Merrill Edge 529 Contribution Form

Merrill Edge 529 Contribution Form - Current account information information about you, the participant: Are you looking for an account servicing form? Select this option if you are funding this nextgen account from any source other than an existing custodial account. Read on to find the best option for you. Bonus will be applied to your. Web a contribution to a 529 plan account is treated as a completed gift from the giver to the recipient (the designated beneficiary of the 529 account) and qualifies for the annual federal gift tax exclusion of $17,000 ($34,000 for married couples filing jointly), per beneficiary. Name (last/first/m.i.) or name of custodianship/trust/corp./ other last four digits of your social security number last name first name m.i. Web 529 plan state tax calculator; On average, parent income and savings cover about 44% of education costs 6 — find out how much you need to save and build a savings plan to help you get there. Web what are the benefits of a 529 plan? Additional information is available in our client relationship summary (form crs) (pdf). Web find forms to customize your merrill angle accounts. Web the automated funding service allows you to automatically contribute the maximum contribution amount allowed by law to a retirement account. To ensure you are meeting the required fund minimums for your account, please refer to the plan’s program’s. Learn more about the az529 education savings plan. Open a custodial nextgen account. Are you looking for an account servicing form? Can a child benefit from having more than one 529? There’s no minimum amount, and best of all, there are several ways to contribute—contribute online, make a mobile deposit, mail a check or set up automated contributions. Information about your designated beneficiary: Web open an individual nextgen account. If you would like funds to be distributed to more than one distributee, please complete a withdrawal request form for each distributee. Web 529 plan state tax calculator; 1 can you open a 529 account for a grandchild? Learn more about the az529 education savings plan. Select this option if you are funding this nextgen account from any source other than an existing custodial account. Try our college planning calculator #1 overall client experience Invest with $0 online stock and etf trades. Ad help your family prepare for college. Making a contribution to your nextgen 529 account is easy. Learn more about the az529 education savings plan. How to get your $50 bonus. Open a custodial nextgen account. Give clients the power to achieve their savings goals with the scholars choice 529 plan. Update account performance, apply for trading auxiliary, and set preferences, such as online delivery. Invest with $0 online stock and etf trades. How to get your $50 bonus. Try our college planning calculator #1 overall client experience If you would like funds to be distributed to more than one distributee, please complete a withdrawal request form for each distributee. How to get your $50 bonus. Web to obtain this form, contact your advisor or merrill. Web what are the benefits of a 529 plan? Update account performance, apply for trading auxiliary, and set preferences, such as online delivery. Ad help your family prepare for college. Web 529 plan state tax calculator; Making a contribution to your nextgen 529 account is easy. Web find forms to customize your merrill angle accounts. Go to the nextgen 529 download forms page. Web find helpful resources and support to help manage your merrill account, including answers to faqs about transferring funds, opening an account, and investing. Web find helpful resources and support to help manage your merrill account, including answers to faqs about transferring funds, opening an account, and investing. Web merrill lynch life agency inc. Information about your designated beneficiary: Ad help your family prepare for college. This is the most commonly used nextgen account type. Update account performance, apply for trading auxiliary, and set preferences, such as online delivery. Web 529 plan state tax calculator; Bonus will be applied to your. Web 529 college savings plan withdrawal request form complete this form if you are requesting a withdrawal from a 529 college savings plan account (“account”). To ensure you are meeting the required fund minimums. Web choose your education account for illustrative purposes only how much should you save for college expenses? Open a nextgen college investing plan with merrill edge. Can you roll over a 529 plan? The aggregate nextgen 529 account balance limit is $520,000 per designated beneficiary (subject to adjustments periodically). This is the most commonly used nextgen account type. Ad help your family prepare for college. Web 529 college savings plan withdrawal request form complete this form if you are requesting a withdrawal from a 529 college savings plan account (“account”). What are the tax advantages when you invest with a 529 plan? Additional information is available in our client relationship summary (form crs) (pdf). There’s no minimum amount, and best of all, there are several ways to contribute—contribute online, make a mobile deposit, mail a check or set up automated contributions. Web what are the benefits of a 529 plan? Click on the account login button at the top right corner of this website. Select this option if you are funding this nextgen account from any source other than an existing custodial account. Web 529 plan state tax calculator; (mlla) is a licensed insurance agency and wholly owned subsidiary of bofa corp. Access account online you can request distributions, make investment changes and contribute online. What counts as a qualified 529 expense? Making a contribution to your nextgen 529 account is easy. Learn more about the az529 education savings plan. Are you looking for an account servicing form?how to report 529 distributions on tax return Fill Online, Printable

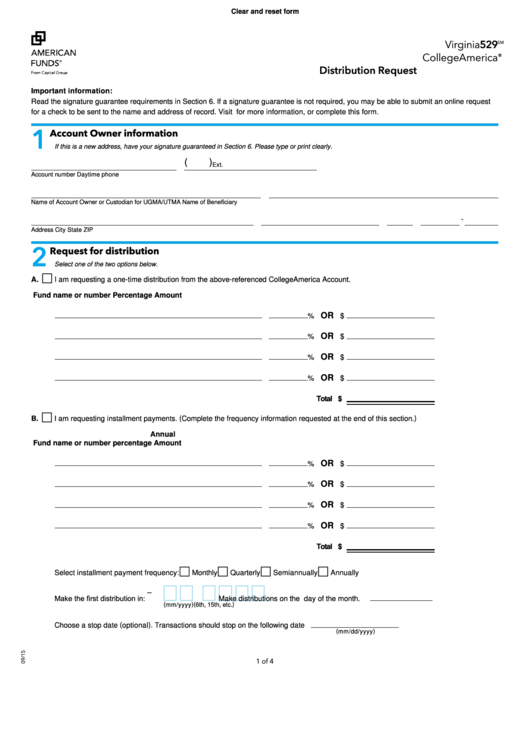

Fillable American Funds 529 Withdrawal Form Distribution Request

Fill Free fillable New York's 529 College Savings

Fill Free fillable New York's 529 College Savings

7,000 in Roth IRA contributions that became 6 million in taxfree

Fill Free fillable Merrill Lynch PDF forms

Fill Free fillable New York's 529 College Savings

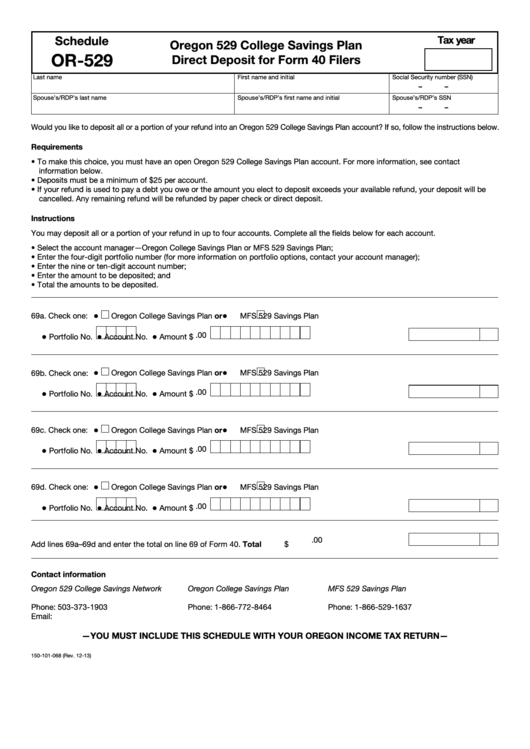

Fillable Schedule Or529 Oregon 529 College Savings Plan Direct

Tax Benefits For 529 Contributions

Merrill Edge Online Account Login Login Helps

Related Post: