S Corp Tax Extension Form

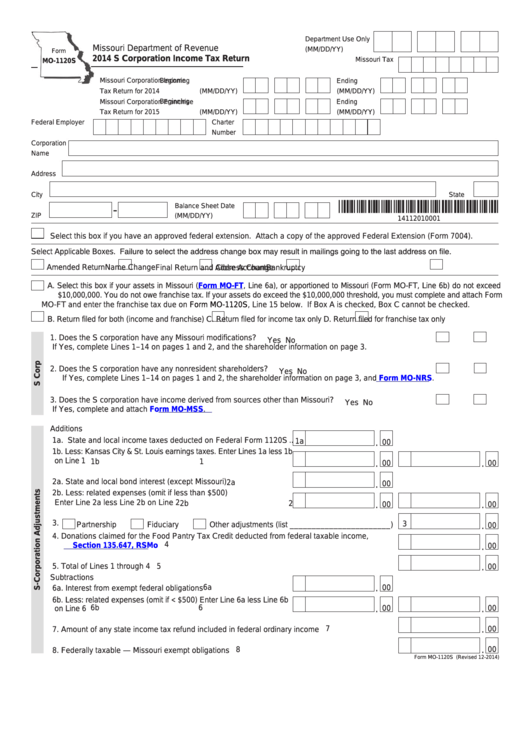

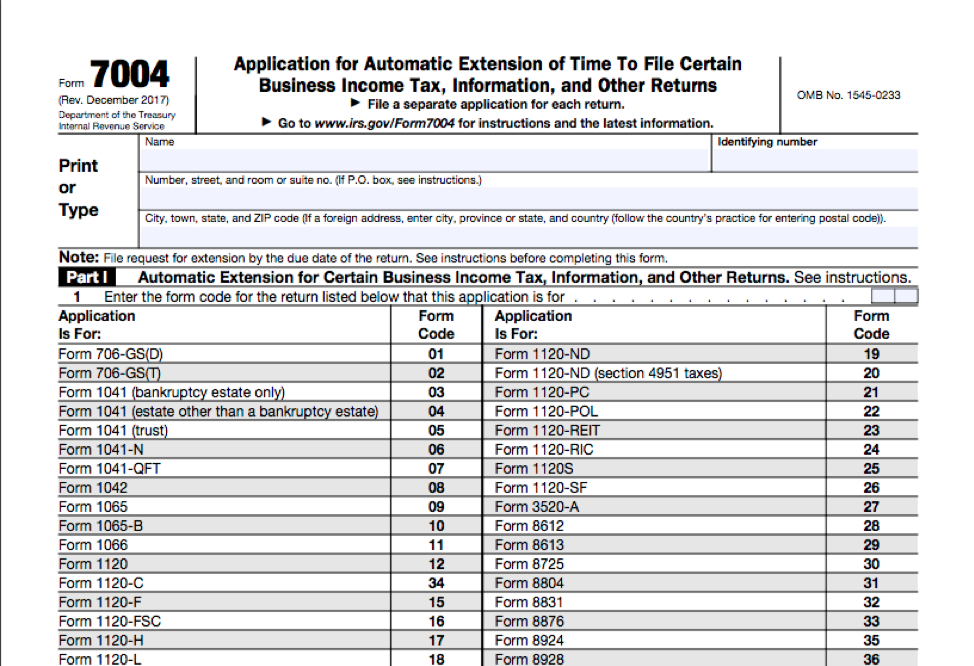

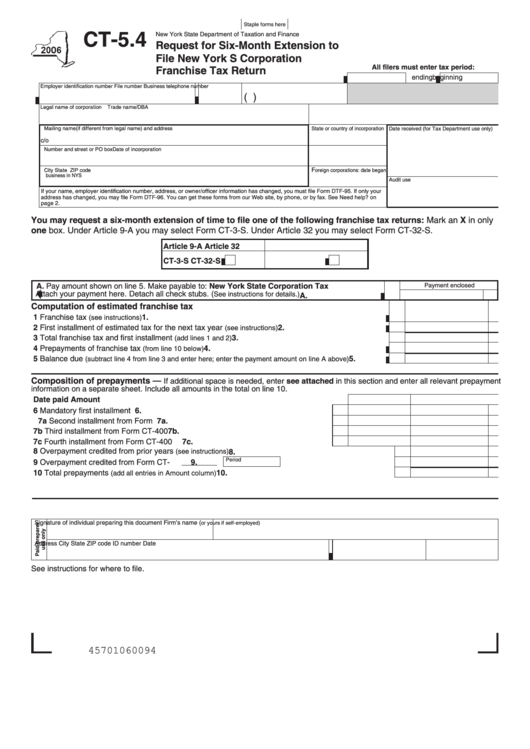

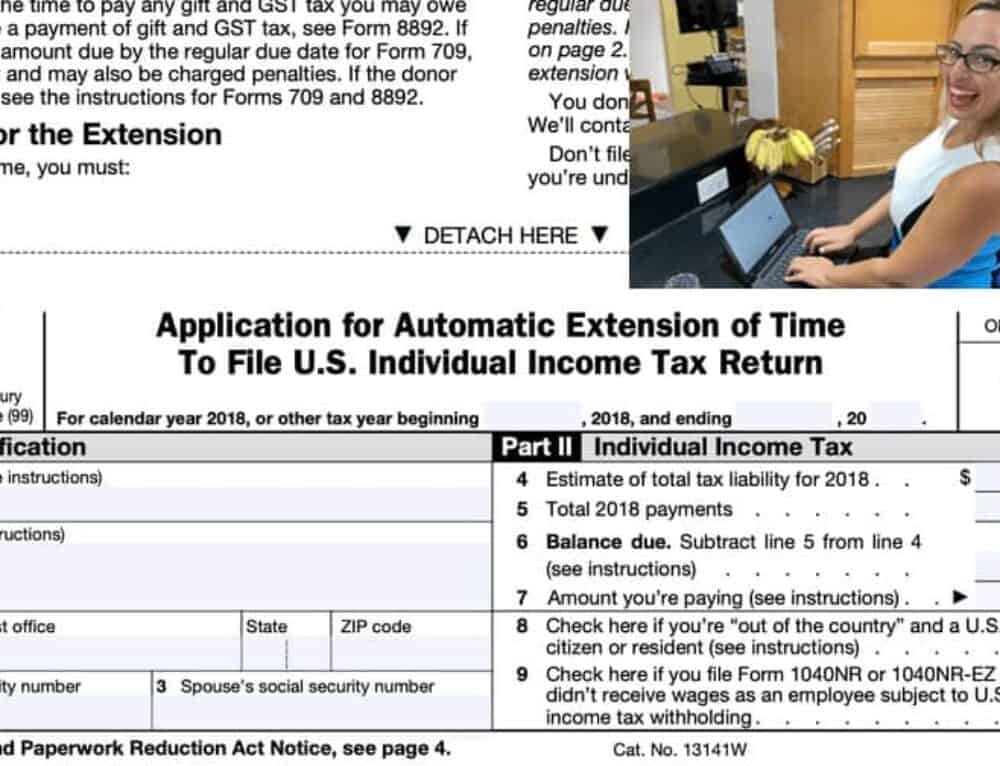

S Corp Tax Extension Form - Arizona s corporation income tax return arizona s corporation income tax return. File request for extension by the due date. The final deadline to file your 2022 taxes is october 16. To file an extension on a return, corporations use arizona form 120ext. Web most major tax software applications allow you to file extensions using form 7004 (for businesses) or form 4868 (for individuals). The form 7004 is an automatic extension that is provided by the. Web corporate tax forms; Please use the form listed under the current tax year if it is not listed under the year you are. Web quarterly estimated tax payments normally due on april 18, june 15 and sept. There’s less than a week until the oct. Complete either a form 7004 or 1120. Web october 16, 2023 is the irs’s deadline for tax return extensions this year. Application for automatic extension of time to. Web comptroller's office 1600 west monroe phoenix, az 85007 filing an extension. Web how to file online. Web how to file online. Now, federal filers have another month to file. You can extend filing form 1120s when you file form 7004. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web most business tax returns can be extended by filing form 7004: Application for automatic extension of time to. Gavin newsom in march to align with the irs’s announcement to push the federal due date to oct. Get started on yours today. Complete either a form 7004 or 1120. The final deadline to file your 2022 taxes is october 16. Web october 16, 2023 is the irs’s deadline for tax return extensions this year. You can extend filing form 1120s when you file form 7004. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Gavin newsom in march to align with the irs’s announcement to push the federal due date to. Start with your business name & our website will walk you through the steps to formation. Now, federal filers have another month to file. Time’s up for millions of americans: To use our online services, create an account, log in, and select file a. Web certificate of exemption from partnership or new york s corporation estimated tax paid on behalf. Complete either a form 7004 or 1120. Arizona s corporation income tax return arizona s corporation income tax return. File request for extension by the due date. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Web comptroller's office 1600 west monroe phoenix, az 85007 filing an extension. To file an extension on a return, corporations use arizona form 120ext. Enter code 25 in the box on form 7004, line 1. Web most business tax returns can be extended by filing form 7004: Ad taxact.com has been visited by 10k+ users in the past month Inclusion of federal return with arizona return the department requests that. The final deadline to file your 2022 taxes is october 16. Ad taxact.com has been visited by 10k+ users in the past month Complete either a form 7004 or 1120. Application for automatic extension of time to file by the original due date of the return. Get started on yours today. There’s less than a week until the oct. Get started on yours today. Form 7004 (automatic extension of time to. Application for automatic extension of time to. Complete either a form 7004 or 1120. We help get taxpayers relief from owed irs back taxes. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web quarterly estimated tax payments normally due on april 18, june 15 and sept. Time’s up for millions of americans: The maximum length of time for an extension granted to an s. The final deadline to file your 2022 taxes is october 16. Complete either a form 7004 or 1120. Web october 16, 2023 is the irs’s deadline for tax return extensions this year. Web the franchise tax board and the irs opted to push the deadline from april 18 to oct. Web there are three steps to filing an extension for s corporation taxes: Inclusion of federal return with arizona return the department requests that. Time’s up for millions of americans: File request for extension by the due date. Web how to file online. Get started on yours today. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Submit the form to the. Web certificate of exemption from partnership or new york s corporation estimated tax paid on behalf of nonresident individual partners and shareholders (this version expires on. Now, federal filers have another month to file. Web file this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165. Application for automatic extension of time to. If you are an s corporation then you may be liable for. Arizona s corporation income tax return arizona s corporation income tax return. Arizona income tax return for s corporations. Web most major tax software applications allow you to file extensions using form 7004 (for businesses) or form 4868 (for individuals).Fillable Form Mo1120s S Corporation Tax Return 2014

2016 tax extension form corporations pipeolpor

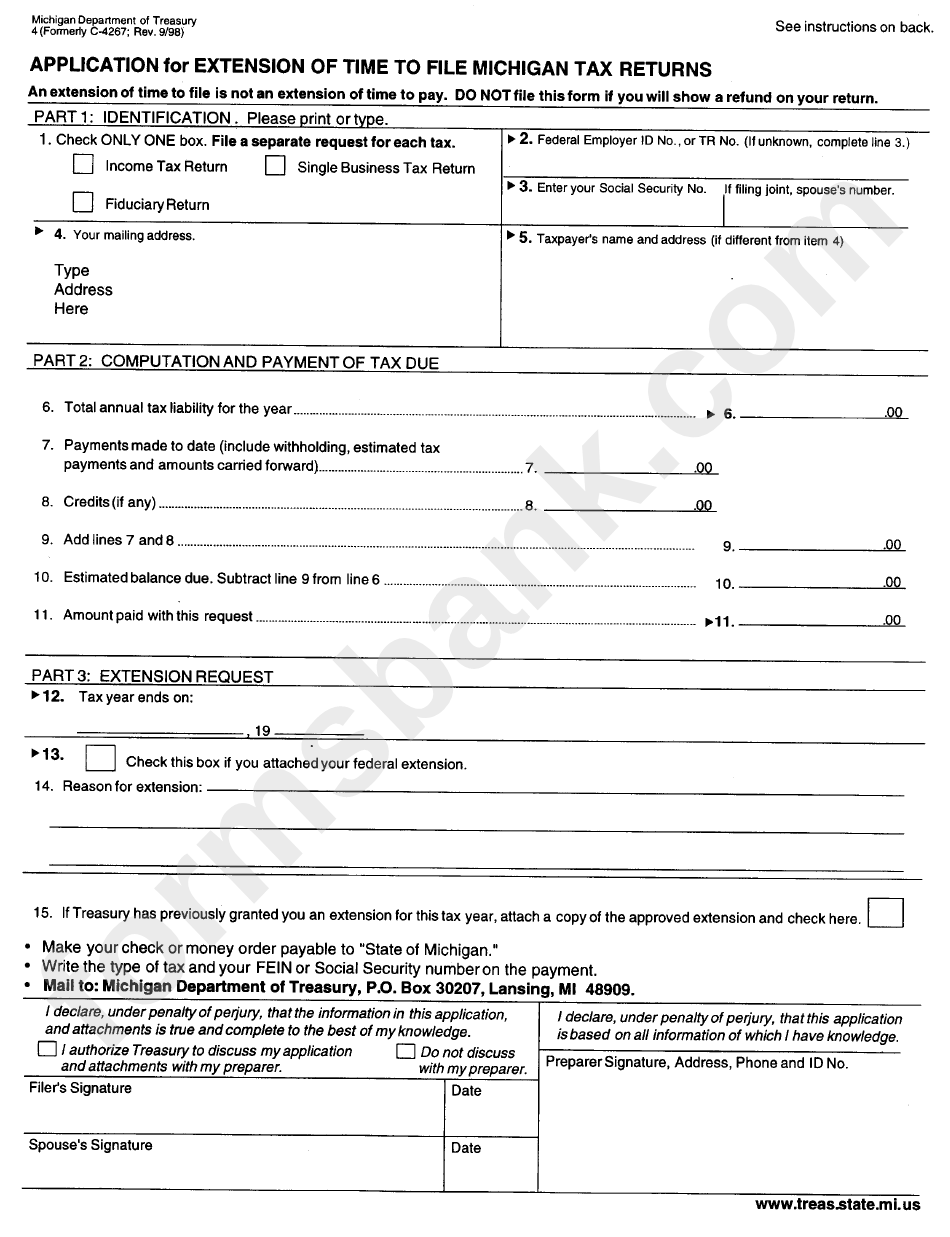

Fillable Form 4 Application For Extension Of Time To File Michigan

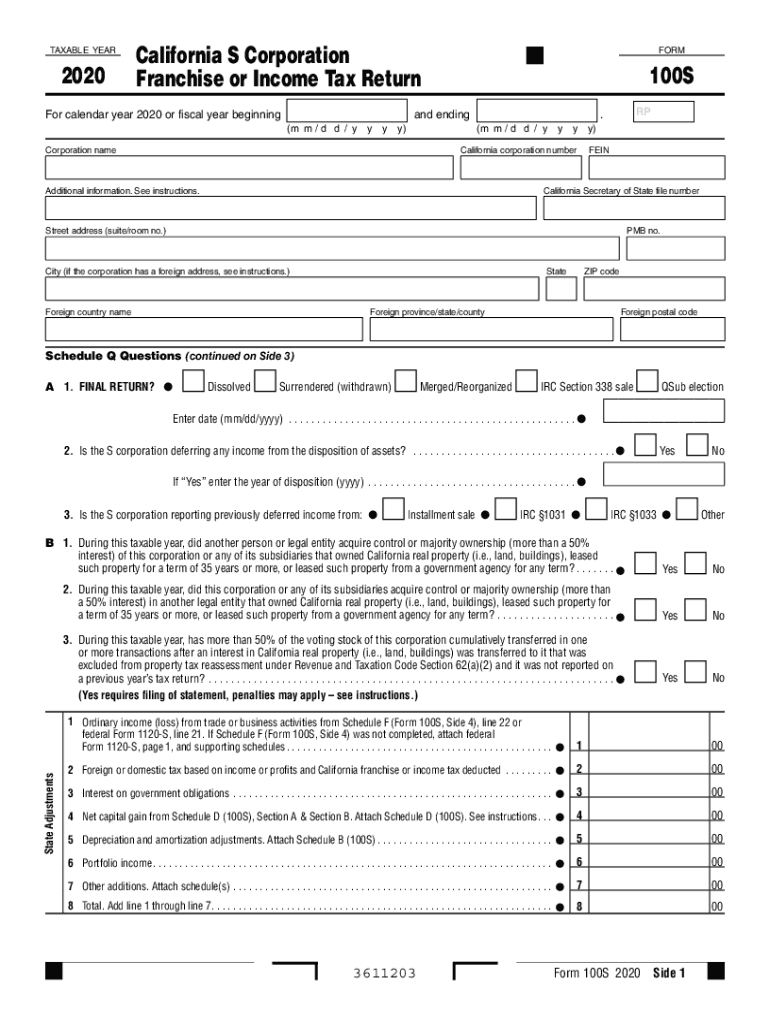

2015 100S California Fill Out and Sign Printable PDF Template signNow

How to File for a Business Tax Extension (Federal) Bench Accounting

Fillable Form Ct5.4 Request For SixMonth Extension To File New York

How To File A Tax Extension For An SCorporation? YouTube

Tax filing mistakes to avoid when filing IRS extension Forms 4868 and

Form 7004 S Corporation Tax Extensions Bette Hochberger, CPA, CGMA

1120S

Related Post: