Ca State Tax Withholding Form

Ca State Tax Withholding Form - Web the income tax withholdings formula for the state of california includes the following changes: Web simplified income, payroll, sales and use tax information for you and your business This certificate, de 4, is for california personal income tax (pit) withholding purposes only. Web disaster victims also may receive free copies of their state returns to replace those lost or damaged. Ad simple software to manage hr, payroll & benefits. Use the 540 2ez tax. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Enter $0.00 for the total withholding amount due on side 1, part iii,. This calculator does not figure tax for form 540 2ez. Web *required field california taxable income enter line 19 of 2022 form 540 or form 540nr. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Taxpayers may complete form ftb 3516 and write the name of the disaster. Enter $0.00 for the total withholding amount due on side 1, part iii,. The form helps your employer. Check the “amended” box. Form 590 does not apply to payments of backup withholding. The de 4 is used to compute the amount of taxes to be withheld from. The number of allowances claimed on your. The de 4p allows you to: Web to claim the withholding credit you must file a california tax return. Web california extends due date for california state tax returns. Wage and tax statement faqs. The de 4p allows you to: Report the sale or transfer as required. Ad simple software to manage hr, payroll & benefits. The de 4 is used to compute the amount of taxes to be withheld from. Web enter all the withholding and payee information. Web the income tax withholdings formula for the state of california includes the following changes: Web to claim the withholding credit you must file a california tax return. The amount of tax withheld is determined by the. Report the sale or transfer as required. Form 590 does not apply to payments of backup withholding. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Web enter all the withholding and payee information. If there is ca withholding reported on the. Check the “amended” box at the top left corner of the form. Enter the amount from form 593, line 36, amount withheld from. Choose avalara sales tax rate tables by state or look up individual rates by address. The number of allowances claimed on your. Simply the best payroll service for small business. Ad simple software to manage hr, payroll & benefits. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. 2022 california estimated tax and other payments. The de 4 is used to compute the amount of taxes to be withheld from. Wage withholding is the. 2022 california estimated tax and other payments. Web california extends due date for california state tax returns. Wage withholding is the prepayment of income tax. Wage and tax statement faqs. Web cal employee connect (cec): Taxpayers may complete form ftb 3516 and write the name of the disaster. The income tax withholdings formula. The low income exemption amount for married with 0 or 1 allowance. We refer to the amount of wages taken from your paycheck for state and federal income taxes as withholding. Check the “amended” box at the top left corner of the. (1) claim a different number of. Web to claim the withholding credit you must file a california tax return. Web cal employee connect (cec): Form 590 does not apply to payments of backup withholding. Irs further postpones tax deadlines for most california. California, massachusetts and new york. Web *required field california taxable income enter line 19 of 2022 form 540 or form 540nr. Wage and tax statement faqs. The amount of tax withheld is determined by the following. The income tax withholdings formula. You must file a de 4 to determine the appropriate california pit withholding. Web enter all the withholding and payee information. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Choose avalara sales tax rate tables by state or look up individual rates by address. Irs further postpones tax deadlines for most california. The de 4 is used to compute the amount of taxes to be withheld from. Explore these zero income tax states. Web disaster victims also may receive free copies of their state returns to replace those lost or damaged. Check out the benefits and pros & cons of zero income tax to plan for your retirement. We refer to the amount of wages taken from your paycheck for state and federal income taxes as withholding. Web california income tax withheld. Enter $0.00 for the total withholding amount due on side 1, part iii,. Taxpayers may complete form ftb 3516 and write the name of the disaster. The amount of income subject to tax 2. The form helps your employer.1+ California State Tax Withholding Forms Free Download

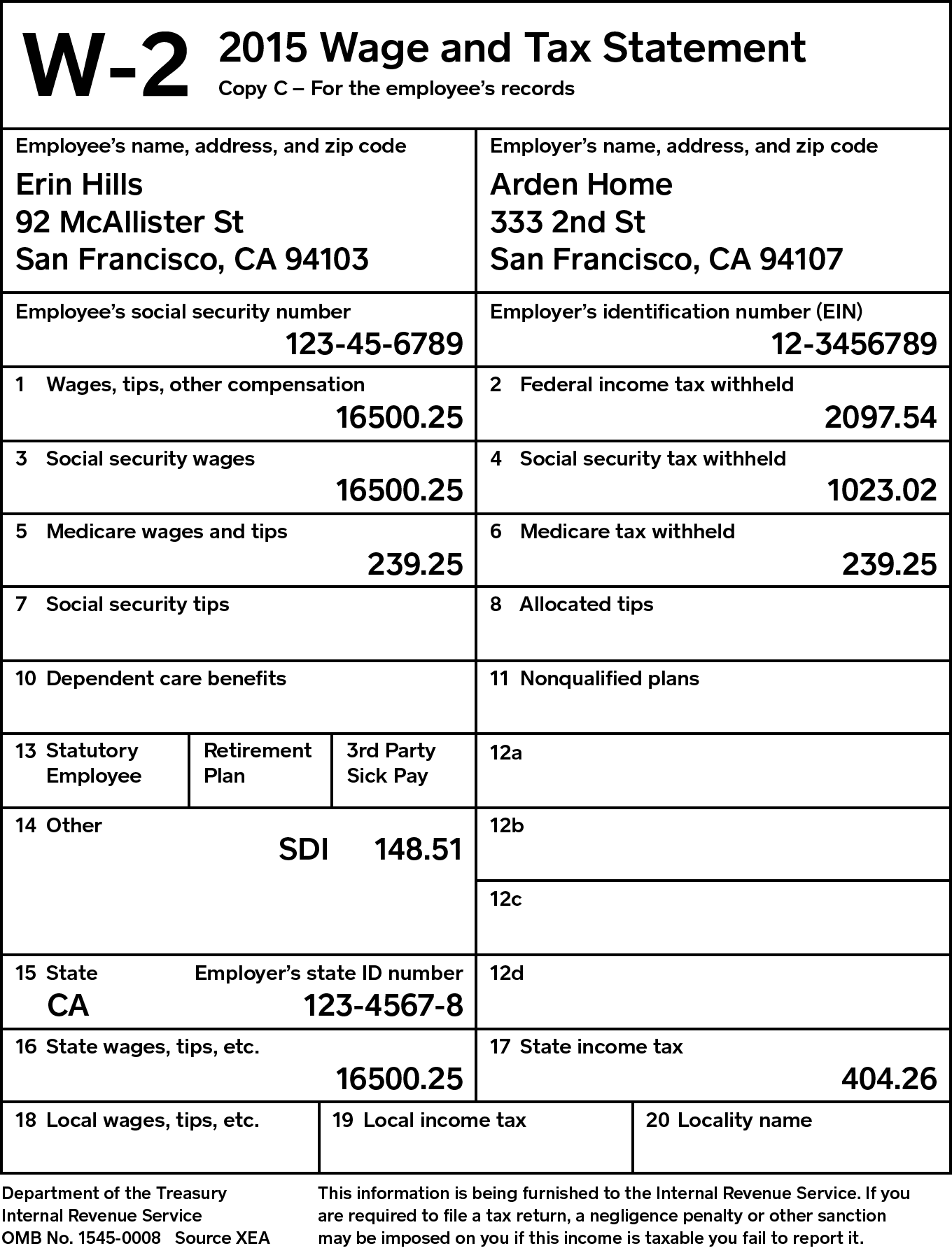

De 4 California State Tax Withholding Form

Exemption California State Tax Form 2023

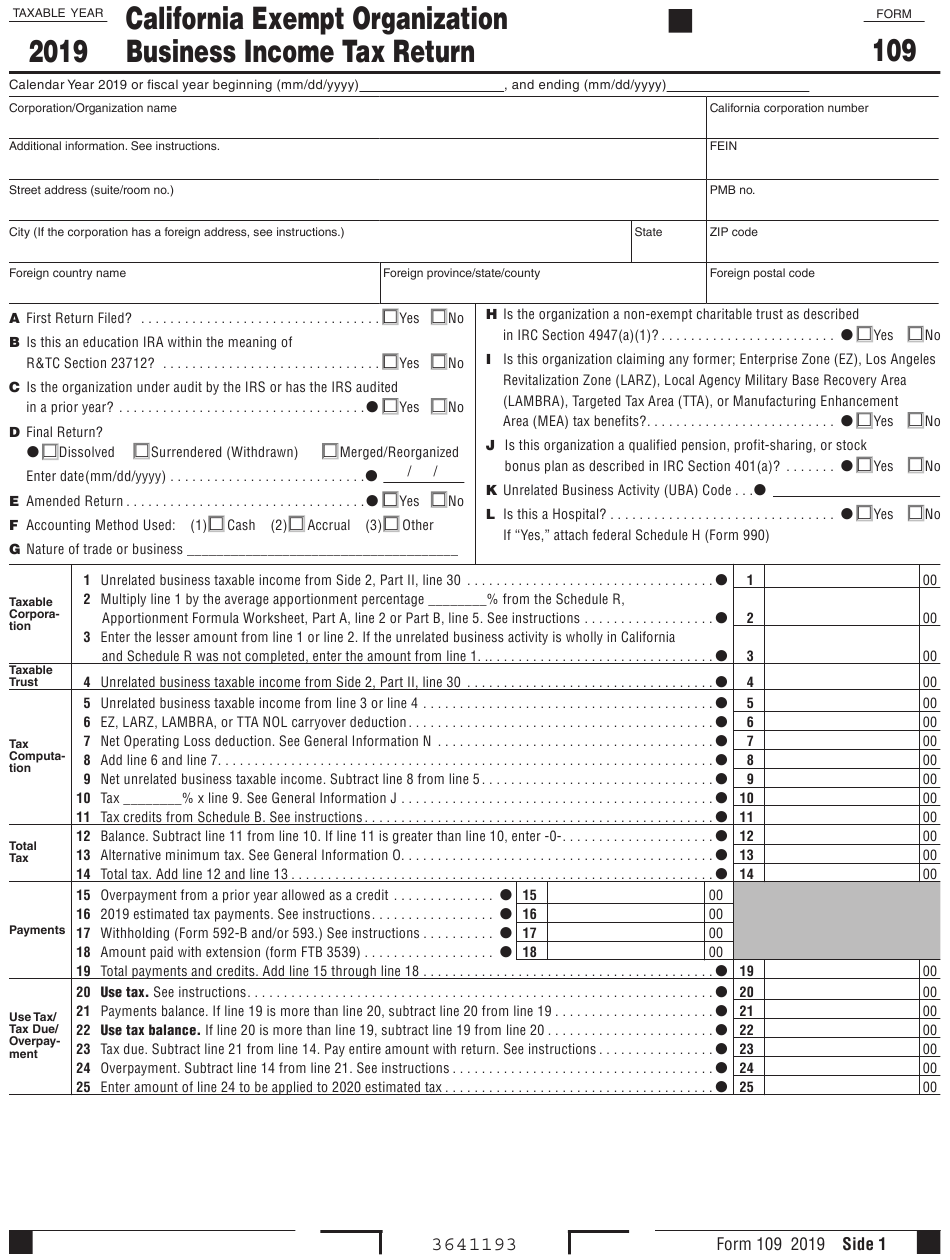

1+ California State Tax Withholding Forms Free Download

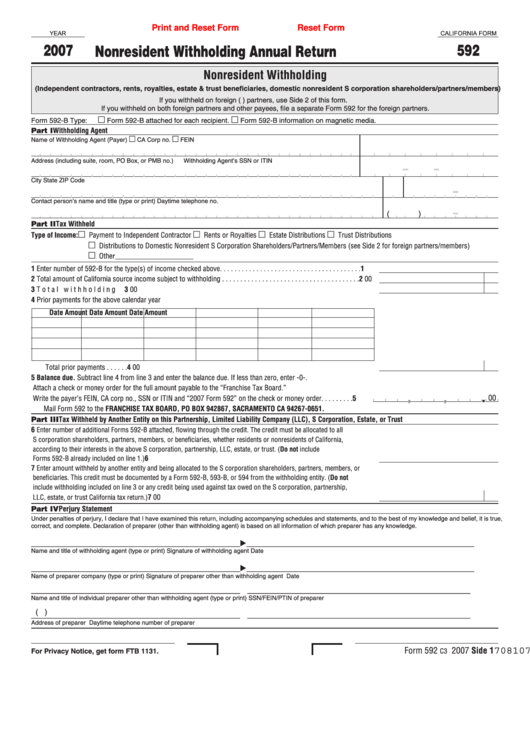

California Withholding Tax Form 592

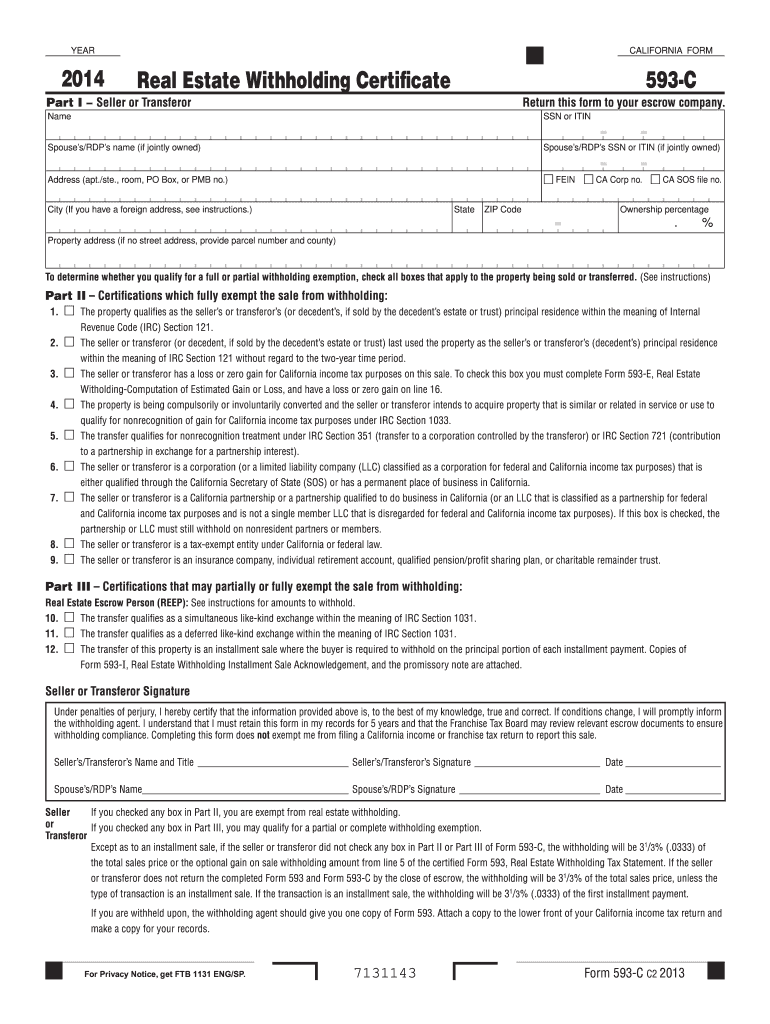

Form 593 C REval Estate Withholding Certificate California Fill Out

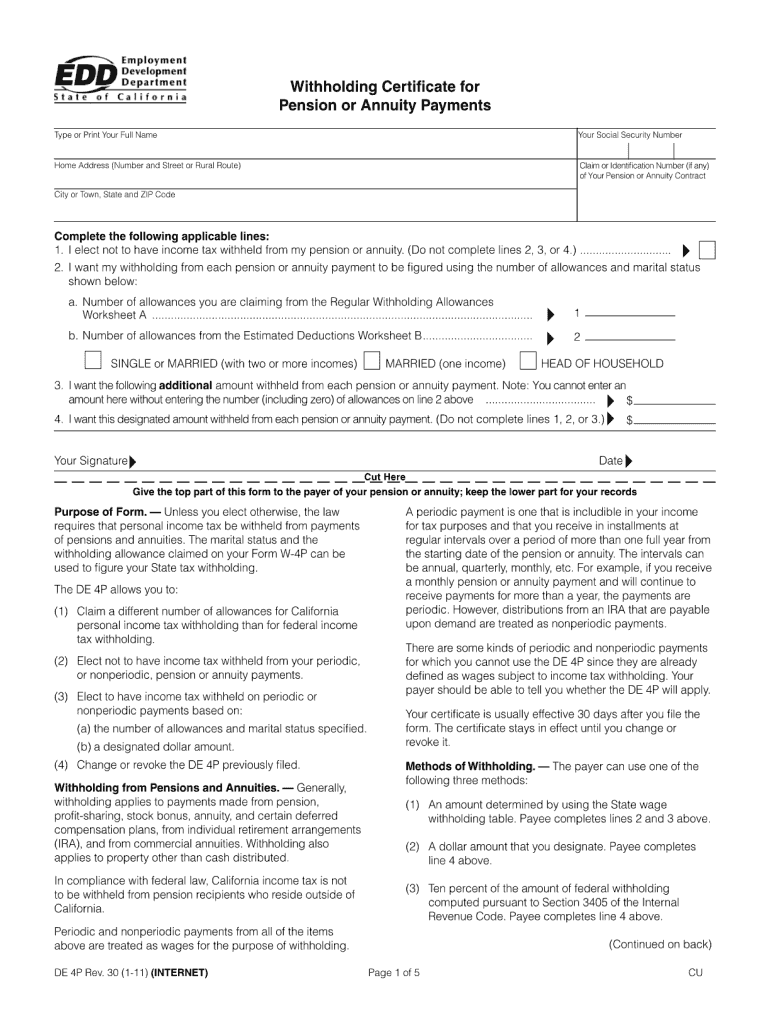

2011 Form CA EDD DE 4P Fill Online, Printable, Fillable, Blank pdfFiller

CA FTB 589 2019 Fill out Tax Template Online US Legal Forms

CA FTB 592F 2021 Fill out Tax Template Online US Legal Forms

California State Tax Withholding Worksheet Appointments Gettrip24

Related Post: