Form 1040 Line 16 Calculation

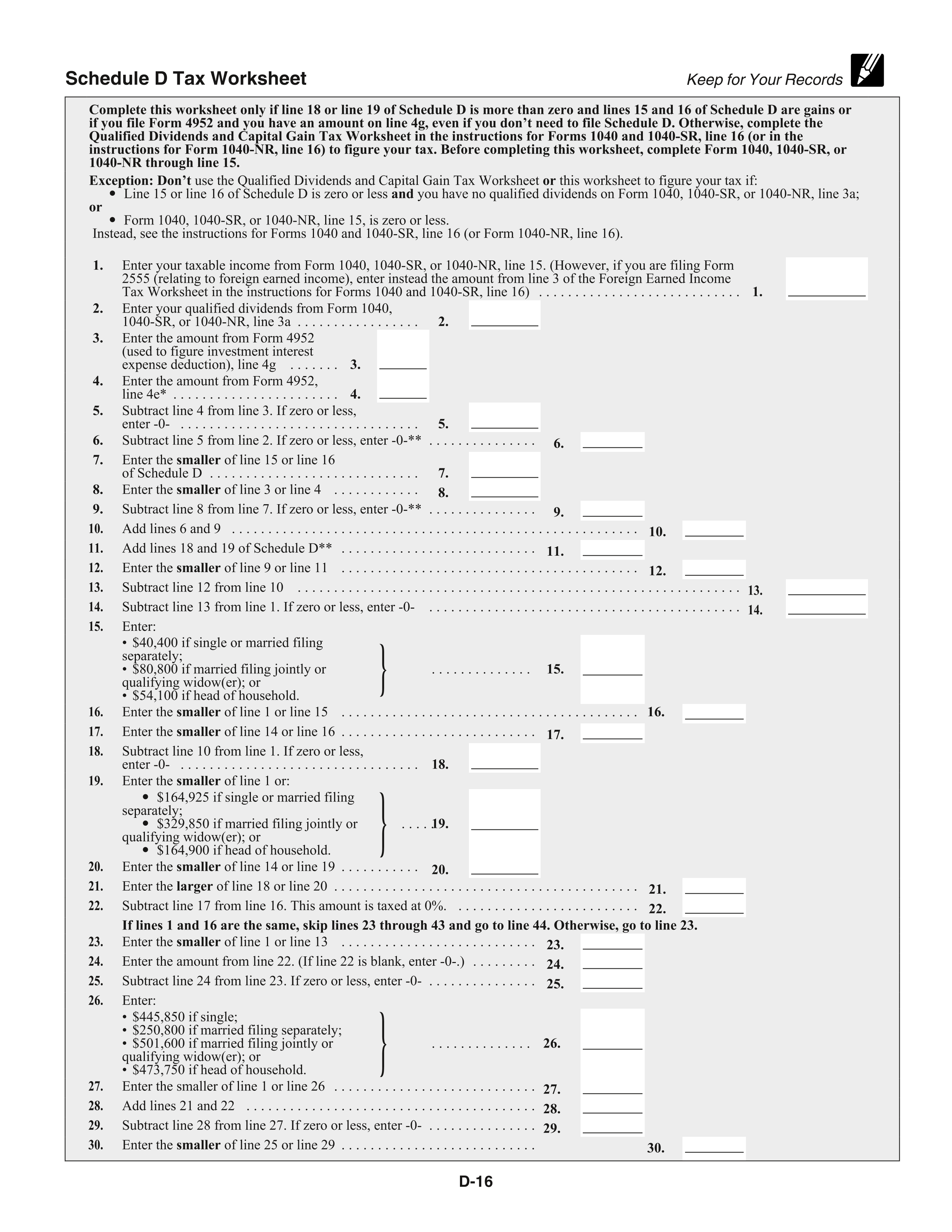

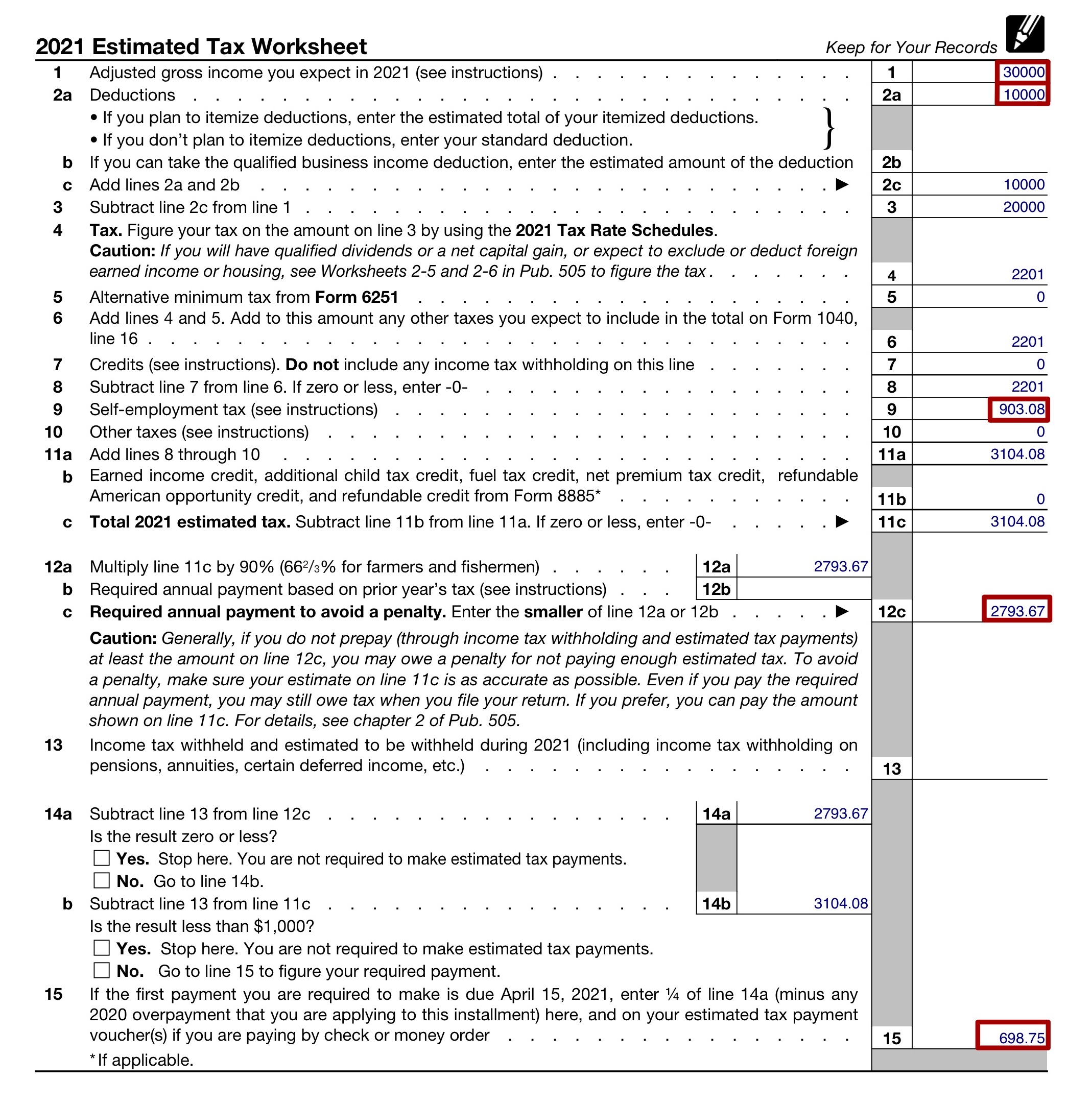

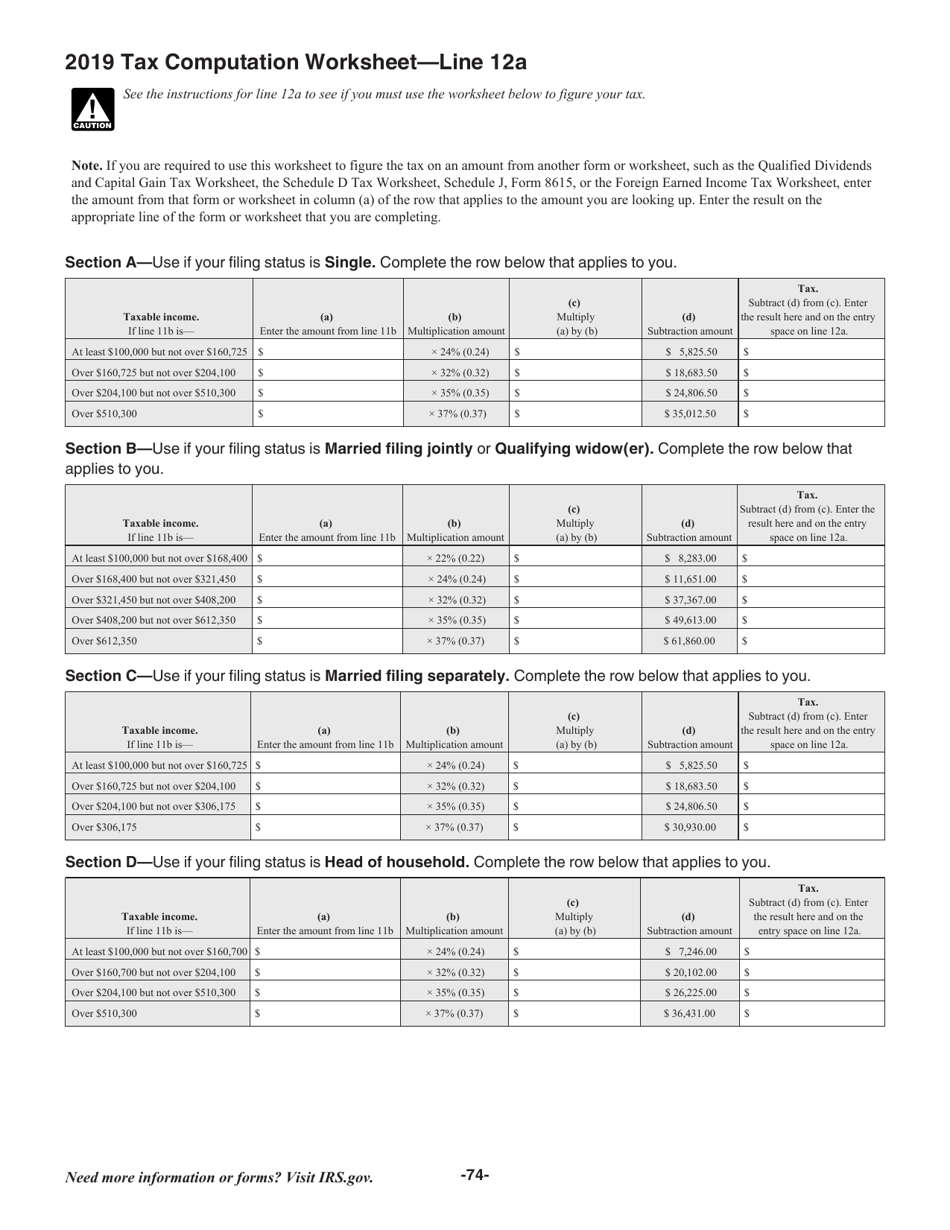

Form 1040 Line 16 Calculation - The tax calculated on your return may not always match the tax tables provided by the irs. Enter your filing status, income, deductions and credits and the tool below can help estimate your total taxes. Web the amount on your line 16 of your form 1040 may be lower than the amount in the standard irs tax table. Irs use only—do not write or staple in this. Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. This amount will not transfer to form 1040, line 7. Enter any unused nebraska personal exemption credit from the calculation on line 8. Web if line 15 is— (a) enter the amount from line 15 (b) multiplication amount (c) multiply (a) by (b) (d) subtraction amount tax. The bottom line form 1040 is the. Do not enter an amount on any other line of schedule a. We offer an extensive selection of office calculators at great prices. You can find them in the form 1040 instructions. To the left of line 16 there should be an indication of what was used to. Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. Web if line 15 is— (a) enter the amount from. Web see the instructions for line 16 to see if you must use the tax table below to figure your tax. Estimate your taxes and refunds easily with this free tax calculator from aarp. Web the tax calculator gives you an estimate for the tax you owe on income you earned in 2023. Web 2020 tax computation worksheet—line 16. Web. Ad a tax advisor will answer you now! The next federal income tax filing deadline is monday, april 15, 2024. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Why doesn't the tax on my return (line 16) match the tax table? Enter your filing status, income, deductions and credits and the. You can find them in the form 1040 instructions. After computing all the components mentioned above, sum them up and enter the total on line 16 of your tax return. Ad get deals and low prices on tax calculators at amazon. Web see the instructions for line 16 to see if you must use the tax table below to figure. Do not enter an amount on any other line of schedule a. Web steps to calculate line 16 on form 1040. If you are required to. Line 17 is manual selection of a yes/no checkbox. To the left of line 16 there should be an indication of what was used to. Web steps to calculate line 16 on form 1040. Web the tax calculator gives you an estimate for the tax you owe on income you earned in 2023. We offer an extensive selection of office calculators at great prices. Why doesn't the tax on my return (line 16) match the tax table? Questions answered every 9 seconds. To the left of line 16 there should be an indication of what was used to. Estimate your taxes and refunds easily with this free tax calculator from aarp. Questions answered every 9 seconds. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: After computing all the components mentioned above, sum. Do not enter an amount on any other line of schedule a. Ad discover helpful information and resources on taxes from aarp. Web these instructions explain how to complete schedule d (form 1040). This is because turbotax is using a different. Web see the instructions for line 16 to see if you must use the tax table below to figure. There are a few sections at the beginning for personal and filing. Qualified dividend and capital gain tax worksheet. Ad get deals and low prices on tax calculators at amazon. Web the tax calculator gives you an estimate for the tax you owe on income you earned in 2023. Why doesn't the tax on my return (line 16) match the. Web the tax calculator gives you an estimate for the tax you owe on income you earned in 2023. We offer an extensive selection of office calculators at great prices. The irs will use this. Questions answered every 9 seconds. This amount will not transfer to form 1040, line 7. Web calculating line 16 on form 1040. This amount will not transfer to form 1040, line 7. Web these instructions explain how to complete schedule d (form 1040). You can find them in the form 1040 instructions. The irs will use this. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: Web the amount on your line 16 of your form 1040 may be lower than the amount in the standard irs tax table. See the instructions for line 16 to see if you must use the worksheet below to figure your tax. Web see the instructions for line 16 to see if you must use the tax table below to figure your tax. We offer an extensive selection of office calculators at great prices. Do not enter an amount on any other line of schedule a. After computing all the components mentioned above, sum them up and enter the total on line 16 of your tax return. * enter the amount from line 3 above on line 1 of the qualified dividends and capital gain tax. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Enter the result here and on the. Web no, form 1040 and form 1099 are two different federal tax forms. Ad a tax advisor will answer you now! Ad discover helpful information and resources on taxes from aarp. The bottom line form 1040 is the. Qualified dividend and capital gain tax worksheet.Irs Fillable Form 1040 IRS Form 1040C Download Fillable PDF or Fill

How do I file estimated quarterly taxes? Stride Health

Brand Creator

MO1040A Fillable Calculating 2015 PDF Tax Refund Social Security

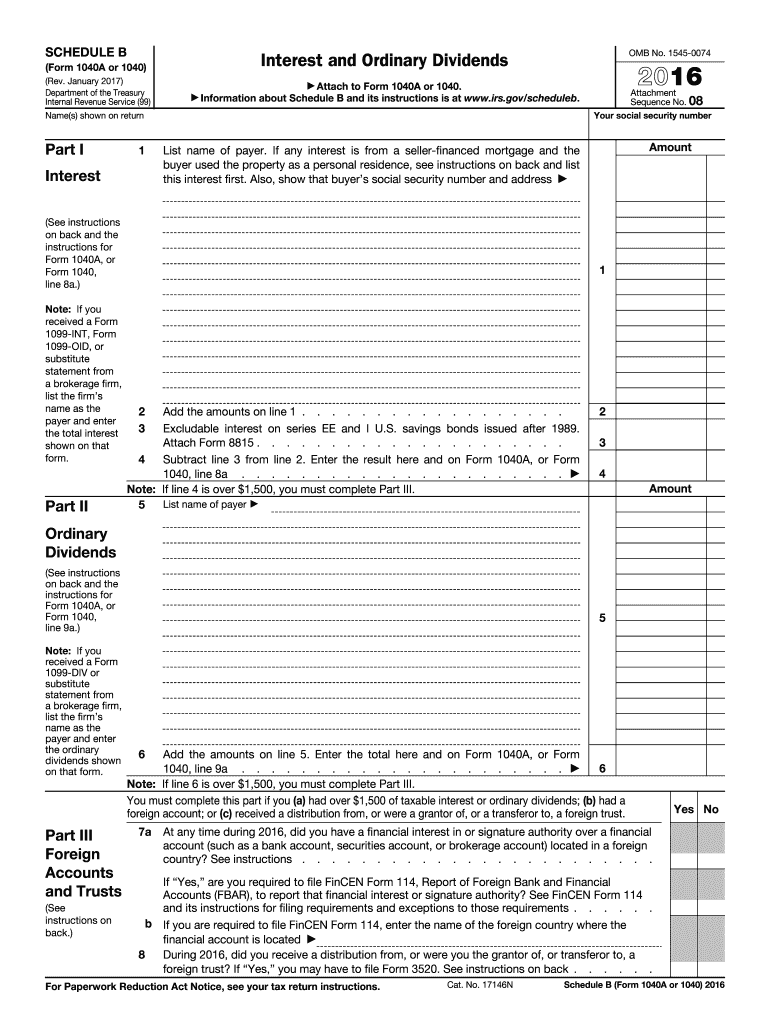

IRS 1040 Schedule B 2016 Fill out Tax Template Online US Legal Forms

[Solved] How do I calculate Line 16 on a 1040 for 2020. Total is

IRS 1040 Lines 16a And 16b 20172022 Fill out Tax Template Online

Irs Form 1040 Line 16a And 16b Form Resume Examples

1040 Printable Tax Form

Capital Gains Tax

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)