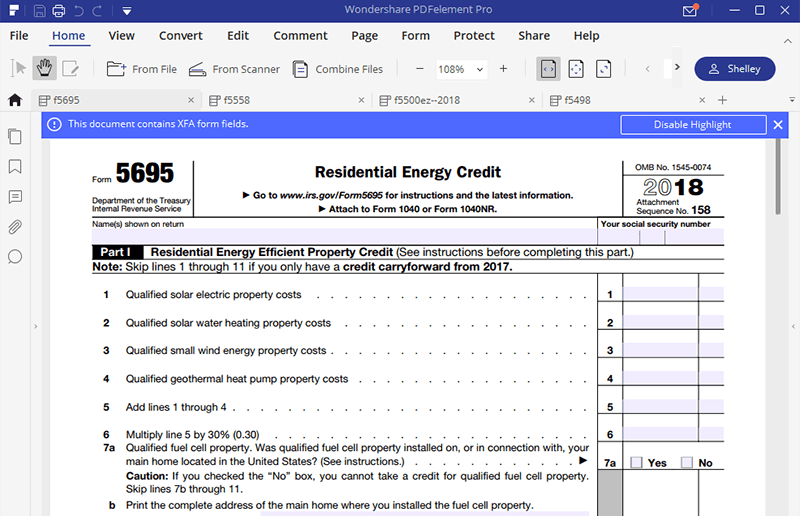

Form Instructions Is Available For How To File 5695 2018 —

2016 Form 5695 Fill Online, Printable, Fillable, Blank pdfFiller

How to File IRS Form 5695 To Claim Your Renewable Energy Credits

2020 Form 5695 Instructions Fill Out and Sign Printable PDF Template

IRS Form 5695 Instructions Residential Energy Credits

Download Instructions for IRS Form 5695 Residential Energy Credits PDF

Claim a Tax Credit for Solar Improvements to Your House IRS Form 5695

for How to IRS Form 5695

IRS Form 5695 Instructions Residential Energy Credits

Related Post: