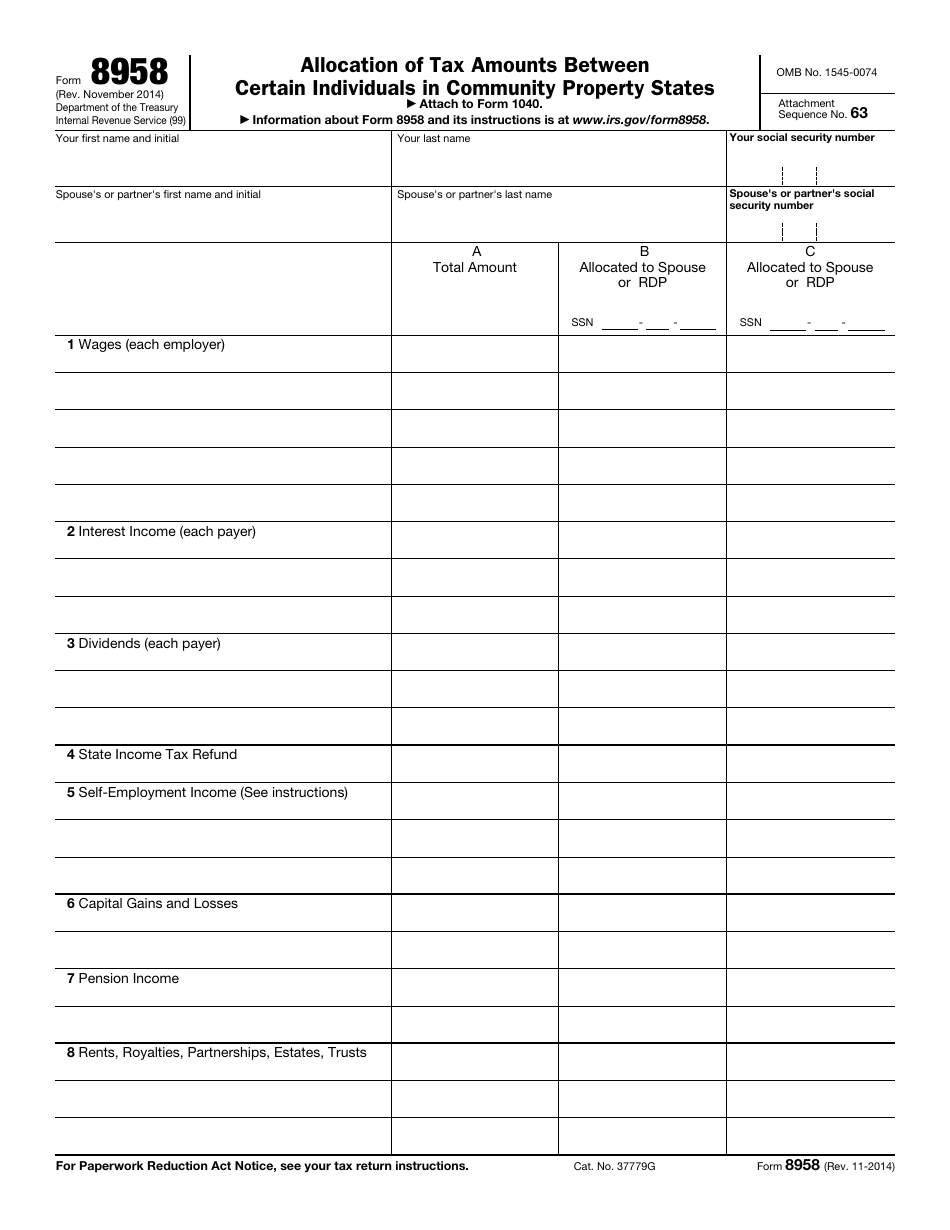

Form 8958 Instructions Example

Form 8958 Instructions Example - Read customer reviews & find best sellers Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Browse & discover thousands of brands. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Ad sign & fill out legal forms online on any device. ★ ★ ★ ★ ★. Web generating form 8958. About form 8958, allocation of tax amounts between certain individuals in. Web this article will help you to generate form 8958, allocation of tax amount between certain individuals in community property states. Download or email irs 8959 & more fillable forms, register and subscribe now! Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Property that was owned separately before marriage is considered separate. Web we last updated the allocation of tax amounts between certain individuals in community property states in february 2023, so this is the latest version of form. Use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. ★ ★ ★ ★ ★. Fill and sign 8958 online and download in. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights.. About form 8958, allocation of tax amounts between certain individuals in. Download or email irs 8959 & more fillable forms, register and subscribe now! Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web use form 8958 to determine the allocation of tax amounts. Send filled & signed form or save. Web for instructions on how to complete form 8958, please check the link: Web use pdfrun's pdf editor and start filling out the sample template. Property that was owned separately before marriage is considered separate. However, if you live in a community property state, you must report. Select the document you want to sign and click upload. Create a free account on. Community property and the mfj/mfs worksheet. Web for instructions on how to complete form 8958, please check the link: Money earned while domiciled in a noncommunity property state is separate income; To fulfill the married filing separately requirements, you’ll each report your own income separately. Use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. Open form follow the instructions. Get access to an online library of 85k forms & packages that you can edit & esign online. Read. Web for instructions on how to complete form 8958, please check the link: Form 8958 **say thanks by clicking the thumb icon in a post **mark the post that. Web if you are married filing separately and you live in one of these states, you must use form 8958 ( allocation of tax amounts between certain individuals in community property.. Fill and sign 8958 online and download in. Ad sign & fill out legal forms online on any device. Read customer reviews & find best sellers Browse & discover thousands of brands. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Read customer reviews & find best sellers However, if you live in a community property state, you must report. , print or send your document via email. Ad sign & fill out legal forms online on any device. Property that was owned separately before marriage is considered separate. , print or send your document via email. Fill and sign 8958 online and download in. Suppress form 8958 allocation of tax amounts between individuals in community. To fulfill the married filing separately requirements, you’ll each report your own income separately. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic. Ad free shipping on qualified orders. Send filled & signed form or save. Suppress form 8958 allocation of tax amounts between individuals in community. Web use pdfrun's pdf editor and start filling out the sample template. Easily sign the form with your finger. Read customer reviews & find best sellers Web generating form 8958. Property that was owned separately before marriage is considered separate. Web for instructions on how to complete form 8958, please check the link: About form 8958, allocation of tax amounts between certain individuals in. Ad sign & fill out legal forms online on any device. Use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. ★ ★ ★ ★ ★. Create a free account on. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Free, easy returns on millions of items. Complete, edit or print tax forms instantly. Web this article will help you to generate form 8958, allocation of tax amount between certain individuals in community property states. Ad access irs tax forms. Open form follow the instructions.Americans forprosperity2007

Form 8958 instructions 2023 Fill online, Printable, Fillable Blank

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

2020 2021 Irs Instructions Form Printable Fill Out Digital PDF Sample

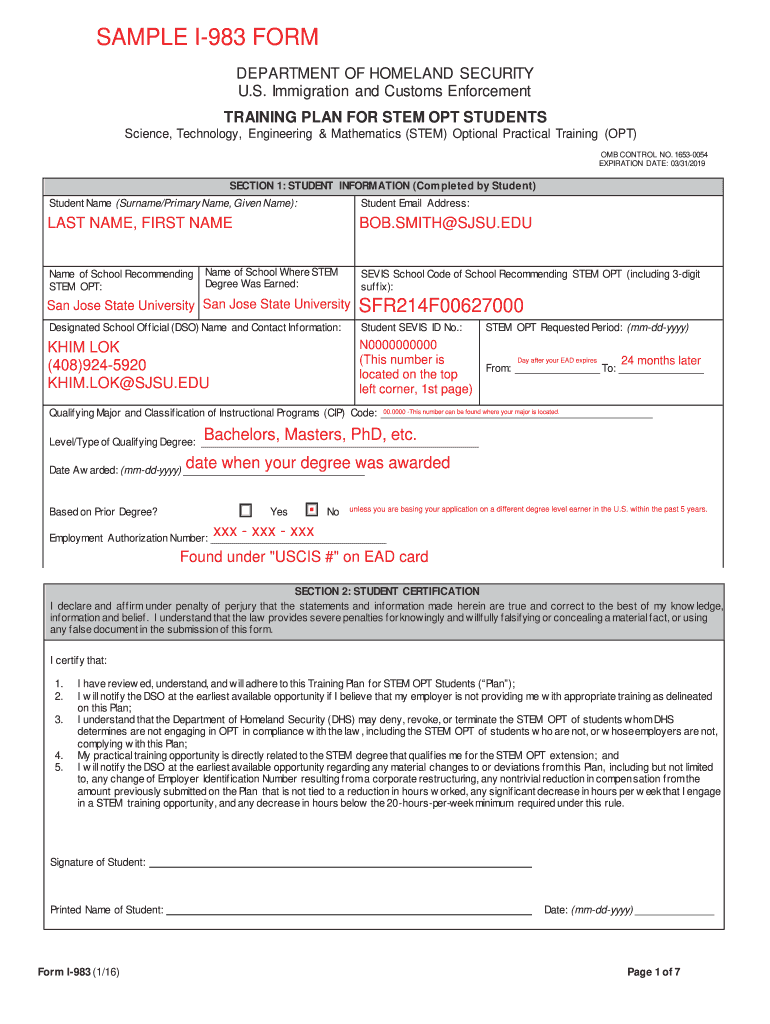

I983 fillable form no download needed Fill out & sign online DocHub

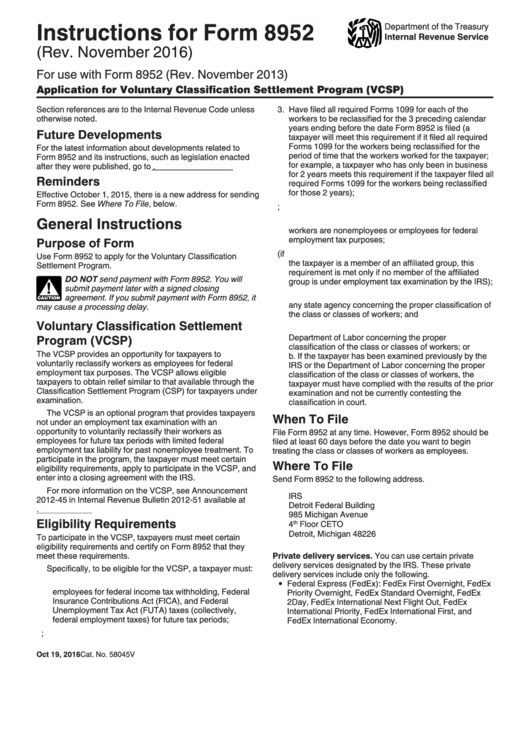

Instructions For Form 8952 Department Of The Treasury 2016

Community Property Rules and Registered Domestic Partners

Form 8958 Allocation of Tax Amounts between Certain Individuals in

3.24.3 Individual Tax Returns Internal Revenue Service

Form 8958 Example Fill Out and Sign Printable PDF Template signNow

Related Post: