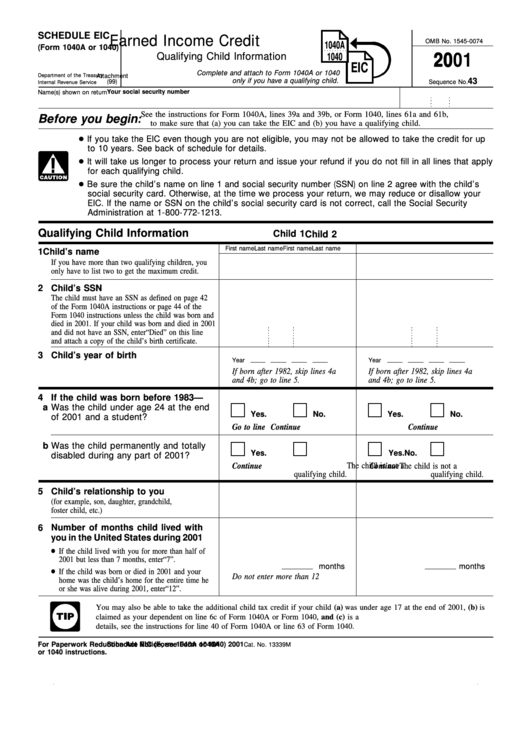

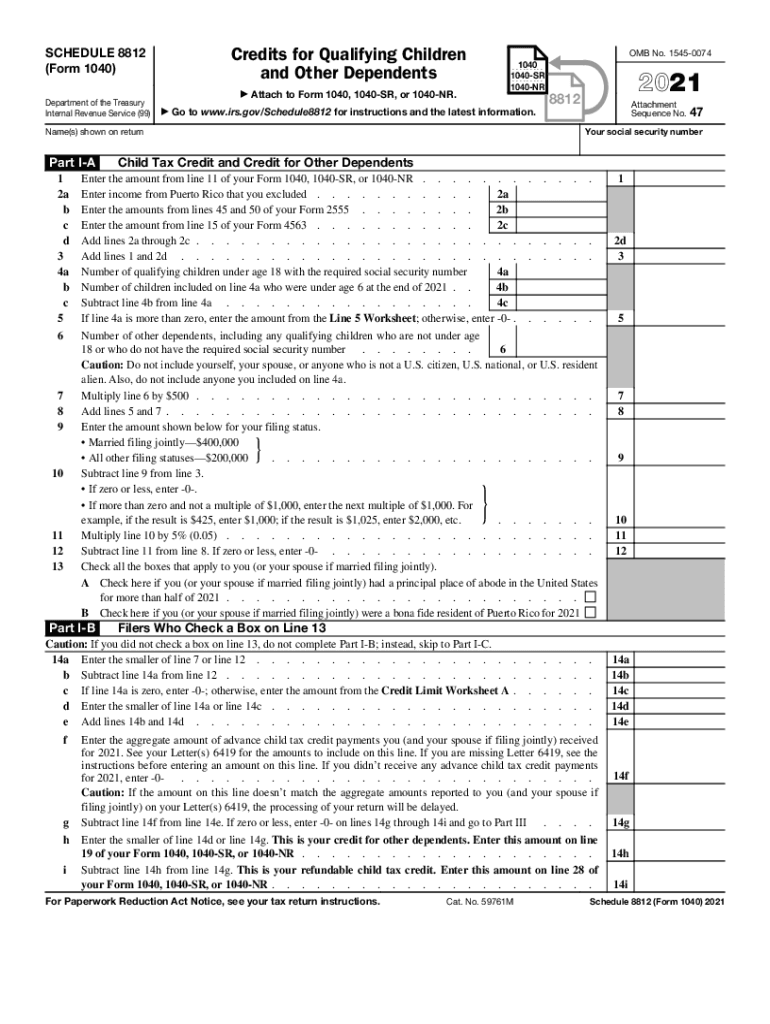

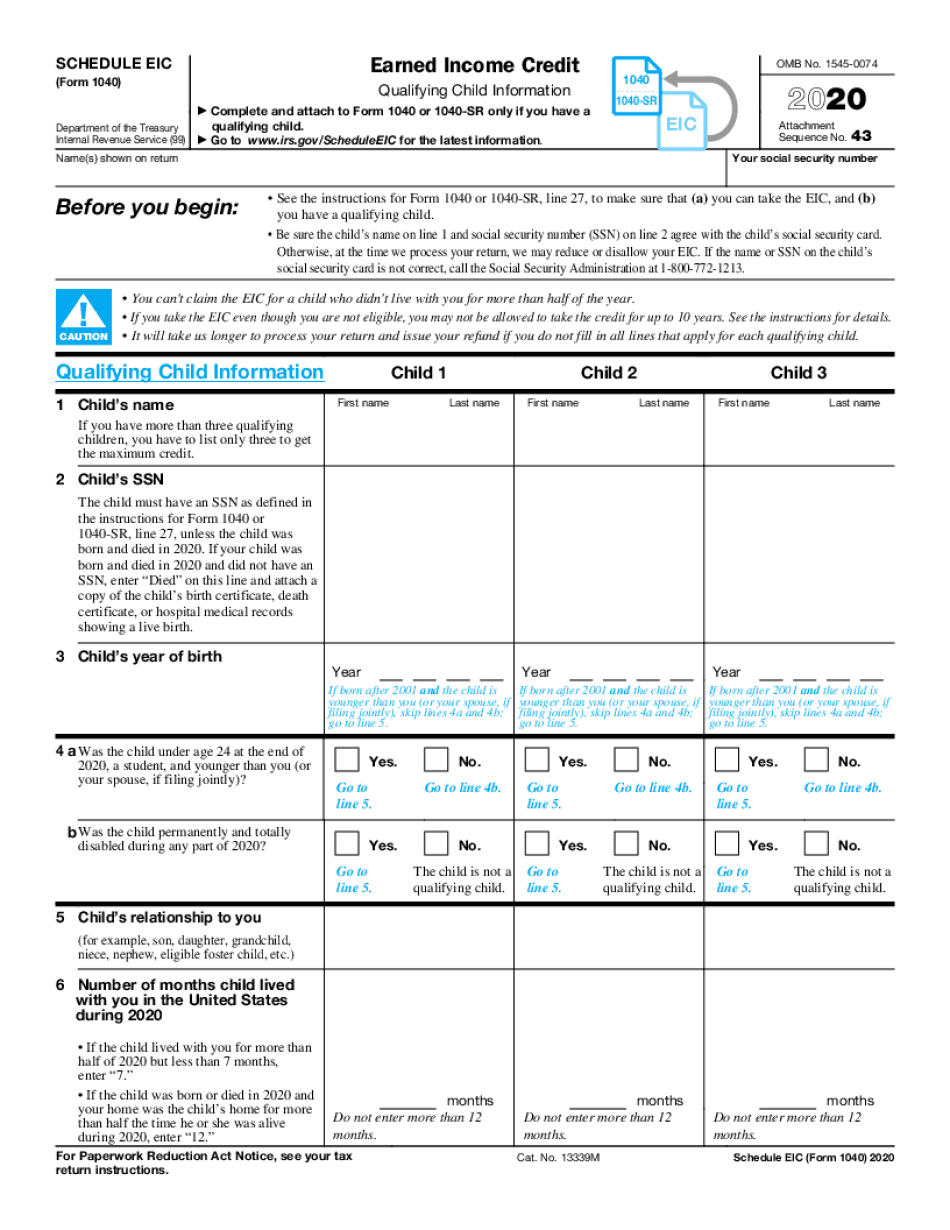

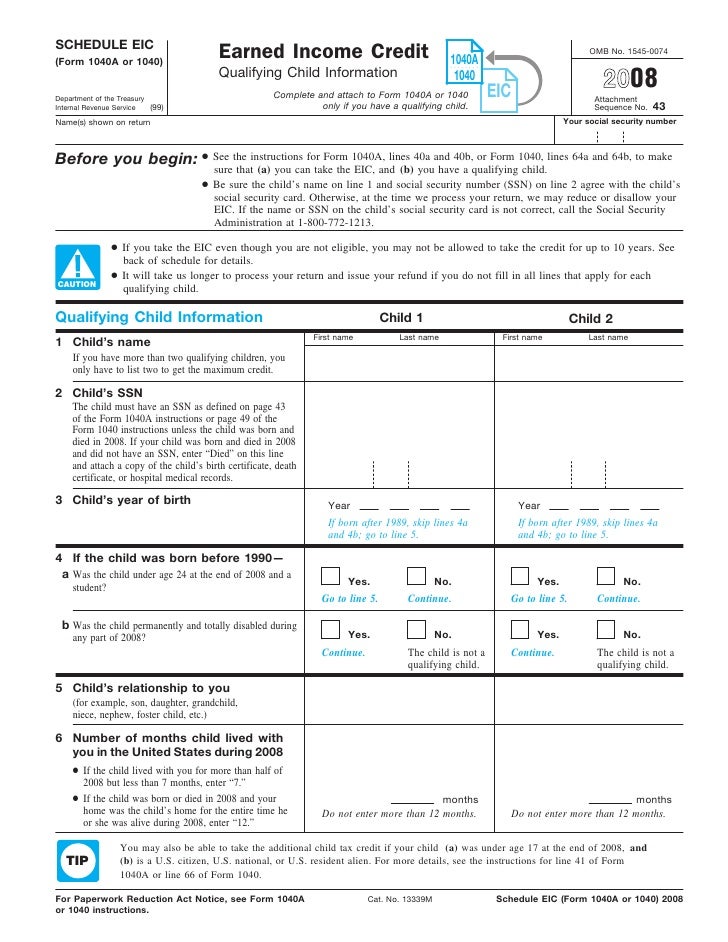

Schedule Eic Form

Schedule Eic Form - Ad complete irs tax forms online or print government tax documents. For 2019 if you file your tax return by july 15, 2023. Earned income credit (eic) what do i need? Web for the latest information about developments related to schedule eic (form 1040) and its instructions, such as legislation enacted after they were published, go to. Answer some questions to see if you qualify. You cannot claim the credit if you are married and filing a. Web • determine if a taxpayer is eligible for the earned income credit • calculate the earned income credit. For 2020 if you file your tax return by may 17, 2024. Web complete this schedule only if you are claiming dependents or are eligible for the illinois earned income credit. To claim eitc you must file a tax return, even if you do not owe any tax or are not required to file. Web how do i apply for earned income tax credit (eitc)? To file a prior year tax. Be sure the child’s name on. Answer some questions to see if you qualify. If you fraudulently claim the earned income credit, you may not. What is form 1040 (schedule eic)? Ad complete irs tax forms online or print government tax documents. Web schedule eic (form 1040) 2020 purpose of schedule page 2 after you have figured your earned income credit (eic), use schedule eic to give the irs information about your. If you have a qualifying. Web for the latest information about developments related. Complete, edit or print tax forms instantly. Answer some questions to see if you qualify. If you have a qualifying. Ad irs publication 596 & more fillable forms, register and subscribe now! Web up to $40 cash back after you have figured your earned income credit (eic), use this schedule to give the irs information about your qualifying child(ren). Web up to $40 cash back after you have figured your earned income credit (eic), use this schedule to give the irs information about your qualifying child(ren). Web schedule eic (form 1040) 2020 purpose of schedule page 2 after you have figured your earned income credit (eic), use schedule eic to give the irs information about your. Be sure the. Answer some questions to see if you qualify. Web form 1040 instructions, step 5, earned income worksheet a or worksheet b: Web complete this schedule only if you are claiming dependents or are eligible for the illinois earned income credit. Web to claim the earned income tax credit, taxpayers must file schedule eic with their tax return. Easily fill out. Ad irs publication 596 & more fillable forms, register and subscribe now! Web up to $40 cash back after you have figured your earned income credit (eic), use this schedule to give the irs information about your qualifying child(ren). Easily fill out pdf blank, edit, and sign them. If you fraudulently claim the earned income credit, you may not. Web. To file a prior year tax. Web for 2021 if you file your tax return by april 18, 2025. Web complete this schedule only if you are claiming dependents or are eligible for the illinois earned income credit. Web 1040 (schedule eic) is a federal individual income tax form. Web • determine if a taxpayer is eligible for the earned. Earned income credit (eic) what do i need? For 2020 if you file your tax return by may 17, 2024. Web • determine if a taxpayer is eligible for the earned income credit • calculate the earned income credit. What is form 1040 (schedule eic)? Web 1040 (schedule eic) is a federal individual income tax form. Answer some questions to see if you qualify. What is form 1040 (schedule eic)? Web for 2022, you may be able to take the eic using the rules in chapter 3 for taxpayers who don't have a qualifying child. Be sure the child’s name on. Web how do i apply for earned income tax credit (eitc)? Save or instantly send your ready documents. Web for the latest information about developments related to schedule eic (form 1040) and its instructions, such as legislation enacted after they were published, go to. Ad irs publication 596 & more fillable forms, register and subscribe now! For 2019 if you file your tax return by july 15, 2023. You cannot claim. Web schedule eic (form 1040) 2020 purpose of schedule page 2 after you have figured your earned income credit (eic), use schedule eic to give the irs information about your. Web to claim the earned income tax credit, taxpayers must file schedule eic with their tax return. Earned income credit (eic) what do i need? Web how do i apply for earned income tax credit (eitc)? If you have a qualifying. Ad complete irs tax forms online or print government tax documents. Ad irs publication 596 & more fillable forms, register and subscribe now! Get ready for tax season deadlines by completing any required tax forms today. In this article, we’ll walk through everything you need to know about. What is form 1040 (schedule eic)? Web • determine if a taxpayer is eligible for the earned income credit • calculate the earned income credit. Save or instantly send your ready documents. Answer some questions to see if you qualify. Web complete this schedule only if you are claiming dependents or are eligible for the illinois earned income credit. You cannot claim the credit if you are married and filing a. Web in 2021, the maximum eitc for those with no dependents is $1,502, up from $538 in 2020 and is available to filers with an agi below $27,380 in 2021. Web 1040 (schedule eic) is a federal individual income tax form. Complete, edit or print tax forms instantly. Easily fill out pdf blank, edit, and sign them. Web for 2021 if you file your tax return by april 18, 2025.Publication 596 Earned Credit (EIC); Schedule EIC

Irs 1040 Form Schedule 1 IRS 1040 Schedule EIC 2020 Fill and Sign

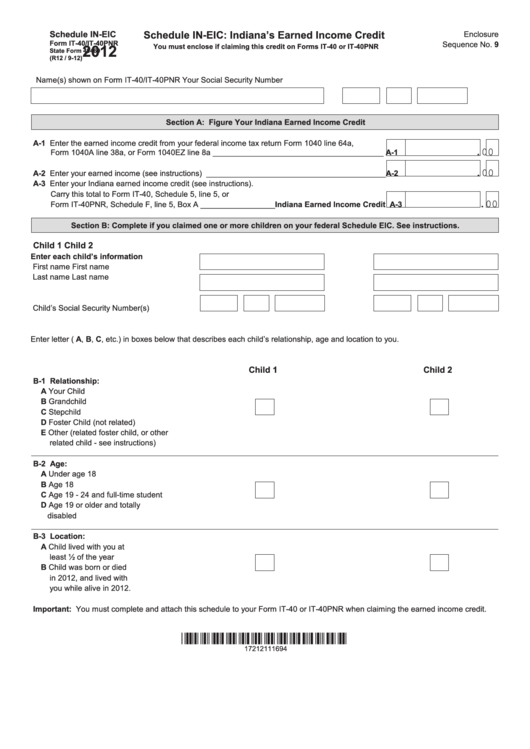

Fillable Form It40/it40pnr Schedule InEic Indiana'S Earned

Eic Worksheet A Instructions 2021 Tripmart

Schedule EIC Form Fill Out and Sign Printable PDF Template signNow

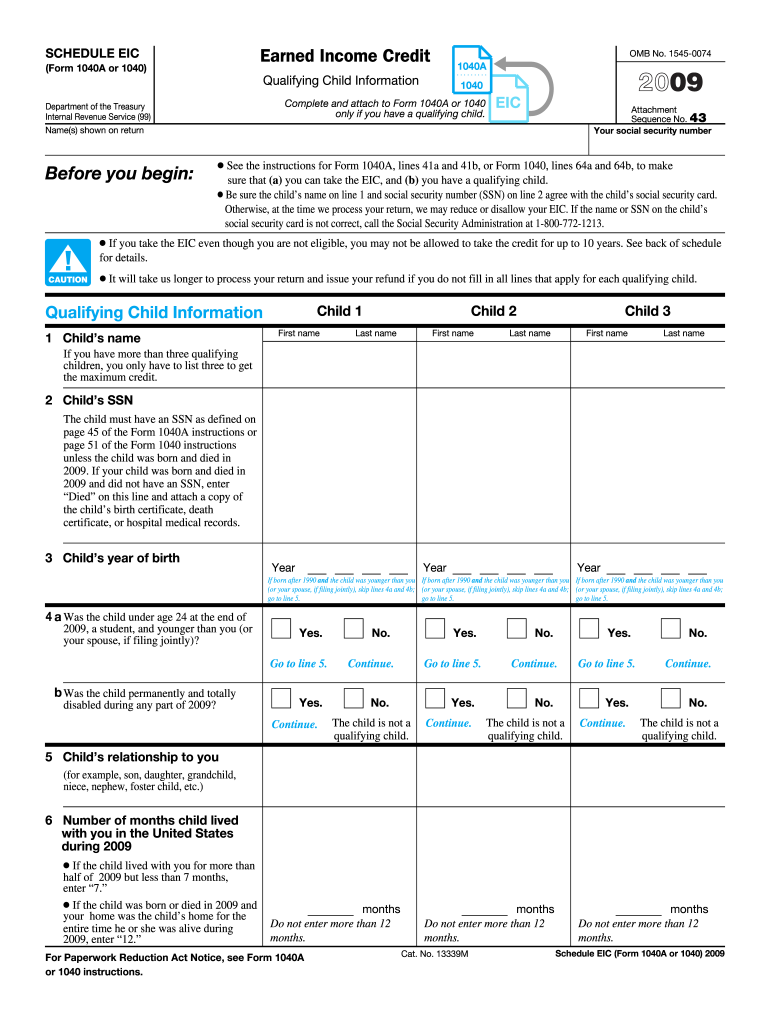

Schedule Eic (Form 1040a Or 1040) Earned Credit printable

Form 8812 Fill Out and Sign Printable PDF Template signNow

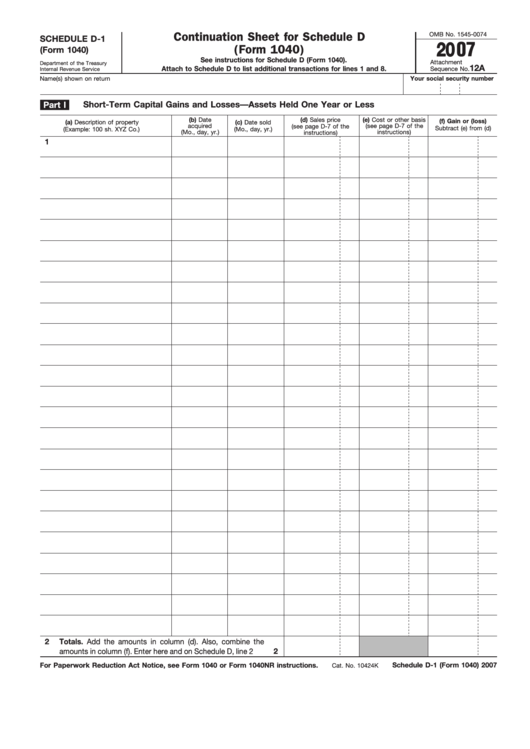

2007 Schedule EIC Irs Tax Forms Earned Tax Credit

Manage Documents Using Our Editable Form For Schedule Eic Form 1040

Form 1040/1040A, Schedule EICEarned Credit

Related Post: