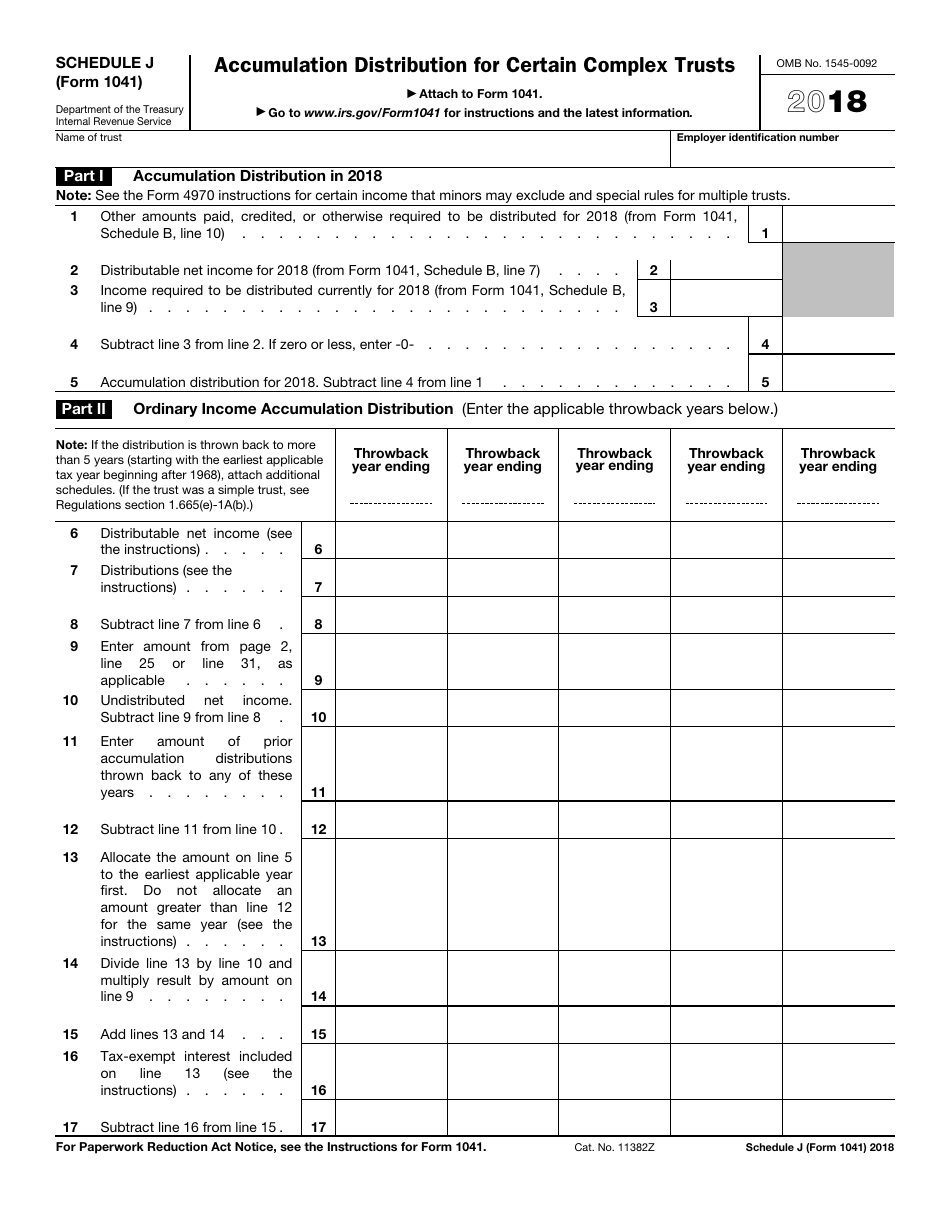

Schedule J Form 1041

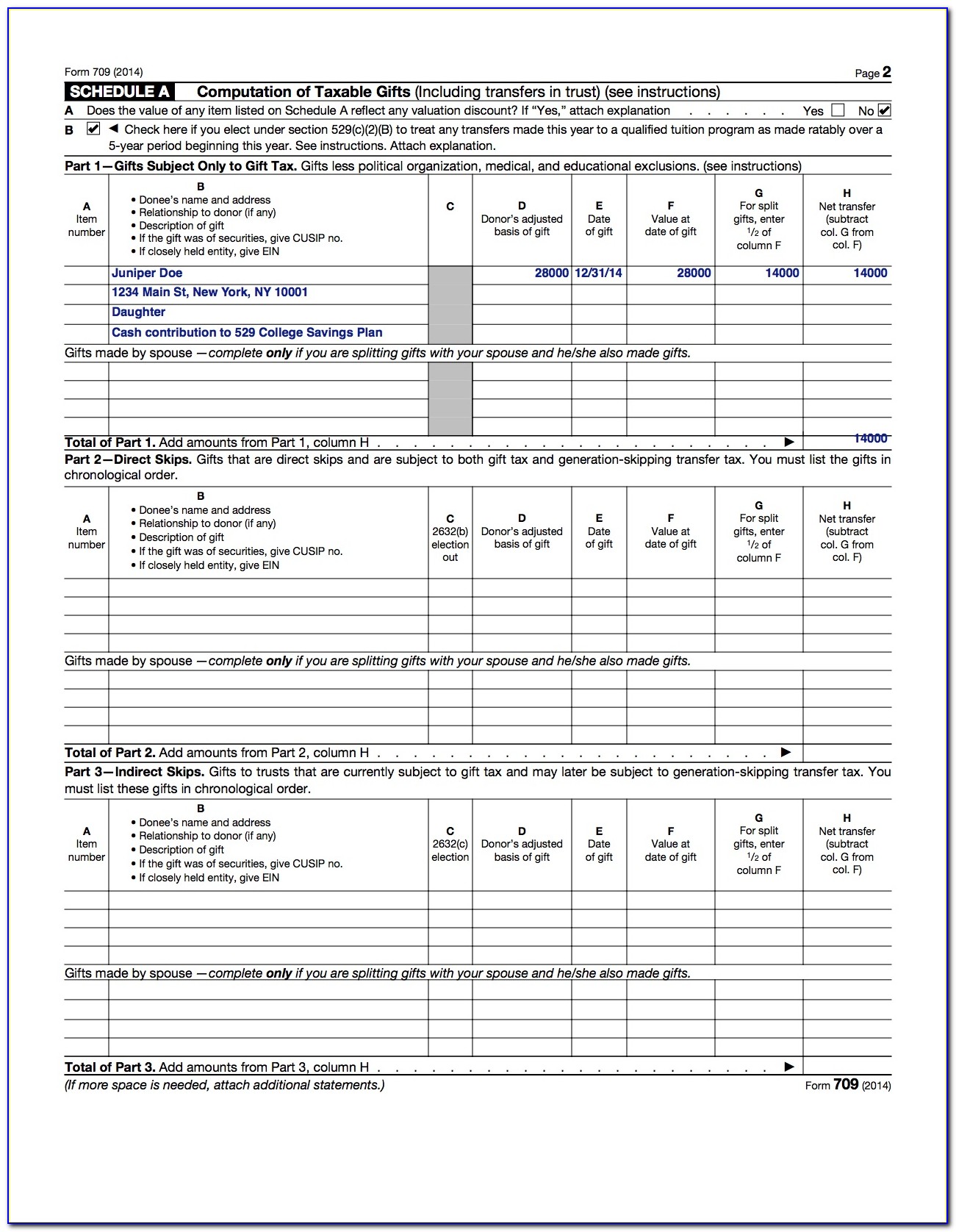

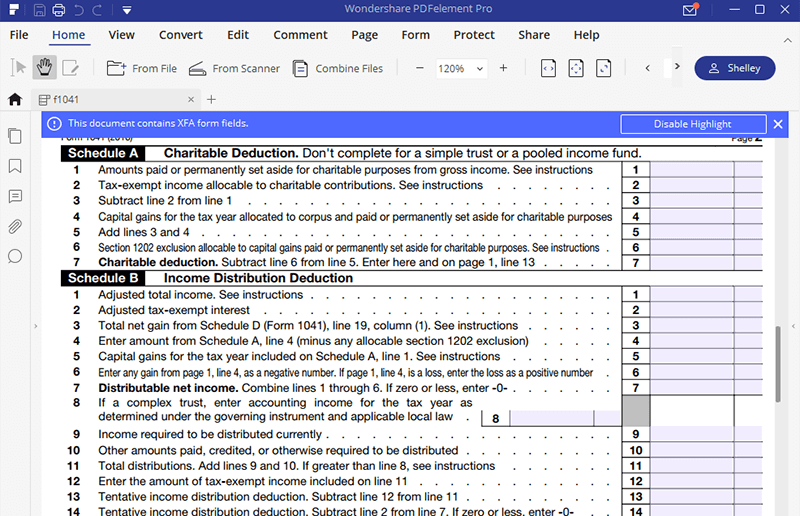

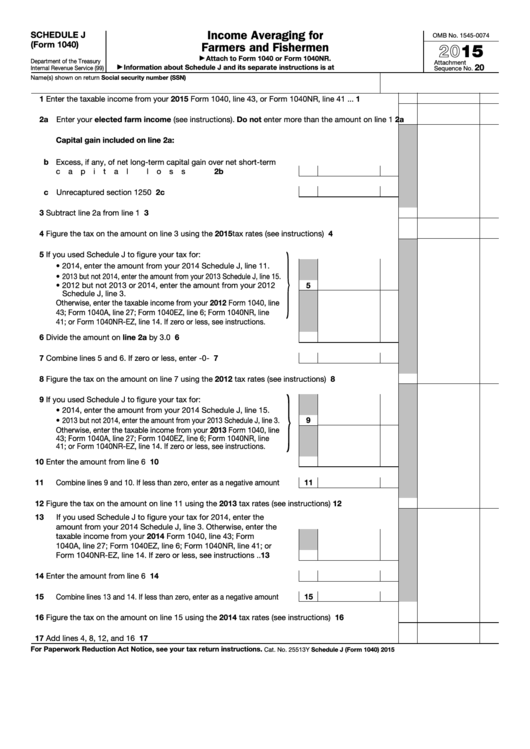

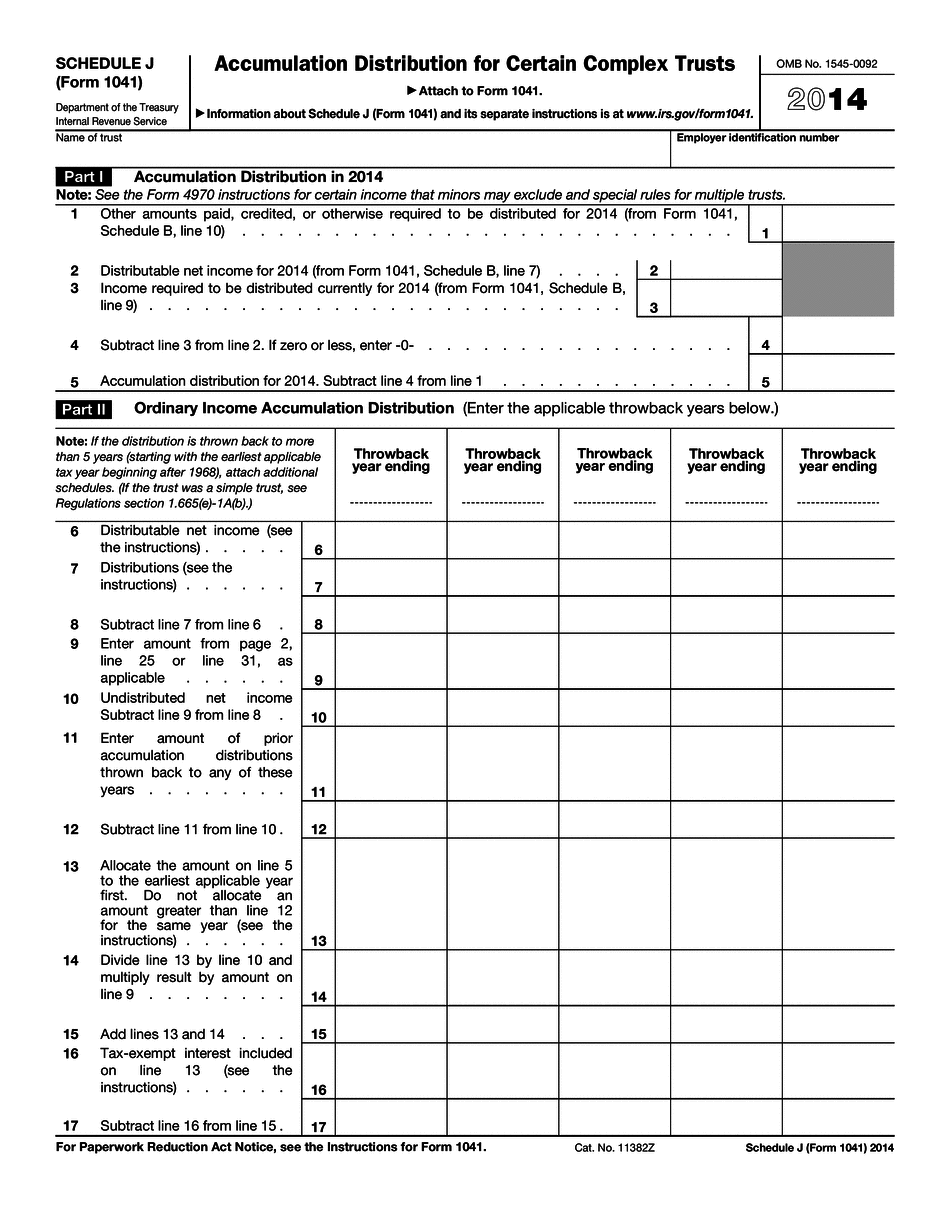

Schedule J Form 1041 - Estates and trusts are permitted to take a deduction on their income tax return (form 1041) for certain income that is distributed to. Web schedule j (form 1041)—accumulation distribution for certain complex trusts. Web information about schedule j (form 1040), income averaging for farmers and fishermen, including recent updates, related forms and instructions on how to file. What is the form used for? Web form 1041 (schedule j) a form that one files with the irs to report distributions from a complex trust above the proper distributions usually made, provided that the distributions. Use schedule i (form 1041) to figure: Line 1—distribution under section 661(a)(2) line 2—distributable net income; Throwback tax rules on distributions from uni to u.s. To start the blank, use the fill & sign online button or tick the preview image of the document. The schedule details the beneficiaries, the income. Taxes imposed on undistributed net income (enter the applicable throwback years below.) (see the instructions.) note: What is the form used for? To start the blank, use the fill & sign online button or tick the preview image of the document. The schedule details the beneficiaries, the income. Get ready for tax season deadlines by completing any required tax forms. Partnership return of income, form 1065. Gains and losses from sales or exchanges. Schedule j to report an accumulation distribution for a domestic. Complete, edit or print tax forms instantly. Web allocation of accumulation distribution, schedule j (form 1041). Gains and losses from sales or exchanges. Basics of schedule j (1041. Ad pdffiller.com has been visited by 1m+ users in the past month Web schedule j (form 1041)—accumulation distribution for certain complex trusts. Web allocation of accumulation distribution, schedule j (form 1041). Ad pdffiller.com has been visited by 1m+ users in the past month Taxes imposed on undistributed net income (enter the applicable throwback years below.) (see the instructions.) note: To start the blank, use the fill & sign online button or tick the preview image of the document. Throwback tax rules on distributions from uni to u.s. Web schedule j (form. The schedule details the beneficiaries, the income. Web form 1041 (schedule j) a form that one files with the irs to report distributions from a complex trust above the proper distributions usually made, provided that the. Web schedule j (form 1041) 2020: Web irs form 1041 schedule j reports income distributions made by an estate or trust during the tax. Gains and losses from sales or exchanges. Web schedule j (form 1041)—accumulation distribution for certain complex trusts. Part i—accumulation distribution in 2022; Basics of schedule j (1041. Line 1—distribution under section 661(a)(2) line 2—distributable net income; Gains and losses from sales or exchanges. Schedule j to report an accumulation distribution for a domestic. Line 1—distribution under section 661(a)(2) line 2—distributable net income; Use schedule i (form 1041) to figure: The schedule details the beneficiaries, the income. The schedule details the beneficiaries, the income. Gains and losses from sales or exchanges. Line 1—distribution under section 661(a)(2) line 2—distributable net income; Top forms to compete and sign. Taxes imposed on undistributed net income (enter the applicable throwback years below.) (see the instructions.) note: Web schedule j (form 1041) 2020: Web form 1041 (schedule j) a form that one files with the irs to report distributions from a complex trust above the proper distributions usually made, provided that the. Partnership return of income, form 1065. Web form 1041 (schedule j) a form that one files with the irs to report distributions from a complex. Gains and losses from sales or exchanges. Web schedule j (form 1041)—accumulation distribution for certain complex trusts. Web schedule j (form 1041) department of the treasury internal revenue service accumulation distribution for certain complex trusts attach to form 1041. Web irs form 1041 schedule j reports income distributions made by an estate or trust during the tax year to its. Top forms to compete and sign. Estates and trusts are permitted to take a deduction on their income tax return (form 1041) for certain income that is distributed to. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or. Web schedule j (form 1041) department of the treasury internal revenue service accumulation distribution for certain complex trusts attach to form 1041. Use schedule i (form 1041) to figure: Web allocation of accumulation distribution, schedule j (form 1041). Get ready for tax season deadlines by completing any required tax forms today. The schedule details the beneficiaries, the income. Schedule j to report an accumulation distribution for a domestic. Basics of schedule j (1041. What is the form used for? Part i—accumulation distribution in 2022; Web form 1041 (schedule j) a form that one files with the irs to report distributions from a complex trust above the proper distributions usually made, provided that the distributions. Taxes imposed on undistributed net income (enter the applicable throwback years below.) (see the instructions.) note: Line 1—distribution under section 661(a)(2) line 2—distributable net income; Web schedule j (form 1041)—accumulation distribution for certain complex trusts. Web schedule j (form 1041) 2020: Complete, edit or print tax forms instantly. Web information about schedule j (form 1040), income averaging for farmers and fishermen, including recent updates, related forms and instructions on how to file. Throwback tax rules on distributions from uni to u.s.1041t Fill out & sign online DocHub

Irs Forms 1041 Schedule B Form Resume Examples EpDLBYgOxR

41 1120s other deductions worksheet Worksheet Works

Guide for How to Fill in IRS Form 1041

Fillable Schedule J (Form 1040) Averaging For Farmers And

Form 1041 Schedule J Fill Out and Sign Printable PDF Template signNow

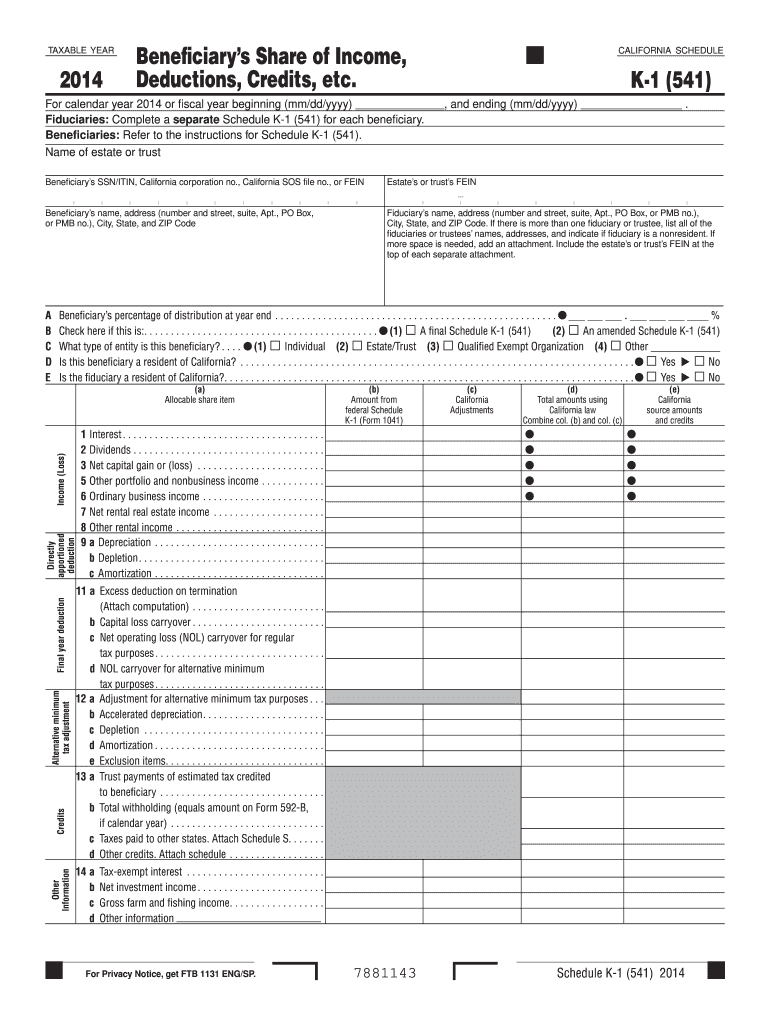

Sample k1 form fabap

U.S. Tax Return for Estates and Trusts, Form 1041

About Schedule K1 (Form 1041)Internal Revenue Service Fill out

IRS Form 1041 Schedule J 2018 Fill Out, Sign Online and Download

Related Post: