Schedule W Tax Form

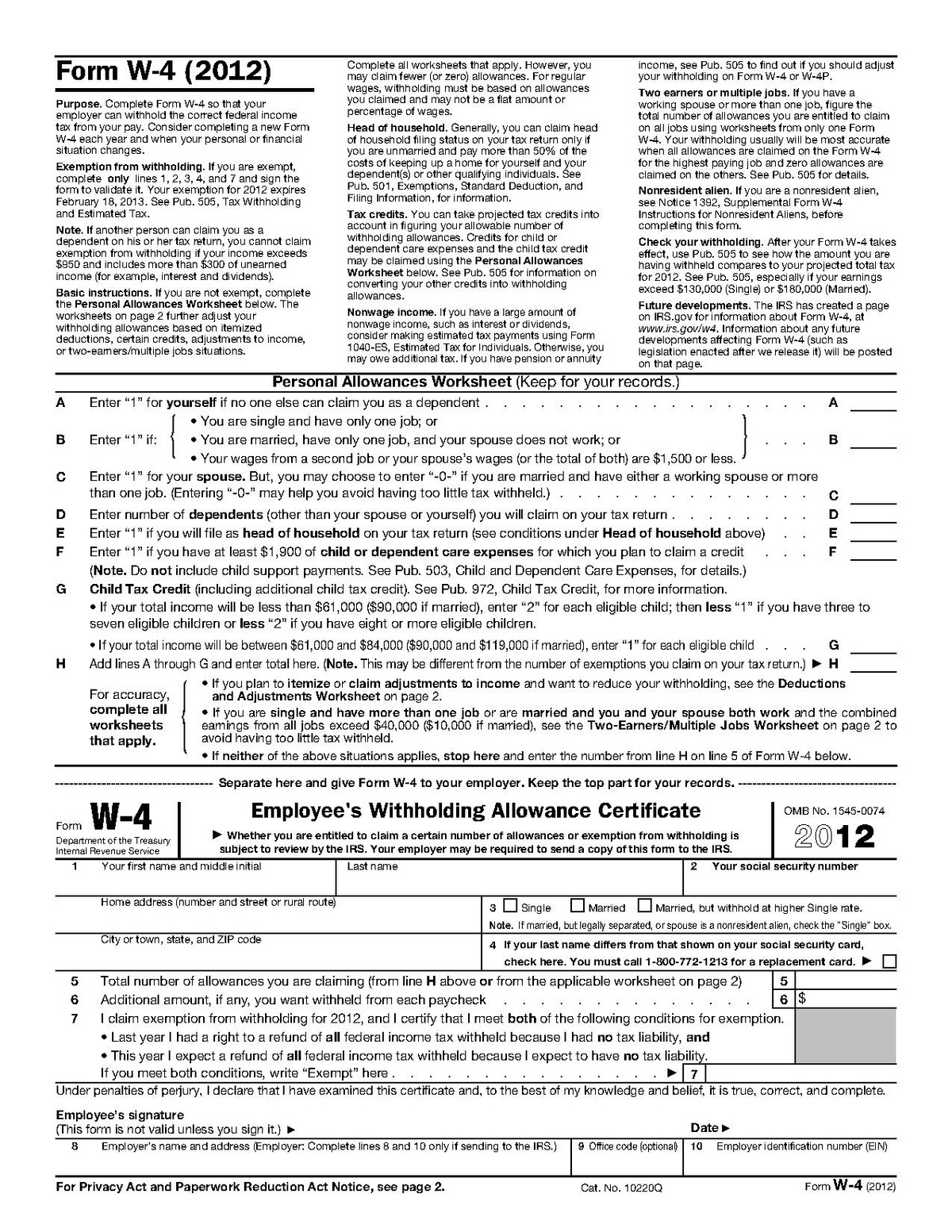

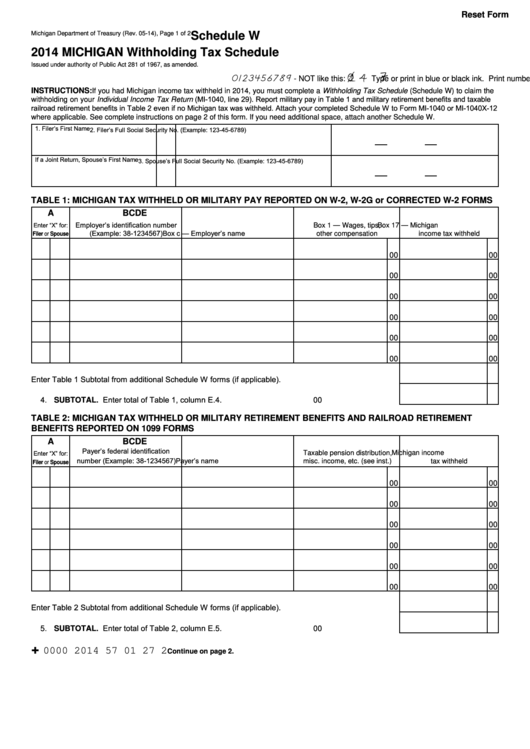

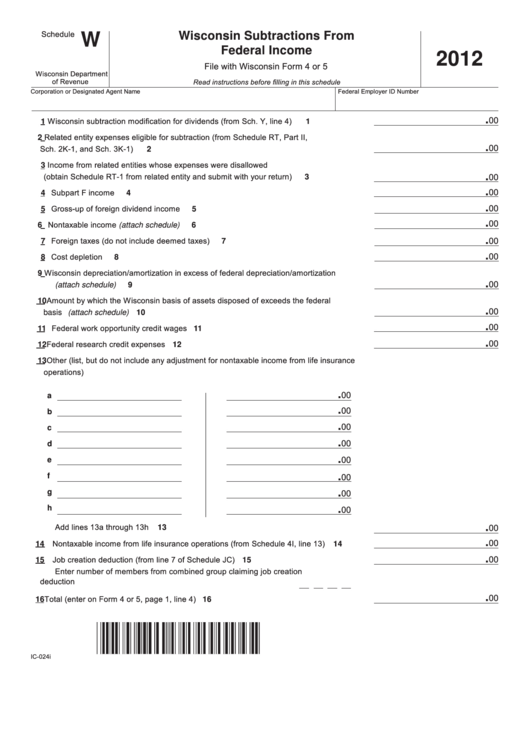

Schedule W Tax Form - Hand off your taxes, get expert help, or do it yourself. Web full service for personal taxes. Ad make office life easier with efficient recordkeeping supported by appropriate forms. An employer whose previous 4 quarter arizona withholding average. Web the schedule an employer must use will depend on the amount of arizona income tax withheld. Web about schedule a (form 1040), itemized deductions. 100 n 15th ave, #301. Web adoa human resources. Yes this for a professional gambler that has withholding in multiple states. Web here’s a helpful guide for what’s generally reported on the following information returns: Participating foreign financial institution to report all united states 515, withholding of tax on. Enjoy great deals and discounts on an array of products from various brands. 51, the instructions for your respective employment tax form, and the caution under. Hand off your taxes, get expert help, or do it yourself. Web minors have to file taxes if their earned. Partnerships must generally file form 1065. Web here’s a helpful guide for what’s generally reported on the following information returns: Acquisition or abandonment of secured property. This schedule is used by filers to report. Enjoy great deals and discounts on an array of products from various brands. Web we last updated the withholding tax schedule in february 2023, so this is the latest version of schedule w, fully updated for tax year 2022. Yes this for a professional gambler that has withholding in multiple states. Web about schedule a (form 1040), itemized deductions. You can download or print. Web here’s a helpful guide for what’s generally reported. Web wage and tax statement. Ad make office life easier with efficient recordkeeping supported by appropriate forms. Gross taxable wages refers to the amount that meets the federal definition of. Web we last updated the withholding tax schedule in february 2023, so this is the latest version of schedule w, fully updated for tax year 2022. Information about schedule a. Acquisition or abandonment of secured property. Participating foreign financial institution to report all united states 515, withholding of tax on. Individual income tax return 2022 department of the treasury—internal revenue service omb no. If you had city income tax withheld in 2021, you must complete a withholding tax schedule (city schedule w) to claim the withholding on your city. Web. If you had city income tax withheld in 2021, you must complete a withholding tax schedule (city schedule w) to claim the withholding on your city. This schedule is used by filers to report. Add lines 1 through 15, column d. Web here’s a helpful guide for what’s generally reported on the following information returns: Web about schedule a (form. Web about schedule a (form 1040), itemized deductions. An employer whose previous 4 quarter arizona withholding average. Add lines 1 through 15, column d. Credit changed from up to $3,600 under covid relief in tax year 2021 to up to $2,000. You can download or print. Web we last updated the withholding tax schedule in february 2023, so this is the latest version of schedule w, fully updated for tax year 2022. 51, the instructions for your respective employment tax form, and the caution under. Web minors have to file taxes if their earned income is greater than $13,850 for tax year 2023. Partnerships must generally. Web we last updated the withholding tax schedule in february 2023, so this is the latest version of schedule w, fully updated for tax year 2022. Participating foreign financial institution to report all united states 515, withholding of tax on. Information about schedule a (form 1040), itemized deductions, including recent updates, related. Partnerships must generally file form 1065. If you. Add lines 1 through 15, column d. Web it appears you don't have a pdf plugin for this browser. Web the schedule an employer must use will depend on the amount of arizona income tax withheld. 100 n 15th ave, #301. Web we last updated the withholding tax schedule in february 2023, so this is the latest version of schedule. If your child only has unearned income, the threshold is $1,250 for tax. Acquisition or abandonment of secured property. 51, the instructions for your respective employment tax form, and the caution under. Ad outgrow.us has been visited by 10k+ users in the past month This schedule is used by filers to report. Gross taxable wages refers to the amount that meets the federal definition of. You can download or print. Web schedule w type or print in blue or black ink. If you had michigan income tax withheld in 2020, you must complete a withholding tax schedule. Web minors have to file taxes if their earned income is greater than $13,850 for tax year 2023. Hand off your taxes, get expert help, or do it yourself. A taxpayer identification number, such as a social security number. The new design is simple, accurate, and gives employees privacy while minimizing the burden on employers and the payroll process. An employer whose previous 4 quarter arizona withholding average. Web go to www.irs.gov/schedulec for instructions and the latest information. Web about schedule a (form 1040), itemized deductions. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Web the schedule an employer must use will depend on the amount of arizona income tax withheld. Yes this for a professional gambler that has withholding in multiple states. Add lines 1 through 15, column d.W4 2020 Form Printable 2022 W4 Form

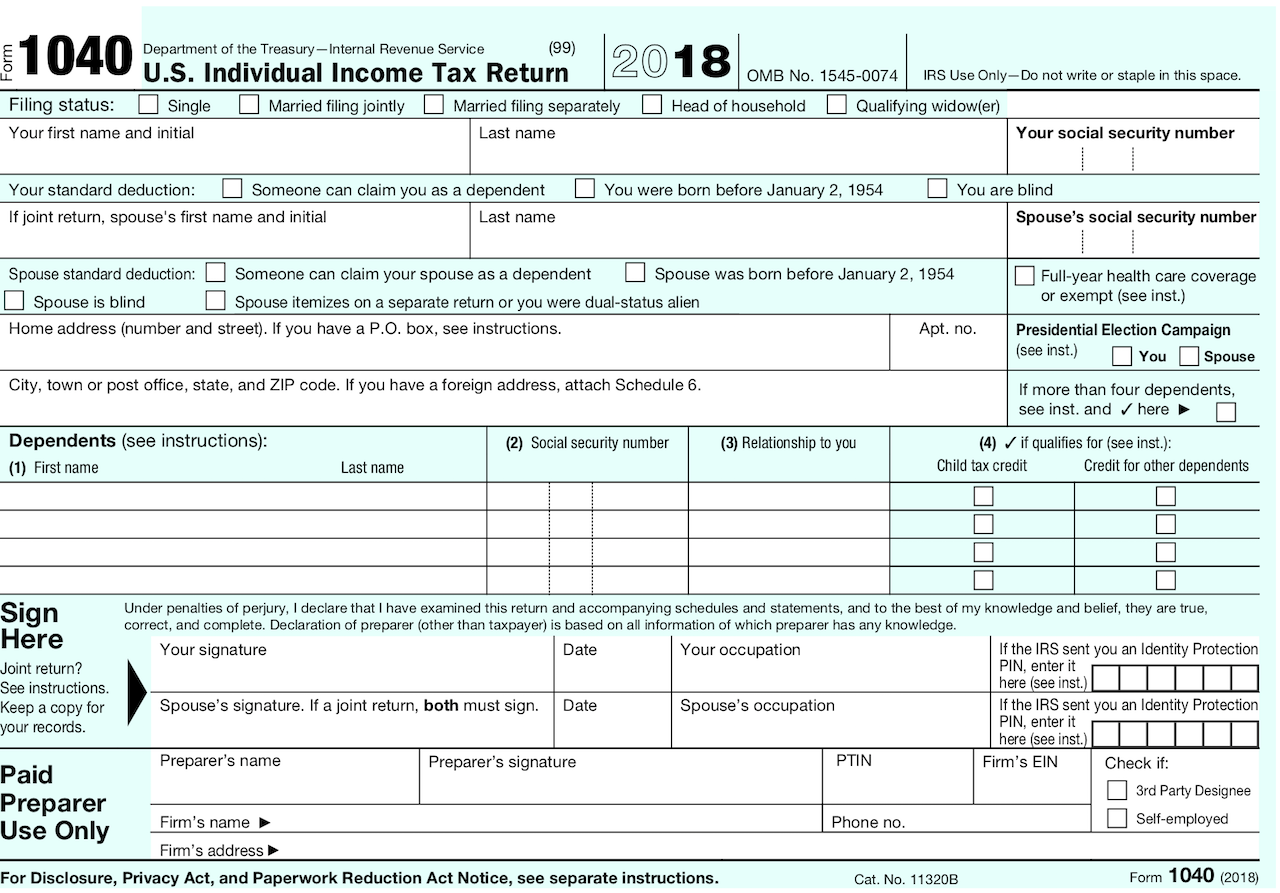

Describes new Form 1040, Schedules & Tax Tables

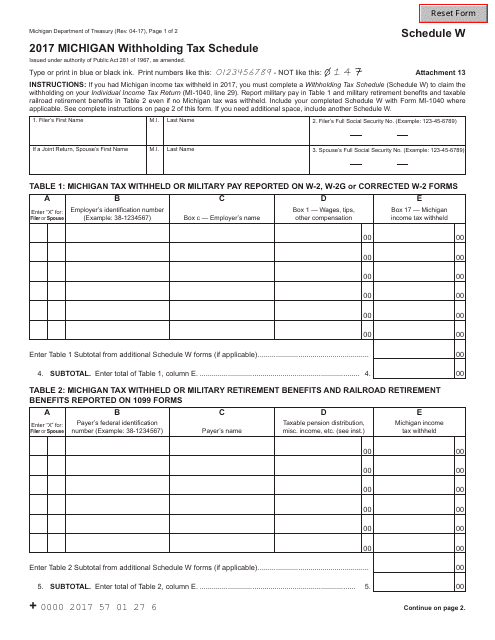

Fillable Schedule W Michigan Withholding Tax Schedule 2014

How To Fill Out a W4 Form for 2021 Millennial Money

1040x Fillable 20202021 Fill and Sign Printable Template Online US

Fillable Schedule W Wisconsin Subtractions From Federal 2012

IRS 1120W 2021 Fill out Tax Template Online US Legal Forms

2017 Michigan Michigan Withholding Tax Schedule Fill Out, Sign Online

What is a W2 Form? TurboTax Tax Tips & Videos

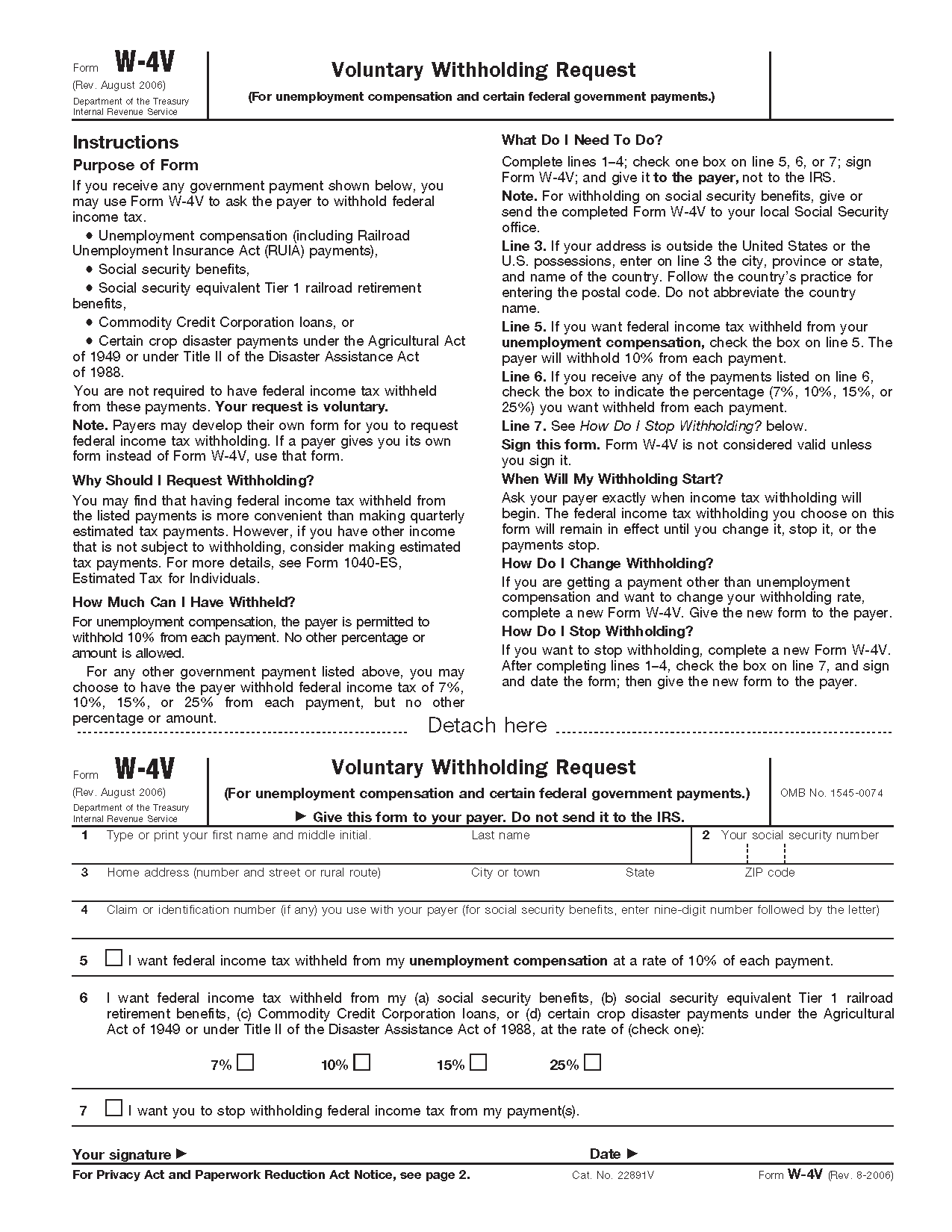

W4V 2021 2022 W4 Form

Related Post: