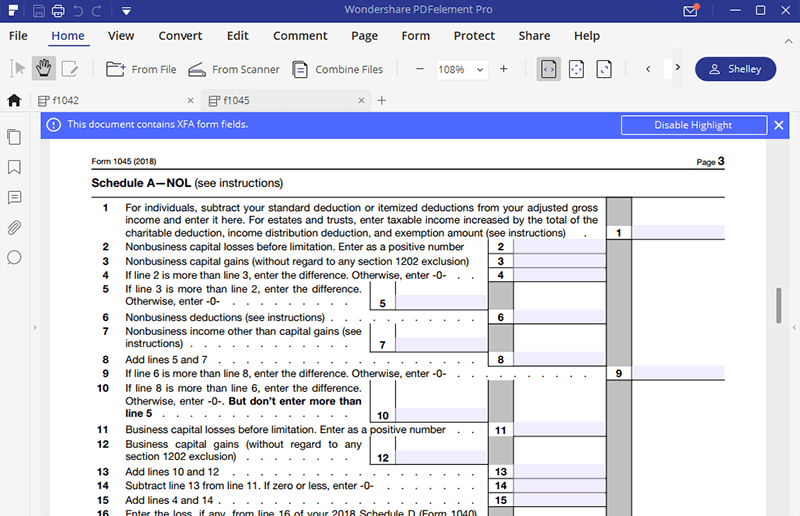

Schedule A Form 1045

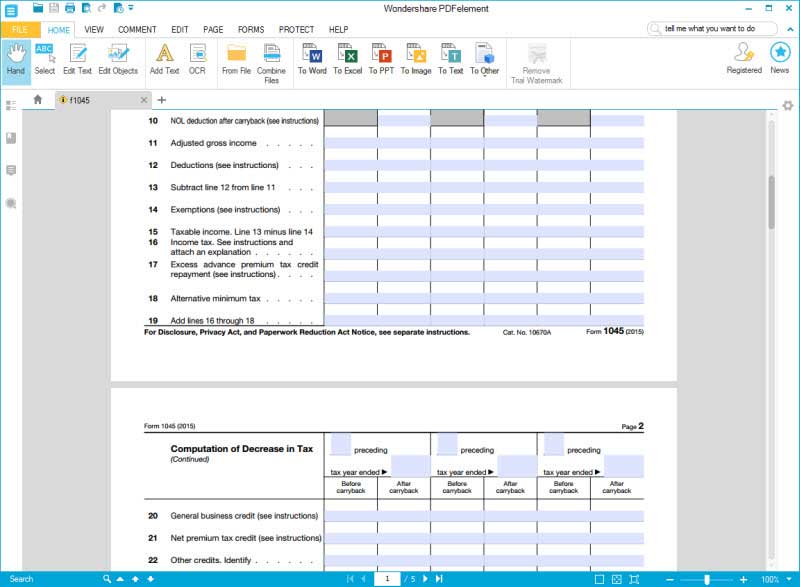

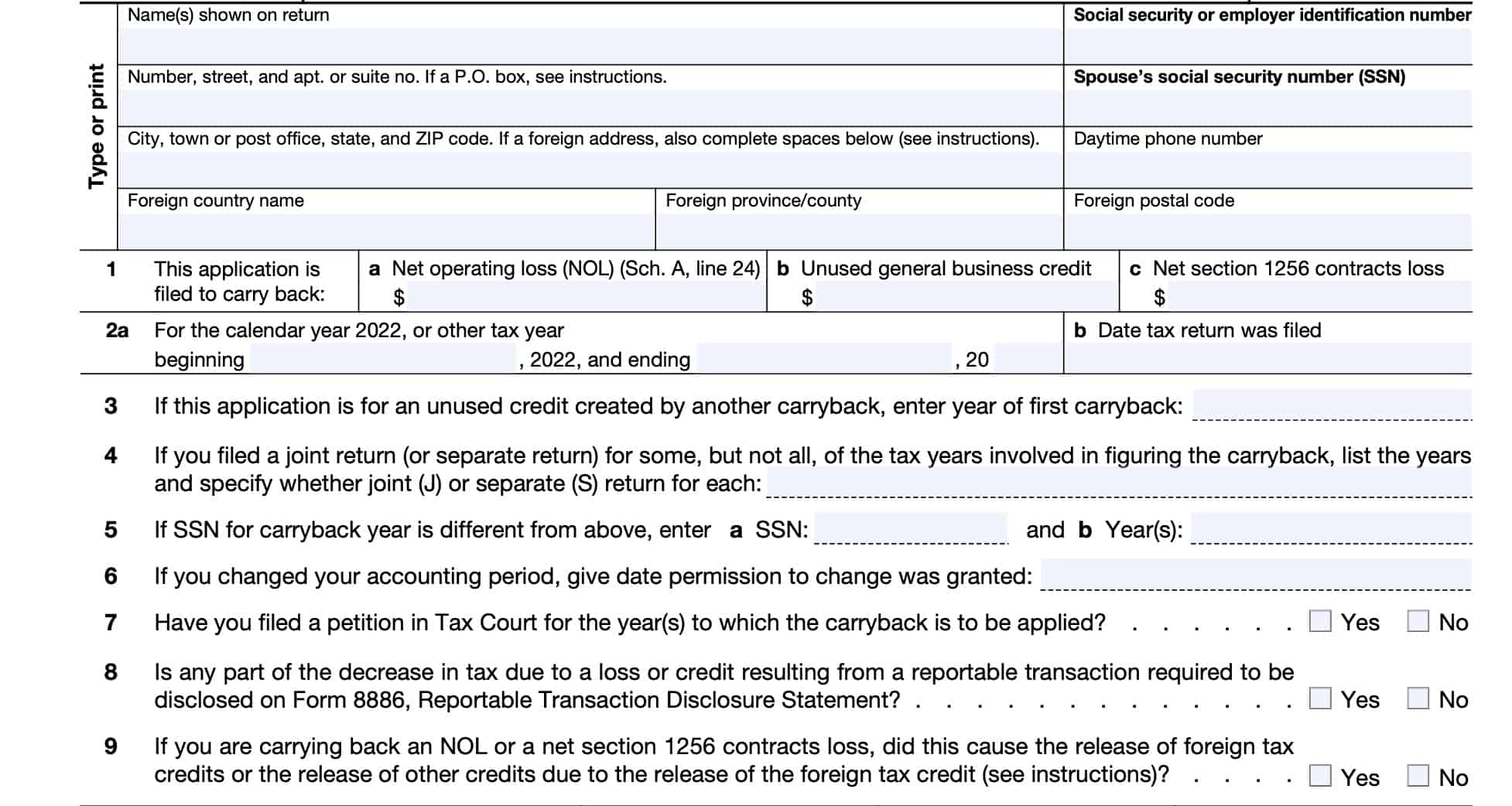

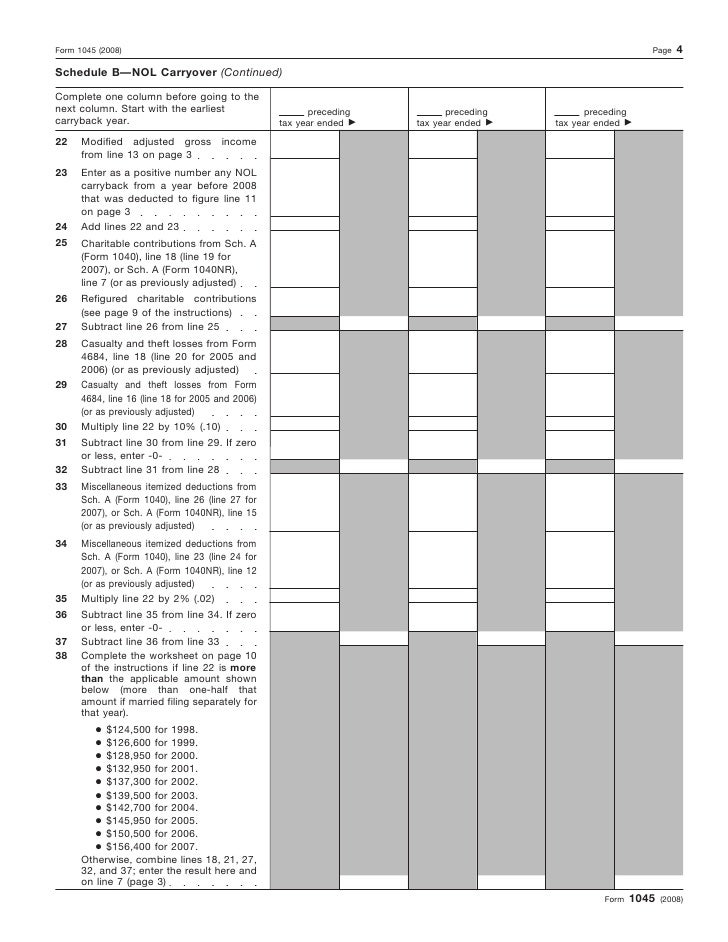

Schedule A Form 1045 - Web form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. Web about form 1045, application for tentative refund. Fill out the form with your. You fill out and file a schedule a at tax time and attach it. If any nonrefundable portion of the credit remains, maple co. Web schedule a on only one form 1045 for the earliest preceding tax years. This schedule is used by filers to report. You were a monthly schedule depositor for 2022 and during any month you accumulated nonpayroll taxes of $100,000. Ad signnow.com has been visited by 100k+ users in the past month The schedule will appear on the right side of your screen. Will use the $10,000 to reduce the liability for the january 7 pay date, but not below zero. You fill out and file a schedule a at tax time and attach it. Web form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. Web information about schedule a. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: You must sign this form 1045 but don’t need to sign the other forms 1045. Web form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. If any nonrefundable portion of. Ad uslegalforms.com has been visited by 100k+ users in the past month You fill out and file a schedule a at tax time and attach it. You must sign this form 1045 but don’t need to sign the other forms 1045. Web about form 1045, application for tentative refund. Web information about schedule a (form 1040), itemized deductions, including recent. You must sign this form 1045 but don’t need to sign the other forms 1045. Web what is the schedule a? Will use the $10,000 to reduce the liability for the january 7 pay date, but not below zero. This schedule is used by filers to report. Web schedule a on only one form 1045 for the earliest preceding tax. Ad uslegalforms.com has been visited by 100k+ users in the past month Web form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. Web we last updated the application for tentative refund in december 2022, so this is the latest version of form 1045, fully updated for tax. Web schedule a on only one form 1045 for the earliest preceding tax years. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: This schedule is used by filers to report. Will use the $10,000 to reduce the liability for the january 7 pay date, but not below zero. Ad signnow.com has. Web about form 1045, application for tentative refund. Those with a negative balance on form. Web what is the schedule a? Schedule a is an irs form used to claim itemized deductions on your tax return. Web schedule a on only one form 1045 for the earliest preceding tax years. If any nonrefundable portion of the credit remains, maple co. You must sign this form 1045 but don’t need to sign the other forms 1045. Will use the $10,000 to reduce the liability for the january 7 pay date, but not below zero. Web what is the schedule a? Those with a negative balance on form. Those with a negative balance on form. This schedule is used by filers to report. You must sign this form 1045 but don’t need to sign the other forms 1045. Ad signnow.com has been visited by 100k+ users in the past month You fill out and file a schedule a at tax time and attach it. You must sign this form 1045 but don’t need to sign the other forms 1045. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Web we last updated the application for tentative refund in december 2022, so this is the latest version of form 1045, fully updated for tax year 2022. Fill. Web from within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen, then click federal ). Web schedule a on only one form 1045 for the earliest preceding tax years. If any nonrefundable portion of the credit remains, maple co. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Web about form 1045, application for tentative refund. Web what is the schedule a? Will use the $10,000 to reduce the liability for the january 7 pay date, but not below zero. Web information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. This schedule is used by filers to report. The carryback of an nol. You must sign this form 1045 but don’t need to sign the other forms 1045. You were a monthly schedule depositor for 2022 and during any month you accumulated nonpayroll taxes of $100,000. Web form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. Fill out the form with your. Schedule a is an irs form used to claim itemized deductions on your tax return. Ad signnow.com has been visited by 100k+ users in the past month Web we last updated the application for tentative refund in december 2022, so this is the latest version of form 1045, fully updated for tax year 2022. You fill out and file a schedule a at tax time and attach it. Those with a negative balance on form. The schedule will appear on the right side of your screen.IRS Form 1045 Fill it as You Want

Form 1045 Application for Tentative Refund (2014) Free Download

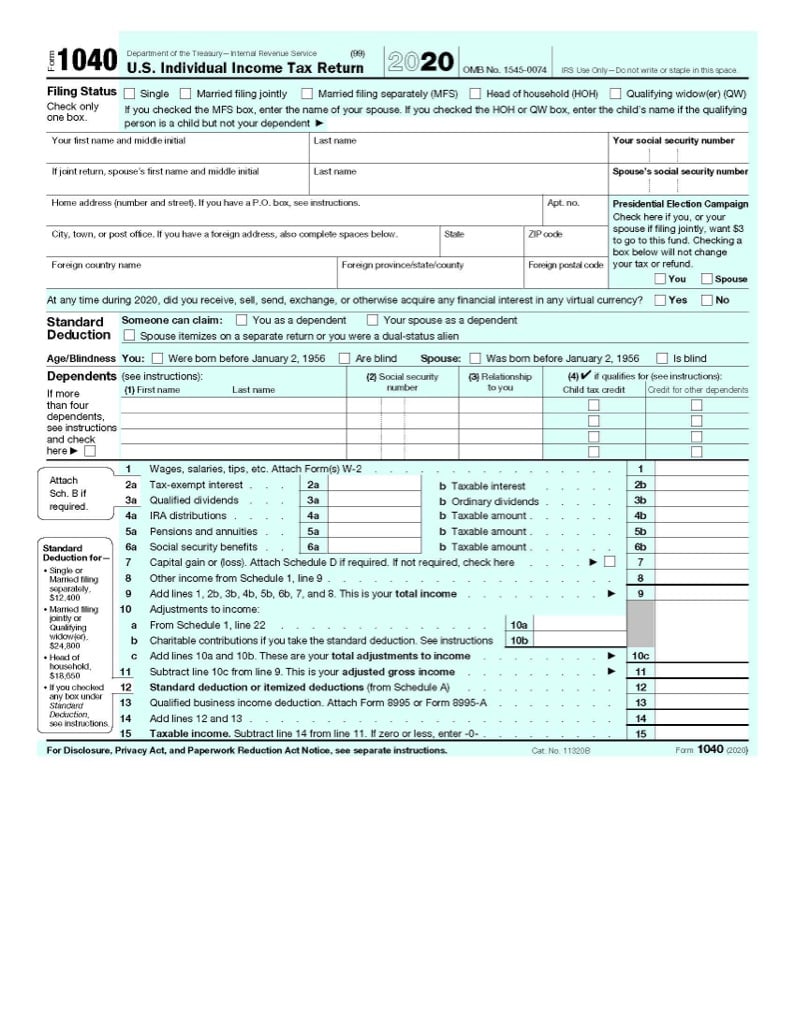

Itemized Deductions & Schedule A (Form 1040)

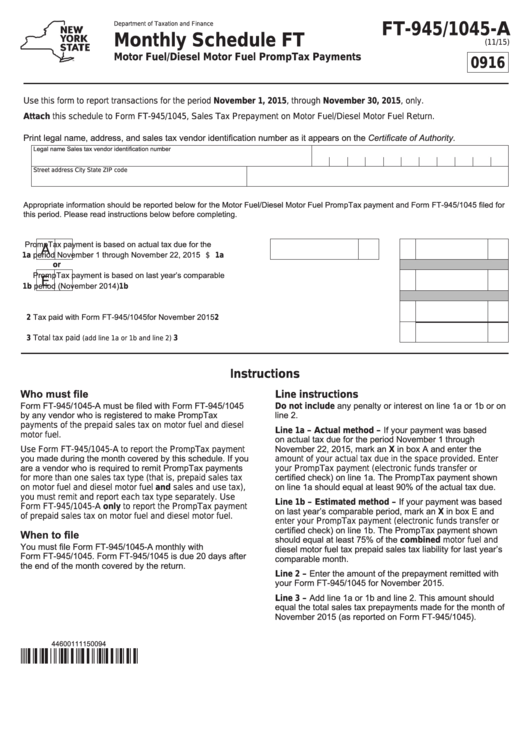

Form Ft945/1045A Monthly Schedule Ft Motor Fuel/diesel Motor Fuel

Instructions for Form 1045 (2017) Internal Revenue Service

IRS Form 1045 Fill it as You Want

IRS Form 1045 Instructions Applying For A Tentative Refund

Form 1045 Application for Tentative Refund

2020 Form 1045 2020 Blank Sample to Fill out Online in PDF

Form 1045, page 1

Related Post: