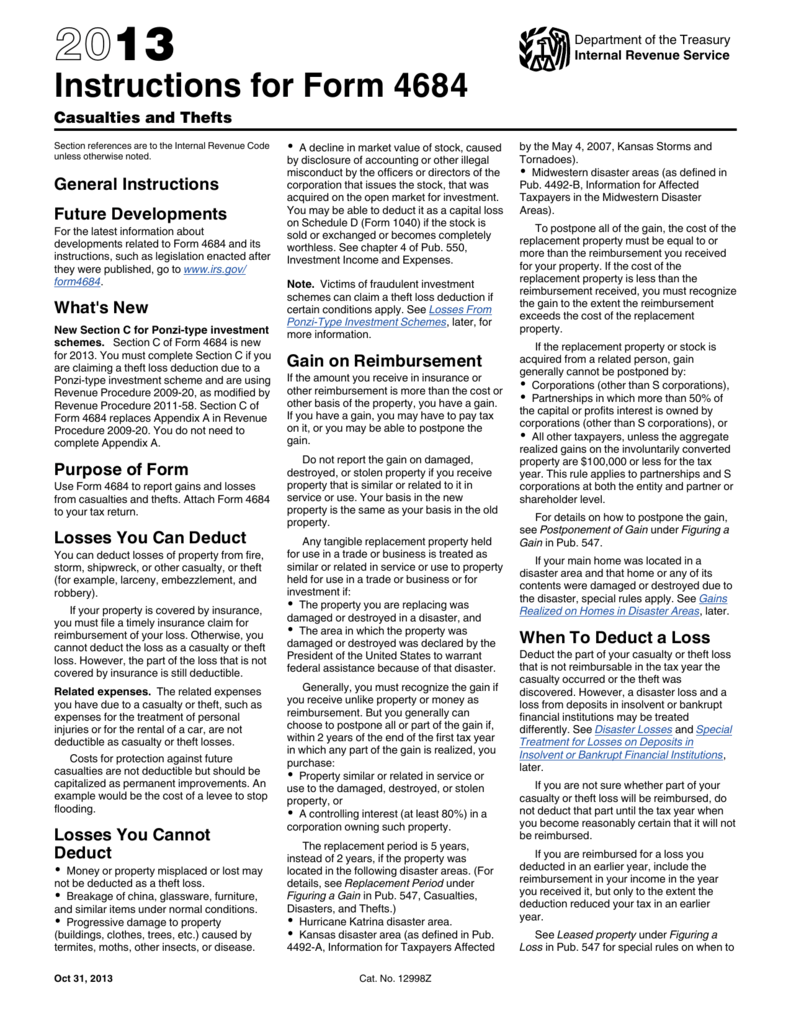

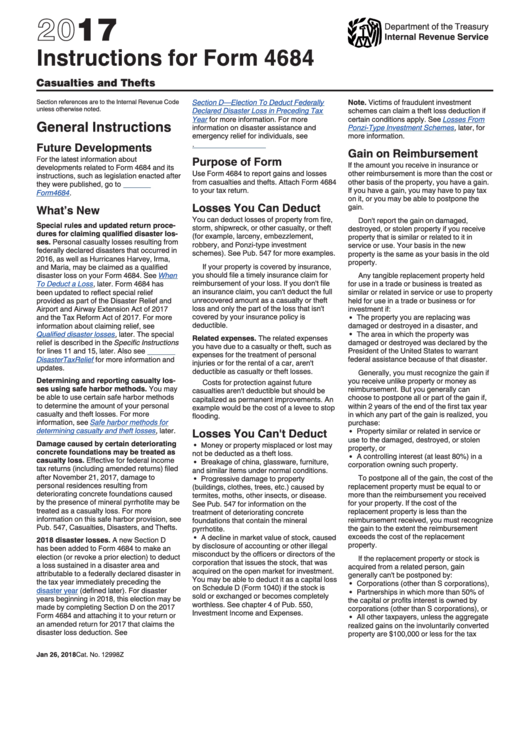

Instructions For Form 4684

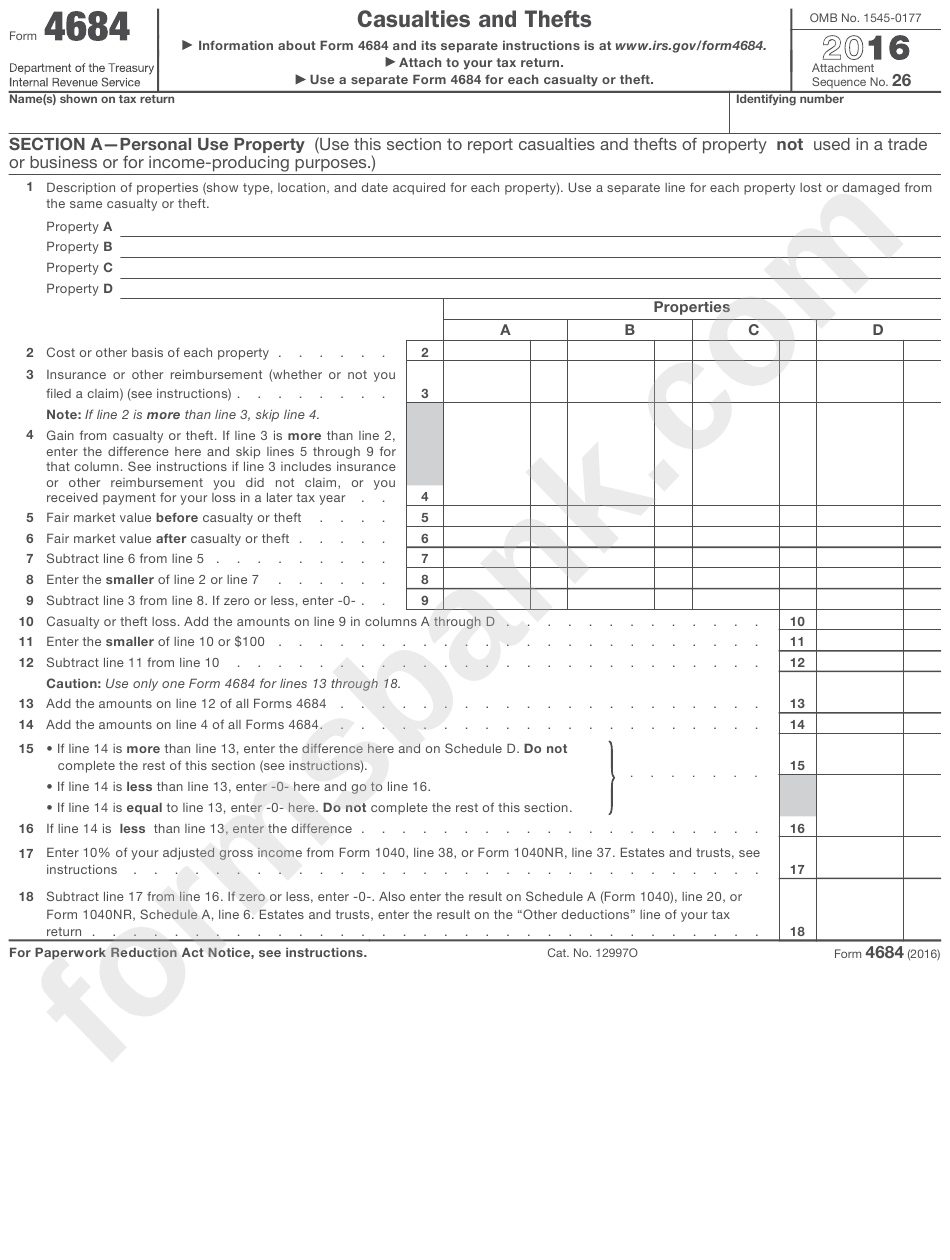

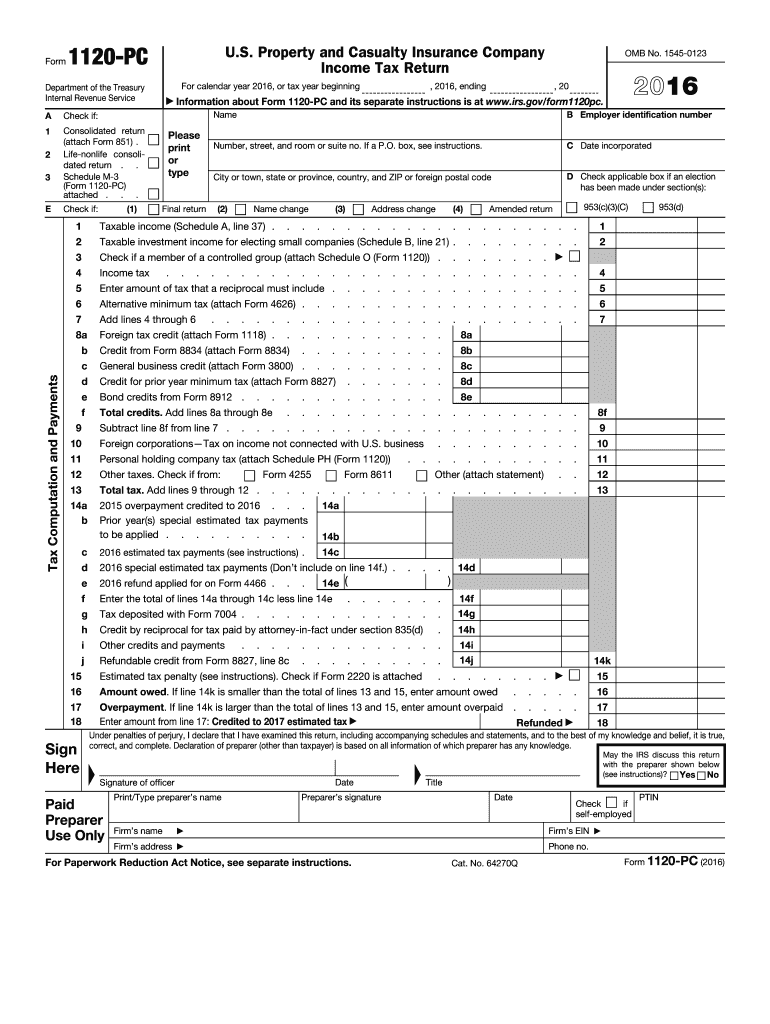

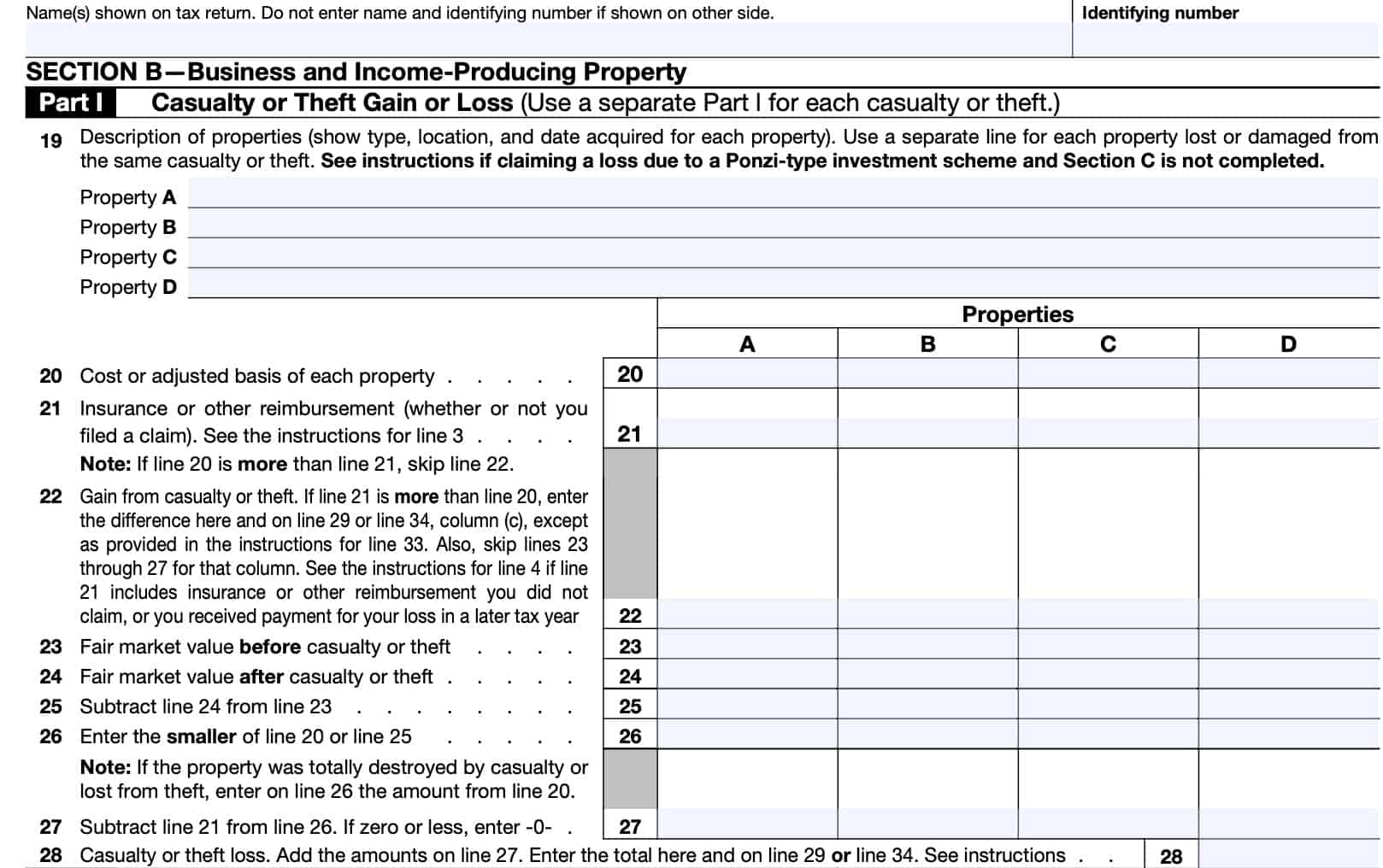

Instructions For Form 4684 - If reporting a qualified disaster loss, see the. Web use a separate form 4684 for each casualty or theft. Web general instructions future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were. Casualties and thefts 2022 01/03/2023 inst 4684: Web a casualty loss is claimed as an itemized deduction on schedule a of form 1040 and form 4684, casualties and thefts. Under the section casualties and thefts (4684) in the field 1=personal, 2=business, 3=income, 4=employee, enter 1. Get ready for tax season deadlines by completing any required tax forms today. Web 3 rows casualties and thefts. Complete, edit or print tax forms instantly. Beginning in 2018 , the tax cuts and jobs act suspended the itemized deduction for personal casualties and theft. Tax relief for homeowners with corrosive drywall: Web the taxact program uses form 4684 to figure the amount of your loss, and transfers the information to schedule a (form 1040) itemized deductions, line 15. Information about form 4684, casualties and thefts, including recent updates, related forms and instructions. Web up to $40 cash back form 4684, casualties and thefts, is. Under the section casualties and thefts (4684) in the field 1=personal, 2=business, 3=income, 4=employee, enter 1. Web general instructions future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were. Beginning in 2018 , the tax cuts and jobs act suspended the itemized deduction for personal casualties and theft.. Complete, edit or print tax forms instantly. Web 3 rows casualties and thefts. Web select the tab labeled 4684, 6781, 8824, 4255. If reporting a qualified disaster loss, see the. Web form 4684 department of the treasury internal revenue service casualties and thefts information about form 4684 and its separate instructions is at. Get ready for tax season deadlines by completing any required tax forms today. Download or email form i4797 & more fillable forms, register and subscribe now! Instructions for form 4684, casualties and thefts 2022 01/12/2023 Information about form 4684, casualties and thefts, including recent updates, related forms and instructions. Beginning in 2018 , the tax cuts and jobs act suspended. Web general instructions future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were. If reporting a qualified disaster loss, see the. Web page last reviewed or updated: This article will assist you with entering a casualty or theft for form 4684 in proseries. Web 4 rows for the. Get ready for tax season deadlines by completing any required tax forms today. Web future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were published, go to. Web general instructions future developments for the latest information about developments related to form 4684 and its instructions, such as legislation. We last updated the casualties and thefts in january 2023, so this is the latest version of form 4684, fully updated for tax. Information about form 4684, casualties and thefts, including recent updates, related forms and instructions. Web 4 rows for the latest information about developments related to form 4684 and its instructions, such. Web what is considered a casualty. Web the taxact program uses form 4684 to figure the amount of your loss, and transfers the information to schedule a (form 1040) itemized deductions, line 15. Complete, edit or print tax forms instantly. Department of the treasury internal revenue service. Select the casualty or theft (4684) section from the lower left sections. Complete, edit or print tax forms instantly. Web use a separate form 4684 for each casualty or theft. Web to enter a casualty or theft on screen 22, depreciation: We last updated the casualties and thefts in january 2023, so this is the latest version of form 4684, fully updated for tax. Web what is considered a casualty loss deduction (form 4684)? Web 4 rows for the. Web select the tab labeled 4684, 6781, 8824, 4255. Web 4 rows for the latest information about developments related to form 4684 and its instructions, such. Information about form 4684, casualties and thefts, including recent updates, related forms and instructions. Download or email form i4797 & more fillable forms, register and subscribe now! Web general instructions future developments for the. If reporting a qualified disaster loss, see the. Beginning in 2018 , the tax cuts and jobs act suspended the itemized deduction for personal casualties and theft. Ad access irs tax forms. Under the section casualties and thefts (4684) in the field 1=personal, 2=business, 3=income, 4=employee, enter 1. Web use a separate form 4684 for each casualty or theft. Tax relief for homeowners with corrosive drywall: Web to enter a casualty or theft on screen 22, depreciation: Web select the tab labeled 4684, 6781, 8824, 4255. Web general instructions future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were. Web a casualty loss is claimed as an itemized deduction on schedule a of form 1040 and form 4684, casualties and thefts. Download or email form i4797 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Web future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were published, go to. Information about form 4684, casualties and thefts, including recent updates, related forms and instructions. Instructions for form 4684, casualties and thefts 2022 01/12/2023 We last updated the casualties and thefts in january 2023, so this is the latest version of form 4684, fully updated for tax. Web the taxact program uses form 4684 to figure the amount of your loss, and transfers the information to schedule a (form 1040) itemized deductions, line 15. Web 3 rows casualties and thefts. This article will assist you with entering a casualty or theft for form 4684 in proseries. Web general instructions future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were.Form 4684 Casualties And Thefts 2016 printable pdf download

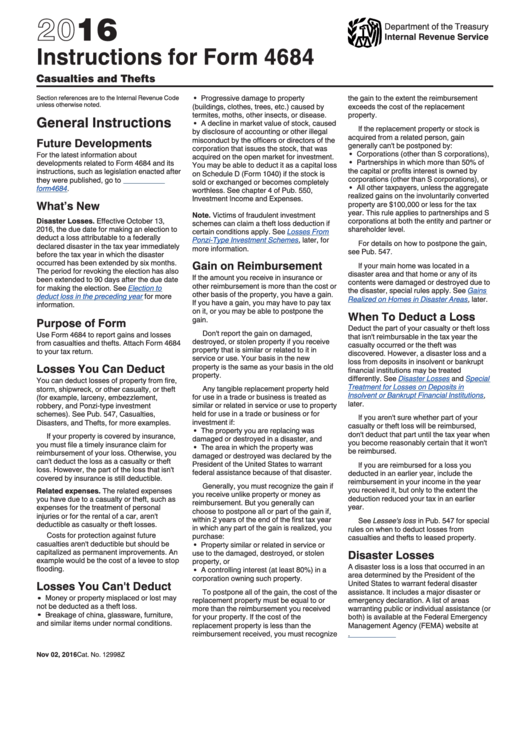

Instructions For Form 4684 Casualties And Thefts 2016 printable pdf

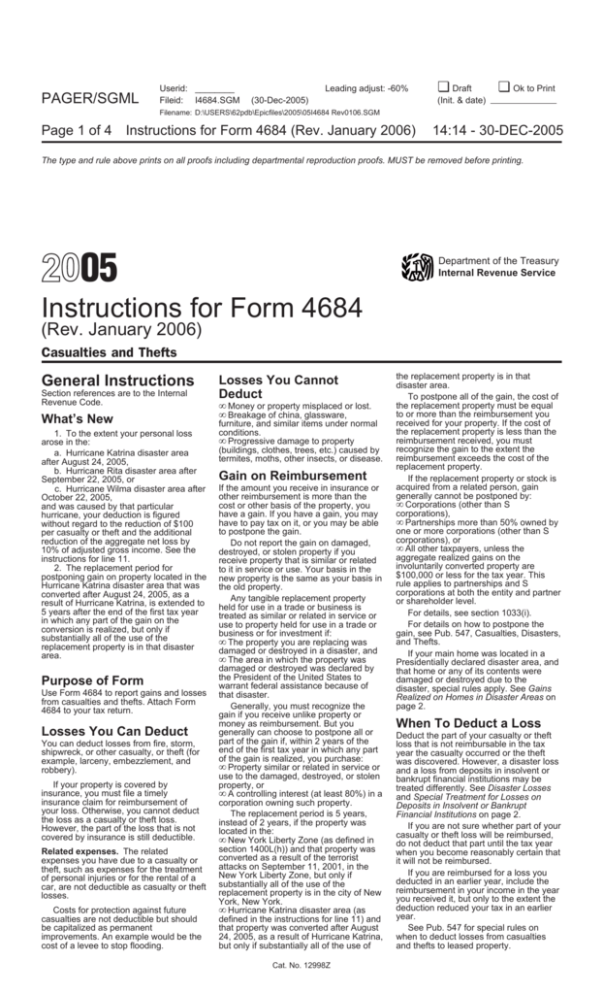

2005 Instructions for Form 4684

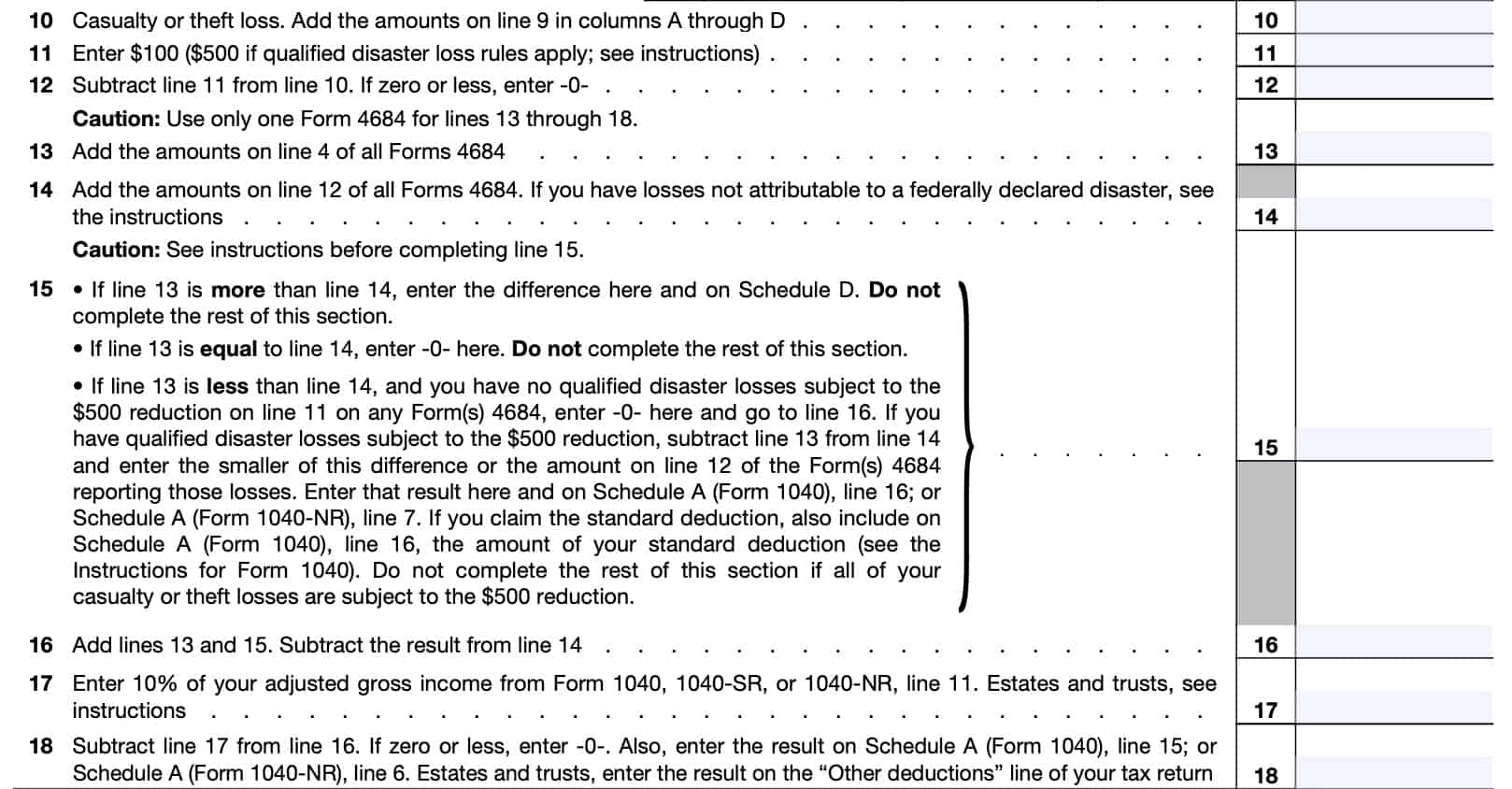

IRS Form 4684 Instructions Deducting Casualty & Theft Losses

Instructions for Form 4684

Form 4684 Example Fill Out and Sign Printable PDF Template signNow

Instructions For Form 4684 Casualties And Thefts 2016 printable pdf

IRS Form 4684 Instructions Deducting Casualty & Theft Losses

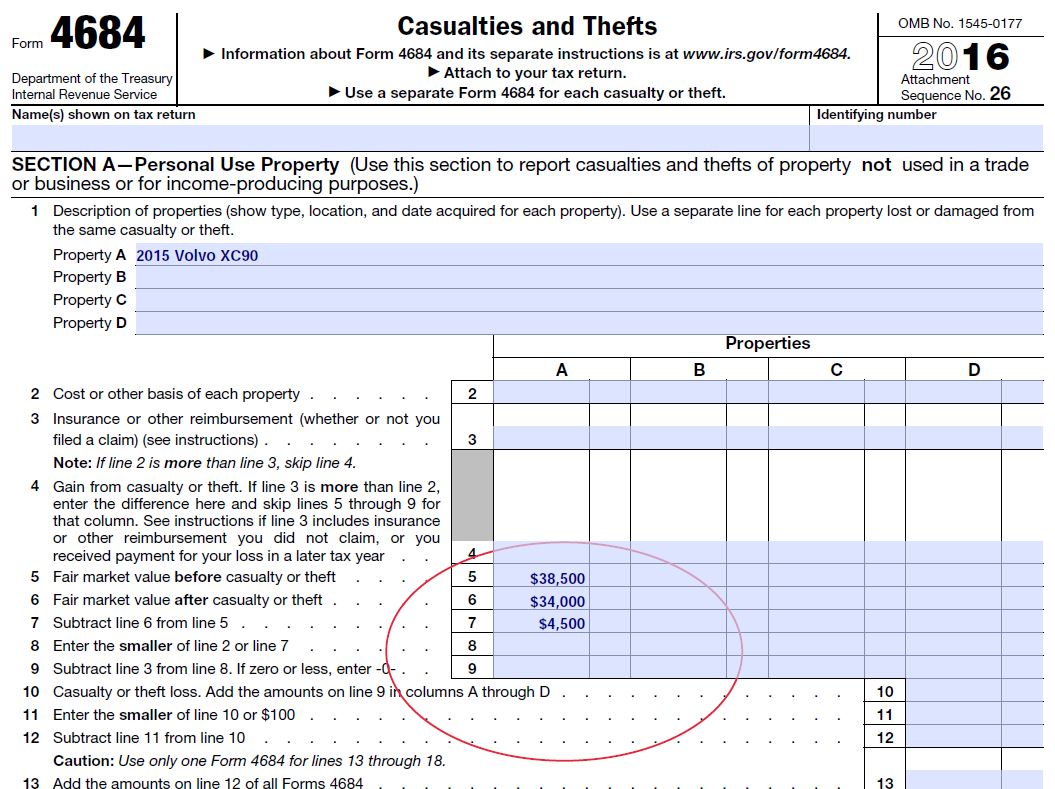

Diminished Value and Taxes, IRS form 4684 Diminished Value Car Appraisal

Form 4684 Casualties and Thefts (2015) Free Download

Related Post: