Schedule D Form 1120S

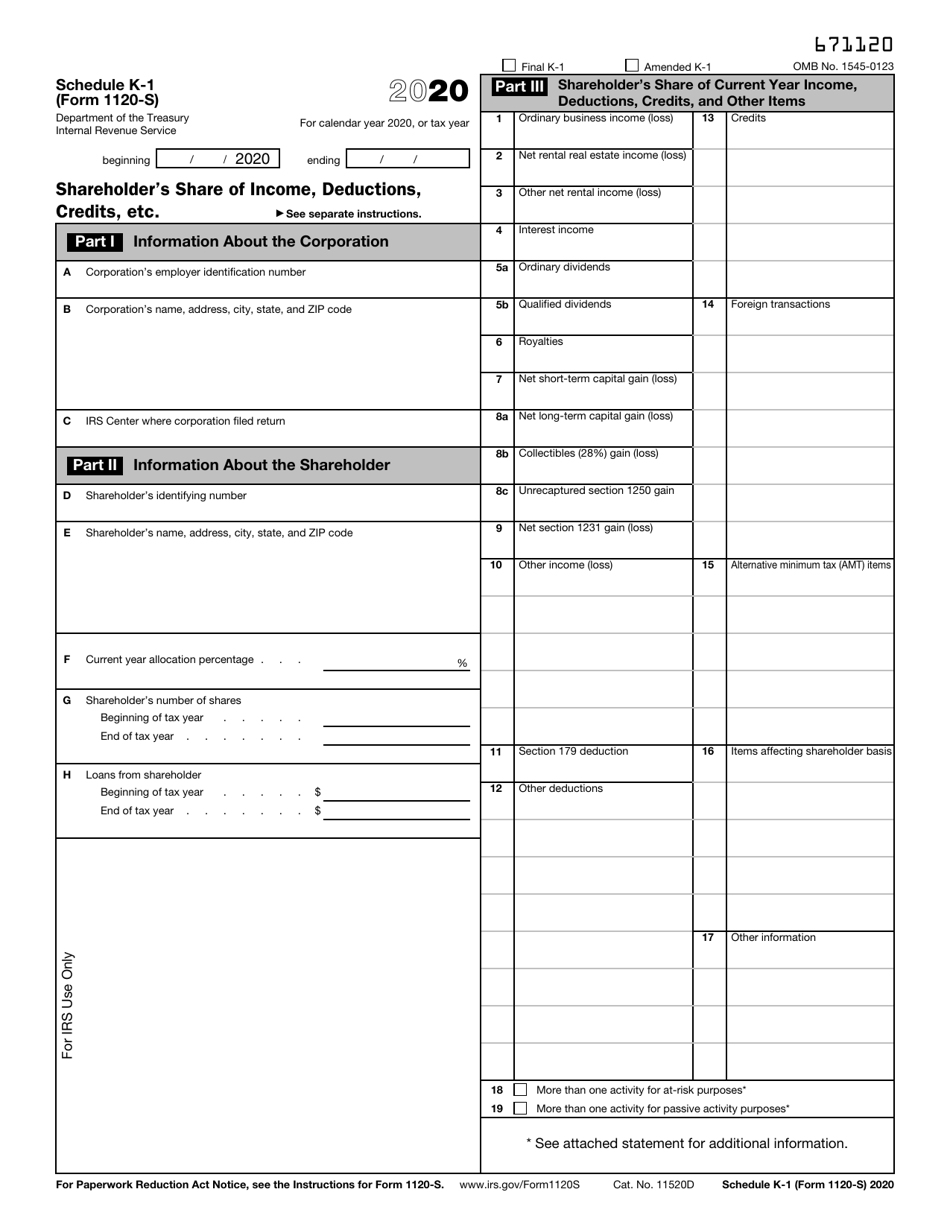

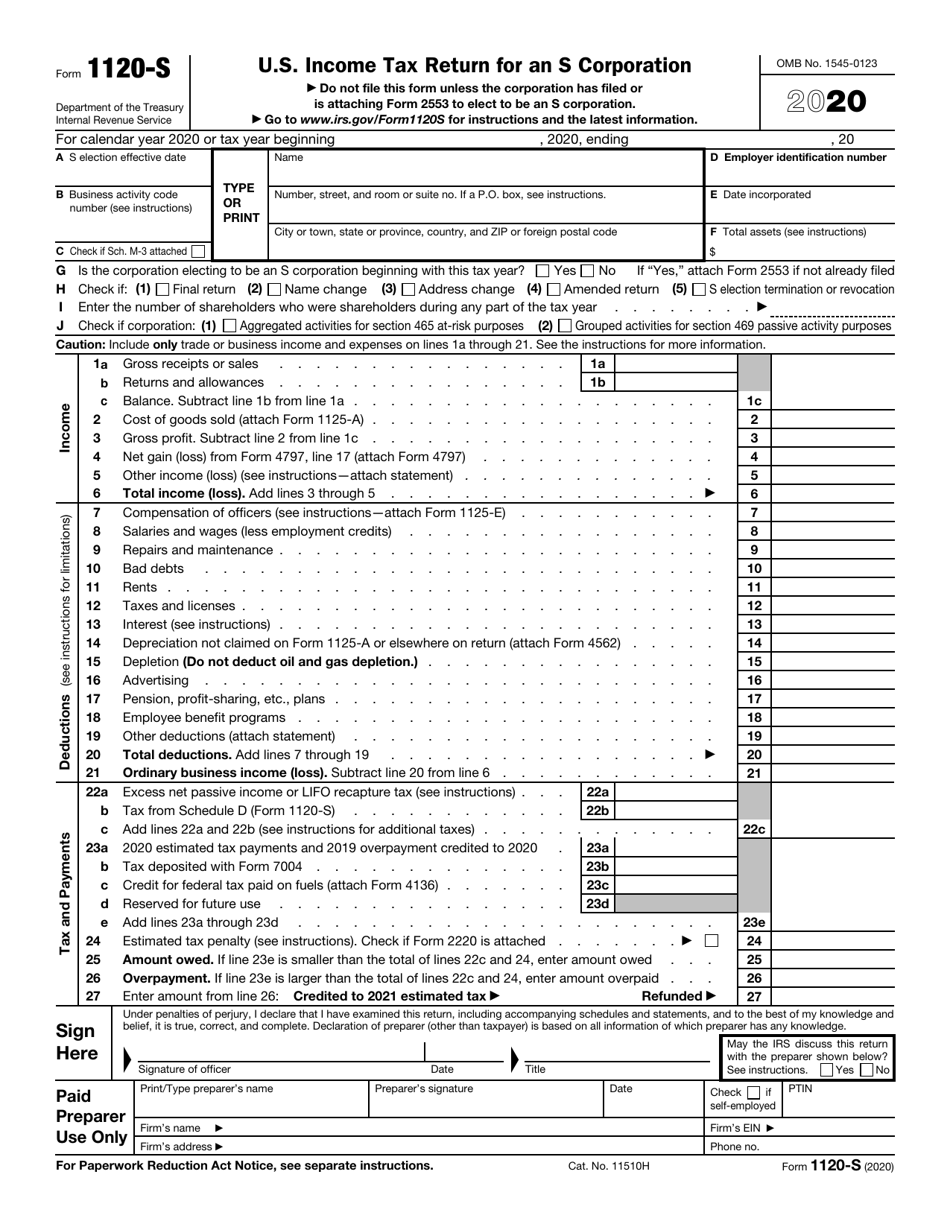

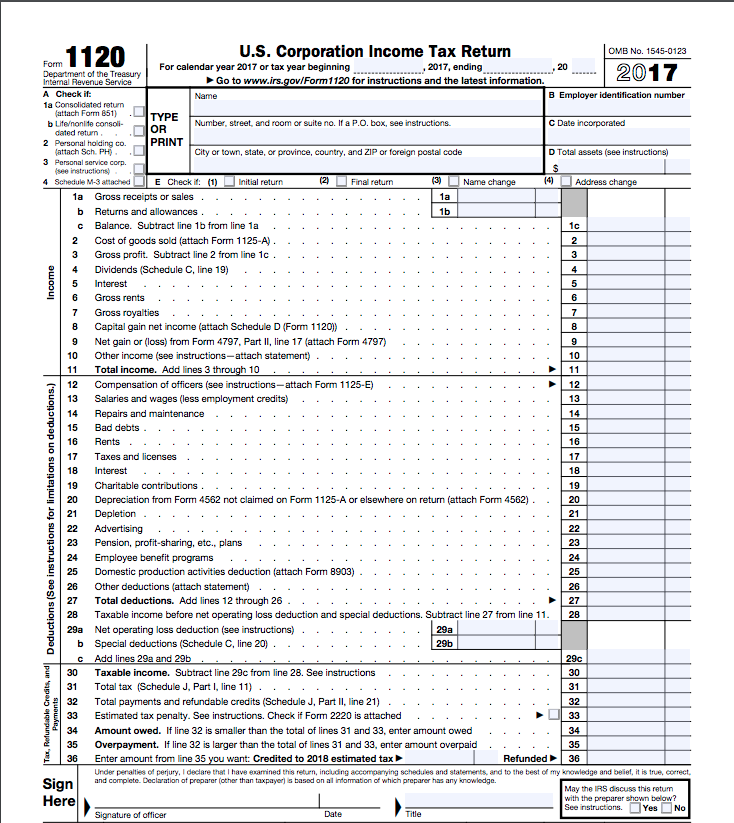

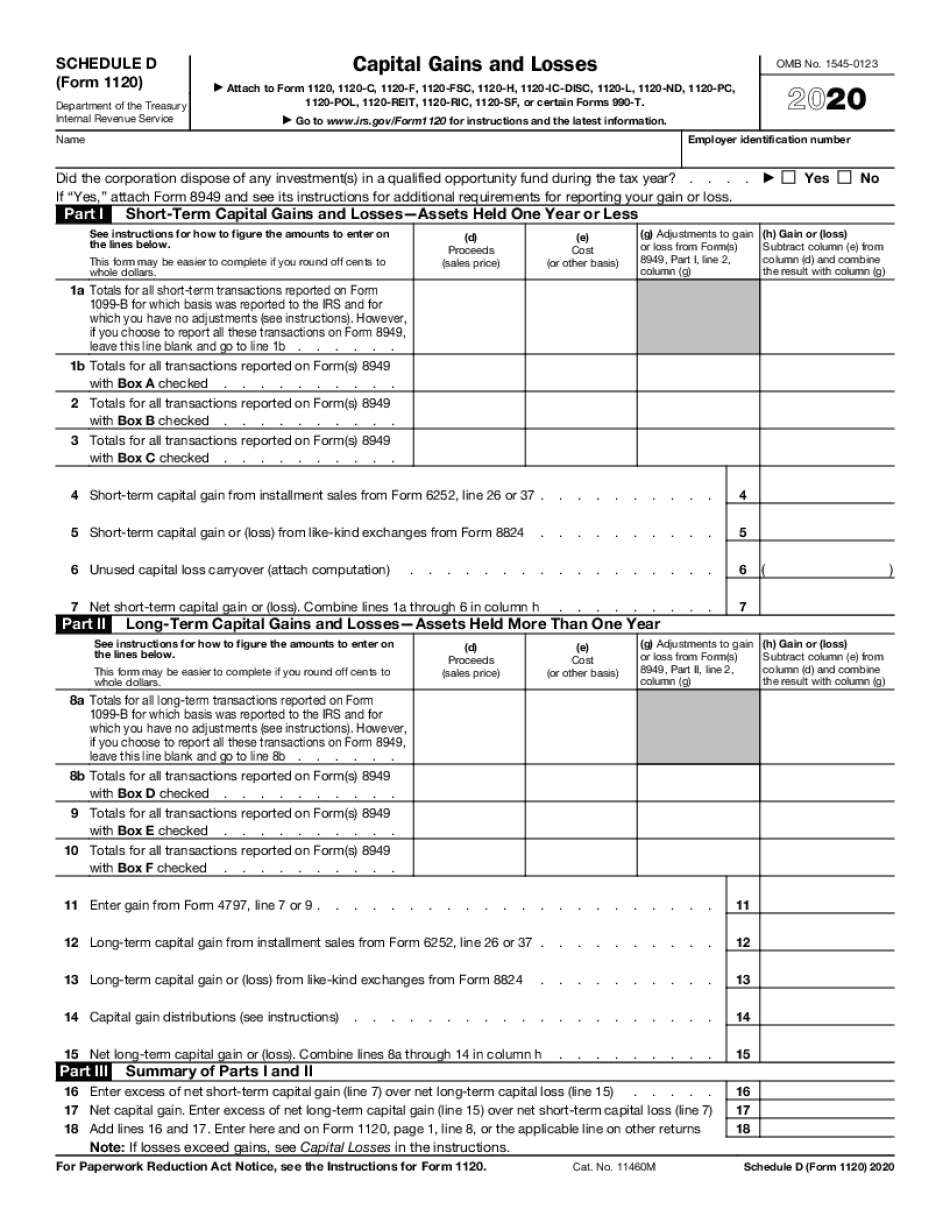

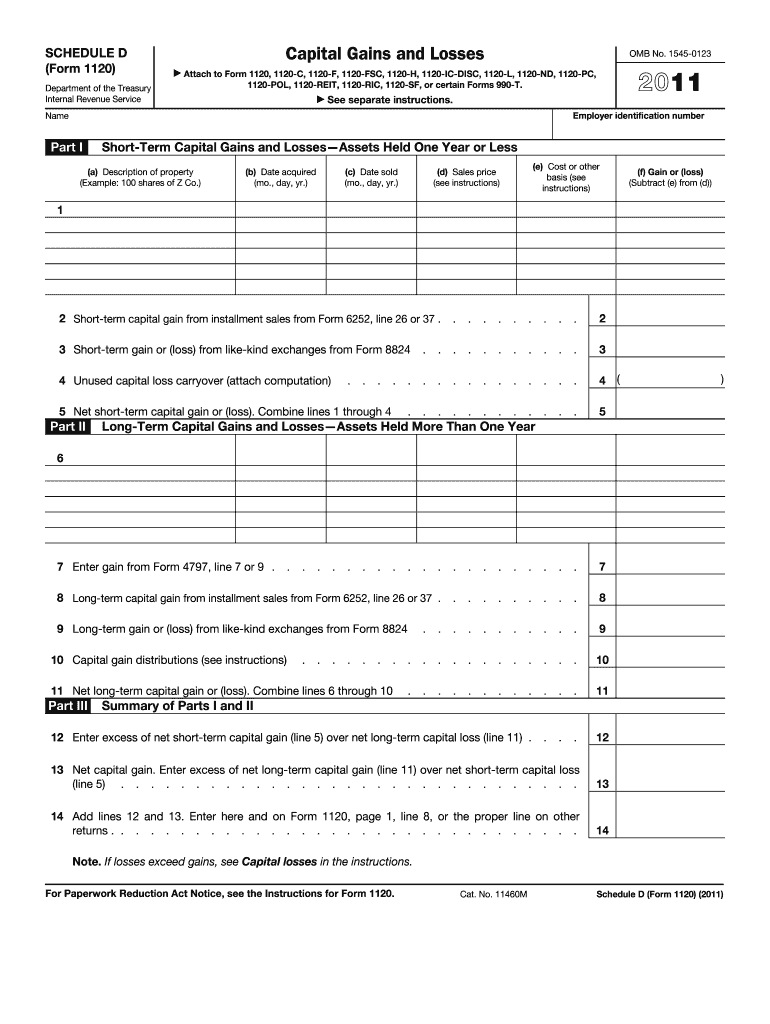

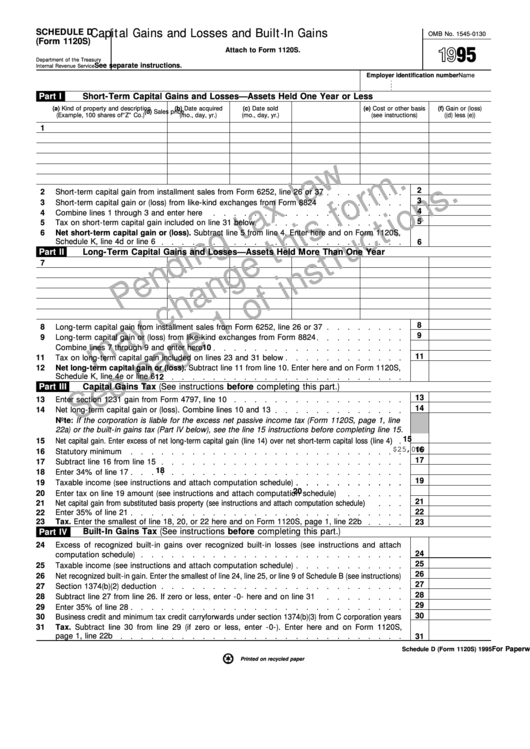

Schedule D Form 1120S - Web the 10 stages to completing form 1120s are listed below: Use form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. Other forms the corporation may have to. Web instructions for form 1120s u.s. Do not file this form unless the corporation has filed or is attaching. Department of the treasury internal revenue service. Web what is the form used for? Gather the information required for form 1120s. General instructions purpose of schedule use. Income tax return for an s corporation. Form 1120s is the tax form s corporations use to file their federal income tax return (not to be confused with form 1120 for c. Gather the information required for form 1120s. Report certain transactions the corporation does not. General instructions purpose of schedule use. Whether you use tax software or hire a tax expert. Do not file this form unless the corporation has filed or is attaching. Form 1120s is the tax form s corporations use to file their federal income tax return (not to be confused with form 1120 for c. Income tax return for an s corporation. Web what is the form used for? Web department of the treasury internal revenue service. Report certain transactions the corporation does not. Gather the information required for form 1120s. Income tax return for an s corporation. Figure the overall gain or loss from transactions reported on form 8949. Web department of the treasury internal revenue service. Income tax return for an s corporation. Figure the overall gain or loss from transactions reported on form 8949; Department of the treasury internal revenue service. Web instructions for form 1120s u.s. Web what is the form used for? Income tax return for an s corporation section references are to the internal contents page photographs of revenue code unless. Web what is the form used for? Ad taxact.com has been visited by 10k+ users in the past month Income tax return for an s corporation. Income tax return for an s corporation. Figure the overall gain or loss from transactions reported on form 8949. Report certain transactions the corporation does. Web the schedule d form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. Other forms the corporation may have to. Do not file this form unless. Web use schedule d (form 1120) to: Figure the overall gain or loss from transactions reported on form 8949; Income tax return for an s corporation. Ad signnow.com has been visited by 100k+ users in the past month Use form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. Income tax return for an s corporation. Web use schedule d (form 1120) to: Web the 10 stages to completing form 1120s are listed below: Web instructions for form 1120s u.s. Web the schedule d form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. Ad signnow.com has been visited by 100k+ users in the past month Report certain transactions the corporation does. Whether you use tax software or hire a tax expert. Web department of the treasury internal revenue service. Web the 10 stages to completing form 1120s are listed below: Do not file this form unless the corporation has filed or is attaching. Web use schedule d (form 1120) to: Form 1120s is the tax form s corporations use to file their federal income tax return (not to be confused with form 1120 for c. Income tax return for an s corporation section references are to the internal contents page. Web use schedule d (form 1120) to: Web instructions for form 1120s u.s. Ad taxact.com has been visited by 10k+ users in the past month Department of the treasury internal revenue service. Figure the overall gain or loss from transactions reported on form 8949. Web what is the form used for? Do not file this form unless the corporation has filed or is attaching. Gather the information required for form 1120s. Use form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. Web department of the treasury internal revenue service. Web use 1120 schedule d capital gains and losses to: Web the schedule d form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. Other forms the corporation may have to. Figure the overall gain or loss from transactions reported on form 8949; Ad signnow.com has been visited by 100k+ users in the past month Report certain transactions the corporation does. General instructions purpose of schedule use. Web department of the treasury internal revenue service. Whether you use tax software or hire a tax expert. Income tax return for an s corporation.IRS Form 1120S Schedule K1 Download Fillable PDF or Fill Online

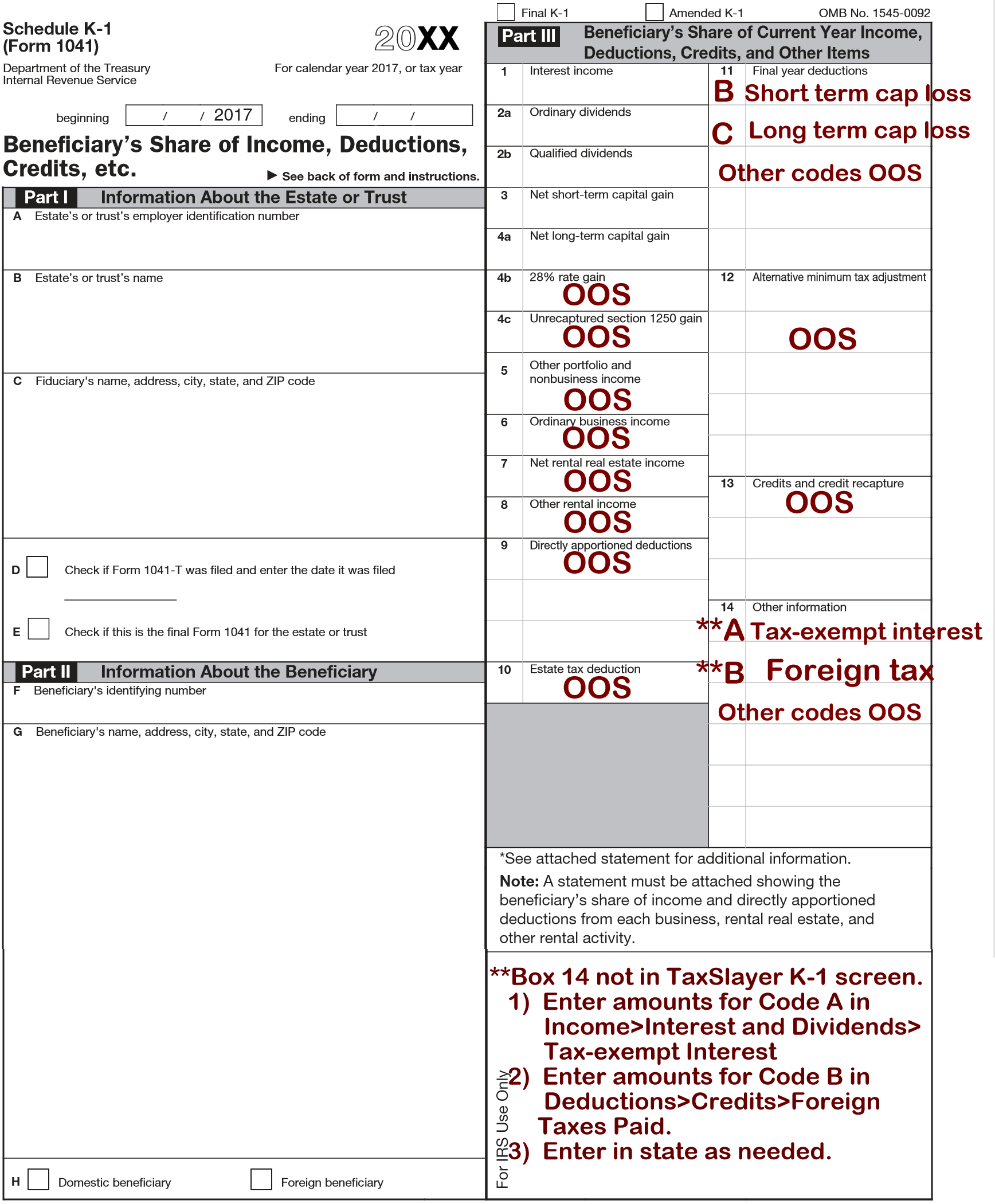

Form 1120S K 1 Instructions 2016 2018 Codes Line 17 —

IRS Form 1120S Download Fillable PDF or Fill Online U.S. Tax

Tax Form 1120—What It Is, How to File It Bench Accounting

Form 1120S (Schedule D) Capital Gains and Losses and Builtin Gains

Fit Schedule K 1 Form 1120s airSlate

IRS 1120S 2023 Form Printable Blank PDF Online

2019 1120s Fill Online, Printable, Fillable Blank form1120

2011 Form IRS 1120 Schedule D Fill Online, Printable, Fillable, Blank

Schedule D (Form 1120s) Capital Gains And Losses And BuiltIn Gains

Related Post: